After the "major outage" incident in August last year, less than half a year later, Futu Securities once again experienced network outage problems, which worried many investors.

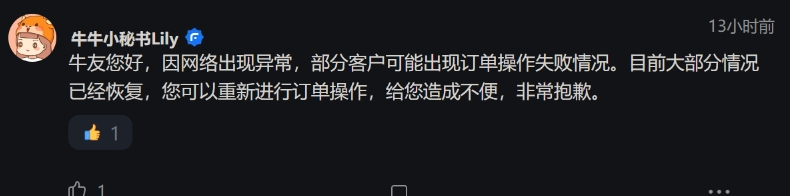

On February 12, during the U.S. stock trading session, some investors reported that Futu Securities had another "network outage" problem. A pop-up message on the mobile phone reported an error saying: Dear customer, due to an abnormality in the network, some customers may have order operations. In case of failure, Futu is currently accelerating the investigation and repair, which has caused inconvenience to you. I am very sorry.

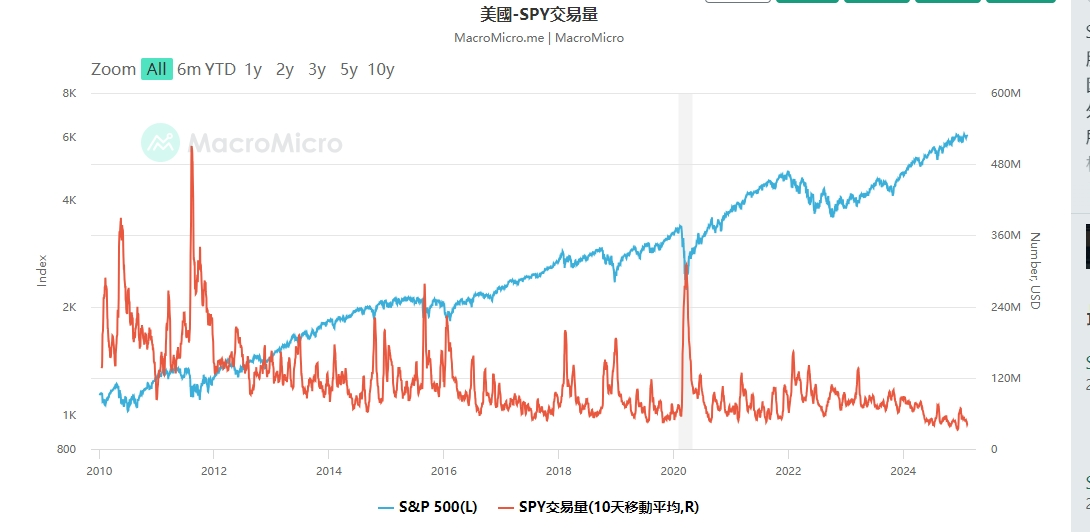

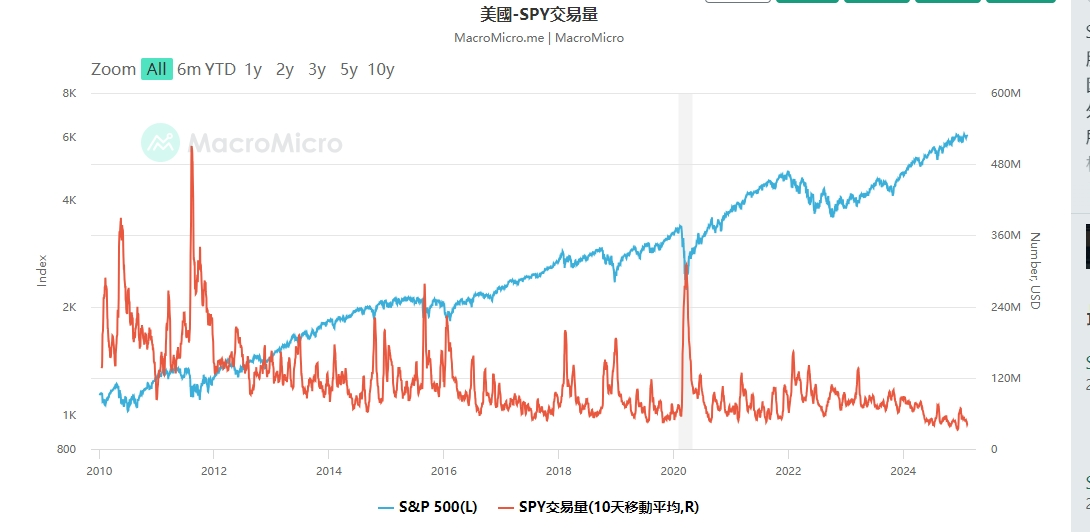

It is understood that yesterday was the release day of important inflation data in the United States, and a surge in transaction volume may often occur at this time.According to data released yesterday, the U.S. CPI rose by 3% year-on-year in January, exceeding expectations of 2.9%; it rose by 0.5% month-on-month, also higher than expectations of 0.3%.Affected by this, the three major U.S. stock indexes fell at the beginning of the session, and investors panicked that the Federal Reserve's interest rate cut this year would fall short of expectations.

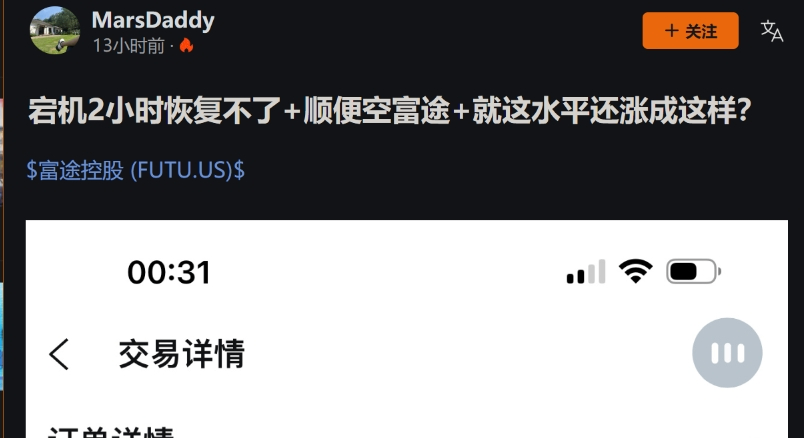

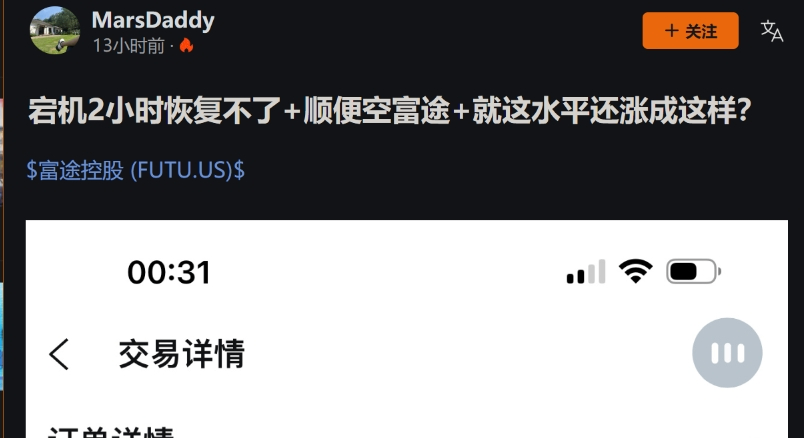

Futu's transaction outage is not an isolated case.In August last year, the brokerage company had a "major outage" incident.

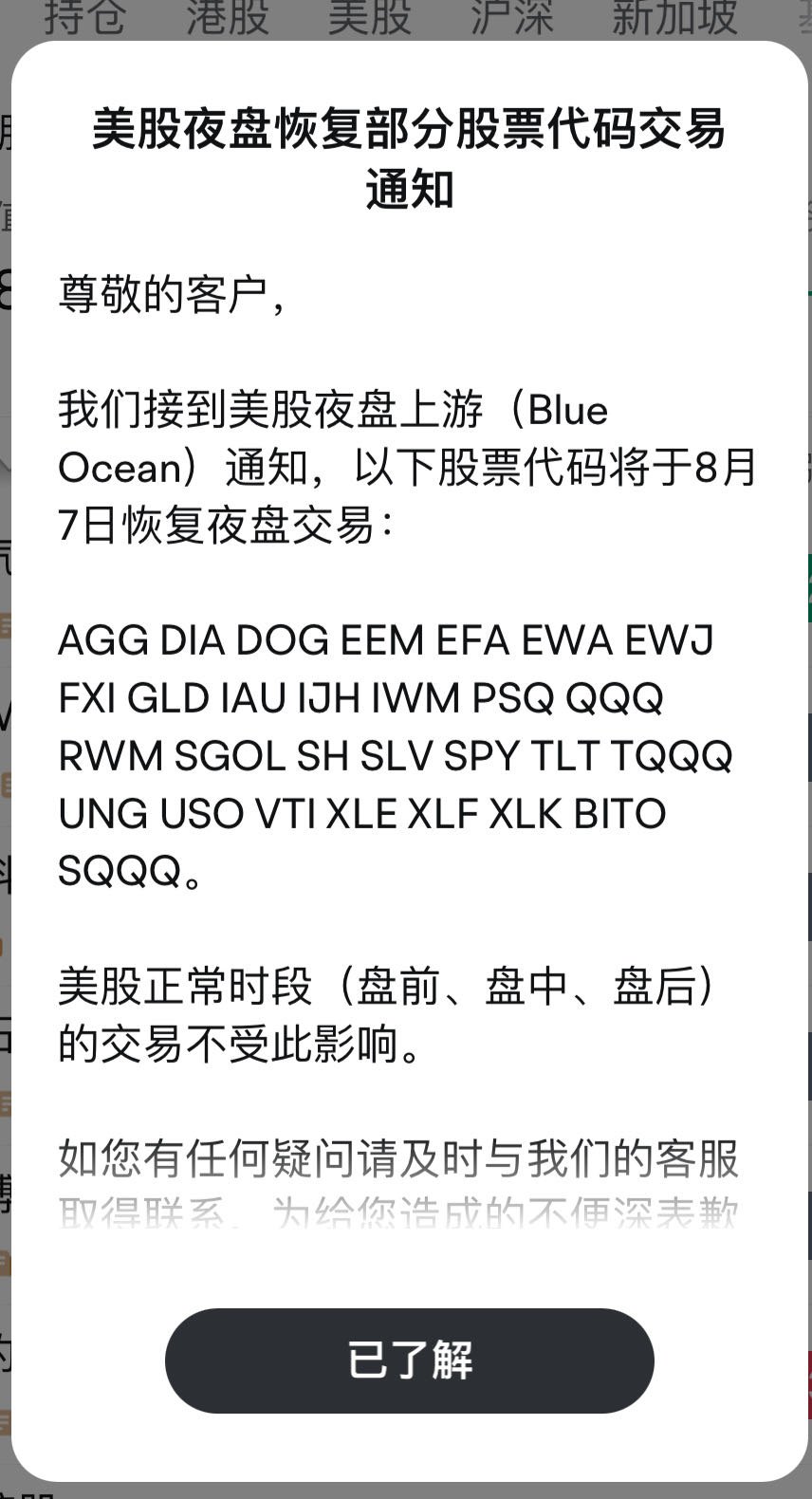

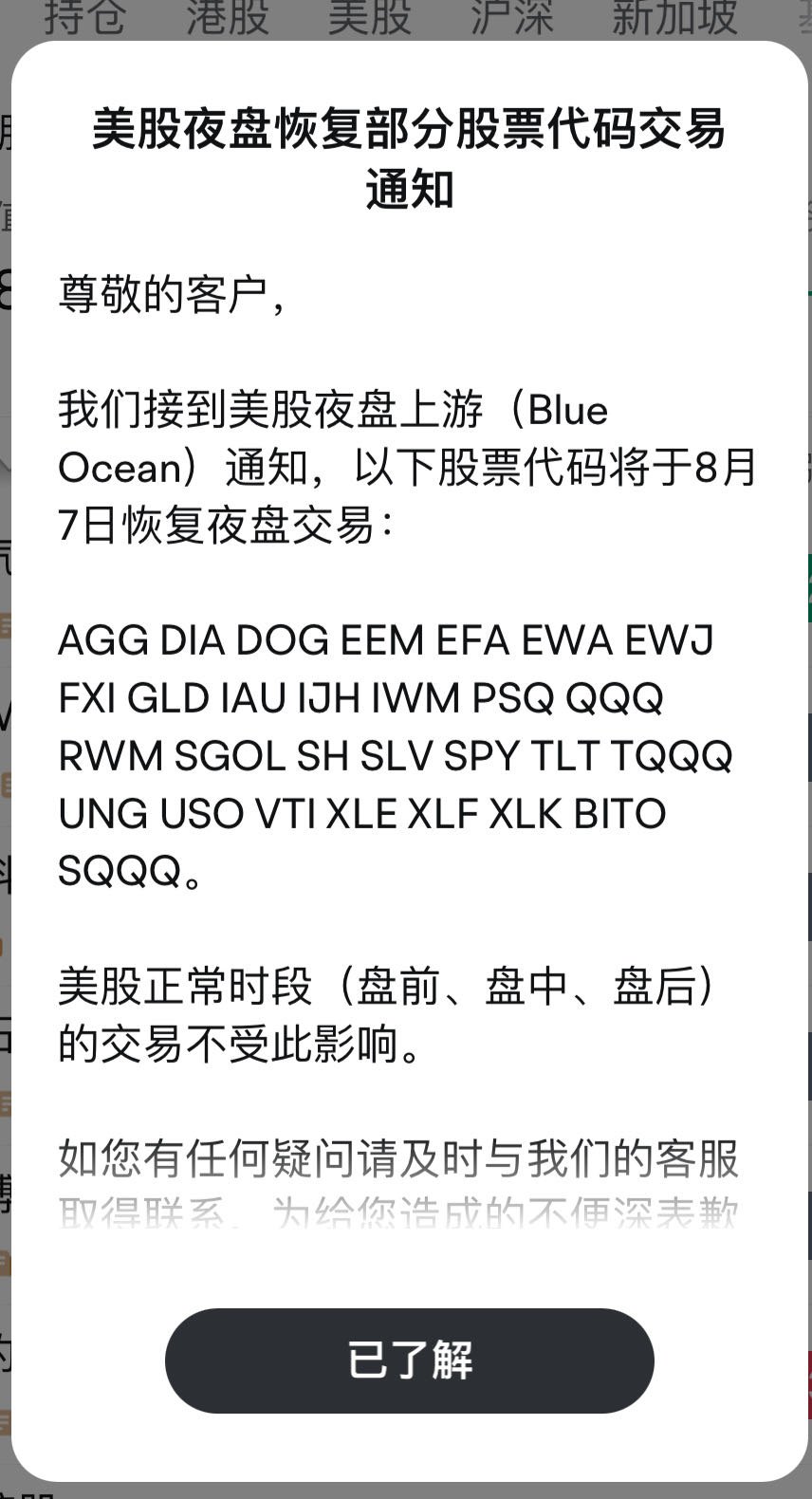

On August 5, affected by the chain reaction of the Japanese stock market's 12.4% plunge, the volume of night trading in U.S. stocks surged. The Blue Ocean system of Futu's upstream supplier had an abnormality between 1:45 and 3:06 a.m. EST, resulting in orders during the period failed to enter the exchange and were eventually cancelled.Futu's customers triggered abnormal short sales during the normal trading session of the next day due to cancellations of orders on the eve of the night. Some accounts suffered forced liquidations and losses, forcing Futu to activate a compensation mechanism.

From a technical perspective, Blue Ocean's system collapse exposed two major hidden dangers to its night-trading infrastructure.First, the redundant design for cross-time zone transactions is insufficient.Night trading relies on a small number of centralized platforms. Once the core node fails, all connected securities firms will be affected.Second, stress tests failed to cover extreme market scenarios.Although Blue Ocean claimed to support highly concurrent trading, when market volatility (VIX index) surged, order processing slowed significantly, forcing some brokers to intervene manually.The over-reliance of securities firms such as Futu on upstream suppliers also highlights the lack of technical autonomy in the industry.

At the regulatory level, there is still a gap in risk prevention and control of cross-border transaction systems.Although the U.S. Securities and Exchange Commission (SEC) requires securities firms to ensure system stability, it lacks mandatory restrictions on the technical standards of third-party service providers.For example, as a non-exchange entity, Blue Ocean's system stability is governed only by commercial contracts, rather than direct review by financial regulators.In addition, the liquidity of night trading is low and the price discovery mechanism is imperfect, further exacerbating order execution deviations during failure periods.

In the incident at the time, most of the injured investors were concentrated on Day Trade and leveraged strategy users.When the market fluctuates violently, delays in the trading system or invalid orders may cause stop orders to fail to be triggered, and losses far exceed expectations.For example, some investors reported that Futu platform had a "failed order order" or a "system error", which resulted in the inability to close positions in a timely manner, and the single-day loss expanded to more than 30% of the principal.

From the perspective of risk management, although Futu's advance payment temporarily alleviated customer conflicts, it still needs to optimize the risk control system in the long run.For example, introduce a real-time monitoring system to automatically suspend high-risk orders when abnormalities are detected from upstream suppliers; or dynamically adjust leverage through algorithmic trading to avoid the chain reaction of forced liquidation.In addition, investors need to reassess the pros and cons of 24-hour trading-although night trading provides arbitrage opportunities across time zones, its liquidity risks and technical uncertainties may offset potential gains.

After the "major outage" incident in August last year, less than half a year later, Futu Securities once again experienced network outage problems, which worried many investors.