US Stock Brokers Comparison: Interactive Brokers vs TD Ameritrade

This article will provide an in-depth comparison of Interactive Brokers and TD Ameritrade, analyzing the background of the two brokerages, which investment products are supported for trading, commissions and fees, which methods of entry and exit are supported, account opening thresholds, security, trading platform features, and more.。

When it comes to established U.S. stock brokerages, investors will first think ofInteractive Brokers和TD AmeritradeThis is the equivalent of a brokerage firm, the largest and oldest financial institution in the United States, which has been in Stockbroker for a long time..com and Investopedia's ranking of the best brokerages are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Administration (FINRA), demonstrating compliance and credibility.。

Both Tracker Securities and Demaili Securities are known for their comprehensiveness, ease of use and safety in the brokerage space, and the market's recognition of them is self-evident.。However, for this equivalent brokerage, we need to study and compare them to understand their differences in terms of background, investment product support, commissions and fees, payment methods, account opening offers, security, and trading platform functionality。

| Brokers | Tracker Securities Tracker Securities | TD Ameritrade |

| Regulators | US SEC, FINRA, Singapore MAS (Interflow Securities Singapore) | US SEC, FINRA, Singapore MAS (TD Ameritrade SG) |

| trading market | The United States, Taiwan, Canada, Mexico, Britain, Singapore, Hong Kong, Australia, Japan, India, Germany, France, Sweden, etc | 美国 |

| Trading products | Stocks, ETFs, Options, Futures, Forex, Bonds, Indexes, CFD, Funds ★ ★ ★ | Stocks, ETFs, Options, Futures, Forex, Bonds, Funds (Singapore Users: Stocks, ETFs, Options, Futures) |

| Trading Commission | IBKR Lite: Zero Commission IBKR Pro: 0.$005 / share, minimum $1 per trade, maximum 1% * trade value | 0 Commission ★ ★ ★ |

| Account Opening Duration | 1 to 3 working days | 1 to 3 working days |

| Difficulty of opening an account | Easier ★ ★ ★ | More difficult |

| Minimum deposit for account opening | 0 USD | 0 USD |

| Deposit expenses | USD 0, bank may charge | USD, 0 Bank may charge |

| Chinese interface | ✓ | ✓ |

| Virtual Account | ✓ | ✓ |

Broker background

1.background of the securities

Founded in 1993 and listed on the Nasdaq Stock Exchange in 2007 (NASDAQ: IBKR)。After years of development, it is now the largest brokerage firm in the United States.。According to April 2022 data, the average daily trading revenue of the users of Interflow Securities reached $2.2 million, and the total assets of its customers reached $324.5 billion.。

Tracker Securities is regulated by the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Administration (FINRA).。In addition, the company now has a branch in Singapore - Interactive Brokers Singapore Pte..Ltd, primarily responsible for Southeast Asia operations and regulated by the Monetary Authority of Singapore (MAS)。

It is characterized by offering the lowest commissions in the market and providing securities trading services in up to 135 markets, covering 33 countries and territories, such as the United States, the United Kingdom, Hong Kong, Singapore, Japan, Australia, India and other European countries.。A small number of Internet brokers that provide securities trading services in a large number of markets.。

In addition, the company also provides financial commodity trading including stocks, ETFs, options, futures, foreign exchange, bonds, indices, CFD, funds, cryptocurrencies, etc.。Users can participate in securities trading in multiple markets and countries by registering a single investment account。

The following is a brief summary of the key information from Ingnet Securities.

| Year of Establishment | Founded in 1993 and listed on the Nasdaq Exchange in 2007 (NASDAQ: IBKR) |

| Trading platform | Client web version trader workstation desktop version IBKR mobile phone version IBKR API |

| Account Type | Managed Account (Custodian Account) |

| tradable market | United States, Taiwan, Canada, Mexico, United Kingdom, Singapore, Hong Kong, Australia, Japan, India, Germany, France, Sweden, etc |

| Investment products | Stocks, ETFs, Options, Futures, Forex, Bonds, Indexes, CFD, Funds |

| Cryptocurrency | Bitcoin, Ethereum, Litecoin and Bitcoin Cash (Xinma users can't trade cryptocurrencies yet) |

| Minimum Account Opening Center | 0 USD |

| U.S. Stock Commission | IBKR Lite: Zero Commission IBKR Pro: 0.$005 / share, minimum $1 per trade, maximum 1% * trade value |

| U.S. Stock Contract Commission | IBKR Lite and IBKR Pro: 0.$65 / contract, minimum $1 per transaction |

| Access mode | Wire transfer, Direct ACH, check, online bill payment |

| Minimum amount of deposit and withdrawal | None |

| Access fee | Brokers do not charge fees, remittance banks and transit banks charge fees |

| Accountidle fee idle fee | None |

2.Demaili Securities background

TD Ameritrade was founded in 1975 and listed on the Nasdaq Stock Exchange in 1997.。In 2020, TD Ameritrade merged with one of the largest U.S. brokerages, Carlson, and became the world's largest asset under management According to data, Carlson's asset under management in 2021 reached 7.$614 trillion。

TD Ameritrade is regulated by the Securities and Exchange Commission (SEC), the Financial Industry Authority (FINRA), and the Commodity Futures Trading Commission (CFTC).。TD Ameritrade also has a Singapore branch, which is primarily responsible for Southeast Asia operations and is regulated by the MAS of the Financial Services Authority of Singapore.。

TD Ameritrade features commission-free, no platform fees for U.S. stocks and ETFs。The rate for an option is 0 per contract.70 USD。TD Ameritrade only covers the US market。

The following is a brief summary of key information from Demaili Securities.

| Year of Establishment | 1975 |

| Trading platform | Thinkorswim web version Thinkorswim desktop version Thinkorswim mobile phone application investment network platform TD Ameritrade mobile phone application |

| Account Type | Managed Account (Custodian Account) |

| tradable market | 美国 |

| Investment products | Stocks, ETFs, Options, Futures, Forex, Bonds, Funds (Singapore Users: Stocks, ETFs, Options, Futures) |

| Minimum Account Opening Center | 0 USD |

| U.S. Stock Commission | Trading commissions for stocks and ETFs are zero; trading commissions for OTC (over-the-counter) stocks are 7.44美元 |

| U.S. Stock Contract Commission | 0 trading commission per option.$70; at 0.Table commission when closing any unilateral option at a price of $05 or less。 |

| Access mode | Singapore Bank Transfer, International Wire Transfer |

| Minimum amount of deposit and withdrawal | 0 USD |

| Access fee | $25, remittance bank and transit bank operating expenses |

| Account idle fee | None |

Comparison of trading markets and investment products

The peculiarity of Intercom is that it offers securities trading in up to 150 markets and 200 countries, while TD Ameritrade focuses only on the U.S. market.。Investors in stocks, Hong Kong stocks, Chinese stocks, etc., are a good choice.。

Interactive Brokers and TD Ameritrade each offer a wide variety of investment products, including stocks, ETFs, options, futures, funds, bonds, foreign exchange, and cryptocurrency futures.。The only difference is that Interactive Brokers offers users to trade cryptocurrency spot directly, while TD Ameritrade offers to trade cryptocurrency futures.。

It is important to note that currently TD Ameritrade's new horse users can only participate in trading stocks, ETFs, futures and options。TD Ameritrade has not yet provided funds, bonds, foreign exchange, and cryptocurrencies for registered users of Singapore and Malaysia to trade.。

| Trading products | Tracker Securities | Demaili Securities |

| Stock | ✓ | ✓ |

| ETF | ✓ | ✓ |

| Fund | ✓ | ✓ (New Horse User: x) |

| Bonds | ✓ | ✓ (New Horse User: x) |

| Options | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Foreign Exchange | ✓ | ✓ (New Horse User: x) |

| Cryptocurrency Futures | ✓ (New Horse User: x) | ✓ (New Horse User: x) |

| Cryptocurrency (spot) | ✓ (New Horse User: x) | X |

Commissions vs. Fees

TD Ameritrade is a broker that offers zero trading commissions for U.S. stocks and ETFs, with a trading commission of 0 per option..$70 and a trading commission of 2 per futures.41美元。

Tracker Securities also has the "lowest cost brokerage" logo, with IBKR Lite trading commissions of zero for U.S. stocks and ETFs.。However, IBKR Lite is only open to US citizens and non-US citizens can only register for IBKR PRO.。

IBKR PRO's trading commissions are also very low, with U.S. and ETF commissions of 0.005美元。Option trading commission of 0 per.$65, 0 per futures.85美元。

| Investment products | Tracker Securities | Demaili Securities |

| Stocks, ETFs | 0.$005, minimum $1 per transaction | 0 USD |

| OTC Stocks | 0.$005, minimum $1 per transaction | 7.44美元 |

| Options | Each 0.$65, minimum $1 per transaction | Each 0.70 USD |

| Futures, futures options | Each 0.85美元 | Each 2.41美元 |

Other non-transaction costs

Interactive Brokers and TD Ameritrade do not include deposit fees, surrogate fees, annual fees, and account idle fees.。

In terms of deposit fees, the equivalent of a brokerage firm neither charges any fees nor has a minimum deposit fee。

In terms of withdrawal fees, the same brokerage firm's withdrawal fees will incur different monetary values to price the。Interactive Brokers charges different currencies to users registered in different countries, and if they are Xinma users, Interactive Brokers can charge an additional S $15 for users who use wire transfers, while TD Ameritrade charges an additional $25.。Remittance banks and transit banks may charge fees, telegraph charges, etc.。

The equivalent of a brokerage firm also does not charge any fees when transferring assets。When transferring assets out of another securities dealer or bank, Interflow will raise interest rates by S $50, while TD Ameritrade will raise interest rates by between $25 and $75.。

| 项目 | Tracker Securities | Demaili Securities |

| Storage fee | X | X |

| Charges | X | X |

| Annual fee | X | X |

| Account idle fee | X | X |

| Deposit expenses | USD 0, bank may charge | USD 0, bank may charge |

| Payment expenses | SGD 15, banks may charge | USD 25, banks may charge |

| Transfer to asset expenses | 0 USD | 0 USD |

| Transfer-out asset expenses | S $50 | $25 - $75 |

Access to gold channels and cost comparison.

1.Tracker Securities

In terms of deposits, there is no minimum deposit threshold for Incap Securities, and the methods of deposit that can be used include.

○ Bank Wire Transfer (Bank Wire)

○ Direct ACH

○ Connect Bank via ACH

○ Online Bill Pay

○ Cheque (Mail a Check)

Tracker Securities supports a more diversified approach to the deposit.。The currencies that the user is supported to transfer include US dollar, Singapore dollar, Hong Kong dollar, Australian dollar, euro, RMB, Japanese yen, etc.。

Suppose you are a Singapore user with a Singapore bank, using the remittance combination of Wise and Bank of Singapore is the most cost-effective way to deposit money in Interfax.。

In terms of disbursement, there is no minimum disbursement of funds from Protox Securities, and the main disbursement methods include.

○ Bank Wire Transfer (Bank Wire)

○ US Automated Clearing House (ACH) Transfer Initiated at IBKR

○ Direct Debit / Electronic Money Transfer

○ BACS/ GIRO/ ACH

○ Check

○ Canadian Electronic Funds Transfer (EFT)

○ Single Euro Payment Area (SEPA)

Interactive Brokers supports more than 20 currencies, such as the U.S. dollar, Singapore dollar, Hong Kong dollar, Australian dollar, Japanese yen, British pound, offshore yuan, etc.。

2.Demaili Securities

In terms of deposit, Xinma users are directly connected to TD Ameritrade Singapore, which is responsible for Southeast Asia, in account opening, deposit and deposit.。

TD Ameritrade does not have a minimum deposit threshold, and the deposit methods that can be used include:

○ DBS, POSB bank transfer

○ Wire Transfer (Bank Wire)

○ Cheque

Support SGD (DBS, POSB, check), USD (wire transfer, check) deposit。

Holding Singapore DBS, POSB bank account, can be SGD deposit, free of fees。If a cheque is deposited, the cheque must be issued by a Singapore bank.。Cheques support both New Currency and US Dollar。

In terms of wire transfers, TD Ameritrade accepts wire transfers from overseas banks, but does not accept other third-party wire transfer platforms such as Wise, and can only receive money in U.S. dollars.。TD Ameritrade does not charge any fees, but the remitting bank, the U.S. receiving bank will charge。

Note: For first deposit over $3,500, you can get up to $100 in remittance fee rebates。To notify TD Ameritrade by email。

In terms of withdrawals, TD Ameritrade does not have a minimum withdrawal threshold and currently only accepts wire withdrawals, which charge $25 per withdrawal.。

| 项目 | Tracker Securities | Demaili Securities |

| Minimum deposit for account opening | 0 USD | 0 USD |

| Minimum amount of deposit and withdrawal | X | X |

| Deposit method | Wire Transfer, Direct ACH, Connect Bank via ACH, Online Bill Pay, Checks (Mail a Check) | Singapore DBS, POSB wire check |

| Deposit expenses | USD 0, bank may charge | USD 0, bank may charge |

| Payment expenses | SGD 15, banks may charge | USD 25, banks may charge |

security comparison

It is safe and legal to invest with two established brokerages, Tracker Securities and TD Ameritrade.。These two brokerages are long-established brokerages.。Tracker Securities and TD Ameritrade were established in 1993 and 1975, respectively.。

Compared to other Internet brokerages, this same brokerage is very large, investors do not have to worry about the risk of brokerage failure.。Interactive Brokers' client assets totaled $324.5 billion, while TD Ameritrade, after its merger with Charles Schwab, had assets under management of up to 7.$614 trillion。

Both Interactive Brokers and TD Ameritrade are regulated by the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and the Monetary Authority of Singapore (MAS).。In addition, one-third of brokerages are also members of the U.S. Securities and Investment Corporation (SIPC).。SIPC offers users a maximum guarantee of up to $500,000, including $250,000 in cash.。

Brokerage branches in other countries are also regulated by local regulators。

Transaction function comparison

1.Tracker Securities

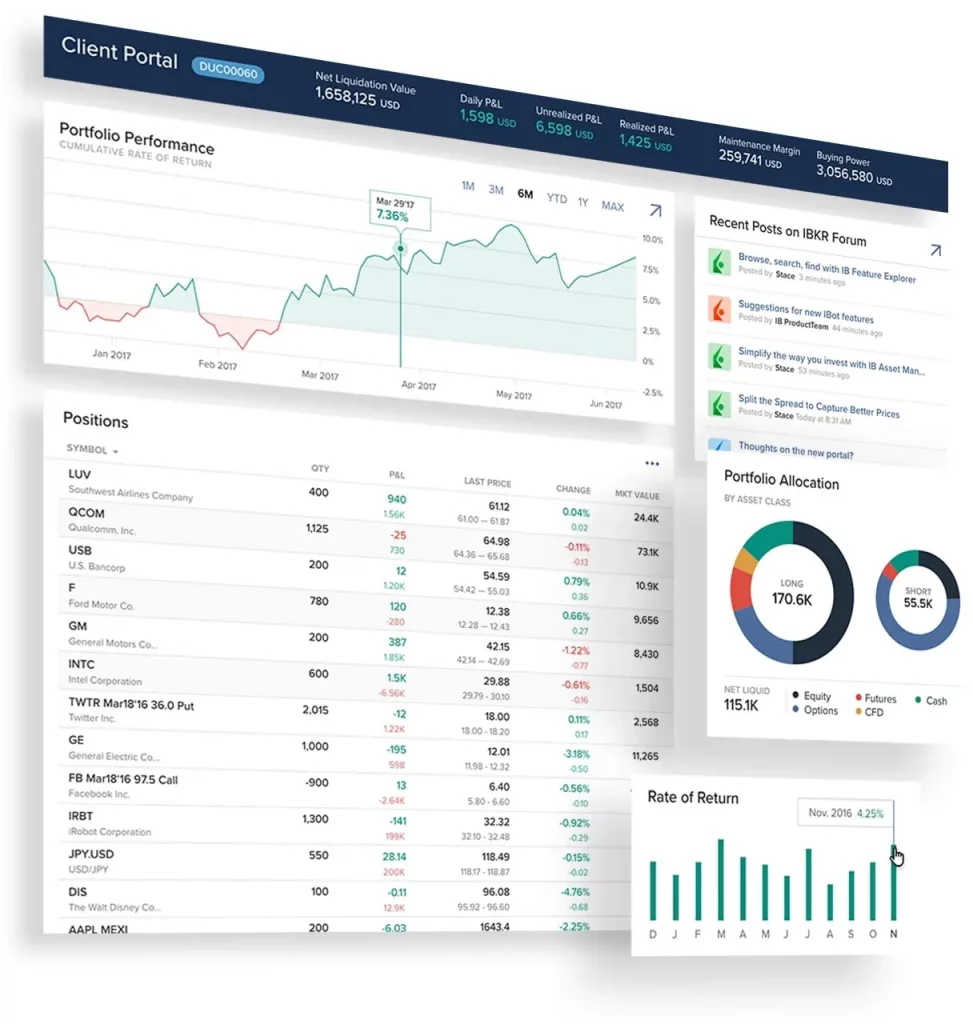

Tracker Securities offers 4 versions of the trading platform:

○ Client Portal Web Edition

○ Trader Workstation (TWS) Desktop Edition

○ IBKR Mobile Edition

○ IBKR API access to the trading platform

The client web version is suitable for novice investors and is a relatively simple web version trading platform.。Users can use a variety of basic functions on the client web page, including real-time market quotes, market information, trading, managing portfolios, quotas and other charts, stock filters, latest market news, financial calendars, analyst research reports, etc.。

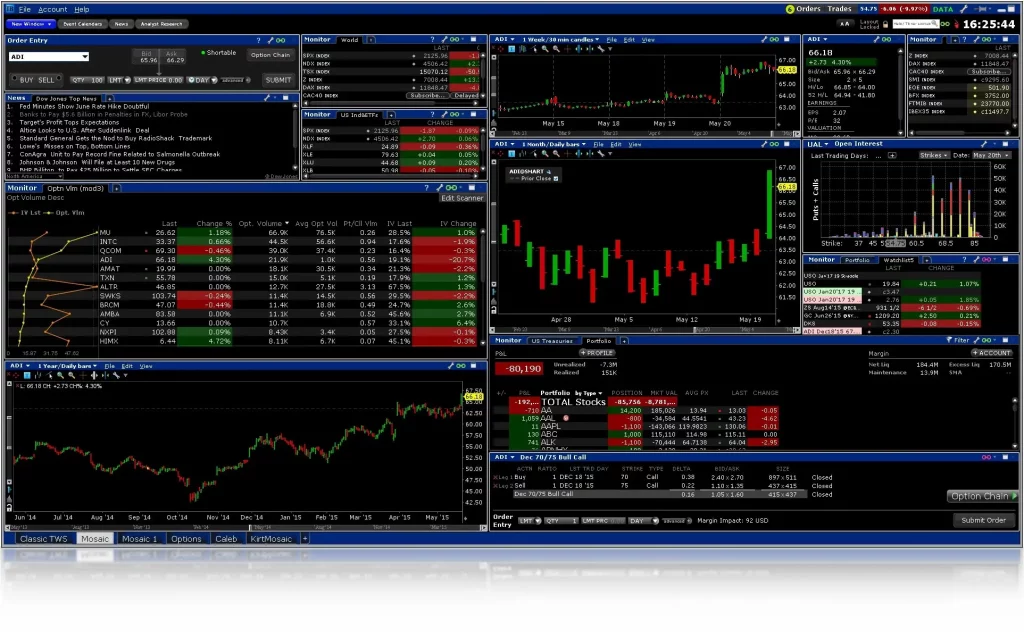

Trader Workstation (TWS) desktop trading platform is suitable for investors who need to watch the market and are professional.。TWS is Interactive Brokers' flagship trading platform offering a variety of advanced trading tools and analytics including:

① More than 100 orders and algorithms

② Customize the access interface (trading, managing orders, using charts, watch lists, technical analysis, etc.) through TWS Mosaic (TWS Rubik's Cube)

③ Get from Reuters, Dow Jones, flyonthewall.Real-time news of com etc

④ Read analyst research reports such as Morningstar and Zacks

⑤ Risk management tools: IB Risk Navigatorsm, Options Analytics, Advanced Options Analytics, Model Navigator

⑥ Advanced trading and analysis tools: Options Strategy Lab, Volatility Lab, FXTrader, Social Market Analytics, "SpreadTrader, OptionTrader, Market Scanners, Advanced Fixed Income Scanner, Strategy Builder, Portfolio Builder, and more

2.Demaili Securities

TD Ameritrade offers 5 versions of the trading platform:

○ Thinkorswim Web Edition

○ Thinkorswim Desktop Edition

○ Thinkorswim APP

○ Investing Web Platform

○ Demaili Securities Mobile APP

Thinkorswim is a TD Ameritrade web trading platform that is simple and easy to use for beginner investors。Its trading tools and analysis functions include a wealth of features and functions such as setting up according to individual needs, querying information about investment indices, screening stocks, reading analysis reports, and watching CNBC news stations.

Thinkorswim desktop version is more complex, providing advanced trading tools and analysis functions for beginners, such as using line drawing tools, creating unique analysis tools, etc., suitable for beginners who need to watch the market and have experience in trading options.。It is recommended that novices use the web version or mobile app version to operate。

Tracker Securities vs Demaili Securities, how to choose?

Both Tracker Securities and Demaili Securities excel in security, and their trading platform tools and features are quite similar, covering easy-to-use and complex advanced operation options.。

However, there are significant differences in market coverage and transaction services。As a core provider of securities trading markets, it covers up to 150 markets, while TD Ameritrade only provides securities trading services for the U.S. market.。In addition, the company supports more diversified deposit methods and transfer currency types, providing investors with more flexible choices.。

In contrast, TD Ameritrade has an advantage in zero trading commissions for U.S. stocks and ETFs, which can effectively reduce investment costs, especially for investors who focus on reducing transaction costs。

Therefore, if you are primarily interested in investing in U.S. stocks and prefer commission-free trading, you may want to consider choosing TD Ameritrade。However, if you want to be involved in investment targets other than the U.S. stock market, such as Taiwan, Hong Kong, Singapore, and Chinese stocks, then it may be more appropriate to choose Tracker Securities。Tracker Securities provides an account that enables investors to invest in different markets at the same time, facilitating diversification.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.