US Stock Brokers Comparison: TD Ameritrade vs Firstrade

TD Ameritrade and Firstrade are the preferred brokerages for many investors, and this article compares and analyzes the background, investment products, commissions, security, and trading platform features of the two brokerages.。

TD Ameritrade (TD Ameritrade) and Firstrade (Firstrade), as the leading securities firms in the field of U.S. stock investment, are jointly characterized by zero commissions, supervision by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA), and provide interfaces in English and simplified Chinese, making them the first choice for many investors to enter the U.S. stock market.。

On the question of which securities dealer is superior, we will conduct an in-depth comparison of TD Ameritrade and Firstrade, analyzing their background, supported investment products, commissions and fees, payment methods, account opening funds, security, and trading platform features.。

| Brokers | TD Ameritrade | First Securities Firstrade |

| Regulators | US SEC, FINRA Singapore MAS (TD Ameritrade SG) | US SEC, FINRA |

| trading market | USA NYSENASDAQAMEXOTCBBOTC PINK | USA NYSENASDAQAMEXOTCBBOTC PINK |

| Trading products | Stocks, ETFs, Funds, Bonds, Options, Futures, Forex, Cryptocurrency Futures | Stocks, ETFs, Funds, Bonds, Options |

| Trading Commission | 0 USD | 0 USD |

| Account Opening Duration | More than 7 working days | 1 to 3 working days |

| Difficulty of opening an account | More difficult | Easy |

| Minimum deposit for account opening | 0 USD | 0 USD |

| Deposit expenses | USD 0 Bank may charge | USD 0 Bank may charge |

| Chinese interface | ✓ | ✓ |

| Virtual Account | ✓ | X |

Broker background

1.TD Ameritrade

TD Ameritrade is one of the largest securities service providers in the United States, founded in 1975, listed on the Nasdaq Stock Exchange in 1997 (NASDAQ: AMTD), acquired software company thinkorswim in 2009, has more than 2,800 users worldwide, for ten consecutive years by StockBrokers..Com ranked first in integrated brokerage。

TD Ameritrade is regulated by the U.S. Securities and Exchange Commission (SEC), the U.S. Financial Industry Administration (FINRA), and the Commodity Futures Trading Commission (CFTC), and provides a wide variety of financial investment products across trading platforms such as stocks, ETFs, funds, bonds, options, futures, foreign exchange, and cryptocurrency futures.。thinkorswim trading platform after long-term perfect test, stable and smooth, give users the best trading experience。

One of its features is that U.S. stocks and ETFs are commission-free and do not charge platform fees;.$70 and an excellent trading interface for options and futures。

In October 2020, Charles Schwab formally acquired TD Ameritrade, but this does not affect TD Ameritrade's continued independent operation to serve investors.。

TD Ameritrade currently covers only the US market。

The following is the key information of TD Ameritrade, a simple startup Demerit Securities:

| Year of Establishment | Established in 1975 |

| Trading platform | thinkorswim Desktopthinkorswim Webthinkorswim MobileTD Ameritrade Mobile |

| tradable market | 美国 |

| Investment products | Stocks, ETFs, Funds, Bonds, Options, Futures, Forex, Cryptocurrency Futures |

| Platform features | U.S. stocks zero commission, low latency, stable and smooth TOS trading platform, futures and futures trading interface is particularly professional and excellent, providing in-depth analysis reports, CNBC News. |

2.First Securities Firstrade

First Securities Firstrade was founded in 1985 by a Taiwanese man in the United States and is a member of the U.S. Financial Industry Administration (FINRA) and the U.S. Securities Investment Protection Corporation (SIPC).。

First Securities is the first to implement zero commissions and fees of U.S. stock brokerages, in many brokerages are still charging users in advance of the purchase and sale of shares, First Securities has broken the tradition, the use of zero fees system.。It is also one of the first U.S. stock brokerages to provide a Chinese interface, so it is very popular with Asian users, especially in Hong Kong and Taiwan.。More and more international account regions are now supported, with the exception of Hong Kong and Taiwan, Macau, Malaysia and Singapore, where users can open accounts with First Securities.。

At present, users can cover the first securities trading stocks, ETFs, funds, bonds, options and other financial products.。Like TD Ameritrade, First Securities covers only the U.S. market。

One of the biggest advantages of First Securities is that U.S. stocks, ETFs, options are zero commissions, zero contract fees, no hidden fees, is the most competitive brokerage in the market, so it is also the first choice for many Taiwanese to invest in U.S. stocks and ETFs overseas brokerage。2020 voted by Kiplinger Personal Finance Magazine as one of the best internet brokers of 2020。

The following is a brief summary of the key information about First Securities First Securities.

| Year of Establishment | Established in 1985 |

| Trading platform | Web version mobile phone App version (iOS, Android) |

| tradable market | 美国 |

| Investment products | Stocks, ETFs, Funds, Bonds, Options |

| Platform features | U.S. stocks, ETFs, options are zero commissions, zero contract fees, 24-hour Chinese customer service, free access to Morning Star, Briefing.Com, Zacks and Benzinga's authoritative information and research analysis reports |

At the same time, we compare the differences between TD Ameritrade and First Securities in terms of which investment products are supported for trading, commissions and fees, account opening funds, access channels and fees, security, trading platform features, and account opening and deposit benefits.。

Comparison of trading markets and investment products

As noted above, TD Ameritrade and Firstrade currently cover only the U.S. market, including NYSE, NASDAQ, AMEX, OTCBB, OTC Pink markets。If you want to invest in overseas markets such as Hong Kong, Singapore, Shanghai and Shenzhen, Australia, etc., you may want to consider opening an account with other brokerage firms such as Futu Securities and Tiger Securities.。

In terms of investment products, TD Ameritrade supports trading a range of investment products, in addition to stocks, ETFs, funds, bonds, options, as well as futures, foreign exchange, cryptocurrency futures and more.。

Currently, neither TD Ameritrade nor Firstrade can trade cryptocurrencies such as Bitcoin, Ethereum。Investors can only leverage TD Ameritrade to trade cryptocurrency futures, ETFs, funds, etc.。

| Trading products | Demaili Securities | First Securities |

| Stock | ✓ | ✓ |

| ETF | ✓ | ✓ |

| Fund | ✓ | ✓ |

| Bonds | ✓ | ✓ |

| Options | ✓ | ✓ |

| Futures | ✓ | X |

| Foreign Exchange | ✓ | X |

| Cryptocurrency Futures | ✓ | X |

| Cryptocurrency (spot) | ✓ | X |

Commissions vs. Fees

In terms of commission fees, TD Ameritrade and Firstrade have zero commissions for both stocks and ETFs.

TD Ameritrade US stock options commission is 0 per contract.$70, while Firstrade has a commission-free system and no fees are required to trade options.。In contrast, Firstrade offers extra on trading options and is the best options trading broker in the market.。First Securities is a good choice if you will trade US stock options on a gap。

The following collates the commission fee structure of TD Ameritrade and Firstrade in stocks, ETFs, OTC stocks, options, futures, and futures options for your reference。

| Investment products | Demaili Securities | First Securities |

| Stocks, ETFs | 0 USD | 0 USD |

| OTC Stocks | 7.44美元 | 0 USD |

| Options | 0.70 USD / sheet | 0 USD |

| Futures, futures options | 2.41 USD / sheet | Transaction not supported |

Comparison of other non-transaction costs

When selecting a broker, in addition to paying attention to the commission fee structure, there are other non-transaction fees (non-transaction fees), such as deposit fees (custody fees), collection module fees (dividend fees), deposit, withdrawal fees, transfer-in fees, transfer-out asset fees, annual fees (account fees), account idle fees (idle fees), etc.。

TD Ameritrade and Firstrade do not charge deposit fees, tuition fees, annual fees and account idle fees.。Similar brokers do not charge any fees at the time of deposit, but the remittance and transit banks used for wire transfers (Wire Transfer / Telegraphic Transfer) may charge fees, telegraphic charges, etc.。The fee is subject to the bank.。

When transferring assets, the same broker does not take up any fees.。When transferring an asset to another securities dealer or bank, the transfer is charged differently depending on the method of transfer (e.g. ACAT, DTC)。The fee is similar to that of a brokerage firm.。

The following collates the fee structure for TD Ameritrade and Firstrade's other non-transaction fees for your reference。

| 项目 | Demaili Securities | First Securities |

| Storage fee | X | X |

| Charges | X | X |

| Annual fee | X | X |

| Account idle fee | X | X |

| Deposit expenses | USD 0 Bank may charge | USD 0 Bank may charge |

| Payment expenses | USD 25 banks may charge | USD 25 banks may charge |

| Transfer to asset expenses | 0 USD | 0 USD |

| Transfer-out asset expenses | $25 - $75 | $50 - $75 |

Access to gold channels and cost comparison.

TD Ameritrade and Firstrade do not have a minimum deposit and withdrawal threshold, the main deposit method of equity dealers are bank wire transfer (Wire Transfer / Telegraphic Transfer), according to the user's region, but also accept Singapore Bank transfer, Bank of America ACH deposit, check, etc.。

1.TD Ameritrade

In terms of deposit, TD Ameritrade has a subsidiary in Singapore to handle Southeast Asia business, and users in Singapore and Malaysia are directly connected to TD Ameritrade Singapore in terms of account opening, deposit and withdrawal.。

TD Ameritrade has no minimum deposit threshold and can use deposit methods including DBS, POSB bank transfers, wire transfers and checks, and supports SGD (DBS, POSB, checks), USD (wire transfers, checks) deposits。

Holding Singapore DBS, POSB bank account, can be SGD deposit, free of fees;

Cheques, which must be issued by the Bank of Singapore, in support of both SGD and USD, are free of charge.

To remit money by wire, to accept money by wire from overseas banks, only in U.S. dollars, TD Ameritrade does not charge any fees, but the remitting bank, the U.S. receiving bank will charge a fee。For example, RM10 to RM40 will be charged for wire transfers from Malaysian banks; US banks will charge $15 to $40.。

Note: For first deposit over $3,500, you can get up to $100 in remittance fee rebates。To notify TD Ameritrade in USD。

In terms of withdrawals, TD Ameritrade does not have a minimum withdrawal threshold and currently only accepts wire withdrawals, which charge $25 per withdrawal.。

2.First Securities Firstrade

In terms of deposits, First Securities does not have a minimum deposit threshold, and the available deposit methods include Bank of America ACH deposits, wire transfers and checks, which support dollar deposits and are fee-free.。

U.S. users can use ACH and check deposits; other non-U.S. users can only use telegraphic transfers.。

Please click here for detailed guidelines on the deposit of First Securities.。

In terms of withdrawals, First Securities does not have a minimum withdrawal fee, but users can only withdraw money by wire transfer, which charges $25 per withdrawal.。

To sum up, TD Ameritrade and Firstrade are roughly the same in the withdrawal channel, non-U.S. users can only remit and withdraw money by wire, and each withdrawal will call $25.。

| TD Ameritrade | First Securities | |

| Minimum deposit for account opening | 0 USD | 0 USD |

| Minimum amount of deposit and withdrawal | X | X |

| Deposit method | Singapore DBS, POSB wire check | Bank of America ACH wire check |

| Deposit expenses | USD 0 Bank may charge | USD 0 Bank may charge |

| Payment expenses | USD 25 banks may charge | USD 25 banks may charge |

security comparison

The size and historical operation of a brokerage firm, whether it is regulated by the SEC, and how many financial licenses it holds are among the criteria for assessing the credibility of a brokerage firm。Brokers who do not have legal supervision and licenses are advised to pay attention to。

TD Ameritrade and Firstrade are both long-established and sizeable securities dealers in the United States.。TD Ameritrade was founded in 1975 and has been around for 47 years.。Founded in 1985, Firstrade is 37 years old.。Similar brokerages are regulated by the Securities and Exchange Commission (SEC) and are members of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).。

SIPC offers users a maximum guarantee of up to $500,000, including $250,000 in cash.。Simply put, if a brokerage firm is faced with a failure, the broker will first convert the remaining assets into cash and return them to the user.。If the amount is insufficient, the rest of the arrears can be paid by SIPC to maximize the security of the user's funds.。

In addition, TD Ameritrade Singapore is regulated by the Monetary Authority of Singapore (MAS).。

In summary, both TD Ameritrade and Firstrade have good safety indices that investors can use with confidence。

Comparison of trading platform functions

The function of the trading platform is a consideration for selecting a broker, including the stability of the platform, which devices are supported, whether the interface is simple, and how many languages are available, which will affect the smooth trading process.。

The following collates a comparison of the trading platform features of TD Ameritrade and Firstrade。

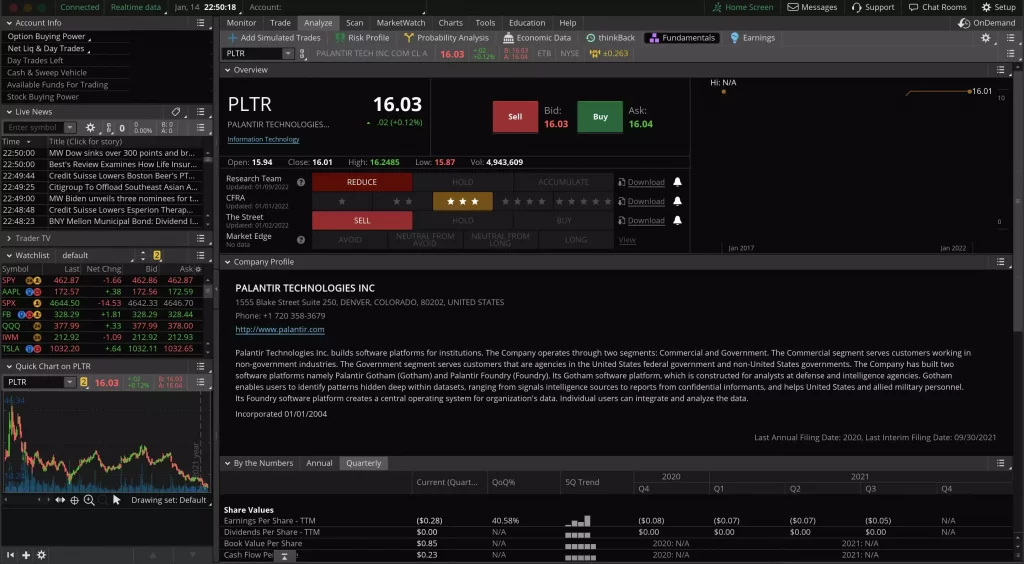

1.TD Ameritrade

TD Ameritrade serves its users through the thinkorswim trading platform (TOS), which is recognized as one of the most up-to-date trading platforms, providing instant quotes (real-time prices) and free Level 2 quotes.。There are also a variety of features on the platform, such as individual stock earnings data, financial calendar, news trends, in-depth analysis reports, CNBC News, and more.。

Users can also create a Watchlist in thinkorswim, screen stocks, etc.。The trading interface for options and futures is particularly good for different strategic operations.。

thinkorswim trading platform with English and Simplified Chinese interface, support a variety of devices, including web version (Web), desktop version (Desktop) and mobile version (Mobile)。

The mobile version is divided into two apps: thinkorswim Mobile and TD Ameritrade Mobile.。Thinkorswim Mobile is designed for active traders, providing richer data and professional viewing information, while TD Ameritrade Mobile has a simple interface for novices.。

Generally, it is enough for beginners to use the web version or mobile version. If you want to operate more advanced functions, such as using line drawing tools and creating exclusive analysis tools, the desktop version is more convenient to use.。

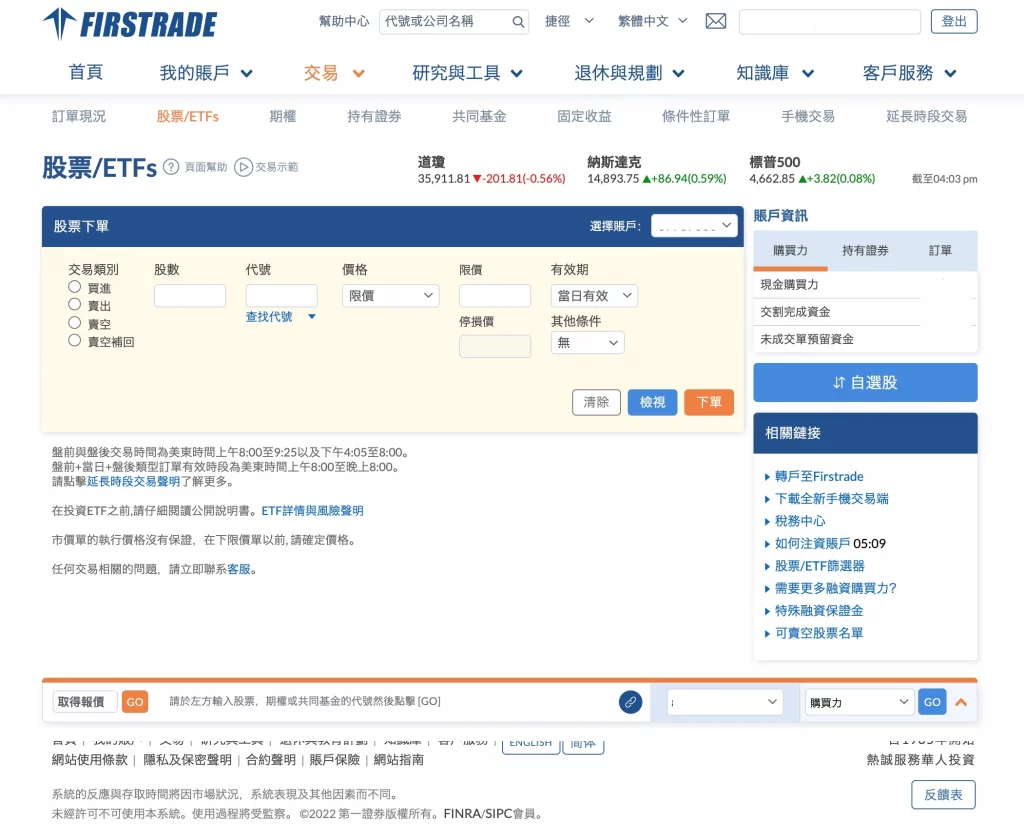

2.First Securities Firstrade

First Securities trading platform has English and simplified Chinese interface, support web version (Web) and mobile version (Mobile), its interface is relatively simple, more suitable for order trading。The advantage is that the novice operation interface is high, the user does not need to log on to the platform to be overwhelmed by the dense number or line graph。Free Morning Star, Briefing for Firstrade users.Com, Zacks and Benzinga's authoritative information and research analysis reports

The disadvantage is that the interface is too simple, the lack of disk watching function, not suitable for in-depth analysis。Also missing the two-step secure login feature。

In general, the Firstrade trading platform is specially designed for novice white, do not need to spend too much time to adapt to the platform, experienced beginners can be converted to Firstrade can also be used by hand, saving time to explore the platform functions.。

Platform Offer Comparison

Demerit Securities and First Securities offer different offers for new users。

TD Ameritrade new users in the first deposit of more than $3,500, TD Ameritrade bank wire transfer fees, up to $100。Users need to notify TD Ameritrade by SMS after wire transfer。

First Securities opens an account and gives you one free share of stock, with a deposit of $100 or more within 30 days of opening the account, and another free share of stock.。Meaning, users have the opportunity to get free shares of Apple, AMD, etc.。US residents only。

Wire transfers of more than $25,000, the same wire transfer fee that Firstrade imposes on banks, up to $25。Once a month, you must remit more than $30 at the Firstrade website to apply for tax。

Demaili Securities vs First Securities, how to choose?

TD Ameritrade and Firstrade share similarities in trading products, regulators, commission fees, cash channels, and fees, which can be troubling to investors when choosing。Both of these companies are well-known established brokerages that provide safe and reliable services, so from a security point of view, either is feasible.。

TD Ameritrade is more prominent in the diversity of tradable products than Firstrade。In addition to stocks, ETFs, funds, bonds, and options, TD Ameritrade also supports trading in futures, foreign exchange, and cryptocurrency futures.。Its thinkorswim platform has a wealth of features, providing free level 2 quotes。Especially in options and futures trading, its trading interface is excellent and suitable for executing different trading strategies。

However, compared to TD Ameritrade, Firstrade is more attractive on a comprehensive commission-free system, covering stocks, ETFs and options, all of which can be traded at zero commission.。In contrast, TD Ameritrade charges 0 per contract for options trading..$70 Commission。In addition, Firstrade's trading platform interface design is simple, and novices can easily get started, providing investors with a more friendly trading experience。

In addition, Firstrade has certain advantages for account opening time considerations。Successful account opening only takes about one to two working days, while TD Ameritrade's new account review takes a relatively long time, usually more than a week, and requires filling out more cumbersome online forms。In this regard, investors can weigh their needs and timing to make more informed choices。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.