What is Moomoo??reliable??

Futu's moomoo trading platform allows you to trade multiple capital markets and investment products in one account.。This article shares moomoo 8 features, transaction costs, advantages and disadvantages and real experience.。

The moomoo trading platform launched by Futu is a very popular and extremely expensive platform recently, with a single account that can trade U.S. stocks, Hong Kong stocks, Chinese A-shares, Singapore stocks, options (options), etc., with a total of more than 1,600 users around the world, and a total trading volume of more than 1 in the second quarter of FY2021 alone..3 trillion Hong Kong dollars。

So, is it recommended to open an account on the Futu moomoo platform to invest in overseas stocks??

This article shares the evaluation, income, advantages and disadvantages of moomoo and the real experience of using it, and provides reference for investors who want to invest in U.S. and Hong Kong stocks, choose the right brokerage, or want to switch investment trading platforms.。

Any questions are welcome to leave a message to discuss。

What is MOOMOO??

Futu Securities (Singapore) NASDAQ-listed company Futu Holdings (NASDAQ: FUTU) subsidiary, the main one-stop online investment services, from account opening, trading, access to financial data of listed companies, enterprise real-time dynamics, the latest international financial news, financial analysis line-drawing tools, valuation, etc. on the platform launched by Futu moomoo.。

In addition, moomoo provides funding to the global live trading community, allowing investors from all over the world to interact in the community in real time, sharing the latest current events, investment information and ideas.。

Founded in 2012, Futu Securities has received strategic investments from Tencent, Matrix and Sequoia Capital through the launch of investment platforms Futu Niu Niu and moomoo to provide investors with multinational financial trading services, and was officially listed on the Nasdaq Stock Exchange on March 8, 2019.。

In March 2021, Futu Securities (Singapore), a subsidiary of Futu Holdings, was officially established in Singapore as a Singapore licensed securities dealer under the supervision of the Monetary Authority of Singapore (MAS).。

Key information for our simple implementation of moomoo:

| Year of Establishment | 2019 Futu Holdings U.S. Nasdaq Exchange Listing |

| Trading platform | Moomoo trading platform supports desktop version (Windows, macOS) mobile app version (iOS, Android) |

| Account Type | Managed Account (Custodian Account) |

| tradable market | United States, Hong Kong, Singapore, China |

| Investment products | Stocks, ETFs, options, warrants / vouchers CBBCs, CBBCs futures, funds, REITs |

| Payment method | Bank of Singapore Transfer Bank of Singapore DDA Real-time deposit wire transfer Wise (deposit) |

| Minimum withdrawal amount | None |

| Payment expenses | None |

| Account idle fee Account idle fee | None |

HawkInsight Exclusive Account Opening Offer [4.30 off!】

Moomoo trading platform 7 features

Online account opening is simple and convenient

Account opening, trading, access to gold can be completed online, the actual account opening only takes 1 day (officially 1 to 3 working days)。

Tradable global multi-market capital and investment products

Currently, users can invest in the U.S., Hong Kong, Singapore and China markets in moomoo, and tradable investment products include stocks, options, American Depositary Receipts (ADRs), funds, futures, Index Equity Funds (ETFs), Real Estate Trusts (REITs), warrants / orders, CBBCs, etc.。

Supports both pre- and after-hours trading。

Zero commission on US stock trading

Futu Securities (Singapore) is one of the few securities dealers in the market to trade U.S. stocks and ETFs at zero commission.。However, it should be noted that trading in moomoo requires a platform fee of 0 per order..99美元。

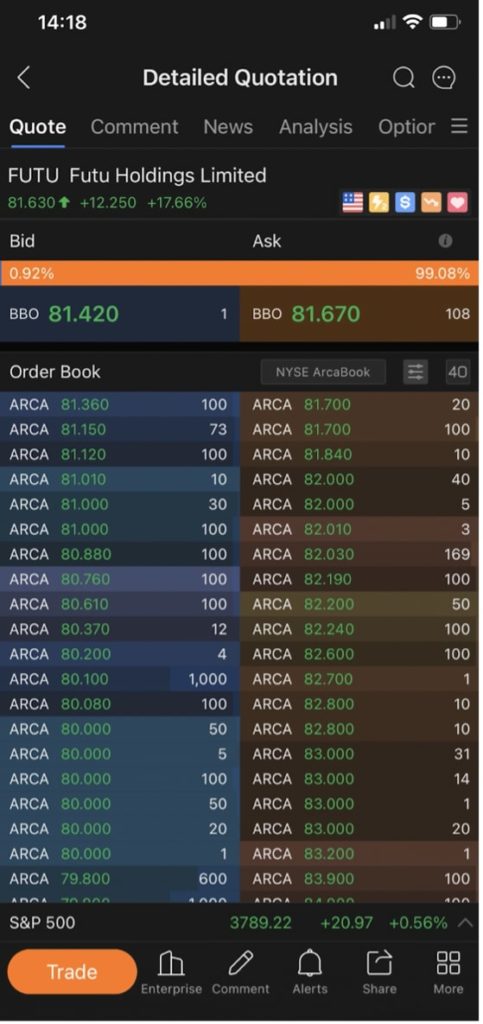

Free Level 2 Real Time Quotes

Moomoo is the only platform that provides free and advanced behavioral information for U.S. stock level 2, providing users with more detailed quotation information and allowing users to bid more accurately.。

In U.S. stock trading, there are three levels of item quotes.

| Level 1 | Free instant stock quotes |

| Level 2 | Best stock quotes on all exchanges |

| Level 3 | Number of registered market traders with the Securities and Exchange Commission (NASD) |

Simply put, the difference between Level 1 and Level 2 is that Level 2 provides more in-depth information on individual stock quotes。

Level 1 only shows the number of Bid (buyer) and Ask (seller) that have opened orders at the current stock price, and the user can see the 5-level opening (order).

The bottom of Level 2 shows the number of buyers and sellers for each price level, allowing users to see the number of orders waiting for the price to be traded, and users can see up to 40 openings.。

The average broker only abandons level 1 real-time quotes, and level 2 requires an additional paid subscription.

Moomoo, on the other hand, provides a more in-depth secondary quote for free, allowing you to view the closing time, price and quantity of up to 40 buy and sell orders (bid and ask) at the same time, helping users to keep abreast of the latest price dynamics of individual stocks and be able to bid more accurately.。

Many day traders (day traders) use Level 2 data to determine price direction and market trends to find buy or sell points。

Comprehensive financial data and investment capabilities

Moomoo provides the most comprehensive financial data and investment functions, including three major corporate financial data, key indicators, business allocation, corporate trends, bulk transaction records, expert financial analysis drawing tools (drawing tools), differential valuation data, analyst ratings and target prices, institutional equity allocation, etc., both technology and value streams are suitable for investors.。

24 / 7 Professional Financial Information and Firm Trading Community

In moomoo, users can 24 / 7 access to global instant hot spots, first-hand grasp of financial market trends and changes。At the same time, users can also share their views, investment experiences and insights on financial current events and individual stocks with large capital investors in moomoo's trading community.。

$1 million virtual account

Moomoo offers a $1 million virtual account (demo trading account) that allows users to conduct simulated transactions in a zero-risk manner, familiarizing themselves with the platform before deciding not to remit real funds.。

There are 2 kinds of virtual accounts: demo account (practice account), demo account (game account)。

Is Moomoo safe??Is it legal??

Platform security is a priority factor for consumers to choose a brokerage platform, after all, the following is the real capital operation, choose a regulated and stable scale of brokerage, in order to minimize risk, protect the safety of funds, protect investment。

Below we will evaluate the security of the moomoo platform from three aspects: regulators, money custody and policy partners.。

Welcome to join our group chat!You can get the latest offers, professional advice and event notifications at the first time。

背景

Fortis Holdings was founded 9 years ago and is a US-listed company.。Futu Holdings' subsidiaries jointly hold 43 financial licenses and qualifications from mainstream financial institutions around the world.。

Futu Securities (Singapore) is regulated by the Monetary Authority of Singapore (MAS) and holds a Capital Markets Services Licence (CMS) under licence number CMS101000。

Investors' U.S. shares in Futu Securities are protected by SIPC up to a maximum of $500,000 (including $250,000 in cash)。Simply put, assuming the unfortunate collapse of Futu Securities (Singapore), users will receive financial compensation from SIPC.。

Asset Custody

In Futu Securities (Singapore) this project is an escrow account (Custodian Account), as opposed to a central escrow account (CDP Account)。It is similar to the Nominee CDS of the horse stock, where the investment assets are not directly under the name of the individual, but are held in custody in a secure institution.。

Futu Securities (Singapore) has implemented an asset defense policy, placing consumer assets in safe custody with a designated licensed custodian and funds in a secured custodian bank to ensure complete separation of their respective assets and funds from Futu Securities (Singapore).。

Strategic Partners

Moomoo's parent company, Futu Holdings, received strategic investments from Tencent, Matrix and Sequoia Capital.。

Taken together, the institutions, asset custodians and strategic partners of Futu (Singapore) are all working with businesses and are essentially security-free and can be used to。

How to open an account on the Moomoo platform?

In moomoo China Futu (Singapore) help account does not need any fees, can apply online, very simple, 10 minutes to complete the account。Futu (Singapore) will approve my work within 1 to 3 working days, and the money I receive is the wealth and information approved by the convenience (time) received on the same day. Very fast!

moomoo Tool

On the moomoo trading platform, there are three types of transaction fees: commissions (commissions), platform usage fees (platform fees) and regulatory fees (other fees)。Special discussion on our main one-stop trading U.S. stocks and ETF billing structure。

The transaction fee structure of the Singapore stock market, Singapore A-shares and China A-shares can be read in detail here.。

Commission

| Investment products | species | Interest Rate |

| U.S. Stocks and ETFs | Dollars | 0 |

| American Depositary Receipts (ADRs) | Dollars | 0 |

Platform usage fee

| Type | species | Interest Rate | Expense |

| Fixed | Dollars | 0 per order.99 | Rich Way |

* Platform usage fees mainly allow moomoo to continue to develop new technologies

* 8% GST (consumption tax) for the use of rental platforms by the Government of Singapore

* If a single transaction is repeated, the system will only consider the platform fee for one order transaction.

* When the cash balance of the investment account is negative, the system will call 4.8% annual interest, calculated on a trading day basis, settled at the end of the month

* * The maximum platform usage fee is 0 of the transaction amount.5%, subject to the minimum charge

Regulatory fees Other fees

| Type | species | Interest Rate | Expense |

| Payment | Dollars | 0.003 / share | American mechanism |

| Regulator regulations (charged only for sale) | Dollars | 0.000008 * Transaction amount, minimum 0 per transaction.01 USD | Securities and Exchange Commission |

| Transaction Activity Fee (TAF, Billing Only at Sale) | Dollars | 0.000145 / share, minimum 0 per trade.$01, up to 5 per transaction.95美元 | FINRA, United States Financial Services Regulatory Authority |

| American Depositary Securities (ADRs) Custody Fees | Dollars | 0.01 to 0.05 / share | Trust Company (DTC) |

For example, if I buy 1,000 shares for $1, I have to pay another fee:

| Type | species | Calculation method |

| Commission | Dollars | 0 USD |

| Platform usage fee | Dollars | 0 USD |

| Payment | Dollars | 0.003 * 1000 = $3 |

Total transaction cost = 0 + 0 + 3 = $3

那么,本次交易除了投入本金1,000美元(1 * 1,000),还需要支付3美元的资金费用。Therefore, the above transportation costs are mainly used to pay for the transportation costs of moomoo。

Experience in using moomoo

Advantage 1: computer version and mobile phone App use smoothly

The goal of Futu (Singapore) is to be in the desktop or mobile app of moomoo, which is simple and clear, and it's easy for just a novice to find stock data, trading data。

In addition, moomoo provides a wealth of individual stock data, market information, technical and fundamental analysis, drawing functions, etc., just a little bit can understand the business of individual stocks, key data, valuation indicators, etc.。

I like momoo very much. The interface of this project is very clean, the information classification is very clear, and the fluency when using it is also very ideal, and there will be no system or stuck problems.。

Advantage 2: Zero-fee withdrawals, built-in currency converter (currency exchange)

There are no fees involved in the deposit and withdrawal of Futu Securities (Singapore) and there is no minimum withdrawal encroachment.。At present, the main remittance methods are Singapore Bank Transfer, Singapore Bank DDA real-time deposit and wire transfer.。

Rich Securities (Singapore) supports the assumption that holding a Singapore bank account, you can first transfer to a Singapore bank account through an account payment platform with a better exchange rate, and then transfer to Golden Rich Securities (Singapore) from a Singapore bank account, which is the most economical exchange rate and wire transfer fee practice.。

The idea is that it would be wise for Bank of Singapore to get into Goldrich Securities (Singapore) very quickly.。When I actually rotate, it only takes less than 5 minutes before and after to complete the entire process (including filling in the rotation information), and the actual operation of the system only takes a few strokes), which is very convenient。

After you deposit your money in SGD, you can use moomoo's built-in currency converter (Currency Exchange) to convert to USD, HKD, RMB。

Note that U.S. stocks must be traded in U.S. dollars, Hong Kong stocks, etc.。

Advantage 3: Unique social communication

Moomoo's live trading community is very active and has successfully attracted investors to share their views on individual stocks and current events, as well as interact with them on individual stock analysis, investment strategies, etc., for more information and investment ideas.。

Advantage 4: Trading U.S. stocks at zero cost

Starting April 13, 2022, MOOMOO's US dollar trading commission adjustment is permanently commission-free.。For investors, this is an incredible transaction cost。

Disadvantages: Unable to trade

Moomoo supports Hong Kong stock trading (zero-share trading), but does not support U.S. stock trading, which will inevitably be less attractive to small capital investors。In particular, blue chips that want to trade the above share prices, such as Tesla (flow chart) about $736 (about 3,469.$15), etc., need to raise additional funds, may be more difficult。

Of course the downside is that it varies from person to person, with some willing to buy, but others unwilling to trade, as securities dealers do.。

Who is suitable for moomoo platform?

There are many securities dealers and trading platforms in the market, each with its own advantages and disadvantages, in the choice, first grasp the priority principle of legal supervision, large scale to choose a few securities dealers, and then choose their own look, use comfortable platform is good.。

Assuming that you are expected to trade U.S. stocks at zero cost and can invest in U.S. stocks, Hong Kong stocks, Singapore stocks, Chinese A-shares, or want to invest in ETFs, options, futures, CBBCs, etc., you need a simple easy-to-use investment platform, then moomoo is a good choice.。

But moomoo has other U.S. stocks free level 2 real-time quotes, more in-depth quote information is perfect for day traders (day trader)。After all, other brokerage platforms get paid subscriptions and can be used in moomoo for free!

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.