How to invest in stocks at Futu Securities (moomoo)?

Futu's one-stop trading platform moomoo interface is direct and easy to use. This article hands-on share how to buy and sell stocks in moomoo with instructional illustrations.

Futu's one-stop trading platform, moomoo, is arguably growing in popularity, with more than 1,600 cumulative users around the world and a total trading volume of more than 1 in the 2021 fiscal quarter..3 trillion Hong Kong dollars。

Futou Securities(Singapore) is loved by users because it supports a variety of trading markets, a wealth of investment trading product options, competitive commission fees, providing comprehensive and professional financial information and analysis, etc., moomoo's computer and mobile applications are easy to use.。

Small reminder before buying and selling stocks

Futu Securities (Singapore) Futu Singapore Pte LtdIt is a subsidiary of Futu Holdings (NASDAQ: FUTU), a NASDAQ-listed company in the United States, with a Singapore Monetary Authority (MAS) registered licensee (license number: CMS101000) and a Market Capital Services License (CMS).。And moomoo is the investment platform launched by Futu.。

After completing the registration and deposit, login moomoo computer version or mobile app can start trading。

It is recommended to use a demo account for trading if you are worried that the unfamiliar interface of the platform will lead to operation errors。Be familiar with the interface of the platform before trading with real money。

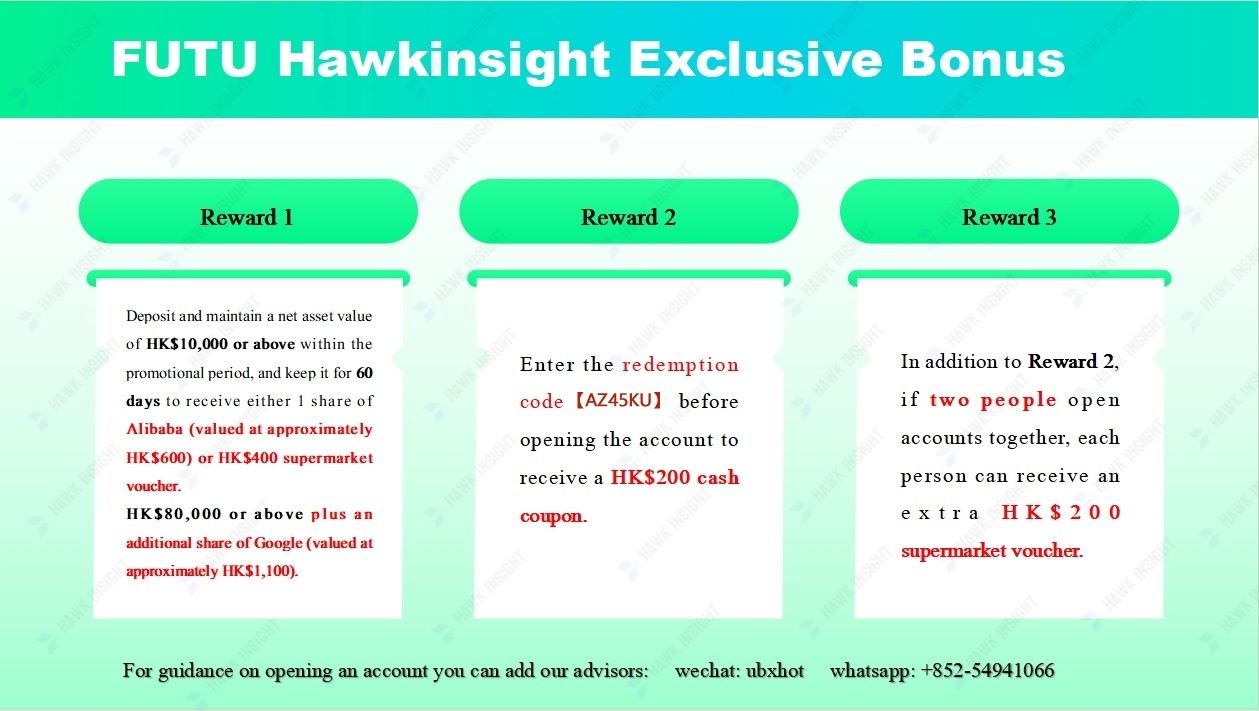

HawkInsight Opening Account Bonus

Moomoo trading platform interface introduction

The computer version of moomoo is similar to the mobile version.。Due to the large number of users of the mobile version, most of the illustrations and screenshots will be based on the mobile version.。

Securities Account

After successful account opening, US, Singapore and Hong Kong stock trading accounts will be automatically opened。You can click on the "trading" interface on the moomoo app to view the information in each account, such as current profit and loss, quick trading, orders, order records, details of today's funds, account names, etc.。

U.S. stock trading records appear in U.S. stock securities accounts; Hong Kong stock trading records appear in Hong Kong stock securities accounts.。

moomoo trade order type

moomoo provides8 different trade order types, including:

◇ Limit Order

◇ Market Order

◇ Stop Limit Order

◇ Stop Order

◇ Touch limit order (take profit)

◇ Touch market order (take profit)

◇ Trailing Stop Limit order

◇ Trailing Stop order

One by one description below。

Limit Order

Users who select a limit order need to specify the transaction price to buy or sell.。The transaction will only be executed if the user-specified buy or sell price is reached or if there is a better price, i.e., higher than the specified bid price or higher than the specified sell out bid price。

Market Order

Users who choose a market order do not need to specify a price, and the trade buys or sells at the current market price, allowing the order to be filled quickly.。Note that market orders can only be placed at the opening of the stock market。

Stop Limit Order

A stop-loss limit order submits a buy or sell limit order through the commission system when the market price reaches the user-specified stop-loss trigger price (Stop Price).。

Buying direction

For example, the current share price of A shares is USD10..00。Mr. A sees a chance for A-share prices to rise USD15。So he goes through the delegate system and sets the stop-loss trigger price at USD15 and buys A shares at the order price USD16.。

Once the share price of A shares reaches USD15 or above, the system automatically submits a limit order for USD16。

Finally, orders are likely to be traded and bought at an absolute USD16 price, but there is no guarantee of a deal.。

Selling direction

The current A-share price is USD20.。Mr. A's cost price is USD10, but he believes there is a chance that A stock prices will fall sharply to USD15。To avoid a significant drop in its price and lose the opportunity to sell, he uses the commission system and sets a stop-loss trigger price of USD15 and sells A shares at the order price of USD14.。

Once the share price of A shares reaches $15 or at this point, the system automatically submits a $14 limit order。

Finally, orders are likely to be traded and sold at USD14, but no deal is guaranteed。

Stop Order

A stop-loss market order submits a buy or sell market order through a delegated system when the market price reaches the user-specified stop-loss trigger price。

The difference between stop-loss market order and stop-loss limit order: stop-loss market order and market order (market order) way to ensure that the order needs to be fast transaction, does not guarantee the price of the transaction;。

Buying direction

For example, the current share price of A shares is USD10.。Mr. A sees a chance for A-share prices to rise USD15。So he goes through the delegate system and sets the stop-loss trigger price at USD15。

Once the share price of A-shares reaches USD15 or above, the system automatically submits a market order and trades at the market price (no guarantee of the transaction price)。

Selling direction

The current A-share price is USD20.。Mr. A's cost price is USD10, but he believes there is a chance that A stock prices will fall sharply to USD15。To avoid a sharp drop in its price and lose the opportunity to sell, he triggers the price at $15 through the delegate system and sets a stop loss.。

Once the share price of A-shares reaches $15 or more, the system automatically submits a market order and trades at the market price (no guarantee of the closing price).。

Supplement sheet (take profit)

Tip Limit Order (Take Profit) The commission system submits a buy or sell limit order when the market price reaches the designated user's take profit trigger price.。

Buying direction

For example, the current share price of A shares is USD10.。A gentleman wants to fall to USD8 in A shares.。So he goes through the commission system and sets the take profit trigger price at USD8 and buys at the limit USD9.。

Once the share price of A shares falls to USD8 or below, the system automatically submits a limit order for USD9。

Finally, orders are likely to be traded and bought at an absolute USD9 price, but there is no guarantee of a deal。

Selling direction

The current share price of A shares is $10.。Mr. A is expected to fall back after A shares rose to $20.。So he went through the commission system and set a take profit trigger price of $20 and sold at a limit of $19.。

Once the share price of A shares reaches USD20, the system automatically submits a limit order for USD19。

Finally, orders are likely to be traded and sold at USD19, but no deal is guaranteed。

Participating in market orders (take profit)

Execute a market order (take profit) The commission system submits a buy or sell market order when the market price reaches the designated user's take profit trigger price.。

Buying direction

For example, the current share price of A shares is USD10.。A gentleman wants to fall to USD8 in A shares.。So he passed the commission system and set the take profit trigger price to USD8.。

Once the share price of A-shares falls to USD8 or below, the system automatically trades at market price (no guarantee of transaction price)。

Selling direction

The current A-share price is USD10.。Mr. A expects to fall back after A-share share price rises to USD20。So he passes the commission system and sets the take profit trigger price at USD20。

Once the share price of A shares reaches USD20, the system automatically submits a market order。If A-shares do fall back, Mr. A succeeds in arbitrage at market price USD20。

Trailing Stop Limit order

The trailing stop limit order allows the user to set the tracking amount or tracking ratio and set the specified price difference。

The system automatically calculates the stop-loss trigger price based on changes in market prices.。

Tracking stop-loss limit order entrustment system, when the market price reaches the user-specified stop-loss trigger price, submit a buy or sell closing limit order.。

Trailing Stop order

The trailing stop loss market order allows the user to set the tracking amount or tracking ratio, and the system automatically calculates the stop loss trigger price based on changes in the market price。

The trailing stop loss market order delegation system submits a buy or sell closing market order when the market price reaches the user-specified stop loss trigger price。

moomoo trading order validity period

There are two types of valid refunds for moomoo order transactions, both valid on the same day (Day) and valid before withdrawal (Good Till Cancelled, GTC)。

Effective day of the day

An order valid on the same day is only valid in stock market trading on the same day。

Simply put, assuming that the stock market closes and the trade ends and the order is not closed, the system will automatically withdraw the order。

Effective before cancellation

The order will remain valid, the invoice order is closed, manually withdrawn, the contract is approaching, or the effective limit of GTC is reached for 90 days。

moomoo allows pre-market after-market trading

When the order trading is allowed, the user can choose "Pre-market after-market trading to cover positions outside RTH"。

RTH stands for Regular Trading Hours, Normal Trading Hours。When the user allows pre-market and post-market trading, all orders can be completed, i.e., 4: 00 to 20: 00 EST (16: 00 to 8: 00 Malaysian time), including pre-market (pre-market) and post-market (post-market) valuations.

If not allowed, trading can only be done at the opening time, i.e. 9: 30 ~ 16: 00 EST (21: 30 ~ 4: 00 Malaysian time)。

moomoo Trading Stock Process

The process of placing an order to buy or sell stocks on the moomoo trading platform is simple.

◇ Select the securities account for this transaction

◇ Select transaction order type

Click on the stock you want to buy and sell.

◇ Set order data (price, unit, recent, etc.)

◇ Set stop price

Choose to buy or sell.

◇ Check the detailed order and confirm it

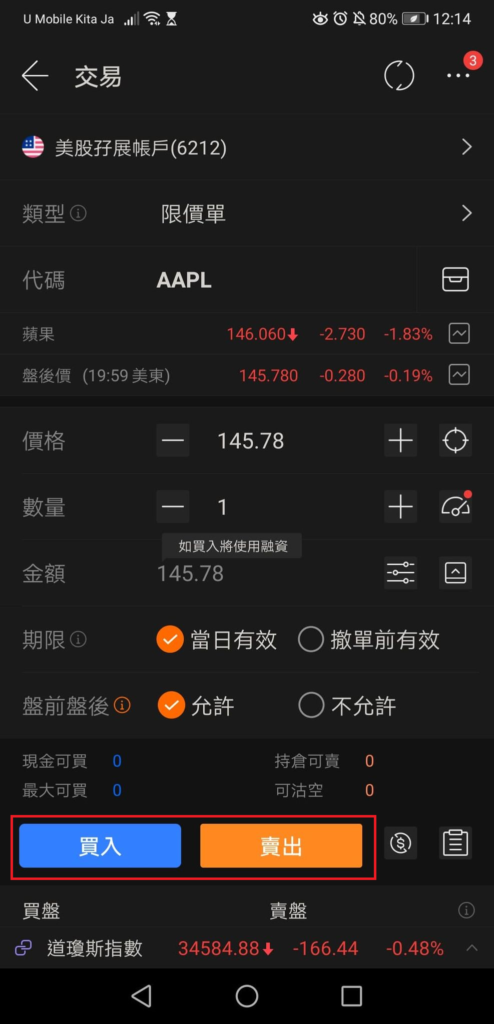

Below I will disassemble the operation process of placing an order using the mobile version of moomoo in a multi-graphic form, and illustrate the example of buying and selling U.S. stocks - Apple (Apple, NASDAQ: AAPL).。

Step 1: After entering the moomoo application, click on the "transaction"

Log in to your personal moomoo account。If you are not familiar with the English interface, you can change the Chinese interface to "General Settings > Settings > General > Language" first.。

Click "transaction" in the toolbar at the bottom of the page to enter the transaction page。

Step 2: Select the securities account for this transaction

Click "Securities Account" in the upper toolbar to select the securities account for this transaction: Singapore, US, Hong Kong and A shares.。

In the case of U.S. stocks (e.g., AAPL Apple), the securities account you should click on is the U.S. stock securities account。

Click "Transaction" to continue to the next step。

Step 3: Select the trade order type

Step 4: Enter the purchased stock code

Enter the name or code of the stock company you want to trade and look for the desired stock。For example, Apple's code is AAPL。If you don't know the stock code, you can use Google to search it.。

Step 5: Set the order data (price, quantity, quantity, allow before and after the disk, etc.)

In the case of a limit order, you need to set and enter the price at which you are interested in buying or selling, and the order will not be closed until the market price matches the price you have set.。If you choose to trade on a market order, trade at the price displayed by the system。

Relative quantities, the minimum number of U.S. stocks traded is 1。

Trading term options include: valid on the day or valid before cancellation of the order.。

Step 6: Confirm the transaction

Click "Unlock Transaction" and enter your transaction password。

Click "Buy" or "Sell"。

It is important to note that if the option itself does not hold a shareholding, but orders a "sell," it is directly a short sale.。

Short, that is, short the stock, first sell high and then buy low, on behalf of you think the stock will fall in the future, so you first borrow the stock from the brokerage firm, sell forced money。The contract will buy back the stock in the near future and return it to the broker.。What you really earn is the difference.。

Finally, you can view the order details。Confirm that there is no problem and click "Confirm" to open the transaction。

If you invest in gold in Singapore dollars, can you buy U.S. or Hong Kong stocks?

In the teaching steps of moomoo placing an order, it is mentioned that before placing an order, you need to select the securities account for this transaction。Because moomoo's app displays securities accounts and funds separately for each exchange.。

Suppose you invest in Singapore dollars and the system invests the funds in a Singapore securities account, can you still invest in U.S. and Hong Kong stocks? Do you still need to invest in U.S. or Hong Kong dollars again??Can I invest in U.S. and Hong Kong stocks??

The answer is, can, also consume again into gold。

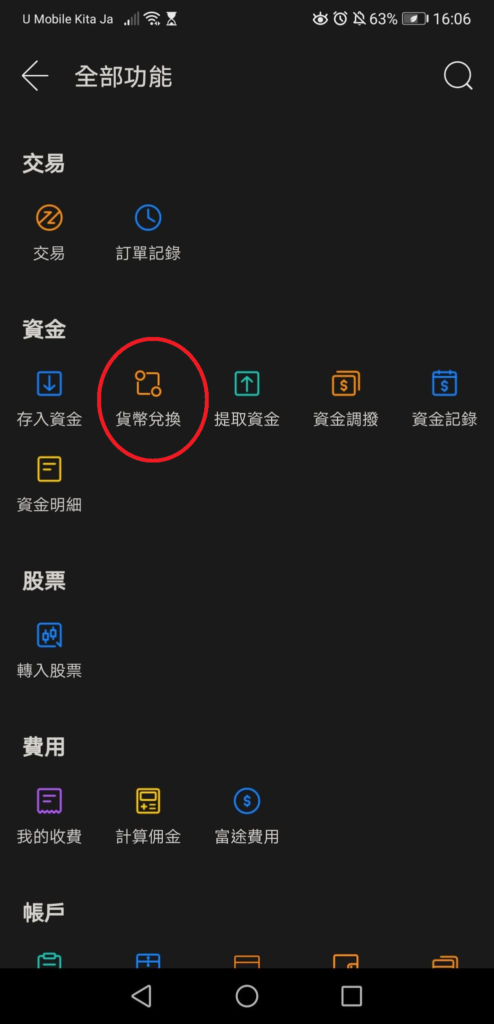

You can use the currency exchange feature built into the moomoo app (currency exchange)。

How to buy stocks in moomoo with other currencies

You can follow the steps below for currency exchange to invest in stocks in other trading markets。

First, click "My" and then click "Transaction Related."

Step 2: Click on "Currency Exchange"

The third step, currency exchange

First, choose which securities account to cash out from, then choose the securities account you want to cash into。

For example, you want to invest in U.S. stocks, but you can choose "Singapore dollar" and "U.S. dollar" above before the Singapore dollar enters the gold.。

The system will automatically display information about your Singapore securities account as well as your US stock securities account, such as the amount convertible in your account, the reference exchange rate and the time to complete the conversion.。

Step 4, enter the cashed-out amount

Enter the amount of cash you want to redeem or select Redeem All。

Cash out of S $1,000 via moomoo's currency exchange feature is expected to reach 738, today revealed.08 USD。Warm reminder, the page's exchange rate reference, the actual exchange rate may change。

Step 5: Apply for redemption

To confirm the redemption, click "Apply for redemption"。You can also click Redeem Record to see if your application was successful。

Trading tips

Moomoo application interface is simple and direct, very easy to get started。Plus, the platform allows the exchange of language settings, if the English interface is not so familiar, you can change to simple, traditional Chinese interface。

If you have any questions, or do not understand any trading terms, the official website of theHelp CenterAnd online 24-hour customer service is your best helper。

Frankly speaking, compared with the local online brokerage, moomoo trading platform provides a more comprehensive and professional interface。For example, there are eight types of trades that are billed, which are ideal for investors who use technology to predict prices and are able to grasp the best time for everyone to buy and sell.。

What I like most about moomoo is that one account supports the trading account function of multiple exchanges and does not need to manage multiple platforms and accounts, which can save a lot of time and effort.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.