TD Ameritrade Demerit Securities: Thinkorswim Buy U.S. Stock Process Operations Teaching

This article collates the process of placing orders to buy U.S. stocks and ETFs on the TD Ameritrade Thinkorswim trading platform to help you easily trade to your favorite U.S. stocks!

Update: Demeli Singapore wants to focus on serving qualified investors and will stop providing investment services to retail investors from December 2023。If you are not a qualified investor and do not meet the conditions for opening an account with Demerit Securities Singapore, it is recommended that you open an account with another brokerage firm.。

TD AmeritradeIt is one of the largest online securities service providers in the United States.。TD Ameritrade provides investors with financial investment products such as stocks, ETFs, options, futures, funds, bonds, cryptocurrency futures, etc. listed on U.S. exchanges through trading software with advanced and innovative technologies.。

Today's article collates the process of placing orders to buy U.S. stocks and ETFs on the Thinkorswim trading platform to help you easily trade to your favorite U.S. stocks!

◇ TD Ameritrade U.S. Stock Trading Process Teaching

◇ TD Ameritrade offers which order types and recent

Small reminder before buying and selling stocks

After registering and merging into a gold TD Ameritrade investment account, you can log on to the Thinkorswim trading platform to place an order.。Users can choose to operate through web version, desktop application and mobile app.。

Enter at account openingOfficial website registered accountbefore starting a transaction using the Thinkorswim app or mobile app。

Download Fast Track

Click DownloadDesktop Applications

Click DownloadMobile APP (Android Android)

Click DownloadMobile APP (iOS)

You can also register a banknote account (virtual account) in Thinkorswim and experience the Thinkorswim trading platform in advance.。Thinkorswim Offers $100,000 in Virtual Funds for Users to Make Simulated Transactions。

Thinkorswim trading platform interface introduction (mobile App version)

Main function column

After successfully opening an account, you can start trading U.S. stocks, ETFs, funds and other financial products listed in the U.S. market.。

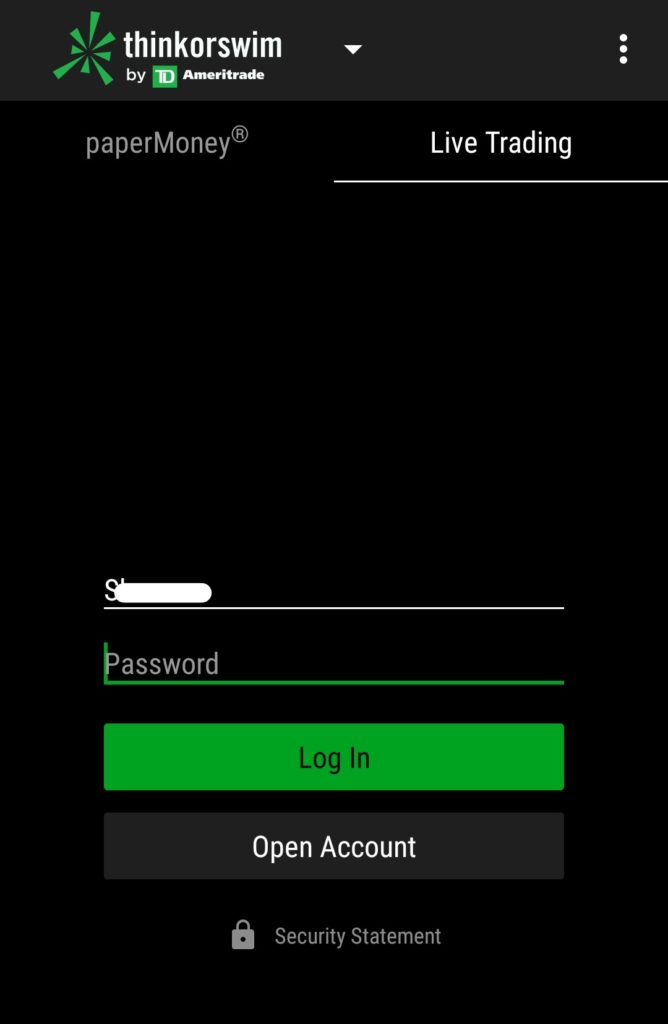

Enter your username and password to log in to the Thinkorswim App。Option to sign in to paperMoney (virtual) account or Live Trading (real) account。

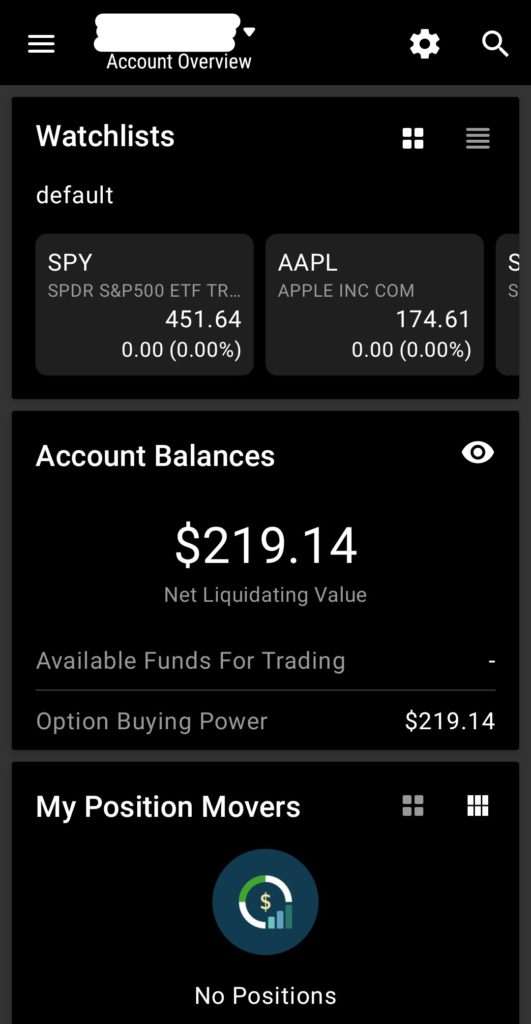

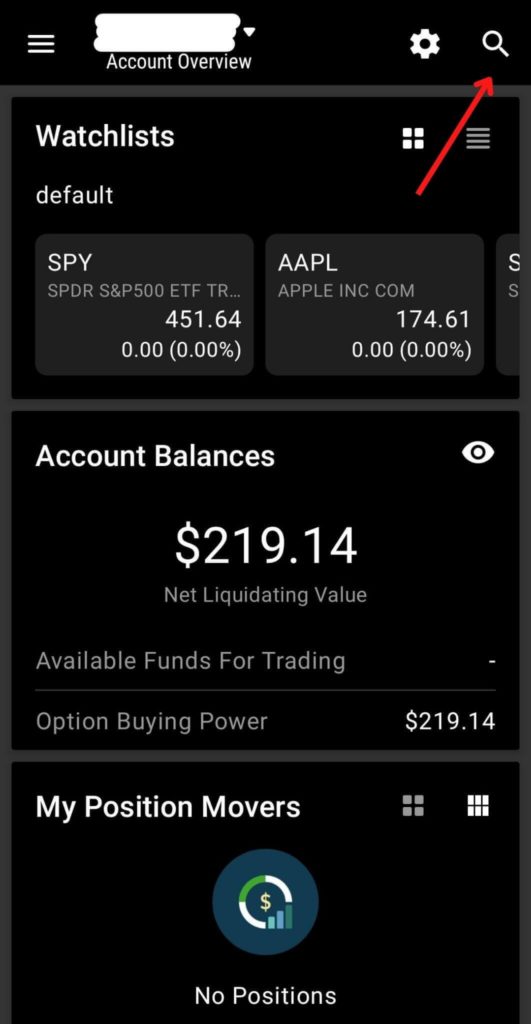

After logging in, on the home page, you can browse the Watchlist, total asset information (account balance), portfolio (Position Movers) and other functions.。

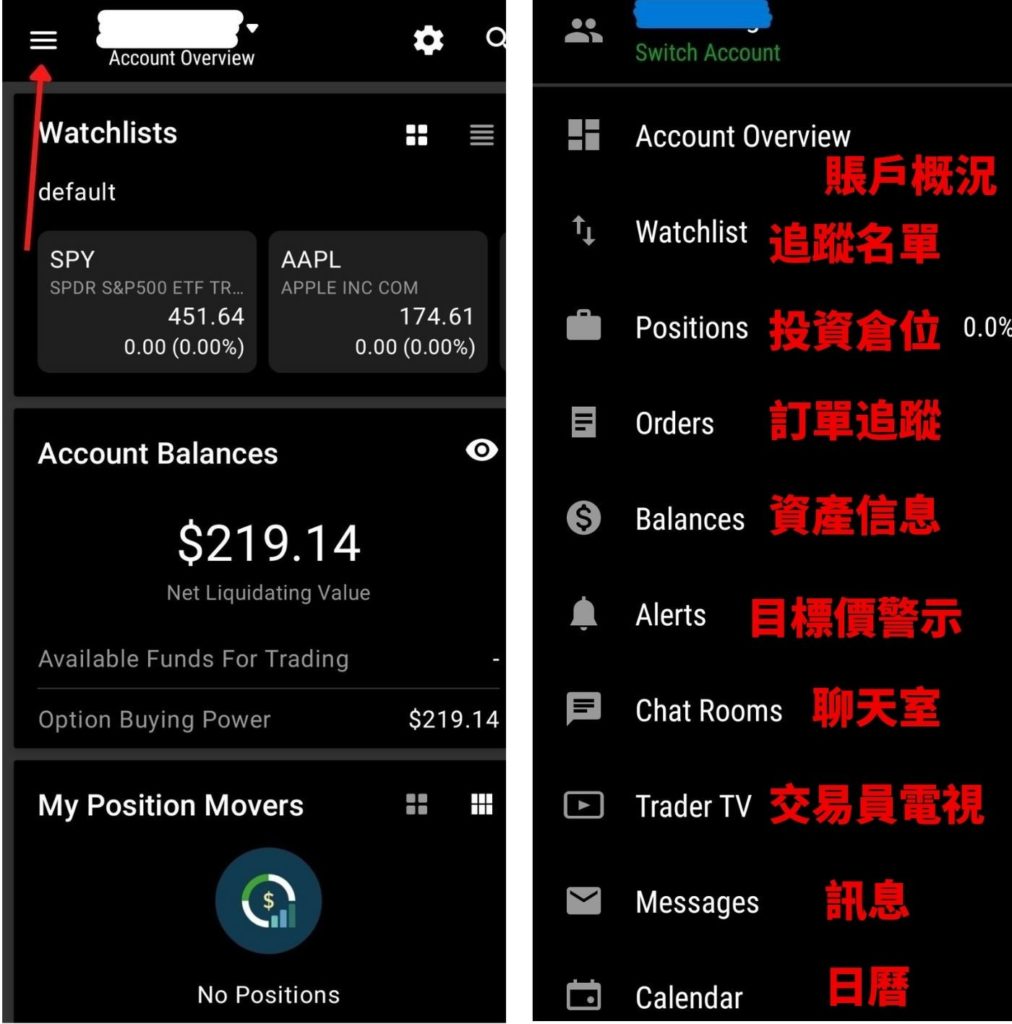

You can also access each feature by clicking the top left directory option。

Check stocks, join tracking list

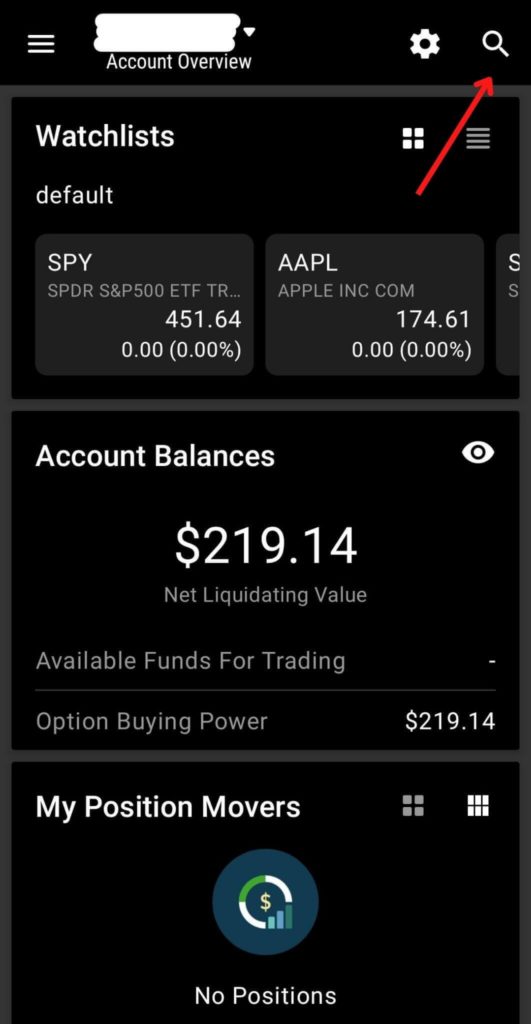

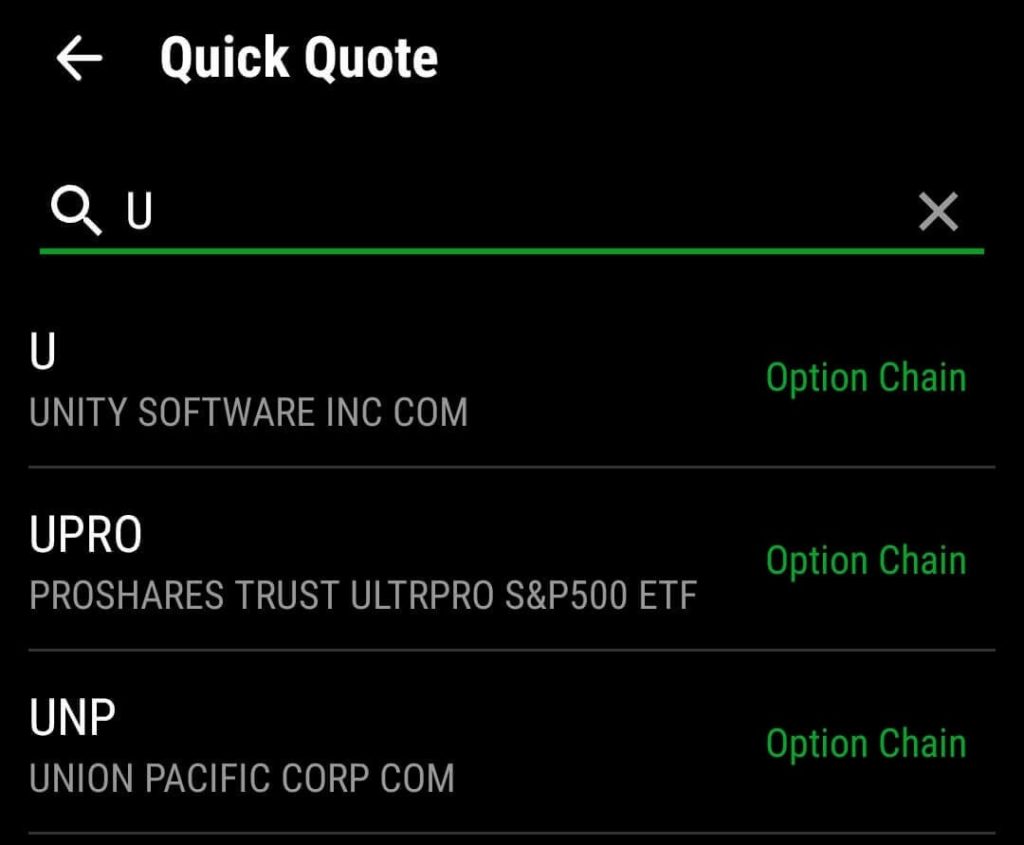

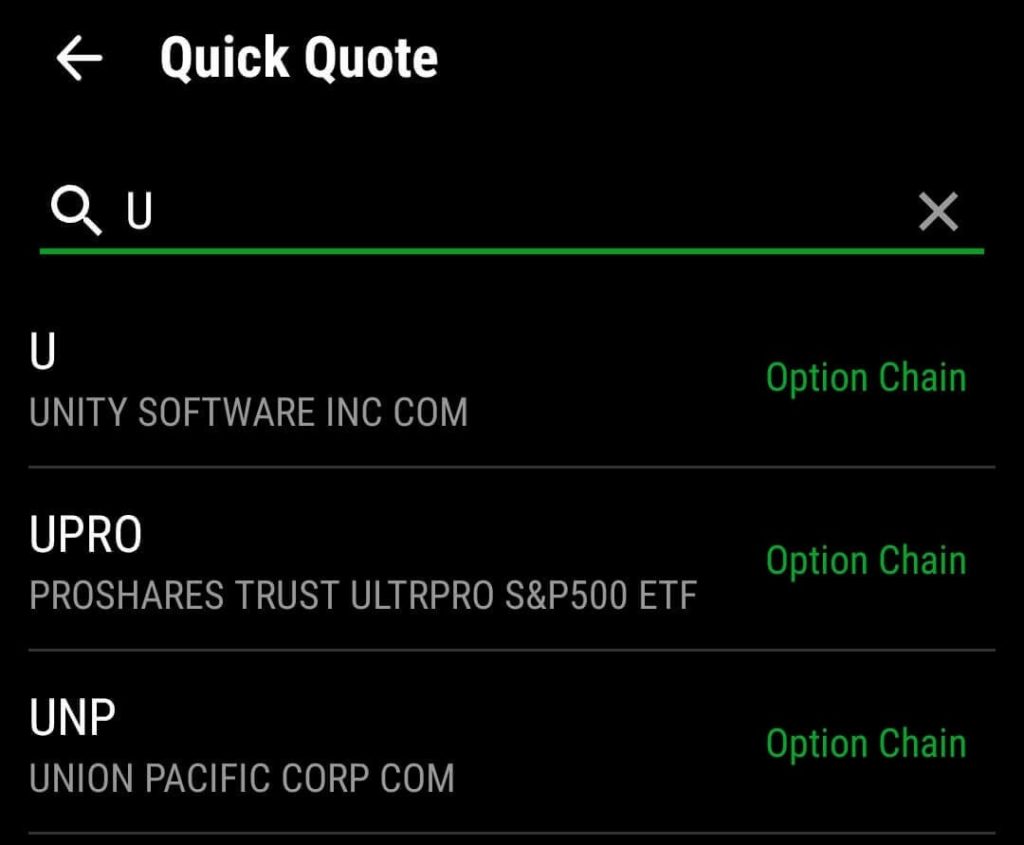

Click the "search" sign in the upper right corner of the home page, and then enter the name or code of the stock you want to query。

On the market page, you can see the latest stock price, price trend, volume, market capitalization, P / E ratio, and swipe to the right to see other key data such as P / E, P / S, EPS, etc.。

Below you can view the K-line chart of the stock price, news about the stock and options quotes.。

To view this stock, click on the top right corner."Stars."Sign added to self-selected stock list (watch list)。

Thinkorswim Order Purchase Process

The process for placing an order to buy stocks and ETFs in the Thinkorswim mobile app is as follows.

◇ Search for stocks / ETFs you want to buy.

◇ Choose trading direction: buy (Buy) or sell / short (Sell)

◇ Set order data (order type, price, quantity, quantity, front and back, etc.)

◇ Confirm the order information and send it out

Next, we will introduce each step of Thinkorswim's order to buy stocks and ETFs in the form of multi-graphic text.。The order process will be based on Thinkorswim mobile phone App Chinese, only 1 minute to complete the order transaction。

You can switch to Simplified Chinese or Traditional Chinese at any time。

Click Directory > Settings > Language > Select the language you want to use in the upper left corner。

Step 1: Select the stock / ETF you want next

Click the "Search" sign in the upper right corner of the home page, then enter the name or code of the stock or ETF you want to invest in, such as Unity Software stock (code: U), to enter the detailed stock market page。

* Note that the following shares are for exemplary purposes, non-investment advice。All investment risks, it is recommended that you do your homework and risk planning before entering the market.。

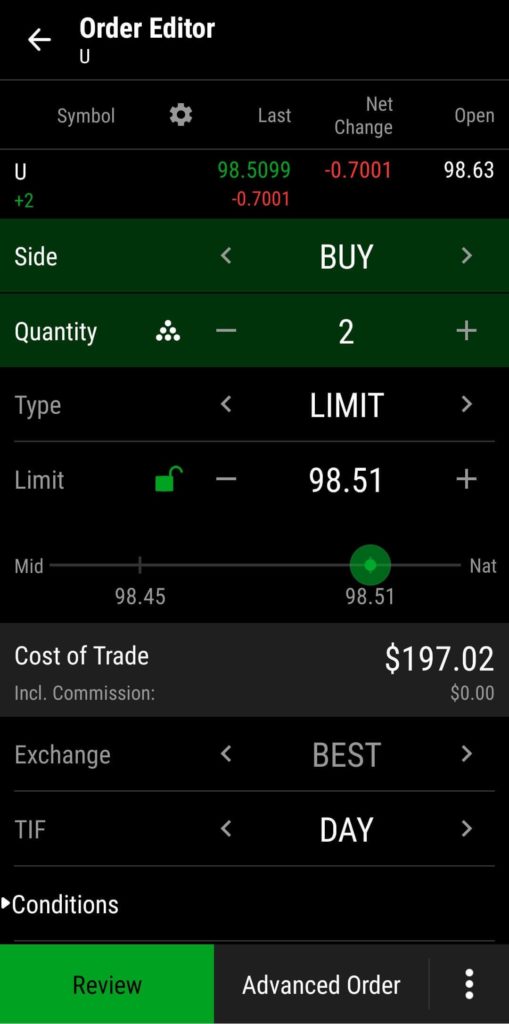

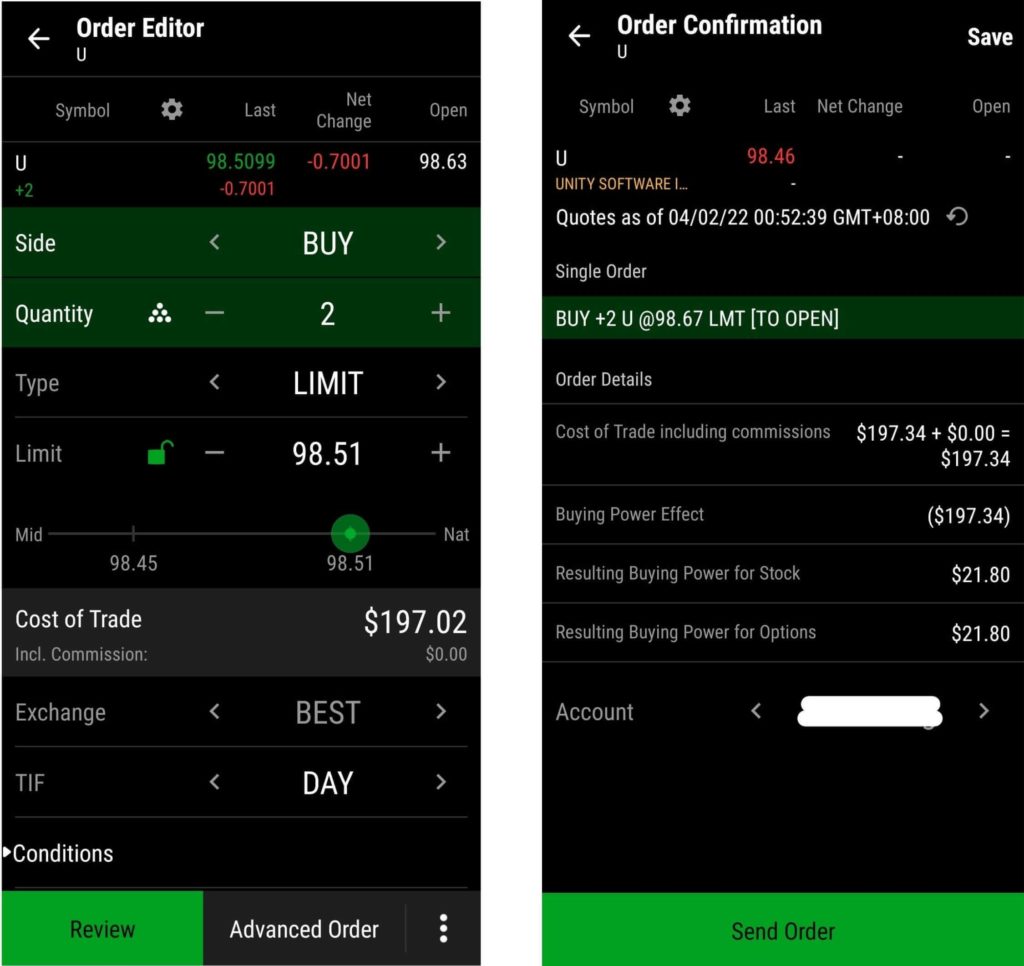

Step 2: Select the trading direction "buy" or "sell," set the order data

Choose BUY in Side or SELL。

Then set the order data, including quantity, order type, price, amount, take profit and stop loss settings.。

Quantity

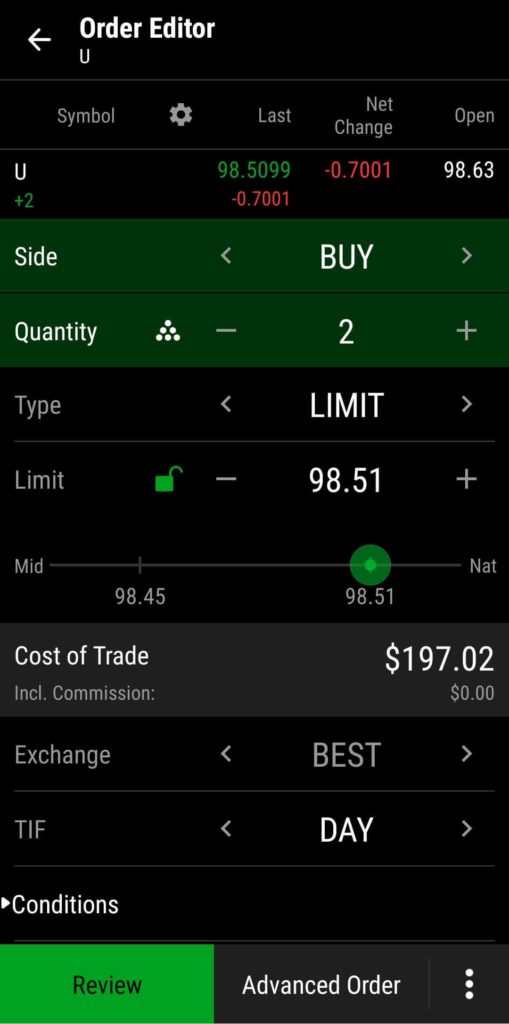

Buy a specified number of units: in the case of investing in Unity Software, the stock is trading at 98.$5099, select the number of units to buy in Quantity。The system preset number of trades is 100 shares and you need to adjust the number to the number of units you want to buy。The number of shares must be an integer, such as 2 shares。

The largest buying unit for U.S. stocks is 1 share, and TD Ameritrade does not support broken stock trading。

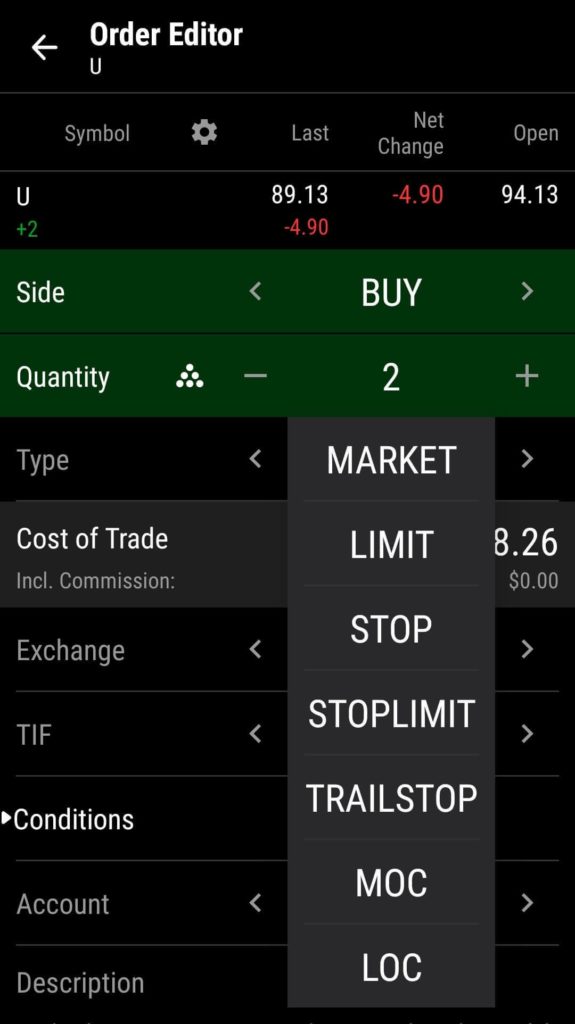

Order Type

Thinkorswim offers 7 types of orders, including limit orders (limit orders), market orders (market orders), stop-loss orders (stop-loss orders), stop-loss limit orders (stop-loss limit orders), trailing stops (trailing stop orders), closing market orders (Market On Close), and closing limit orders (Limit On Close).。The next section will detail the differences between these 6 orders.。

Price

Suppose you select an order type that is not a market order, such as a mandatory limit order, a stop order, and set a buy or sell limit (or trigger price)。

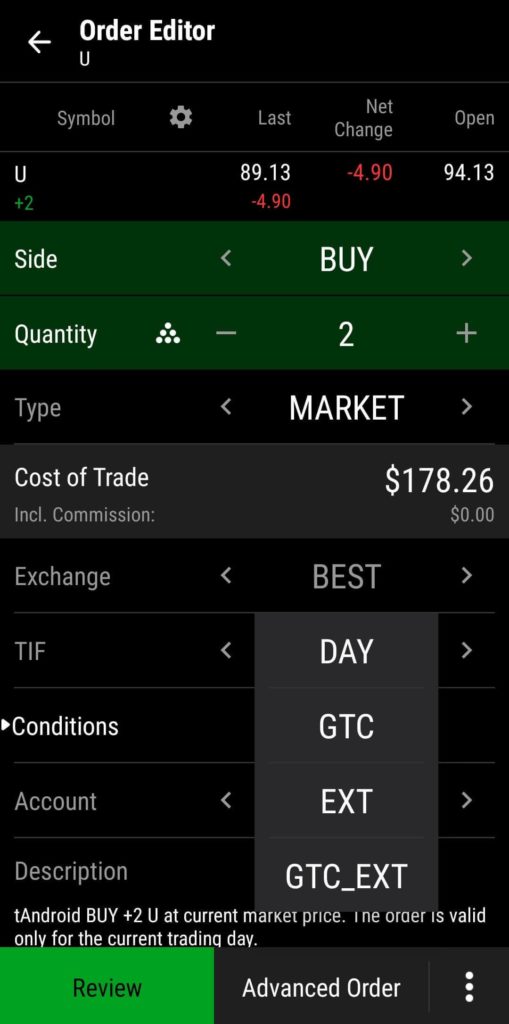

Current Effective Time

The number of valid orders, including Day, Good Till Cancel, Extended Gain (Extended Trading Time), and GTC + Extended Gain option (GTC + EXT)。

Valid for the day (Day)Indicates that the order is valid only in stock market trading on the day of the order, and that unfilled orders are automatically withdrawn after the close of the day。

Valid before cancellation (Good Till Cancelled, GTC)Indicates that the order will remain valid until it is closed or manually cancelled。

Extended Trading Hours (EXT)Indicates that the order will remain valid before and after the disk.。

GTC + Extended Gain (GTC + EXT)Indicates that the order will remain valid before and after the market until it is closed or manually cancelled.。

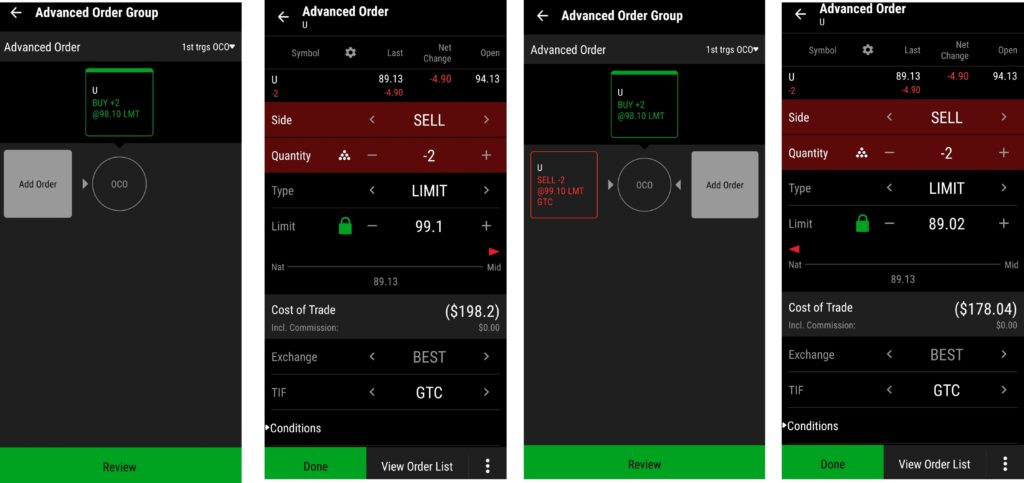

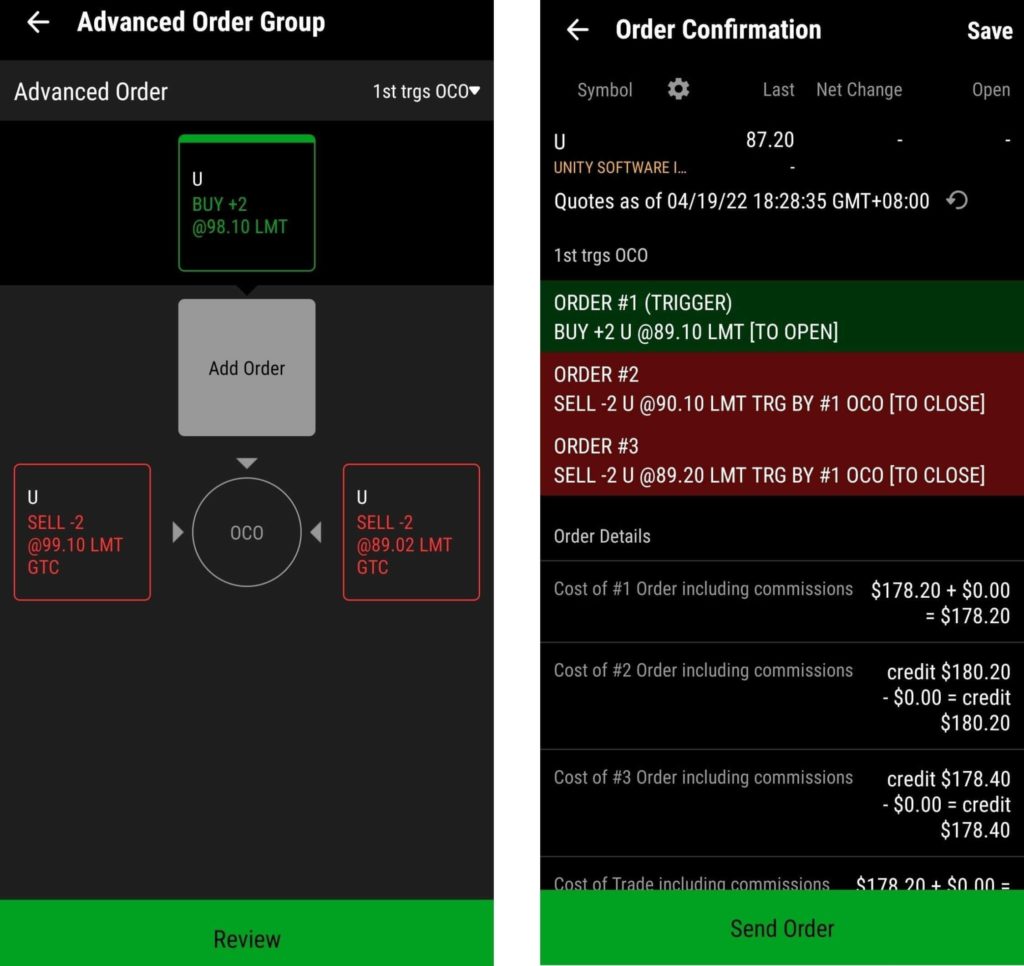

Step 3: Use OCO to set stop loss and take profit points (skip to the next step if not needed)

Click "Order in advance" in the lower right corner to set the stop loss point and stop profit point.。

You can first set a stop loss or take profit order。Here we first set up a take profit order.。Click "Add Order," set the take profit price as you set the order data above, and finally suggest setting the effective before cancellation (GTC), as we cannot guarantee that the stock price will reach the take profit price we set on that day.。Okay, click Finish.。

Next set stop loss order。The steps for setting a stop loss order are basically the same as setting a take profit order, just adjust the quantity and stop loss price。Okay, click Finish.。

Of course, you can also set only one of the stop loss or take profit orders。If you are not sure what stop loss and take profit orders are, you can skip to the next section to see。

Click "View" to confirm the order information, and then click "Send Order" to submit the order。

Step 4: Confirm the order information and submit the order

If no take profit or stop loss order is set, click "Review" to confirm the order information, and then click "Send Order" to submit the order。

Demaili Securities Order Type

Market Price List (Market Price List)

When you place a market order (market order), you execute the current market price to place an order and buy and sell without setting your own price.。

Limit Order (Limit Order)

When you place a limit order (limit order), you need to set your own closing price。When the share price reaches the specified price, or is preferred over the specified bid price (sell - higher than the specified ask price)), the order is closed.。

Stop Order

When you place a Stop Order, you need to set a Stop Price in the order, and when the stock price reaches the trigger price, the system automatically submits a buy or sell market order, but there is no guarantee that the execution price will be equal to or close to the trigger price.。

Stop Limit Order

When you place a stop-loss limit order (stop-loss limit order), you need to set a specified stop-loss trigger price (stop-loss price) and limit price (limit price) in the order, and once the price reaches the trigger price, the trade will be executed at a specific limit price or better, but there is no guarantee that the execution price will be equal to or close to the trigger price。

With stop-loss limit orders, you may miss the market。In an exciting market, you may not be able to execute an order at a stop-loss limit or better at all。

Trailing Stop / Stop Limit

When you place a Trailing Stop Limit (Trailing Stop Limit), you need to set a moving trailing stop price (or add a limit), and then the system will automatically adjust the position of the stop price according to the stock price based on the set limit.。

For example, I buy Unity Software at a stock price of 100 and set the mobile tracking cap to 20, which means that the stop loss is 80 (100-20)。

If the stock price falls immediately after buying, breaking through the stop loss price of 80, the system will immediately use the market price, or set the limit price to help me sell the position.。

But if the judgment is correct and the stock price rises all the way to 120, then the stop loss price will also track to 100 (120-20).。

At this point, as soon as the stock price falls below 100, the stock will be sold immediately, or at the limit price.。If the stock price rises to 140, then the stop-loss track becomes 120, and so on.。

Trailing stop limits have both advantages and disadvantages.。The advantage is that you can trade at a lower price in the case of short-term volatility.。But the downside is that if the stock is sold off on bad news and the stock price stays below your minimum selling price, your stock will not be traded。

Trailing stop limits apply only to stocks traded on NASDAQ, NYSE, and AMEX。

Closing market order (at market close)

A closing market order (closing price) is a market order (market order) that is traded close to the closing price (closing price).。

Closing Limit Order (Closing Limit)

A closing limit order (Limit on Close) is an order submitted at the close of the day, and if the closing price is equal to or needs to be submitted (Limit Price), the order will be executed at that time.。

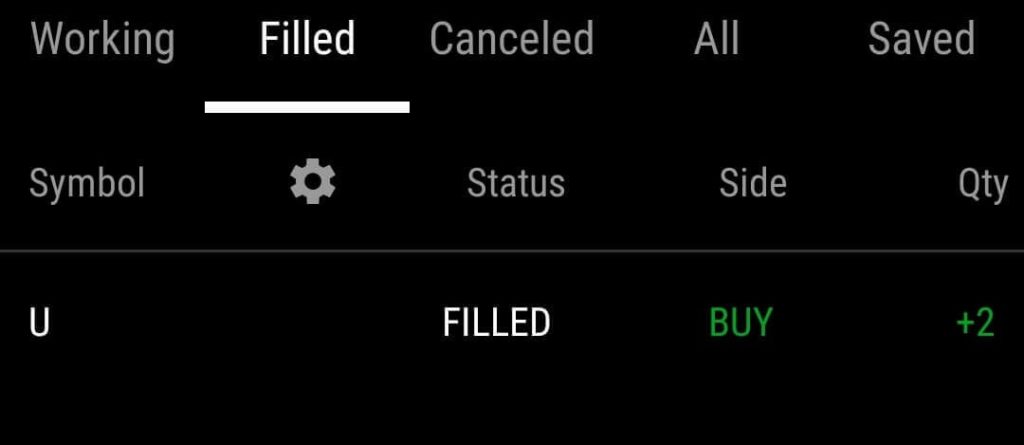

Track Order Status

On the home page or column, go to "Order" to view the order status. If the order has not been completed, it will be displayed in "Working" (pending execution)。If the order has been closed, it will be displayed in "Completed" (Completed)。You can also go to "All" to view your order history for the past 30 days.。

Demaili Securities supports pre-market after-market trading

TD Ameritrade's premarket after-hours trading is called Extend Trading Hours (EXT)。

TD Ameritrade's extended order (EXTO) order is valid for 24 hours and changes to (5 days a week, excluding market holidays) at 8: 00 p.m. EDT.。For example, your next trade order at 8 p.m. EDT on Monday will take effect immediately until you reply at 8 p.m. on Tuesday。

SUMMARY

This is the process of placing an order to trade stocks using Thinkorswim.。Any questions, welcome to leave a message to communicate with us。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.