How to deposit Moomoo from SG bank?

This article introduces Futura Securities (Singapore) deposit and withdrawal methods and complete illustrated instruction.

Futura Securities (Singapore) is becoming more and more popular due to its support for trading on a wide range of trading markets and its ultra-low commissions. Futura Securities (Singapore) is becoming more and more popular due to its support for trading in a wide range of trading markets at the same time, and the advantages of ultra-low commissions, etc. At present, it only accepts bank transfers (telegraphic transfers) as a means of depositing and withdrawing funds, and the efficiency of such transfers is also very fast.

This article introduces the way of deposit and withdrawal of Futu Securities (Singapore) and the complete flow chart solution teaching.

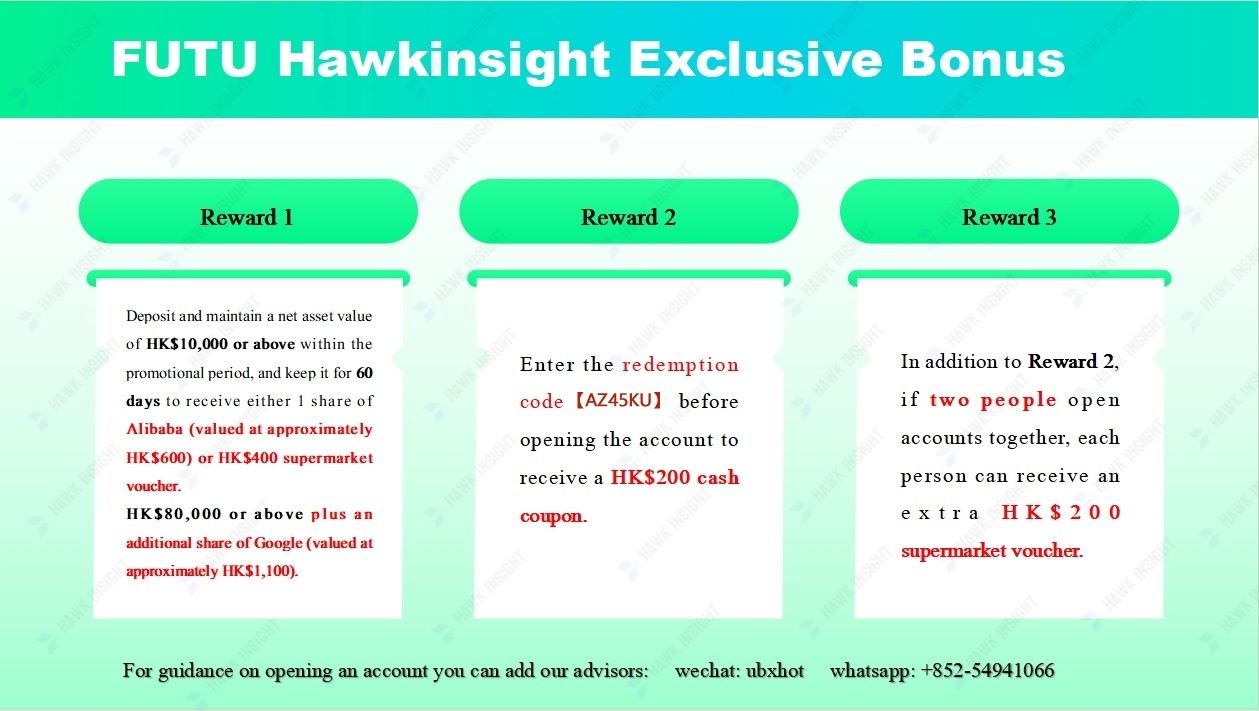

HawkInsight Exclusive Account Opening Offer!

Moomoo deposit and withdrawal considerations

1. You can deposit money only after you have successfully opened an account.。

2, Futu Securities (Singapore) has no minimum or maximum interruption of deposit.。

3. Futu Securities (Singapore) accepts US dollars, Singapore dollars and Hong Kong dollars as deposits.。Securities accounts and funds on each exchange will be shown separately。Assuming a dollar deposit, the system will deposit funds into a U.S. securities account; in Singapore dollars, the system will deposit funds into a Singapore securities account。However, you can use the currency exchange feature (currency) built into the moomoo app

4, Futu Securities (Singapore) need to use your own bank account transfer (and Futu Securities (Singapore) account name is the same),Do not accept transfers from third-party bank accounts, third-party payment platforms, e-wallets or corporate accounts。Recommended to use Singapore FAST transfer, zero fee。

January 14, 2022 update: Futu Securities (Singapore) said it accepts Wise deposits, and after the deposit is made through userWise, it is required to send an additional convenience to clientservice @ futusg..com, attach remittance voucher, moomoo id and full Chinese name, rich channel team to review funds。

Deposit method

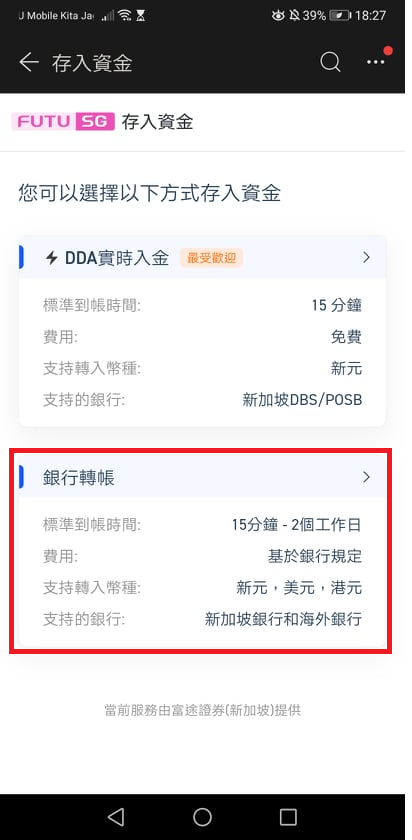

Futu Securities (Singapore) accepts two methods of deposit: DDA (Direct Debit Authentication) real-time deposit and bank transfer (wire transfer)。

"Futu Securities is currently offering an exclusive account opening promotion. During the promotional period (ending on April 30), users who successfully open a Futu NiuNiu Hong Kong and US stock trading account using the redemption code [AZ45KU] can receive rewards worth up to HK$2,100 upon successful account opening."

The differences between the two are as follows:

DDA (Direct Debit Authentication) real-time deposit

DDA (Direct Debit Authentication) Real-time deposit is a partnership between Futu Securities (Singapore), DBS Bank of Singapore (DBS) and Postal Savings Bank of Singapore (POSB) to provide users with authorized, fast and convenient transfer services.。

Before using the DDA real-time deposit method, you need to bind your DBS / POSB bank account with Futu Securities (Singapore).。

After binding, whenever you initiate a transfer of funds within the moomoo app, the bank will automatically perform the transfer。Although DDA real-time deposit only supports SGD transfer, compared with other SGD deposit methods, the biggest advantage of DDA real-time deposit is that the deposit is free, expected to arrive within 15 minutes (office period), and convenient and convenient.。

Note that the first use of DDA deposit must first authorize the binding of DDA and DBS / POSB accounts, binding teaching can be clicked.Here。

If you want to delete the bound bank account and cancel the DDA account authorization, you can clickHere。

Bank transfer

Bank transfer can short-circuit "Singapore bank account" and "non-Singapore bank account"。

Transfers from other bank accounts in Singapore

You can remit SGD using fast and secure transfer (FAST) from other banks in Singapore such as Maybank SG or CIMB SG。The FAST transfer method is also the deposit method recommended by Futu Securities (Singapore), with zero fees.。

Generally, it only takes about 15 minutes (office period) to arrive。

If you choose to remit about USD or HKD, you will be treated as a general wire transfer, which will take 1 to 3 working days, and in CIMB SG, for example, the fee is S $25-30.。

Futu Securities (Singapore) itself does not charge any entry and exit fees, and intermediate fees are charged by the remitting bank and the transit bank used by the bank.。Note that different banks have different charges, you can check the wire transfer charges of individual banks online。

Non-Singapore bank accounts

Non-Singapore bank accounts, whether in SGD, USD or HKD, are transferred by wire transfer and require 1 to 3 working days。The handling fee is around $25.。

Futu Securities (Singapore) itself does not charge any entry and exit fees, and intermediate fees are charged by the remitting bank and the transit bank used by the bank.。Note that different banks have different charges, you can check the wire transfer charges of individual banks online。Or use Wise remittance deposit。

The arrival speed of remittance deposit, from the fastest to the slowest: Singapore DBS / POSB bank account binding DDA real-time deposit > Singapore other bank account transfer > non-Singapore bank account using wire transfer (TT) remittance

Moomoo gold teaching

Futu Securities offers bank transfers to Singapore bank accounts and non-Singapore bank accounts, and users are free to remit SGD, USD or HKD.。As for which currency to remit, it depends on which market you want to invest in。

The following deposit steps will be taught using the moomoo app, a traditional Chinese interface, and a Singapore bank account.。

"Futu Securities is currently offering an exclusive account opening promotion. During the promotional period (ending on April 30), users who successfully open a Futu NiuNiu Hong Kong and US stock trading account using the redemption code [AZ45KU] can receive rewards worth up to HK$2,100 upon successful account opening."

Step 1: Log in to the moomoo app

After logging into the moomoo application, click on "transactions" > "deposit funds" in the toolbar below

Step 2: Choose the way to deposit funds

Since we use Singapore bank account, so here we click on "bank transfer"。

Step 3: Select the gold coin species and the gold bank.

You can select the type of gold coins entered including Singapore dollars, US dollars and Hong Kong dollars.。Here we choose Singapore dollar。

The choice of deposit banks includes the Bank of Singapore and banks in other countries / regions.。Here we choose the Bank of Singapore。

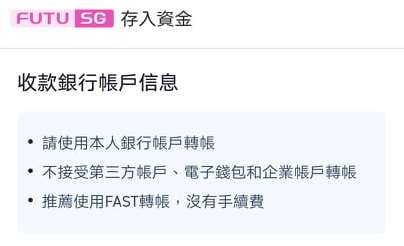

Note that moomoo emphasizes the use of your own bank account for transfers (the same name as the Futu Securities (Singapore) account) and does not accept transfers from third-party bank accounts, third-party payment platforms, e-wallets or corporate accounts.。

Moomoo customer service cannot directly see the name of the sender due to the third-party account deposit method。Therefore, if you use a third-party payment platform for remittance, please remember to provide remittance funds to moomoo's online customer service to facilitate manual processing by customer service。

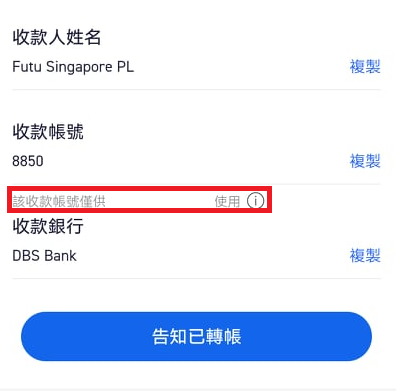

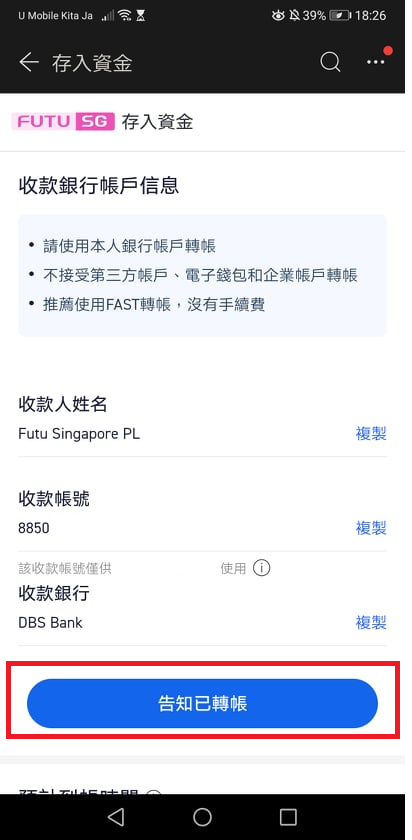

Step 4: Obtain the Receiving Bank Account

View and copy the receiving bank account information to facilitate the next bank transfer。

Note that everyone's collection account number is different and is for your personal use only, so the correct collection account number is the same as what your app shows。

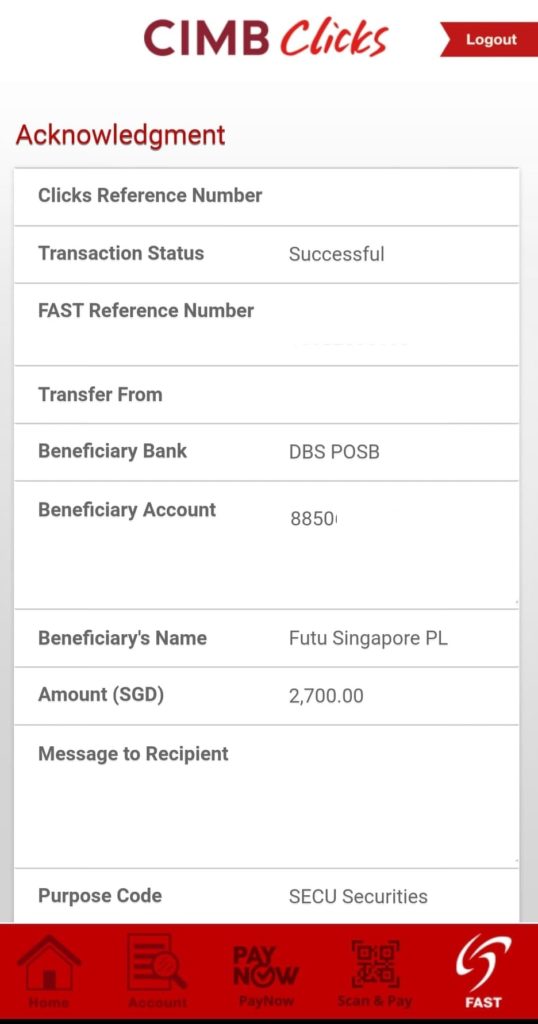

Step 5: Complete the transfer at the bank

Use your own bank account (the same name as your Futu Securities (Singapore) account) to make online transfers based on the receiving bank account information displayed。

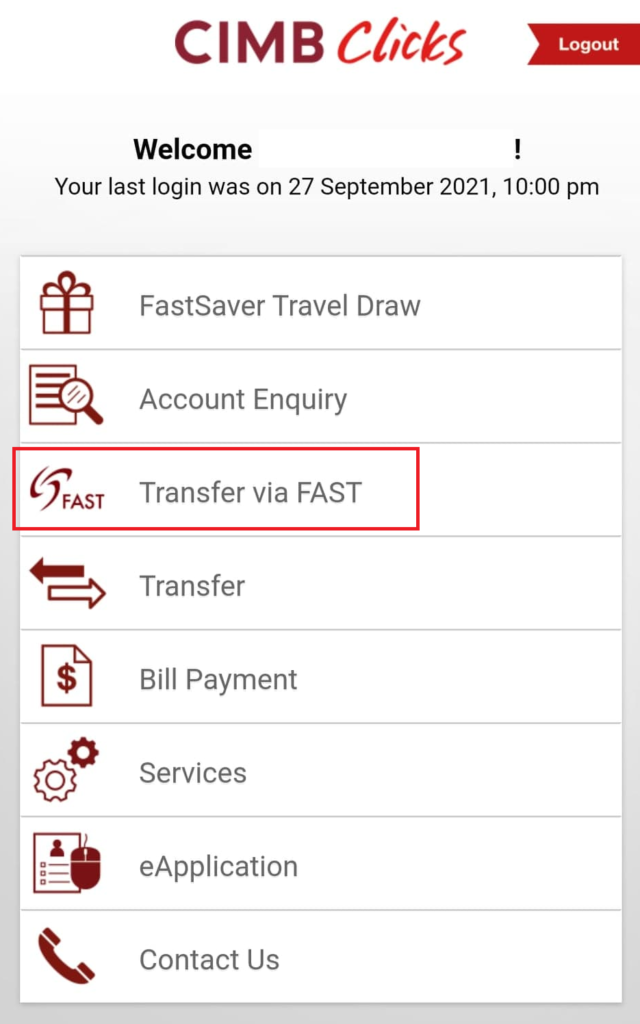

For example, I use CIMB SG, first click on the FAST transfer service and then enter the bank account of Futu Securities (Singapore)。

Rich Securities (Singapore) stresses that it does not accept remittances from other people's bank accounts, e-wallets and cash remittances.。If such funds are received, no refund will be made。However, the cost of the refund will be borne by the user himself。

Step 6: Deposit into Futu Account

After completing the round, you can click on "Know Round"。

Overall, Singapore banks have been successful in the past 1-3 business days a week。Moomoo customer service will process the funds during office hours after receiving them.。After completion of the deposit, the system will be notified by mail and application message。

If you do not complete the deposit beyond the above promised time, please remember to contact moomoo's 24-hour online customer service。

In addition, to view the deposit history, click "Transactions" > "Securities Account" > "All" > "Fund History" in the toolbar below the application.。

Considerations for Futu Securities (Singapore) Withdrawal Matters

1, there is no minimum or maximum interruption of the payment.。(Note: Using a bank that does not support FAST transfers, the minimum withdrawal amount is SGD 50) 2, Futu Securities (Singapore) does not involve any withdrawal fees, but in the withdrawal

When using the bank will charge a fee, different banks have different charges.。Futu Securities (Singapore) recommends FAST transfers with zero fees。3, when the money can only be remitted to your own bank account and into Futu Securities (Singapore)Same account name, do not accept remittances to third-party bank accounts, joint bank accounts, etc.。

Futu Securities (Singapore) currently only accepts bank transfers (wire transfers), as well as bank transfers from Singapore bank accounts and non-Singapore bank accounts.。Users can freely choose to remit RMB, USD or HKD。

The following steps will be based on the moomoo application, the traditional Chinese interface, using a Singapore bank account.

"Futu Securities is currently offering an exclusive account opening promotion. During the promotional period (ending on April 30), users who successfully open a Futu NiuNiu Hong Kong and US stock trading account using the redemption code [AZ45KU] can receive rewards worth up to HK$2,100 upon successful account opening."

Step 1: Log in to the moomoo app

After logging into the moomoo application, click "Trading" > "Securities Account" in the toolbar below.

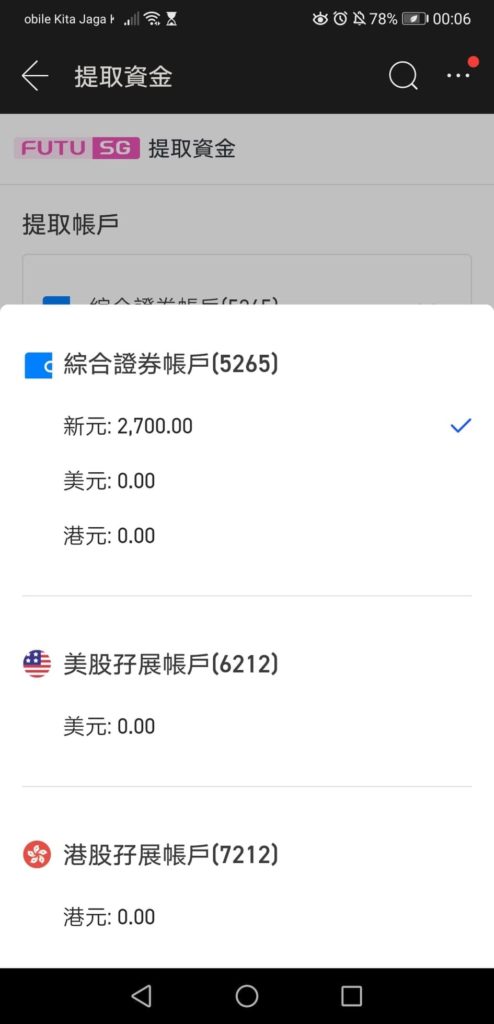

Step 2: Initiate a withdrawal application

Click All > Withdrawal Funds in the toolbar below

Step 3: Enter the withdrawal amount

Select the securities account you want to withdraw from (US, Hong Kong or General), then enter the amount of cash you want to withdraw and click Next.。

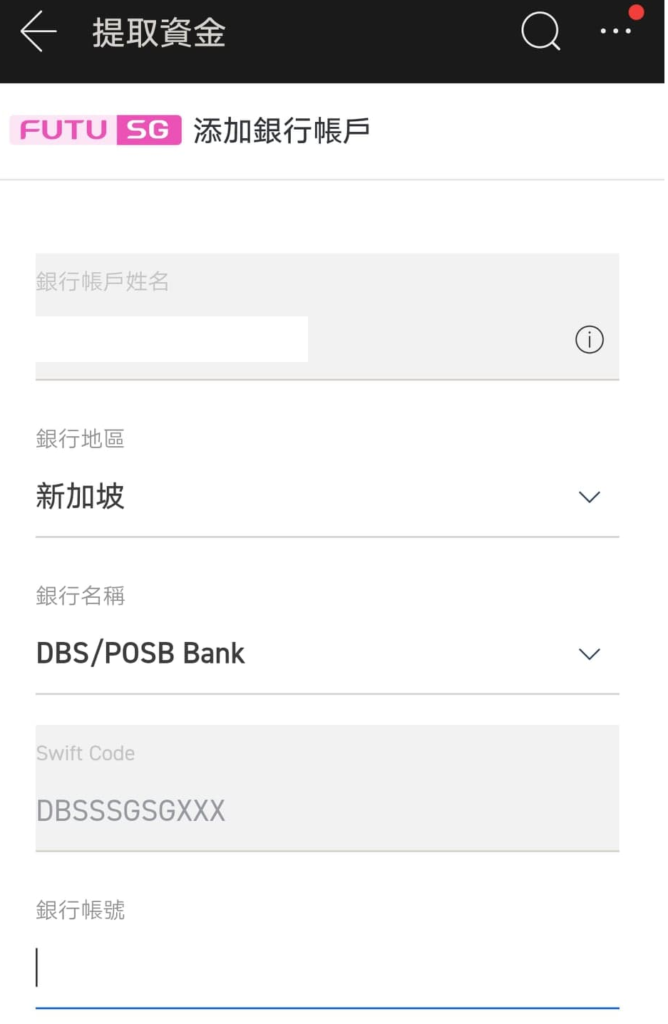

Step 4: Fill out your bank account

Remember to use your own bank account (same name as Futu Securities (Singapore) account)。Futu Securities (Singapore) does not accept withdrawals to other people's bank accounts and company accounts, otherwise the withdrawal application will be rejected.。

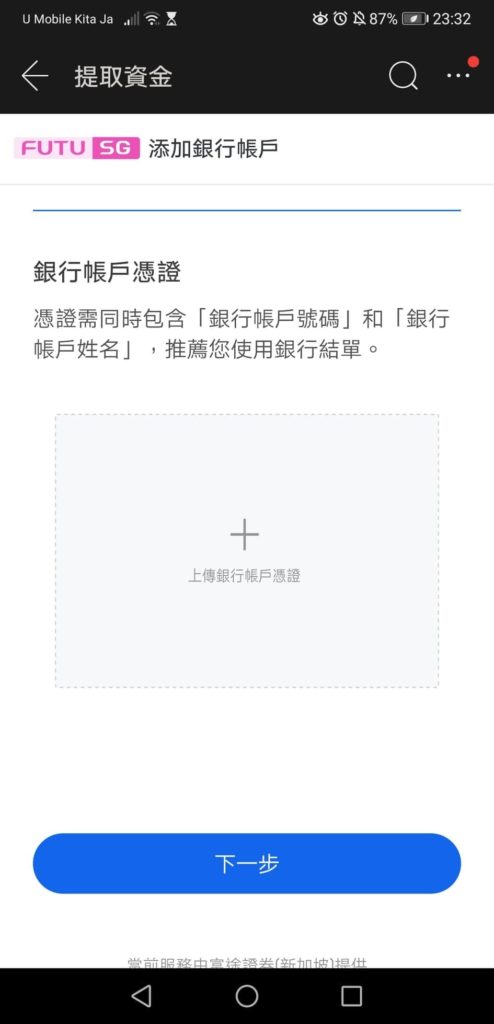

Step 5: Upload the bank account voucher

Note that both the "Bank Account Number" and "Bank Account Name" must be included to prove that the receiving bank account belongs to you。It is recommended to use documents such as bank statements and account opening information.。After uploading, click Next。

Step 6: Submit an application

After confirming the withdrawal, click "Submit"。The application displays the estimated time of arrival。You will receive an information notice from Futu Securities (Singapore) after the successful withdrawal.。

Step 7: View Fund Records

After you apply for a deposit, you also go to the application and click "Trading" > "Securities Account" > "All" > "Fund Records" in the toolbar below to view the withdrawal fund records.。

There are generally the following states:

- ◇ Processing: Withdrawal application waiting for processing。

- ◇ Completed: withdrawal application completed and funds remitted。

Cancelled: The user cancelled the withdrawal request.。

◇ Rejected: The withdrawal application was not approved, please check the email or app notification for specific reasons.。

◇ Corrected: The funds were refunded by the bank and added back to the Futu Securities (Singapore) account.。

Payment expenses and estimated time of arrival

I believe this is a lot of users are concerned about things, worried about slow or high cost of gold。

"Futu Securities is currently offering an exclusive account opening promotion. During the promotional period (ending on April 30), users who successfully open a Futu NiuNiu Hong Kong and US stock trading account using the redemption code [AZ45KU] can receive rewards worth up to HK$2,100 upon successful account opening."

After the withdrawal application is submitted, moomoo will process it in time during office hours。Futu Securities (Singapore) does not charge any fees for withdrawals, but the remitting bank will charge a fee of around S $30 from the withdrawal amount.。Note that different banks have different charges, you can check the fees of individual banks online.。

Meaning, if you make a deposit to a Singapore bank through FAST (not exceeding S $200,000), the deposit fee is 0。If you are a Malaysian, you can install a CIMB SG bank account to process the payment procedure and save the bank charges in the payment process.。

SUMMARY

Remittance in and out of the withdrawal speed, from the fastest to the slowest: Singapore DBS / POSB bank account binding DDA real-time deposit > Singapore other bank account transfer > non-Singapore bank account using wire transfer (TT) remittance。

Generally speaking, people who do not live in Singapore do not have a Singapore DBS / POSB bank account. Therefore, the most appropriate and cost-effective way to deposit money is to transfer money through another bank account in Singapore using Fast and Secure Transfer (FAST).。Not only is it efficient, but it can also help keep track of bank wire transfer fees and save on transaction costs!

"Futu Securities is currently offering an exclusive account opening promotion. During the promotional period (ending on April 30), users who successfully open a Futu NiuNiu Hong Kong and US stock trading account using the redemption code [AZ45KU] can receive rewards worth up to HK$2,100 upon successful account opening."

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.