2024 Futu Securities (Hong Kong) Account Opening Complete Process

How to open an account with Futu Securities?This article will introduce you in detail。

Futu Securities (Futu Securities) is a Hong Kong-US stock Internet brokerage firm invested by Internet giant Tencent, one of the popular Internet brokerage firms in Hong Kong, its mobile app "Futu Niu Niu" can not only buy and sell Hong Kong stocks / US stocks, but also provide real-time quotes, financial news, investment analysis tools and social interaction functions to facilitate investors to invest and interact anytime, anywhere.。

Futu Securities (Futu Securities) is subject to the Securities and Futures Commission (SFC) of Hong Kong.Regulatory Securities Company, Regulatory Certificate No. AZT137。

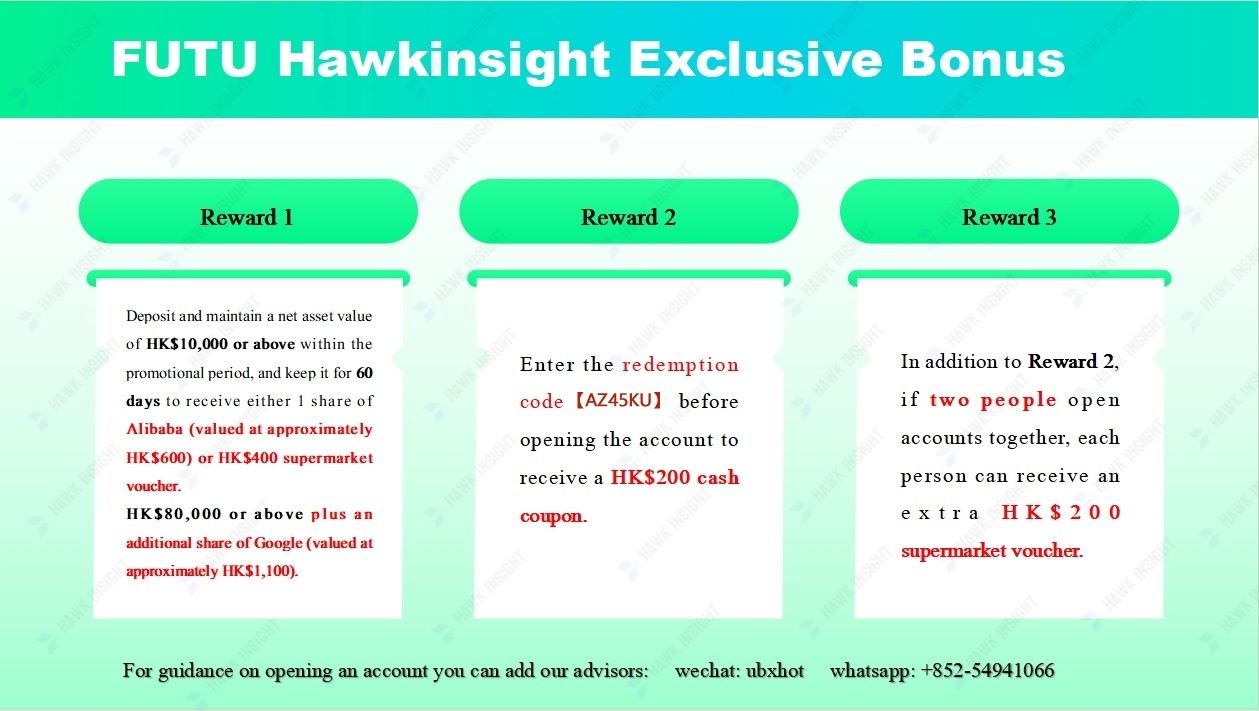

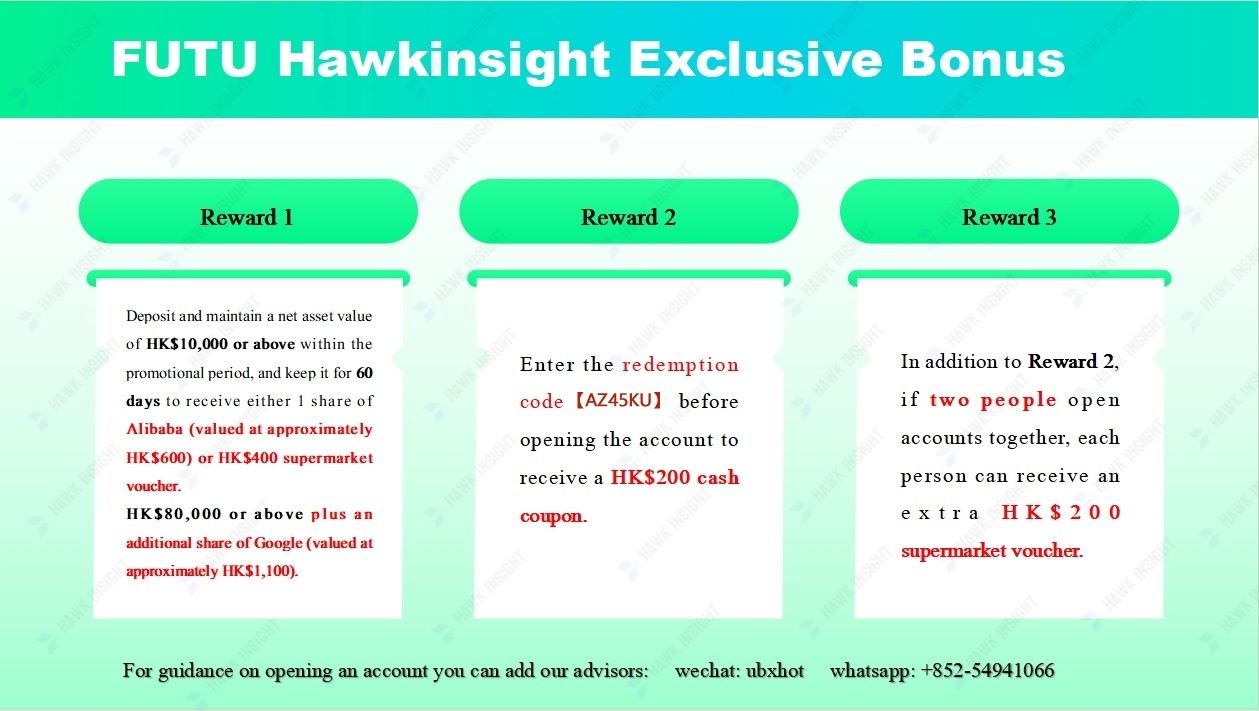

June Hawk Insight Exclusive Offer

Double Rewards (stackable) for limited time from 6.1 to 6.30:

- First Reward: Deposit a cumulative net deposit of $10,000 or above and stay for 60 days, you will receive 1 Alibaba stock or $400 worth of e-supermarket vouchers.

- Second Reward: (With a cumulative net deposit of $80,000 or above, you will be entitled to 1 TSMC stock after 60 days of deposit.

Opening Invitation Code [AZ45KU]

▍ Futu Securities account opening process

1.Account opening method description

1.1 Open an account online

Online transfer account opening can be completed without going out, you need to transfer HK $10,000 or US $1,500 to your Hong Kong bank account.。

1.2 witness account opening offline

Online appointment, offline witness。Appointment at a designated location to witness the account opening with Futu staff (currently only supported in Hong Kong)。Or visit the Hong Kong headquarters of Futu Securities without appointment.。

◇ Address: Room C1-2, 13th Floor, United Centre, 95 Queensway, Hong Kong

The phone:+852-2523 3588

Residents of Hong Kong

(1) Hong Kong Permanent Identity Card + Proof of Address (issued within three months)

(2) Hong Kong Resident Identity Card + Hong Kong Visa Identity Card + Proof of Address (issued within three months)

(3) Hong Kong resident identity card + local passport + proof of address (issued within three months)

Residents of other countries / regions

Please contact customer service consultation

1.3 Check account opening

Check account please prepare the following information:

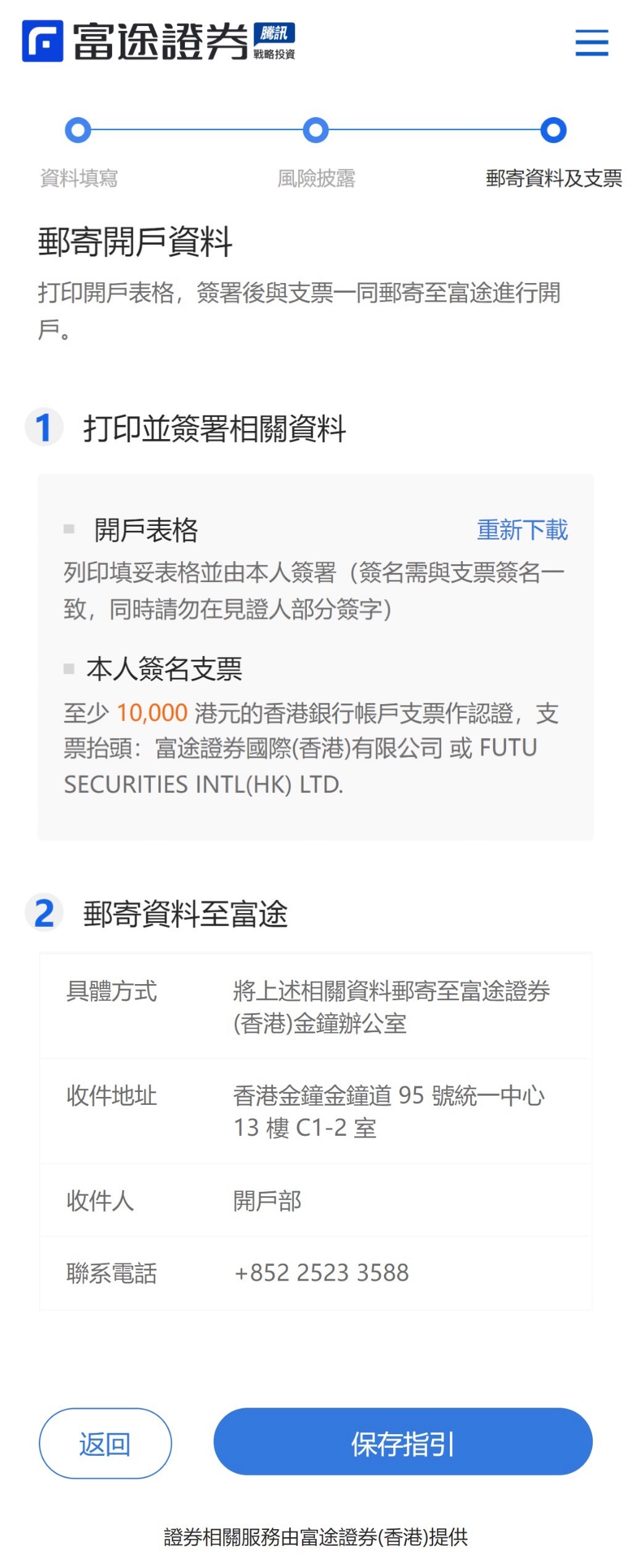

- Copies of identity documents: Non-Hong Kong permanent residents are required to provide additional proof of identity documents of origin.

- Copy of Proof of Address: within three months of date of issue

- Account opening form: print the completed form and sign it by yourself (signature must be consistent with the signature of the check, and do not sign the witness section)

- I signed cheque: at least HK $10,000 Hong Kong bank account cheque payable to Futu Securities International (Hong Kong) Limited or Futu Securities International (Hong Kong) Limited.

Document delivery method:Documents can also be mailed to Futu

- Address: Room C1-2, 13th Floor, United Centre, 95 Queensway, Hong Kong

- Recipient: Account Opening Department

- Courier Phone:+852-2523 3588

1.4 Third-party witness account opening

For customers who do not have a Hong Kong resident identity card or a Hong Kong bank account, they can download and fill out the account opening form, find qualified witnesses for third-party testimony, and mail the materials to Futu to open an account.。

2.Register Account

Fill in the "mobile phone number" → for security verification, send "SMS verification code" → fill in the "verification code" → drag the slider to complete the puzzle → set the "login password"。

3.Select Account Opening Method

At this time, you have successfully registered your account and entered the account opening page for Hong Kong and overseas residents. Please select an account opening method suitable for you to apply for opening an account.。

4.Online transfer account opening

4.1 Online transfer account opening guidelines.

When you choose the online transfer account opening method, please carefully check the online transfer account opening steps, and check "I have read and agreed to sign all the account opening documents," and then click "open now" to enter the account opening process。

4.2 fill in the identity information and upload identity documents

Fill in your identity information (gender / country / region / ID type / date of birth / place of birth / email address) according to the prompts on the page, and upload the corresponding ID photo。

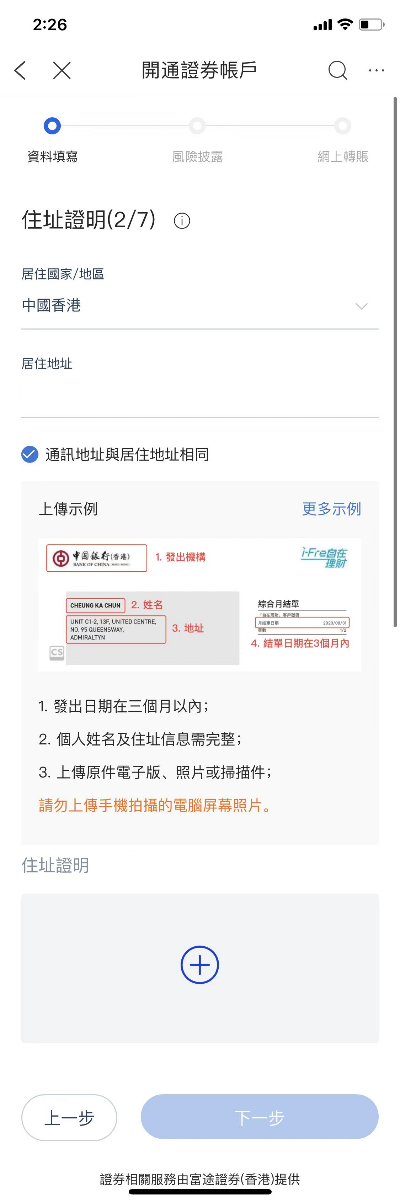

4.3 fill in the residence address and upload address certificate

Fill in your residential address and upload proof of address consistent with your residential address。Need to meet:

- Issue date within three months

- Personal name and address information must be complete

- Upload the original electronic version, photo or scan

* Do not upload photos of computer screen taken by mobile phone

4.4 fill in the professional status, financial situation, investment experience

Fill in your professional status, financial situation, investment experience information according to the page prompts。

4.5 Fill in tax information, other information disclosure.

Fill in your tax information and other information disclosure according to the prompt on the page。

4.6 Account selection

Select the type of account you want to open, the default selection of Hong Kong stock financing account, U.S. stock financing account, A-share financing account and fund account, you can manually cancel the type of account you do not want to open.。

4.7 Risk disclosure

A licensed representative will give you a voice explaining the main risks of the selected account in trading, and you can turn up the volume of your phone to listen to it.。

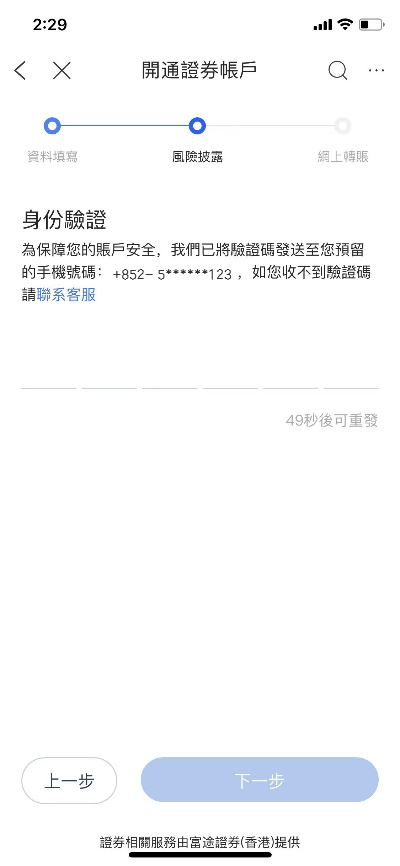

4.8 Authentication

SMS verification through your bound mobile phone number。

4.9 Confirm information and sign

Check the information you have filled in. If you find any errors, you can directly click "Modify" to modify the information in the corresponding part. Please complete the electronic signature after confirming that it is correct.。

4.10 View online transfer guidelines

At this point, you have submitted the information section and still need to initiate an online transfer to complete the account opening.。

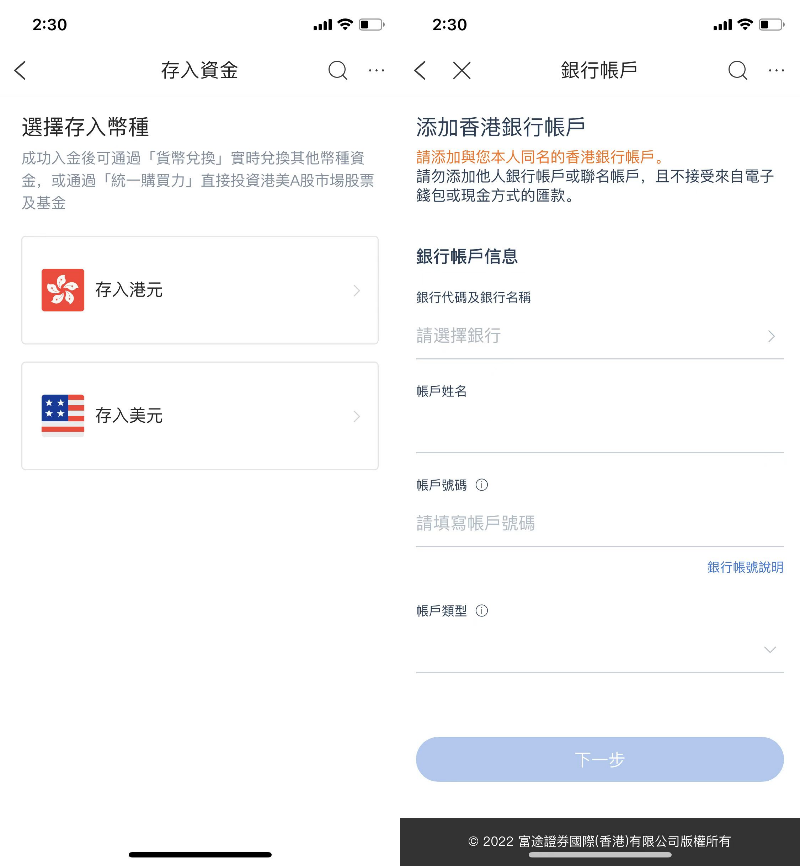

4.11 Select deposit currency and add Hong Kong bank account

Please select the currency of the deposit and add your own Hong Kong bank account information of the same name to bind。

Please note:

1.You can choose to deposit USD only if you choose to open an account that includes a U.S. stock account。

2.Do not use third-party accounts, joint accounts, POA accounts for transfers。

4.12.1 FPS transfer (deposited in Hong Kong dollars)

When the currency selected for deposit is Hong Kong dollar, FPS speed is supported, and customers can transfer money by filling in the FPS identification code of Futu Securities in online banking or stored value payment instruments, and return to Futu to fill in the amount to submit an application.。

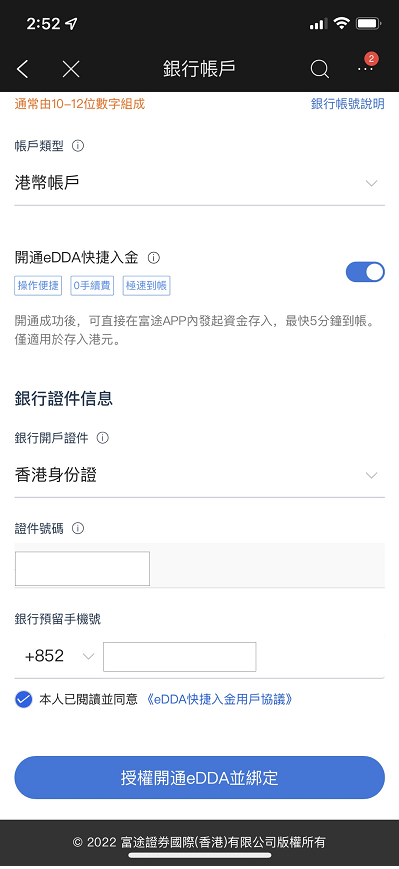

4.12.2 eDDA transfers (deposited in Hong Kong dollars)

When the currency selected for deposit is Hong Kong dollar and the selected bank is a bank covered by Futu, eDDA transfer is supported. After the customer submits information on the Futu side for account authorization, the funds will be deducted from the bank account and deposited into the account after the account is opened.。

Banks that currently support the initiation of authorization from Futu: Hang Seng Bank, HSBC, Bank of China (Hong Kong), Nanyang Commercial Bank, Fung Rong Bank, Industrial and Commercial Bank of China (Asia), Wing Lung Bank, Standard Chartered Bank, CITIC Bank (International), ZhongAn Bank。

Real-time authorized banks, such as HSBC, need SMS verification after filling in the bank document information and immediately verify the authorization from the bank side:

For banks that are not authorized in real time, such as Hang Seng Bank, fill in the bank certificate information and submit an application before verifying authorization from the bank side.

4.12.3 E-banking online banking transfer (transfer currency is Hong Kong dollar)

When the currency selected for deposit is Hong Kong dollar, E-Banking online banking transfer is supported, and the receiving account is ICBC (Asia)。

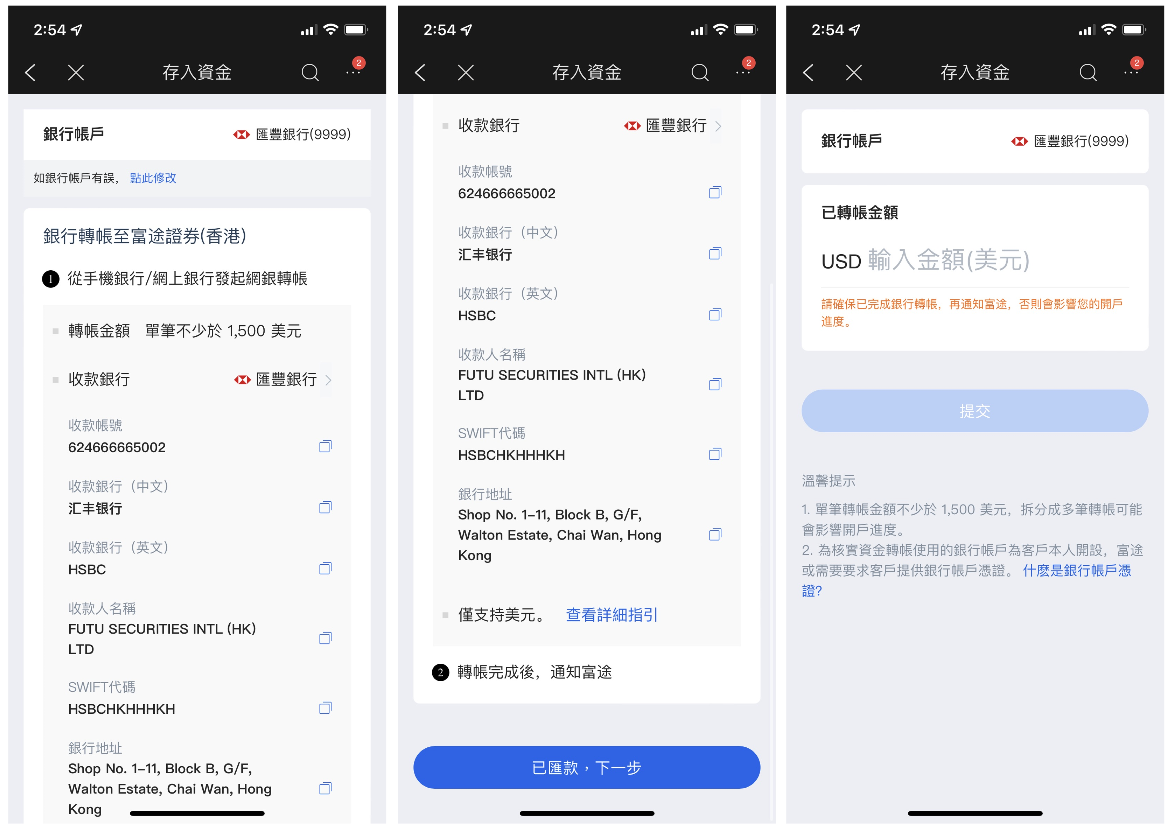

4.12.4 E-banking online banking transfer (transfer currency is USD)

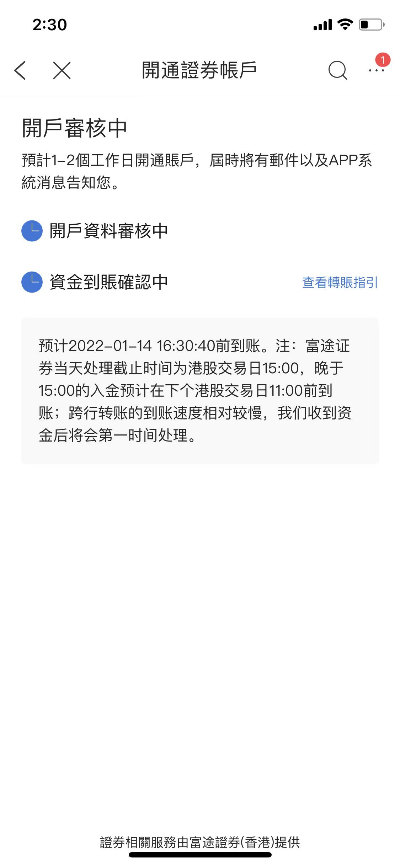

4.13 Submit an account opening application

After the transfer and notification, the account opening application is completed, and you can check the progress of the account opening here at any time.。We will complete the audit within 1 ~ 2 working days。If you need to modify, supplement information or open an account successfully, you will receive system messages and email notifications, please pay attention。

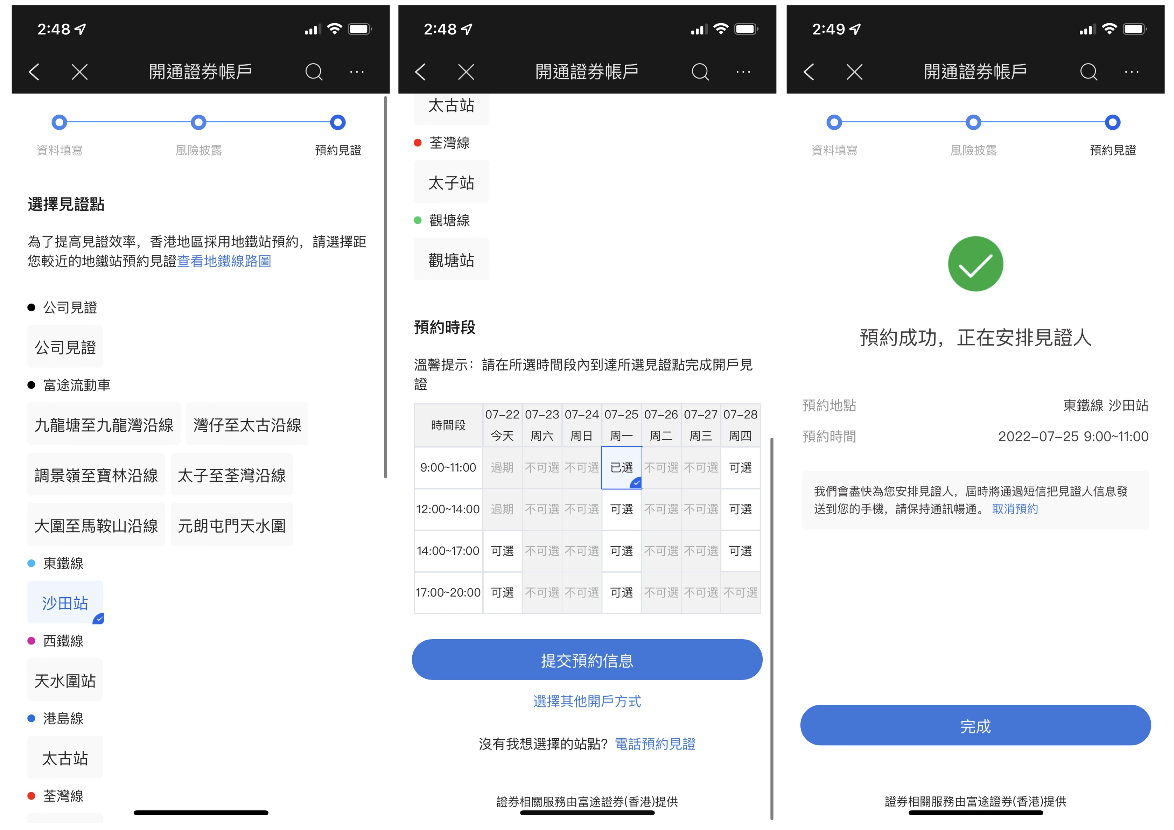

5.Open an account by appointment offline

You can choose the witness site and the appointment period on the page. If the appointment is successful, we will arrange the witness for you as soon as possible. At that time, the witness information will be sent to your mobile phone via SMS. Please keep the communication unblocked.。

6.Select Check Account

You can view the information you need to prepare to open a check account and how the documents are delivered.。

▍ Frequently Asked Questions

1. How do I know if my account is open?

After the account is opened, Futu will notify you by email and APP system messages. Please be sure to fill in the correct common email address when registering.。

2. How long is the processing time?

Normally, Futu Securities (Hong Kong) will process the relevant account opening application within 1-3 working days。In some cases, the broker may proactively contact the applicant for more information。

3. Charge standard

| Fees (Equity / ETF) | ||

| Type | Country / Region | 费用 |

| Hong Kong Stock | Commission | 0.03% * Transaction amount, minimum 3 per order.HK $00 (not charged during the commission-free period) |

| Platform Fee | HK $15 per order | |

| U.S. stocks | Commission | 0.$0049 / share, minimum 0 per order.99美元 |

| Platform Fee | 0.$005 / share, minimum $1 per order | |

| A Shares | Commission | 0.03% * transaction amount, minimum 3 yuan per order |

| Platform Fee | 15 yuan / Order | |

4. Arrival time of deposit

◇ eDDA Express Deposit Arrival Time

| Time to initiate deposit notification | Estimated arrival time |

| Monday 08: 00 - Saturday 09: 55 | Within 5 minutes |

| Other time | Before 08: 10 next Monday |

◇ FPS revolution fast-in payment arrival time

| Time to initiate deposit notification | Estimated arrival time |

| Monday 08: 00 - Friday 15: 00 | Within 2 hours |

| Other time | Before 11: 00 next Monday |

◇ E-Banking peer online banking transfer, ATM / counter peer transfer

| Time to initiate deposit notification | Estimated arrival time |

| Hong Kong Stock Exchange Trading Day 09: 00-15: 00 | Within 2 hours |

| Other periods | Before 11: 00 on the next Hong Kong stock trading day |

◇ E-Banking inter-bank online banking transfer, ATM / counter inter-bank transfer

- Due to the inter-bank transfer involved, if the non-express transfer bank takes a long time to process, the arrival speed is slow, is expected to be 1-3 working days.。

- The time mentioned is Beijing time, the trading day is Hong Kong stock trading day, and the working day is Hong Kong bank working day;

- E-Banking inter-bank online banking transfer, ATM / counter inter-bank transfer support currency: Hong Kong dollar, US dollar, offshore RMB。

Transfer of cheques

Due to the bank's need to process checks, the arrival rate is slow and is expected to be 2 working days.。

The above time is Beijing time, the trading day is the Hong Kong stock trading day, the working day is the Hong Kong bank working day.。

Holding a bank account in Taiwan

Transfer outside Hong Kong, the bank needs a long time to process, the arrival speed is relatively slow, it is expected that the arrival time is 1-3 working days, Futu will be the first time after receiving the funds, please refer to the entry notice.

Holding bank accounts in other regions

Estimated arrival time is 1-5 business days after initiating remittance notification。

After the remittance is accepted by the bank, the funds are transferred one by one through the bank's transfer bank and finally arrive at the designated account of the receiving bank.。During the transit process, the arrival time cannot be accurately calculated because the remittance path is not fixed.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.