Broker M + Online: Advantages and Disadvantages & Security Analysis

M + Online is a trading platform of Malacca Securities, a well-known domestic brokerage firm.。This article introduces the advantages and disadvantages of M + Online, commission structure, security。

With the continuous progress of science and technology and the development of the network, securities trading has gradually evolved from the traditional order through the phone, to the online trading platform to place orders, as well as the use of APP orders, brokerage business towards electronic development is inevitable.。In Malaysia, securities networking has become a trend, in addition to the rise of emerging trading platforms such as Rakuten Trade and FSMone, senior brokerage firms such as CIMB, Maybank and Hong Leong have also launched their own trading platforms to provide diversified convenience for securities investment.。

The M + Online trading platform evaluated in this article is the trading platform of Malacca Securities Sdn Bhd, a well-known domestic brokerage firm, which is completed on the Internet from account opening, viewing and placing orders.。Evaluation content includes:

- M + Online Benefits

- M + Online Disadvantages

- M + Online Account Security

- Who is M + Online for??

- M + Online Experience

What is M + Online??

M + Online is an electronic trading platform launched by Malacca Securities Sdn Bhd, a well-known domestic brokerage firm, which was officially launched in 2012 and provides digital services such as online trading and account opening.。Malacca Securities Private Limited was established in 1963 and has a history of 60 years.。

M + Online has a variety of securities account types to choose from, including Cash Account, Islamic Cash Account, Collateralised Account, etc., catering to different investment styles and preferences.。Investors can trade Malaysian equities, real estate trusts (REITs) and exchange-traded funds (ETFs) through M + Online。

The following is a brief summary of the key information of M + Online:

| Year of Establishment | Founded in 1963, M + Online platform launched in 2012 |

| Account Type | Direct CDS Account |

| tradable market | Malaysia |

| Investment products | Stocks, Real Estate Trusts (REITs), ETFs |

| Minimum account opening threshold | RM11 |

| Horse Stock Commission | Minimum Commission RM8 |

| Access mode | Bank Online Transfer Malaysia |

| Minimum amount of deposit and withdrawal | Manual Transfer:RM0 FPX Direct Transfer:RM1,000 |

| Access fee | None; M + Online will charge RM1 withdrawal fee if the withdrawal amount is less than RM100 |

▍ M + Online Features

Opening an account on the whole line is quick and convenient.

In the trend of securities networking, the whole line of application for securities accounts has become a standard for brokerage firms, in M + Online can also complete the account opening action in the network, from registration, fill in information, submit identity documents are online。

The editing room measured the account opening process, the overall fast and smooth, clear instructions, the operation will not be stuck, about 3 to 5 minutes to complete the account opening to fill in the information, upload identity documents, within 24 hours to pass the audit, complete the account opening.。

One of the lowest commissions for horse stock trading

M + Online trades horse stocks with commissions as low as 0.05%, or a minimum of RM8 for a single transaction.00, one of the lowest commission charges in the country。Its main competitors such as Rakuten Trade and CGS CIMB iTrade have a minimum commission of 0.1% * trading volume, compared to M + Online's commission structure, which has a great price advantage.。

The M + Online trading commission pricing scheme is as follows:

| Cash Account | Collateralised Account | T+7 Account | |

| Transaction < RM50,000.00 | 0.08% | 0.30% or 0.08% * | 0.30% or 0.08% * |

| Deals > RM50,000.00 | 0.05% | 0.20% or 0.05% * | 0.25% or 0.05% * |

| Intraday trading | None | 0.10% | 0.10% |

| Minimum Commission | RM8 | RM10 | RM10 |

* 0.05% or 0.08% applies to transactions using available cash in a trading account。

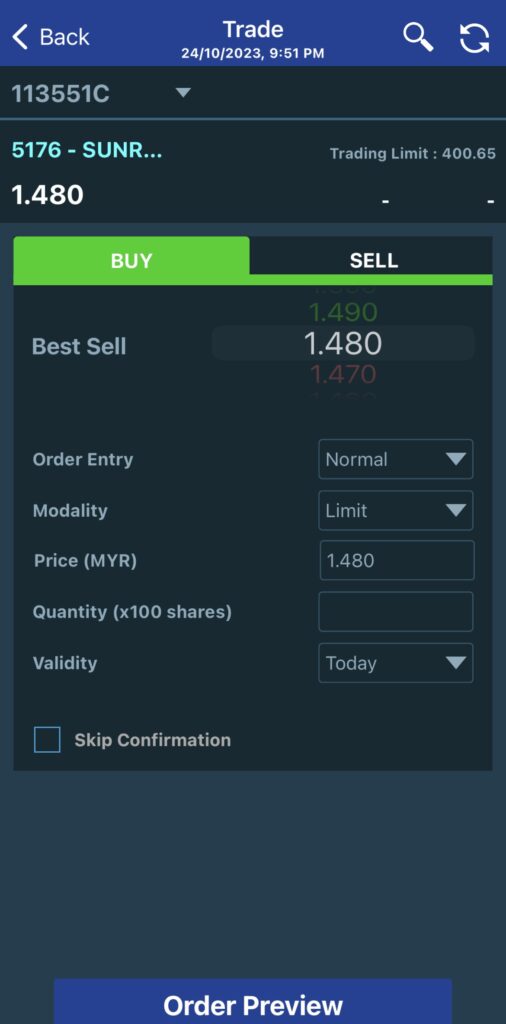

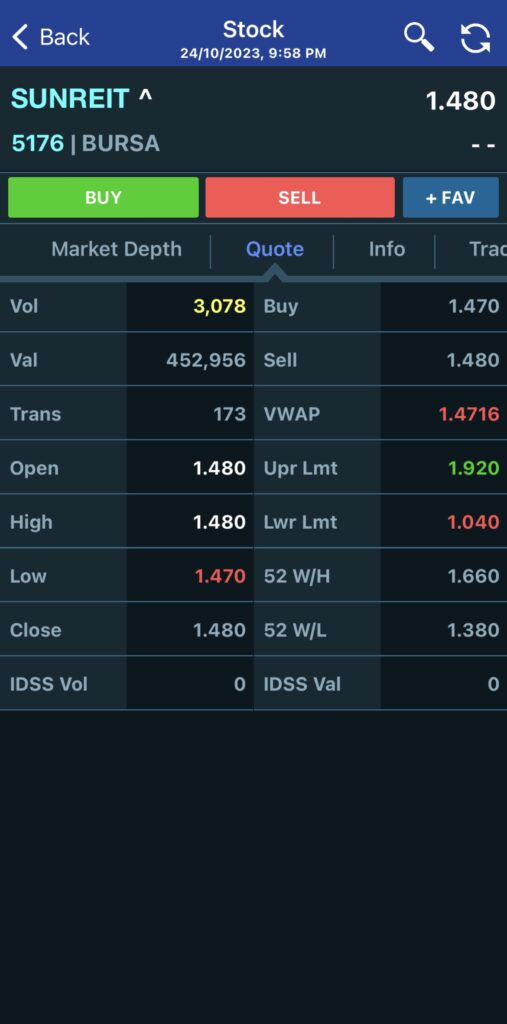

Note that the following shares are for demonstration purposes only and are not investment advice。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

For example, suppose you trade 100 shares of SUNREIT at RM1 per share..48, this transaction is 100 x RM1.48 = RM148, the commission is RM148 x 0 based on the pricing plan.08% = RM0.1184, as M + Online has a minimum commission requirement, the paid-in commission for this transaction is RM8。

Cross-platform seamless trading experience

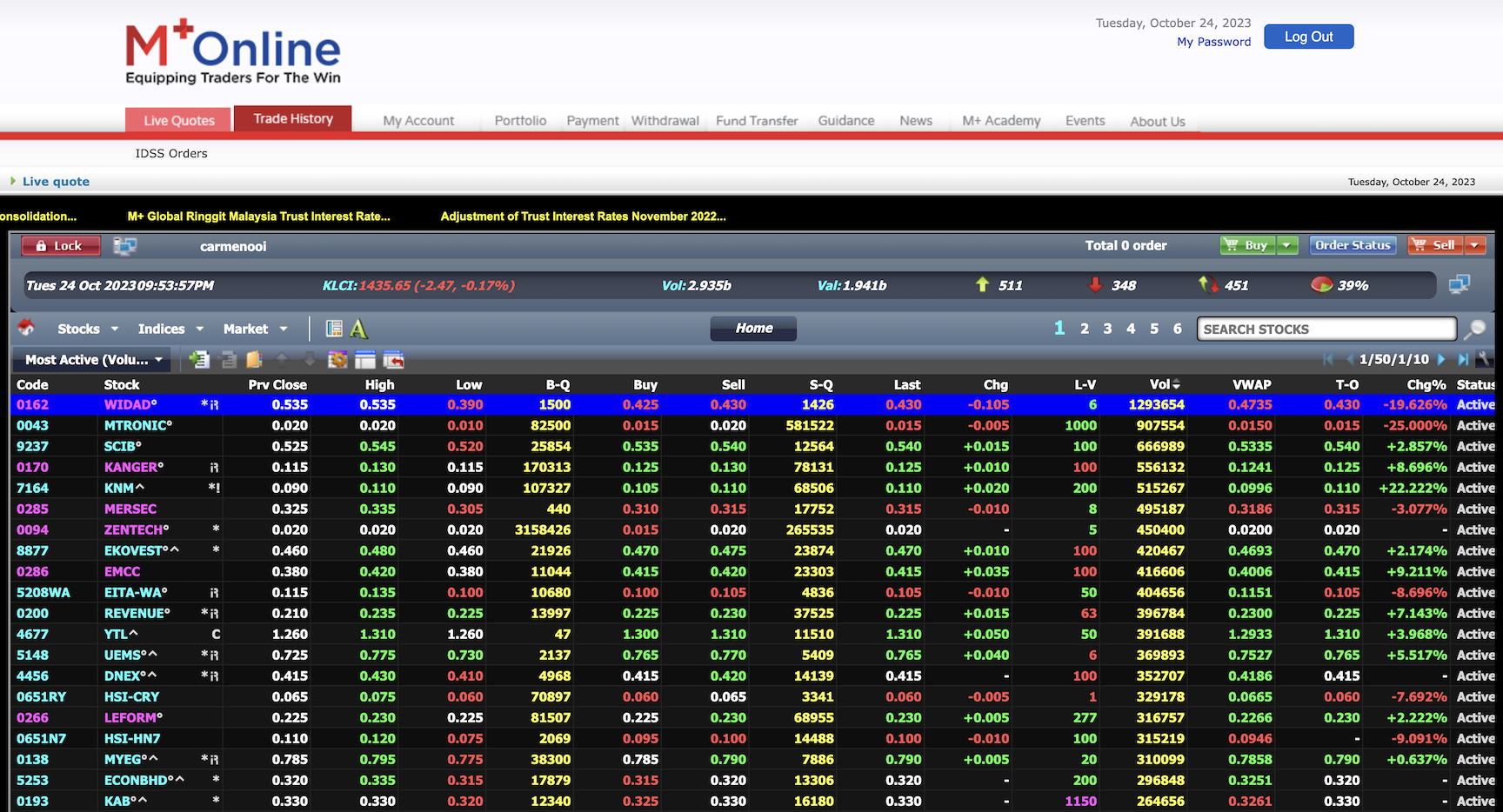

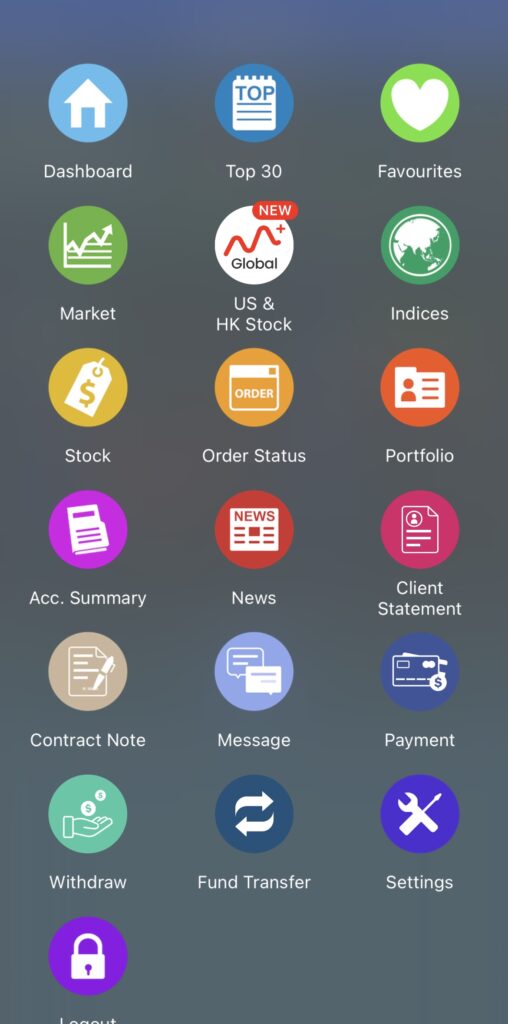

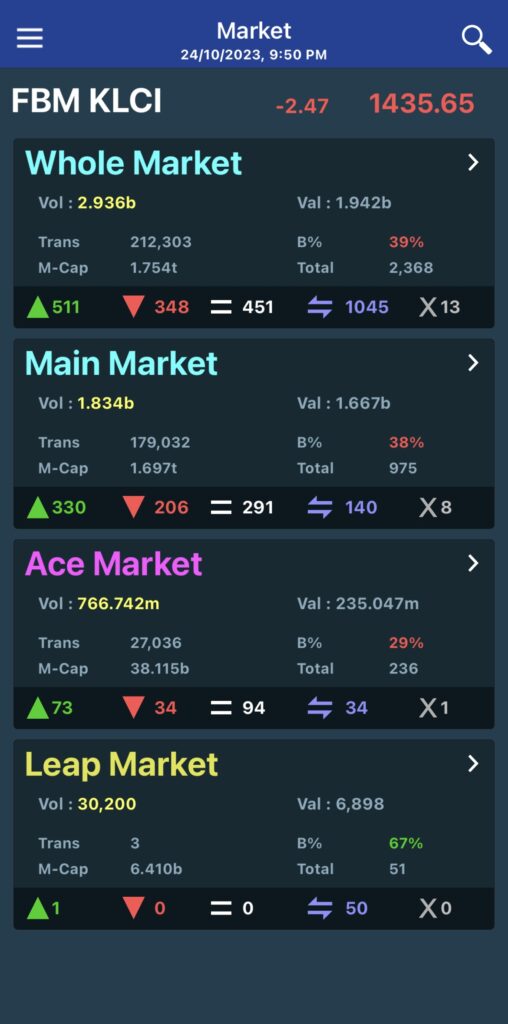

M + Online focuses on One for all, All for one's "catch all" trading experience, which is suitable for different browsers and 3C devices, including computers, mobile phones, tablets, etc.。Users are free to choose to use the online trading platform (web version) or APP to see the order, and the interface design and operation of different devices are not very different, the novice adaptation period is quite short.。

The operation of deposit and withdrawal is simple.

M + Online deposit channels, including online bank transfers, checks, cash and more。The deposit is generally immediate (the use of Manual Transfer needs to wait for a working day or so), the deposit is also a working day to the account, the process is simple and direct.。

M + Online Experience

Advantage 1: web version and APP easy to understand

The interface design of M + Online trading platform is simple, direct and clean, all the information and operation functions are clear at a glance, even a novice can quickly get started to use, from watching to placing an order easily。

Advantage 2: Additional investment features

In addition to the basic trading function, M + Online also provides additional investment information such as the company's financial report information and market trends to facilitate investors to analyze and study the performance of individual stocks and make corresponding investment decisions.。

Advantage 3: Direct CDS account available

In Malaysia, CDS central deposit accounts are generally divided into two types: Direct Account and Nominee Account.。Direct CDS is characterized by the fact that shares are deposited in an individual's name, dividends are remitted directly to an individual's bank account, eligible to participate in general meetings, etc., while Nominee CDS records shares in the name of a brokerage / investment bank, so all dividends, corporate activities, new share purchases (IPOs), etc. need to be processed through an investment bank.。

With a trading account on M + Online and a Direct CDS account, account holders have direct management rights over dividends, corporate activities, etc., and are more flexible for investors who prefer to handle investment-related matters on their own。

Disadvantage 1: platform investment function is less

Although M + Online provides additional investment information, it is slightly less than other trading platforms, including the lack of drawing features commonly used in technical analysis, stock filters, etc.。

Disadvantage 2: No virtual accounts available

Familiar with the securities trading platform, you may find that the vast majority of domestic investment platforms do not provide virtual accounts (paper account) to allow users to experience in advance, feel the function of the trading platform, M + Online is no exception, does not provide virtual accounts.。

What other users say?

The author observed the evaluation of the M + Online trading platform on the APP Store, which currently has 210 comments with a rating of 3.1 point, which belongs to the middle level. The common bad reviews are that M + Online does not support the facial recognition function Face ID login account, M + Online is not as novel as M + Global APP, login problems, poor customer service, etc.。

Is it safe and legal to invest in M + Online??

Investing with M + Online is safe and legal。M + Online is an electronic trading platform launched by Malacca Securities Sdn Bhd, regulated by the Securities Commission of Malaysia and the Bursa Malaysia and allowed to trade securities.。

Who is suitable for using M + Online??

M + Online is part of Malacca Securities Pte Ltd, which is a well-established domestic securities dealer with rich experience and good reputation, suitable for novice and veteran investors who want to enter the Malaysian stock market.。

In addition, Malacca Securities Private Limited launched a new M + Global trading platform in May 2023, covering the U.S. and Hong Kong securities markets, and provides M + Global and M + Online funds transfer function (Inter Transfer), users can transfer M + Online funds to M + Global use, quite convenient。If you are interested in investing in Hong Kong stocks, M + Online is an option worth considering。

How to open an account in M + Online?

M + Online adopts the whole line to open an account, the process of filling in the information is simple, the account application approval is also quite fast, even if it is the first time to apply for a securities account is also very easy to get started.。

Click the exclusive link to enter the account opening page, enter your personal data, upload relevant documents to verify your identity, and pay the account opening fee RM11, you can successfully open an account in about 24 hours。

If you encounter any problems with opening an account, you are welcome to leave a message and communicate with us at any time.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.