How to open an account in 2024 Fidelity?

Navigating the complexities of trading can be a challenge. If you are a new investor, you need a broker with a user-friendly trading interface and strong educational materials.Fidelity is regulated in the United States by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) and is covered by the U.S. Investor Protection Program (SIPC), which has a limit of $500,000 in coverage, including $250,000 in cash. This amount is significantly higher than that offered by most investor protection programs.

Founded in 1946, Fidelity is one of the largest stock brokerage firms in the U.S. offering commission-free stock and ETF trading and is owned by FMR LLC, the parent company of the Fidelity Group.

Fidelity has an excellent web-based trading platform and a wide selection of products, offering a variety of advanced tools to support users' investment research.In addition, Fidelity offers financial planning, advice and educational resources, making it a good choice for beginners. In this article, we'll explain the Fidelity account opening process in detail, including what to prepare for and what to look for, and compare the fee differences with E*TRADE and TD Ameritrade.

▍ Fidelity account opening and deposit

1. Open the Fidelity website and fill in the registration form to apply for an account

Fidelity provides 24-hour online account opening, the audit time is usually 1-3 days, after passing the first deposit and trading.

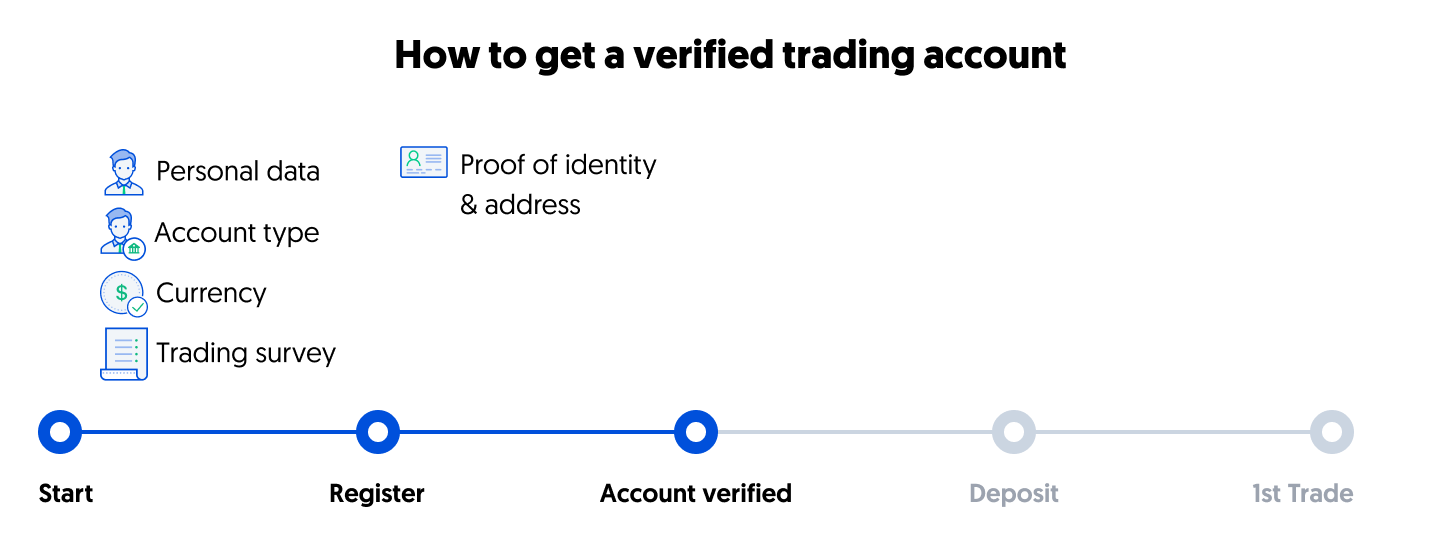

Fidelity Account Opening Steps:

- Select Account Type。

- Add personal information, such as social security number, residence, employment status, etc.。

- Choose your investment / trading preferences。

- View your information。

- Confirm Terms and Conditions。

- Print and mail / fax application form。

The online portion of the application takes about 20 minutes, but by mail, account opening and verification takes about 3 business days.

Registering for international stock trading is relatively quick and easy; brokerage accounts take only 5 minutes after verification.

The following steps are usually taken at the final stage of the application process or after verification of identity:

- You will need to fill out a trading experience questionnaire. It can be a bit intimidating at first, but don't worry. This is standard procedure as brokers need to make sure you have some basic financial knowledge and understand the risks of trading.

- Next, you will need to choose your account type and base currency.

- As a final step, you will need to fund your account before you start trading.

2, how to choose the appropriate account type?

Brokers usually offer a variety of account types. When selecting an account, consider your trading experience and choose the account that is right for you.Factors to consider include: your investment objectives, risk tolerance, trading frequency and any associated fees or account balance minimums.

If you are a beginner, we recommend that you choose the most basic account offered by your broker, i.e. "Standard Account".

3, how to choose the base currency?

The following base currencies are available at Fidelity: USD, EUR, GBP, AUD, CAD, DKK, HKD, JPY, SGD, NZD, NOK, NLG, ZAR, SGD, SEK, CHF.

If possible, try to make deposits to your brokerage account in the base currency of your account. By depositing funds to your trading account in the same currency as your bank account, you will not have to pay a conversion fee.

Conversion fees are required in the following cases:

- The currency of the deposit is different from the currency of the brokerage account.

- The currency of the asset you are trading in is different from the base currency of the brokerage account.

Opening a multi-currency bank account with Digital Banking is a convenient way to save on currency conversion fees.

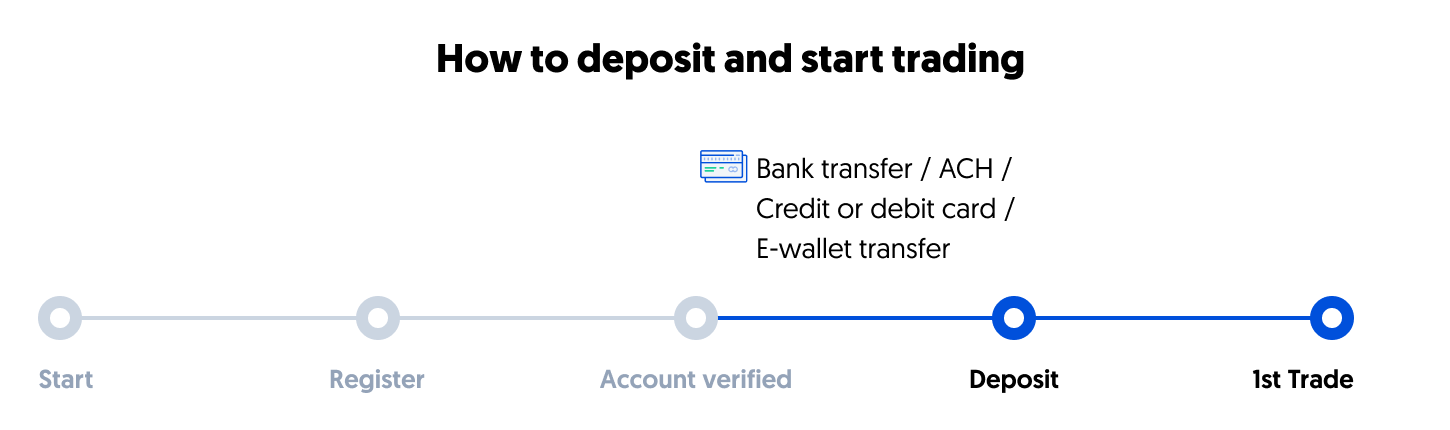

4. Capital the account and start Fidelity trading

Fidelity will verify your account shortly after you fill out the registration form, upload your documents, complete the trading survey and select your account type and base currency.

After successful verification, you will need to fund your account in order to start trading. At Fidelity, the minimum deposit is 0 USD.

Deposit process:

- Select the deposit method.

- Enter the amount to be deposited and other necessary transaction details.

- Double check that the payment details are correct.

- If everything is correct, click Submit Deposit Request.

▍ Fidelity costs

Fidelity has average transaction fees and low non-transaction fees, including commission-free U.S. stock trades.The downside, however, is that margin rates and fees can be higher for some mutual funds.

| Advantages | Disadvantages |

| √ Commission-free U.S. stocks and ETFs | x High cost of non-free mutual funds |

| √ A low bond fee | x high margin rate |

| √ No idle fees |

We compared Fidelity's fees to two similar brokers we selected, E*TRADE and TD Ameritrade.These competitors were selected based on objective factors such as products offered, customer profile, and fee structure.

-

Commission-free stocks and ETFs

Fidelity's commission-free U.S. stock trading is great.

| Broker | U.S. stocks |

| Fidelity | $0.0 |

| E * TRADE | $0.0 |

| TD Ameritrade | $0.0 |

On the other hand, international equity trading fees are relatively high, it is not common for U.S. brokers to offer non-U.S. equities, and there is a small fee for sell orders, as brokers are subject to an activity assessment fee of $0.01 to $0.03 per $1,000 of principal.

-

High margin rates

Fidelity's U.S. dollar margin rates are higher than the industry average.USD margin rates are calculated as follows: base rate + tiered markup. The markup for balances of 0-25k is +1.25%.

| Broker | USD Margin Rate |

| Fidelity | 13.6% |

| E * TRADE | 14.2% |

| TD Ameritrade | 14.8% |

-

Option Commission Low

Fidelity's U.S. equity index option fees are approximately half the industry average.The cost of options on US equity indices is calculated as follows: $0.65 per contract.

| Broker | U.S. Stock Index Options |

| Fidelity | $6.5 |

| E * TRADE | $6.5 |

| TD Ameritrade | $6.5 |

-

No idle fee, no withdrawal fee

There are no inactivity fees, no withdrawal fees, and no fees for ACH and U.S. dollar wire withdrawals.However, non-USD wire withdrawals are charged 3% of the withdrawal amount.In our review, we tested electronic (ACH) withdrawals, which operated without any problems. Additionally, there is a currency conversion fee if the international stock traded is denominated in a currency other than the account currency. The currency conversion fee depends on the amount of your trade.

| Transaction Amount | Cost (% of transaction volume) |

| < $100,000 | 1% |

| $100,000 - $250,000 | 0.75% |

| $250,000 - $500,000 | 0.5% |

| $500,000 - $1 million | 0.35% |

| > $1 million | 0-0.2% |

-

Other commissions and fees

High Mutual Fund Commissions: The following fees apply to trading mutual funds - $49.95 or $75 to buy, free to sell; free for about 3,600 mutual funds.

Low commissions on bonds: U.S. Treasuries charge the following fees - $0 for Treasuries and $1 for other bonds up to $250 each.

| Broker | mutual fund | U.S. Micro Electronics Stock Index Futures |

| Fidelity | 37.5美元 | - |

| E * TRADE | 20.0 USD | 15.0 USD |

| TD Ameritrade | 50.0 USD | 22.5美元 |

▍Is Fidelity safe??

Security.Fidelity is regulated in the United States by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) and is covered by the U.S. Investor Protection Program (SIPC), which has a limit of $500,000, including $250,000 in cash. This amount is significantly higher than that offered by most investor protection programs.

Fidelity also offers an additional $1 billion in coverage at the firm-wide level. There is no cap on securities coverage per client, but cash coverage is capped at $1.9 million per account.

Another safeguard is Fidelity's Client Protection Guarantee, which means that the firm will reimburse you for losses resulting from unauthorized activity in a covered account that is not your fault. You are automatically covered for all cash and securities held in a covered Fidelity account.

However, Fidelity does not offer negative balance protection. If you have a negative account balance, you will not be covered.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.