M + Global Online Account Opening Complete Process

To enable Malaysian investors to participate in trading in the US and Hong Kong markets, Malacca Securities has leveraged its 60 years of experience in helping investors achieve market profitability to launch an innovative investment trading app, M + Global.。This application is designed to provide investors with a wider range of investment options and more flexible trading opportunities, further expanding the influence of Malacca Securities in the fintech sector.。

In the 2022 RETAIL INVESTOR CAMPAIGN AWARDS organized by the Malaysia Stock Exchange, Malacca Securities Sdn Bhd, with its long history and outstanding performance, became the most award-winning person in one fell swoop, with a total of 22 awards.。

Founded in 1963, Malacca Securities is a 60-year-old local Malaysian securities firm that holds a Capital Markets Services Licence (CMSL) and is regulated by the Securities Commission Malaysia.。The company has 17 branches in Klang Valley, Penang, Johor, Pahang, Ipoh and Jeddah.。Since 2012, Malacca Securities began to focus on the development of digital business, and successfully launched the online horse stock trading platform M + Online, to provide customers with a more convenient trading experience and instant market information.。

It is worth mentioning that the world's largest companies by market capitalization usually choose to list on the U.S. stock market, such as Apple (Apple), Microsoft (Microsoft), Google (Google), Amazon (Amazon), Tesla (Tesla) and so on.。At the same time, as an international financial center, Hong Kong's stock market also covers many high-growth and high-quality stocks, such as Tencent (Tencent), China Mobile (China Mobile), Hang Seng China Enterprise Index ETF (HSCEI ETF) and so on.。

To enable Malaysian investors to participate in trading in the US and Hong Kong markets, Malacca Securities has leveraged its 60 years of experience in helping investors achieve market profitability to launch an innovative investment trading app, M + Global.。This application is designed to provide investors with a wider range of investment options and more flexible trading opportunities, further expanding the influence of Malacca Securities in the fintech sector.。

Now, Malaysian investors can easily get instant quotes and market information on all U.S. and Hong Kong stocks through M + Global, and invest in Hong Kong-U.S. stocks and derivatives such as ETFs, Wo Lun and CBBCs at low commissions.。Overseas brokerage firms serving U.S. stocks,

Investors can directly into the M-Global account, without the need to remit funds overseas, can help investors save a lot of access fees and time.。

In addition, all investors can open a financing account (margin account) through M + Global without additional application procedures.。Financing accounts offer investors greater purchasing power and flexibility。

Today this article shares the complete process of M + Global account opening, in the form of multi-graphic hand segmentation with you to smoothly cooperate with M + Global personal investment account, less than 10 minutes to complete the online account opening process.。

M + Global Account Preparation

Please open an account in a stable place on the Internet so that your account opening process will be smoother and easier to complete。

M + New Users

If you have not invested in an M + account, please prepare the following documents and information before your M + Global account:

- Identification documents (front and back photos)

- Tax Number (Nombor Cukai Pendapatan / Income Tax Number)

- The latest bank statement

M + old users

If you have already had a horse stock investment account in M + Online, the process of opening an M + Global account will be very simple.。You only need to prepare the tax number (Nombor Cukai Pendapatan/ Income Tax Number), you can open an account directly.。

M + Global Account Considerations

When a new user opens an M + Global account, the system will automatically open an investment account for the user at the same time.。

Securities account type

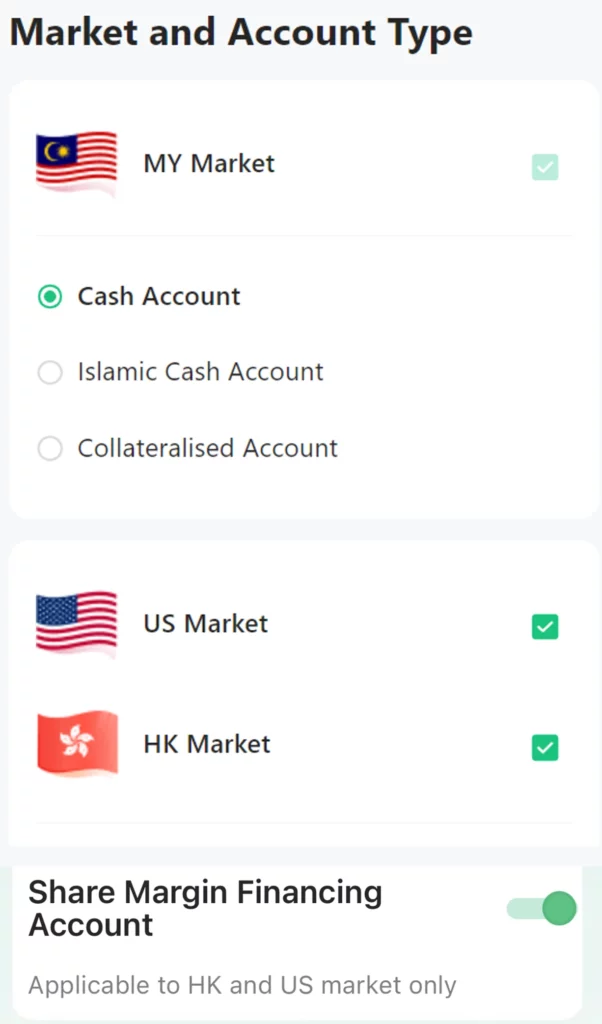

Depending on investment needs, investors will have three options for horse stock securities accounts: Cash Account, Islamic Cash Account or Collateralized Account.。

1.Cash Account

After completing the deposit in the account, the investor can start trading.。When an investor sells shares, the funds are deposited directly into the account。

2.Islamic Cash Account

Islamic cash accounts enable investors to make compliant investments that are consistent with Islamic principles。Accounts set up in accordance with Islamic financial principles, clear interest transactions and investments related to non-Islamic business。

3.Collateralized Account

Investors can use their own smaller funds to increase the potential for investment returns through leverage.。Investors only need to pay for the purchase of shares on two business days (T + 2) between the trading dates.。

4.M + Global US and Hong Kong Stock Investment Account

Next, you can check the U.S. market (U.S. stock market) and the Hong Kong market (Hong Kong stock market) to trade U.S. and Hong Kong stocks through M + Global.。

Note: M + Global provides users with trading services for U.S. and Hong Kong stocks, while M + Online provides users with trading services for horse stocks.。

5.Share Margin Financing Account

In addition, M + Global provides free financing accounts in the U.S. and Hong Kong stock markets for all non-users (share financing accounts)。With the opening of financing accounts for U.S. and Hong Kong stocks, users will have more flexibility and options when investing, and investors will be able to buy a larger number of shares with a smaller amount of money.。This way, investors can get a greater return on their investment when the stock price rises。

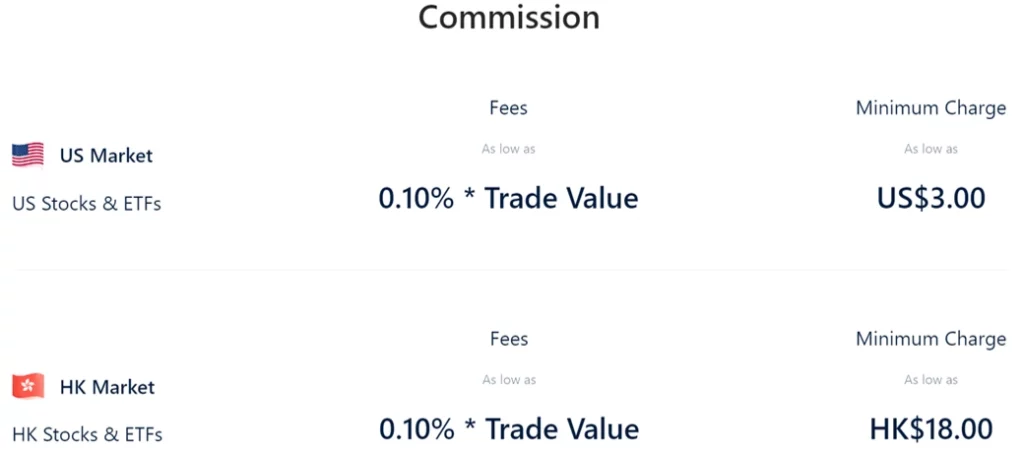

M + Global Commission Charges

| Trading products | Commission charges |

| US stocks and ETFs | Trading Commission is 0.10%, with a minimum commission of $3 for a single transaction |

| Hong Kong stocks and ETFs | Trading Commission is 0.10%, the minimum commission for a single transaction is HK $18 |

M + Global New User Account Opening Process Teaching (Multi-Figure)

○ Account Opening Fee Cost: RM 11

○ Time Needed: 1 to 3 working days

The account opening process for new M + Global users requires only 13 simple steps:

- Click the exclusive account opening link to enter the registration page

- Fill in contact information

- Select Account Type

- Authentication

- Fill in personal data

- Fill in job and vendor data

- Fill in financial profile

- Fill in the status of the investment risk

- Declaration of tax residence

- Declaration of relationship between immediate family members and Malacca Securities Pte Ltd

- Read and agree to the Account Opening Agreement and related disclosures

- Electronic signature

- Payment of account opening fees

We recommend that you use the official website to open an account, easy to fill in information, upload documents。

This section focuses on how new users (who have not registered with M + Online) can change their M + Global accounts.。If you already have an account with M + Online, you can go directly to the next section: Teaching the process of replacing an M + Global account by an old user (already registered with M + Online)。

The following author will open an account on the M + Global website and introduce how to open an account on the M + Global website in about 10 minutes.。

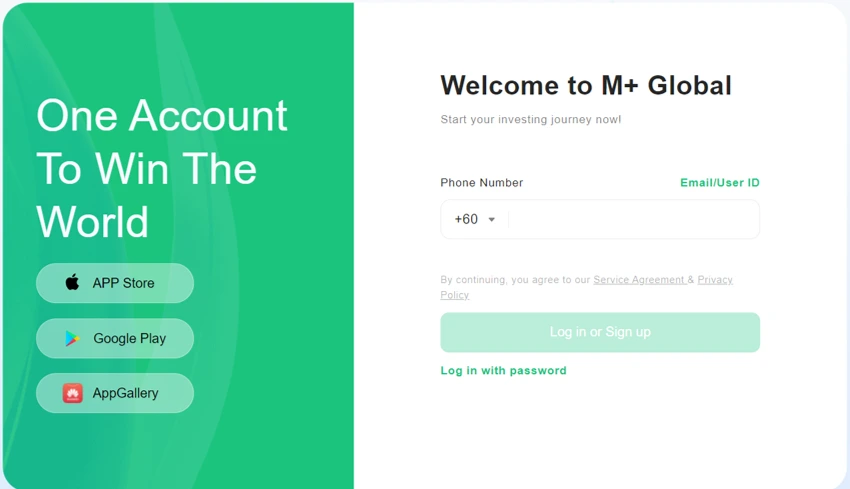

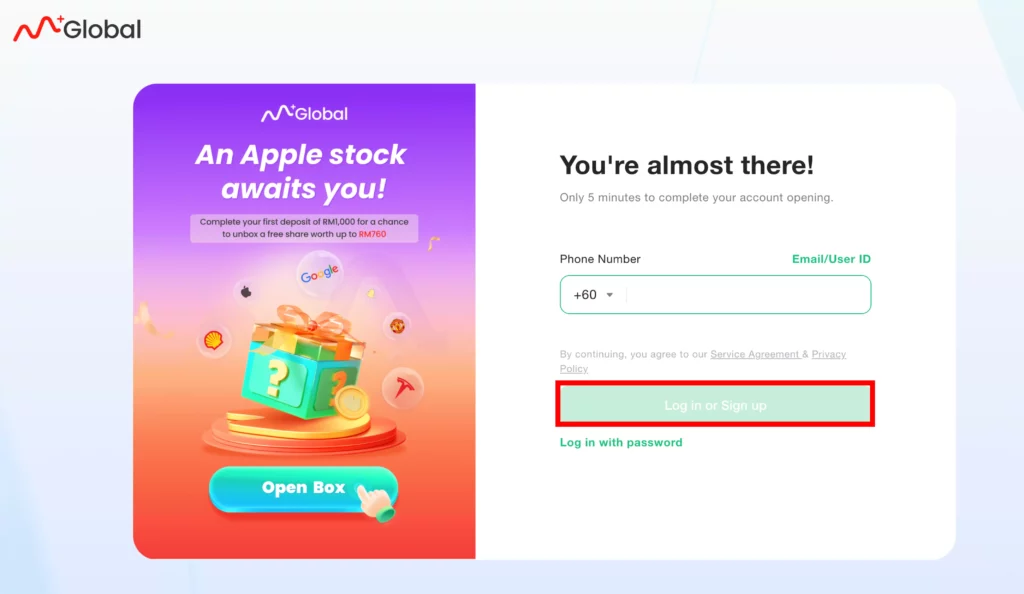

Step 1: Click the account opening link to enter the registration page

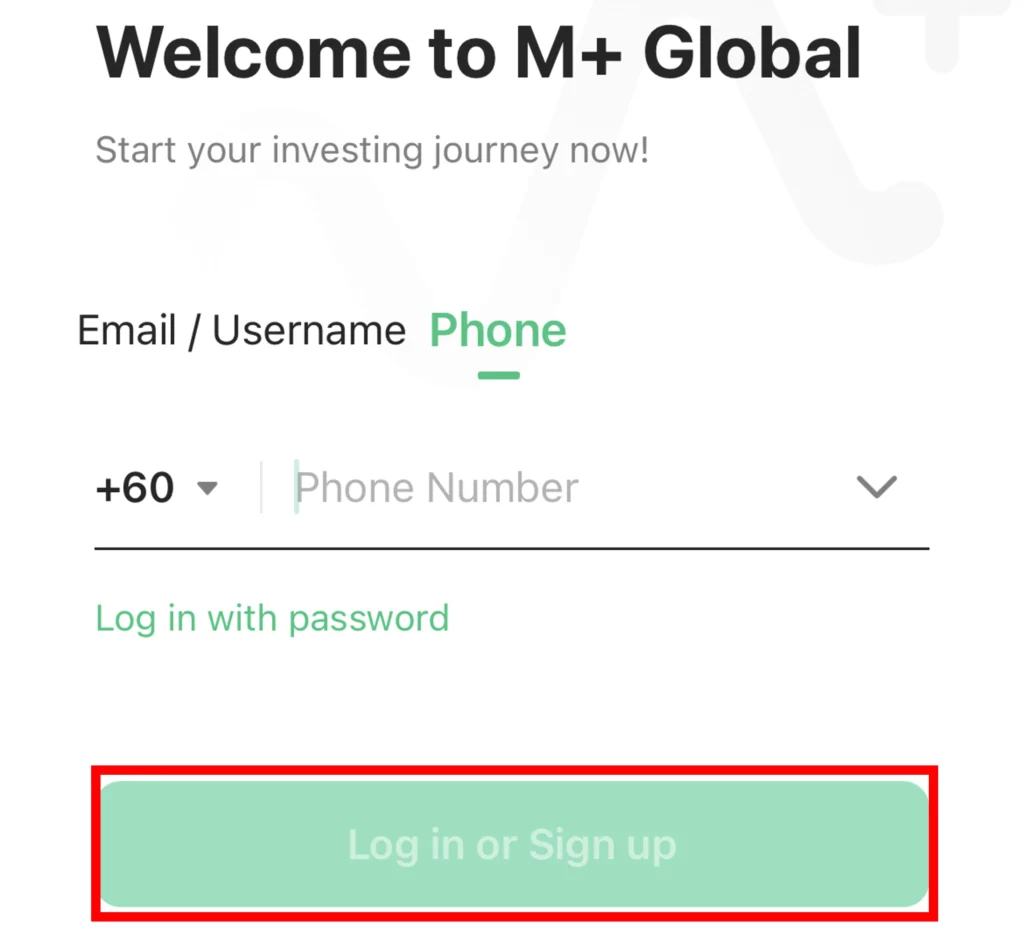

On the registration page, you can choose your mobile phone number or email to register your account。After entering your mobile phone number or email to register your account, click「Log in or Sign Up」。

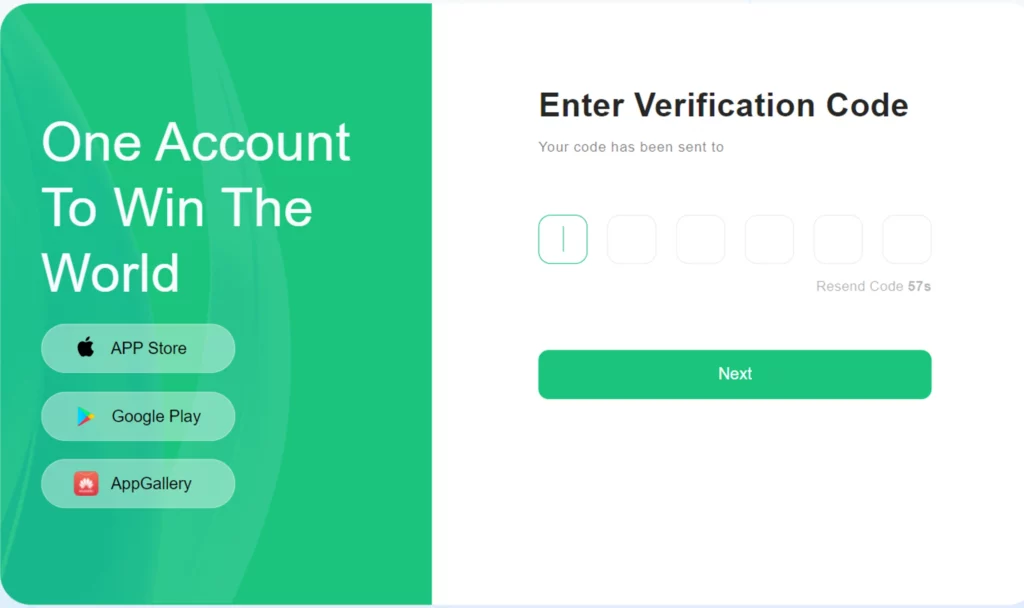

6. After entering the verification code, click "Next"。

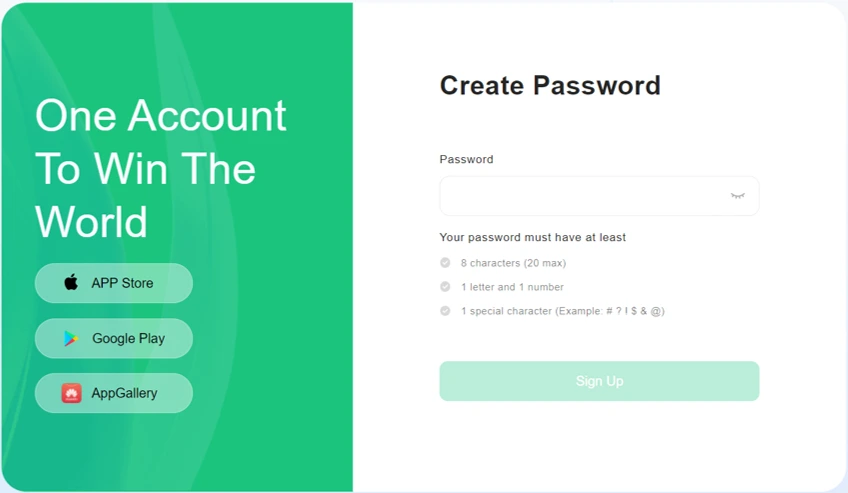

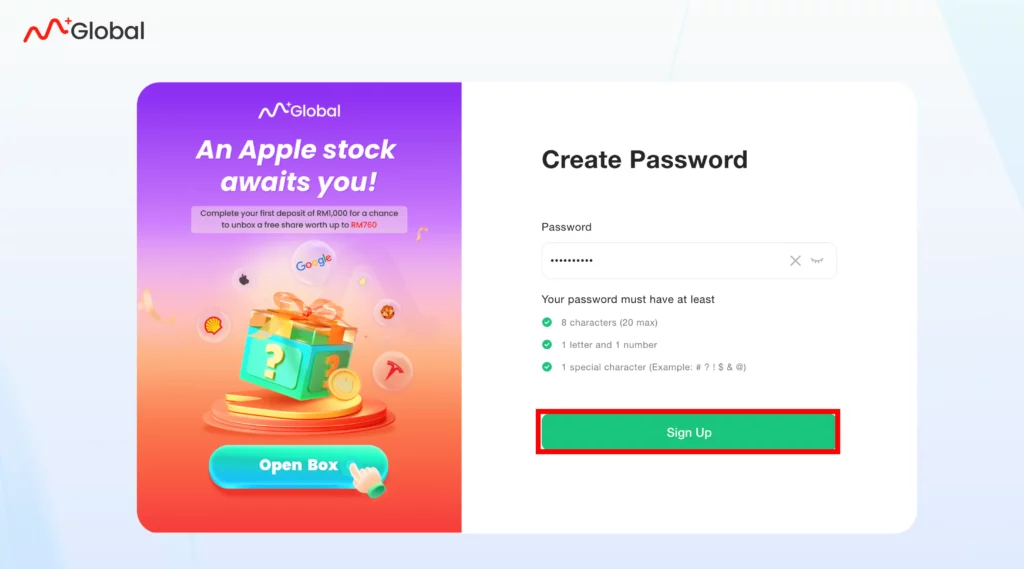

At the same time, you need to set a password。The password you set must be at least 8 characters (up to 20), including at least 1 letter, 1 number, and 1 special symbol。

After setting the password, click "Sign Up"。

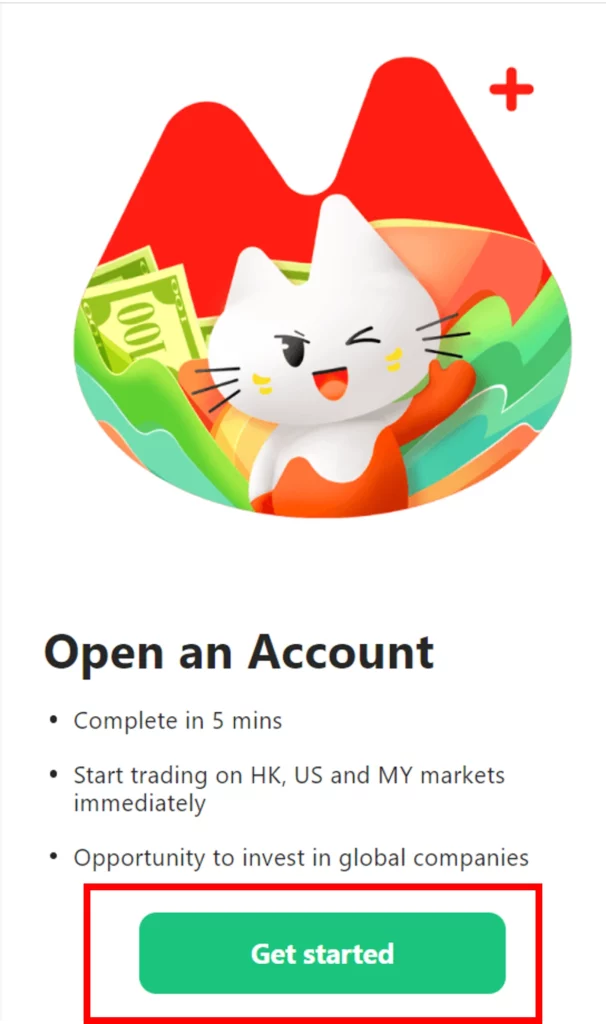

Click「Get Started」。

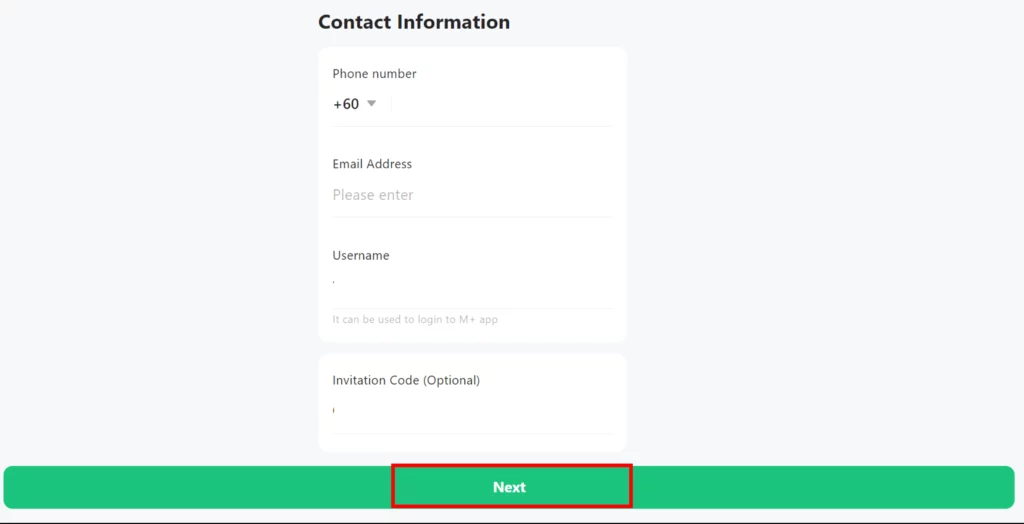

Step 2: Fill in the contact information

After you fill in the contact number, email and username, click "Next"。The user name you fill in can be used to log in to the M-plus application.。

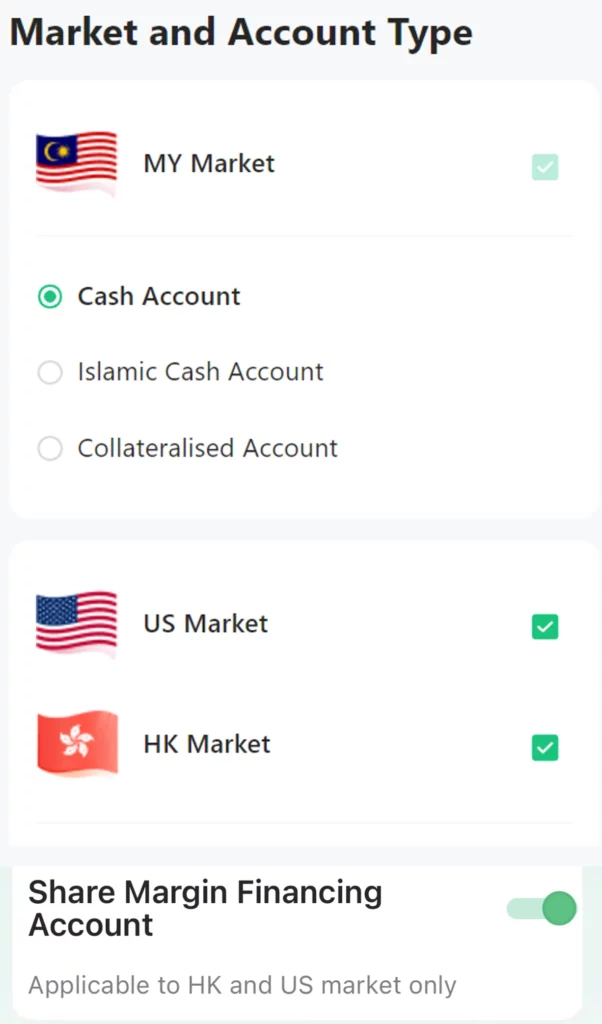

Step 3: Select an account type

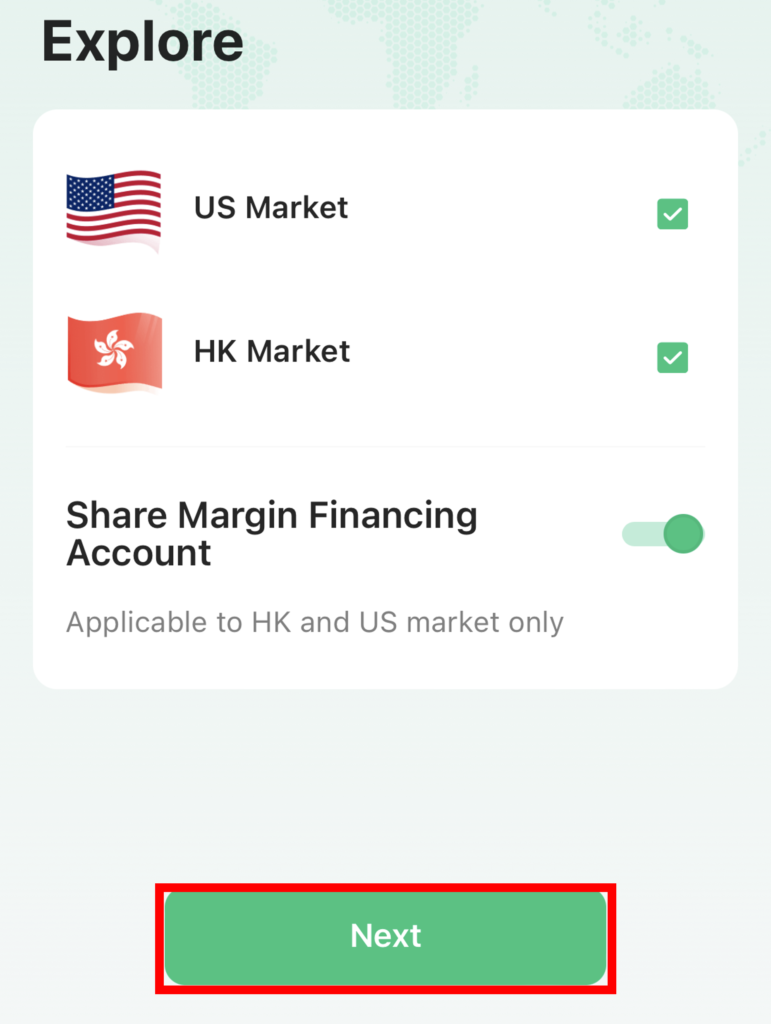

Regarding the horse stock trading account, you can choose to open a cash account (Cash Account), an Islamic Cash Account (Islamic Cash Account) or a mortgage account (Collateralised Account) as needed.。At the same time, the system automatically opens the U.S. and Hong Kong stock markets for investors.。

We recommend that you keep the status of the Share Margin Financing Account opened by default.。

After selecting the account, click "Next"。

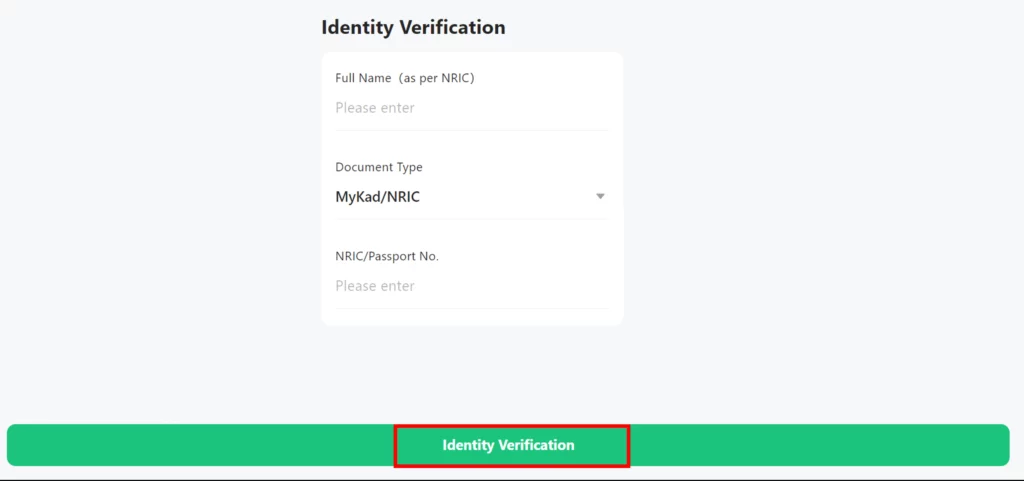

Step 4: Verify Identity

After filling in the name (must be the same as the full name on the ID card) and the ID number, click「Identity Vertification」。

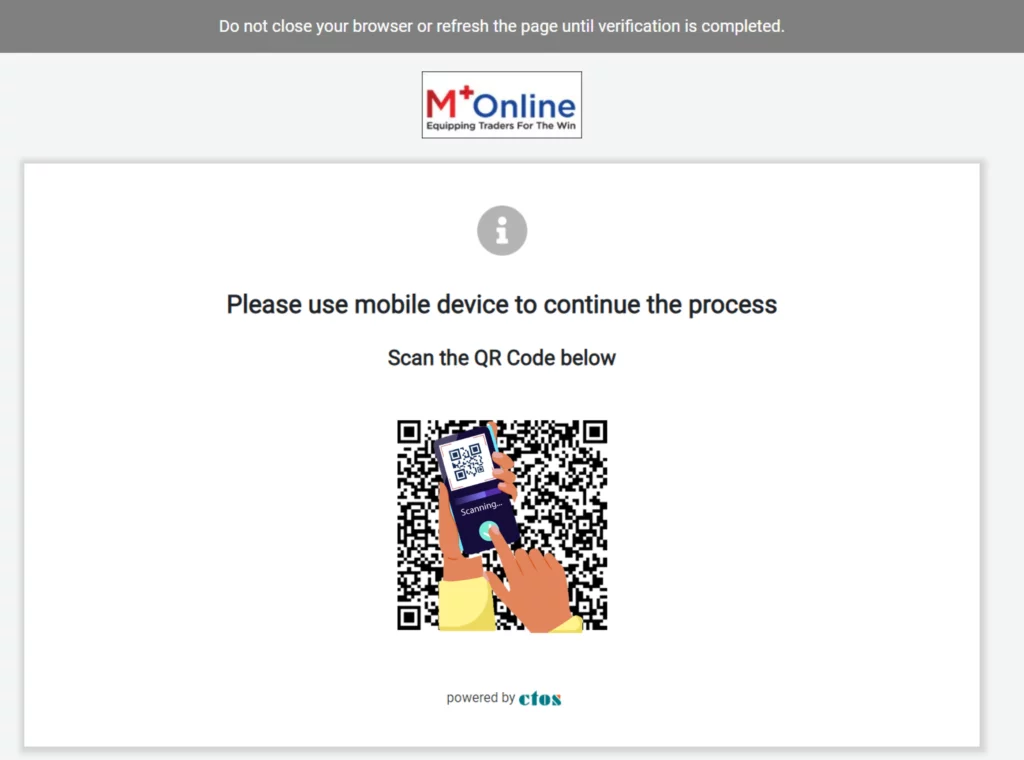

At the same time, you need to use your phone to scan the code and enter the authenticated web page。It should be noted that please do not close the browser or refresh the page until the verification is complete。

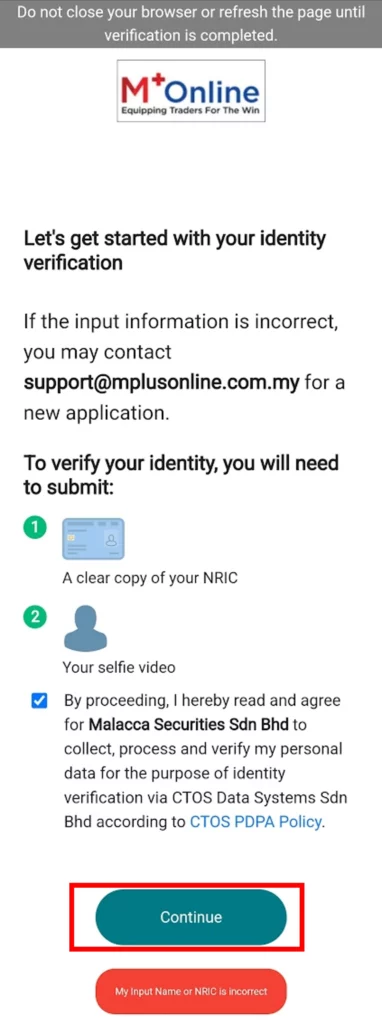

Check your name and ID number。If the information is correct, you can tick the box to indicate that you have read and in which Malacca Securities Sdn Bhd collects, processes and authenticates your personal data for authentication purposes through the credit advisory service CTOS.。After checking, click "Continue"。

If the name and ID card size information is wrong, please press the red key "My Input Name or NRIC is incorrect" to declare。

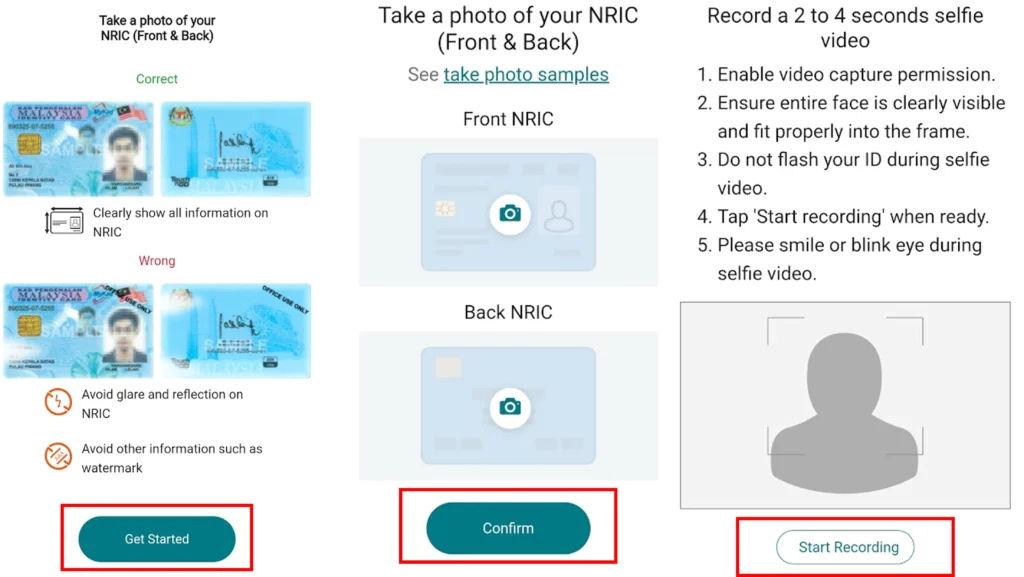

Next, after reading the requirements of ID card shooting, click "Get Started" to shoot ID card。It is important to note that the photo of the ID card you submit must clearly show all the information on the ID card, avoiding strong light reflections and watermarks。

After submitting your ID photo, click "Confirm" to go to the next step。

Click「Start Recording」record a 2 to 4 second wink or smile personal avatar video。Please make sure your profile picture is clearly and completely recorded。

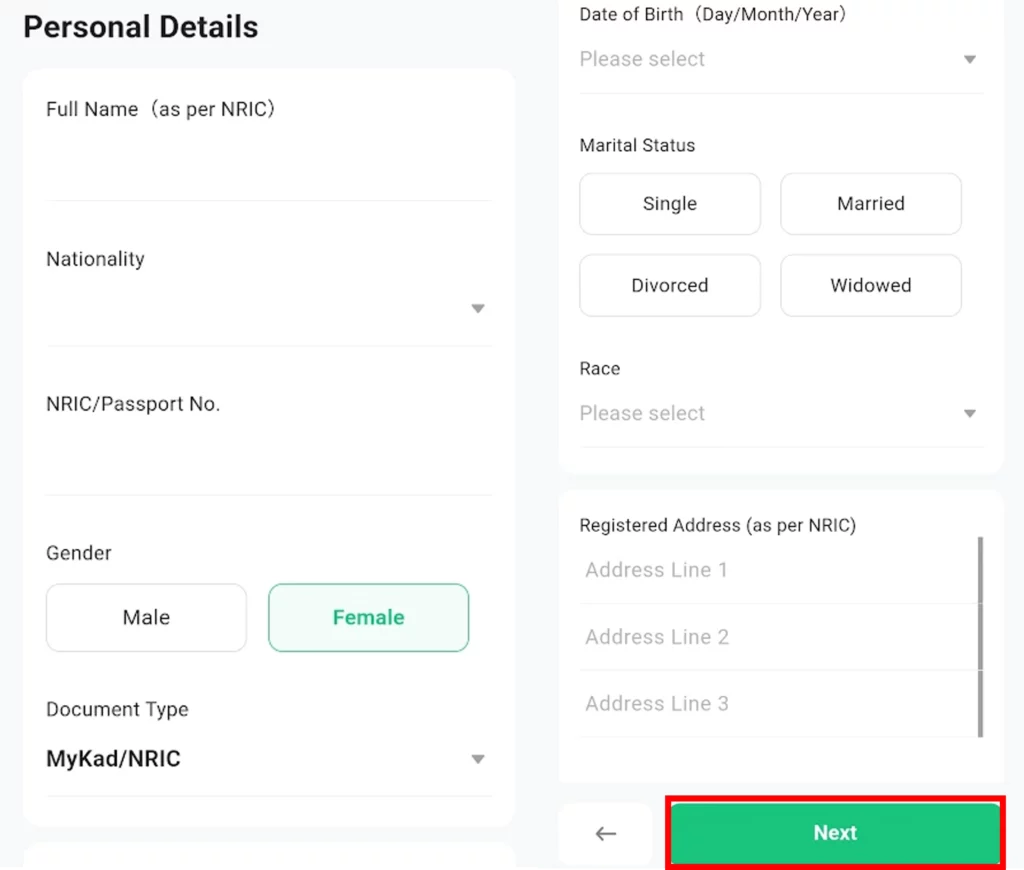

Step 5: Fill in your personal data

In this section, you fill in your full name, nationality, ID number, gender, date of birth, marital status, race, and address。It is important to note that your full name and address must match the information on your ID card.。

Once completed, click "Next."。

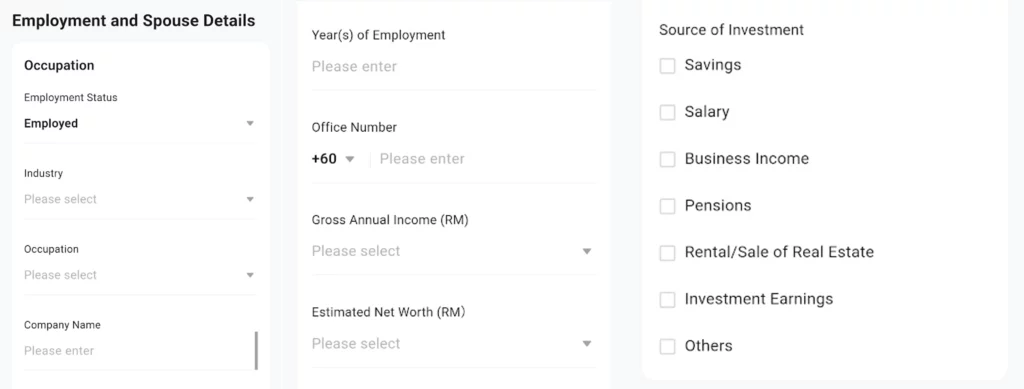

Step 6: Fill in the work and spouse information

In the Work section, you need to fill in the employment status, industry, occupation, company name, length of service, company contact number, total annual income (RMb), estimated net assets (RMb) and source of money invested。

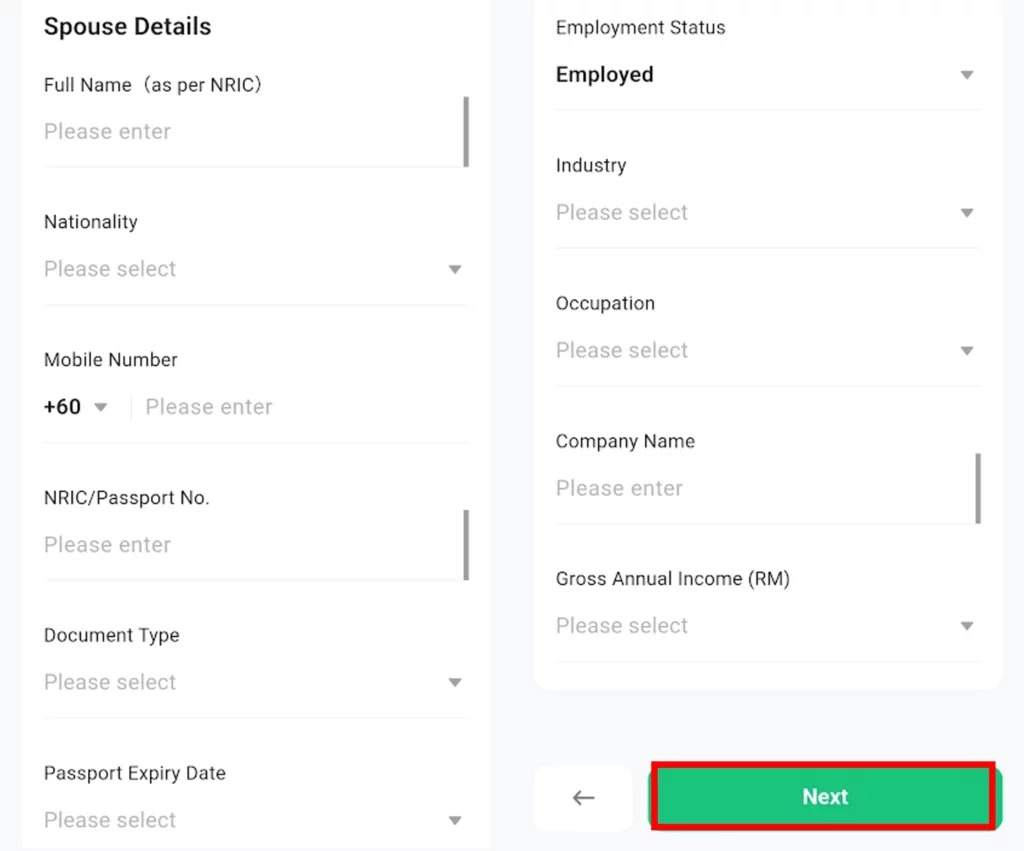

Next, you need to fill in the company's data, including: name (to match the name on the ID card), nationality, contact number, ID number, employment status, industry, occupation, company name and total annual income (RMK))。

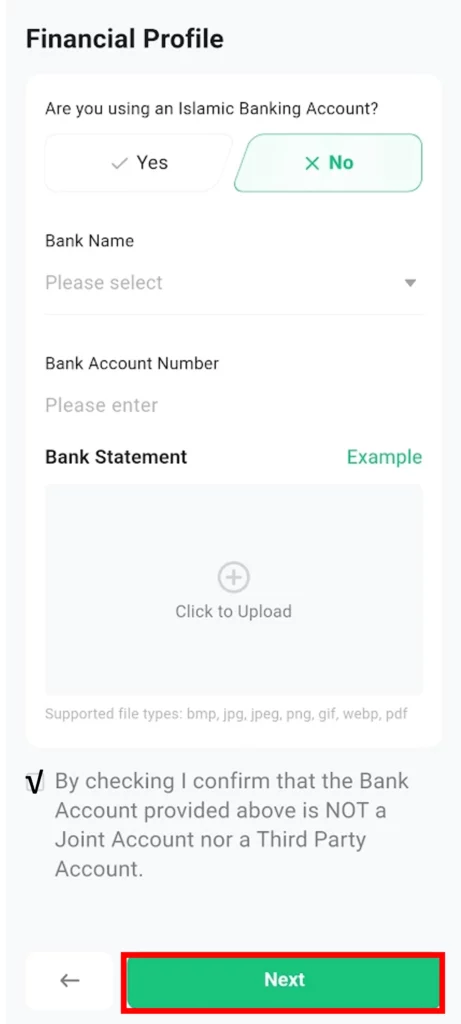

Step 7: Fill in the financial profile

If you use an Islamic bank account, then you are "Yes."。If the account you are using is not an Islamic bank account, choose No.。

Then you need to fill in the bank name, account number and submit the latest bank statement template。Bank statement clearly showing bank name, account name and account number。You can click「Example」View bank statement templates。

Note: The debt bank of the bank statement you have attached must be the same as the bank name you have filled in.。

After that, check the description to indicate that you confirm that the bank account provided is not a joint account or a third-party bank account.。Continue, click "Next" to proceed to the next step。

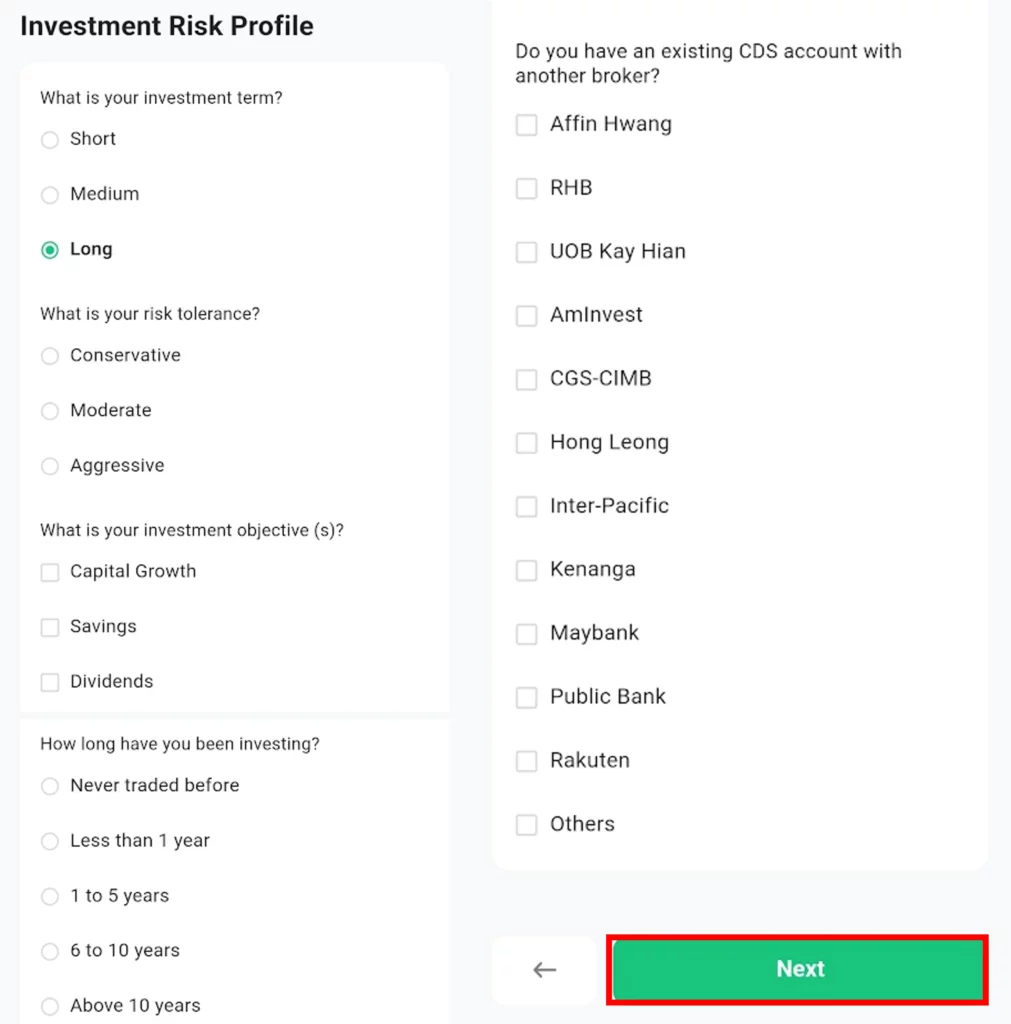

Step 8: Fill in the status of investment risk

In this section, you'll need to select your investment horizon, risk tolerance, investment objectives (multiple choice), investment years, and whether you have a CDS account with another broker.。

Once completed, click "Next."。

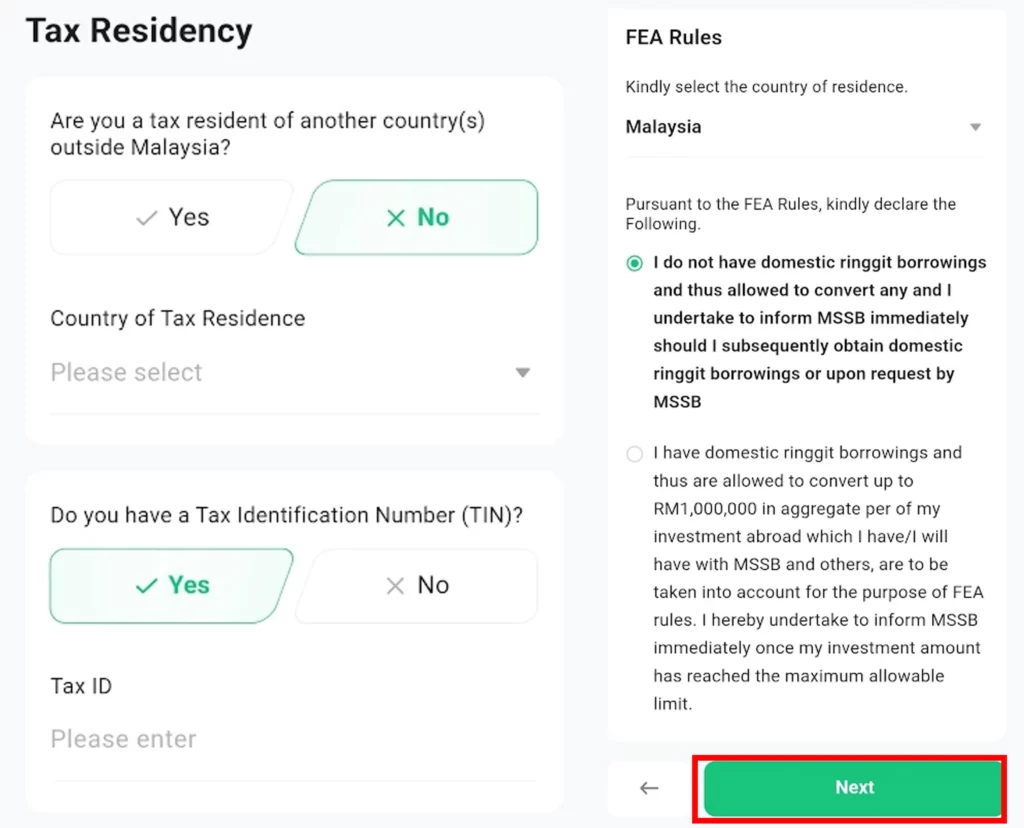

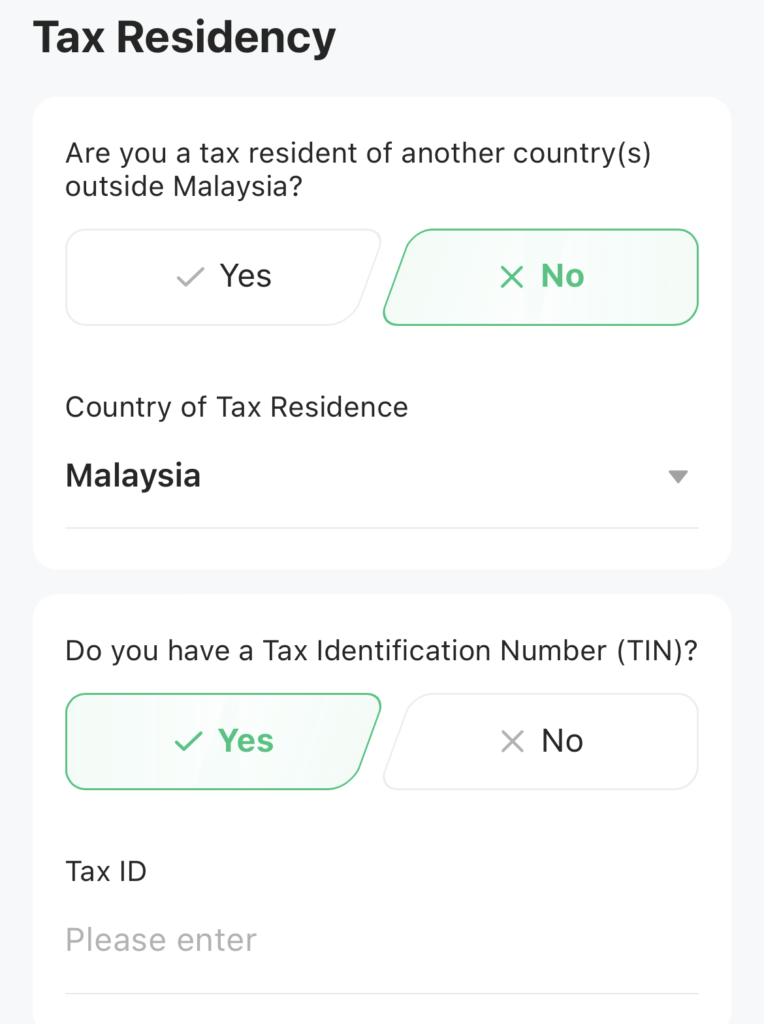

Step 9: Declare tax residence

If you are a tax resident in Malaysia, you only need to select "No"。Conversely, if you are not only a tax resident in Malaysia, but also a tax resident in another country, then you choose "Yes" and choose a country name in your tax residence country.。

Next, select "Yes" in the Do you have a Tax ID Number field to indicate that you have a tax identification number, and fill in your tax identification number in the Tax ID field。If you currently have a tax identification number, select "No"。

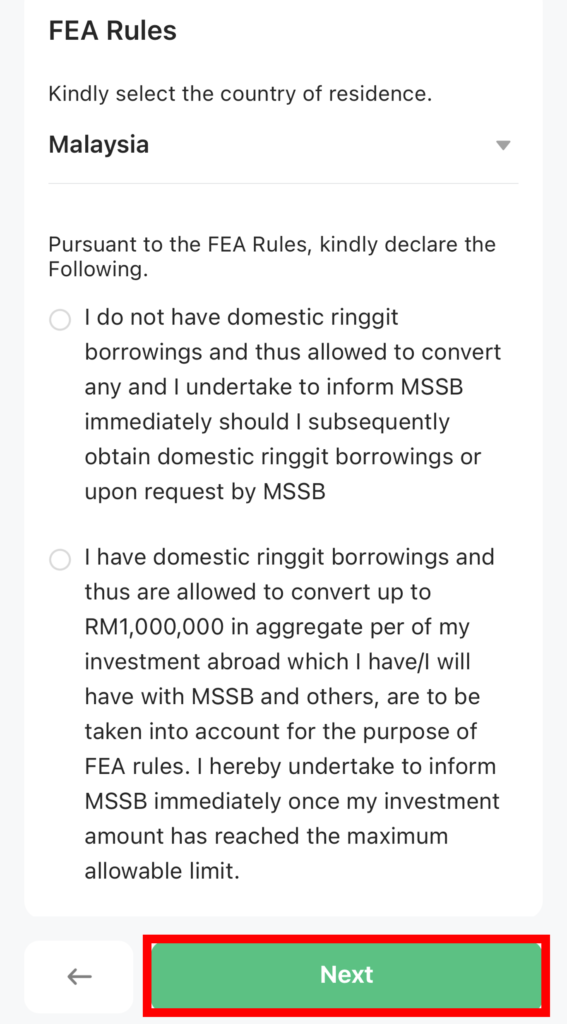

After selecting "Malaysia" in the column of the country of residence, you need to select the statement according to the FEA regulations (full name in English: Foreign Exchange Administration Rules)。

The FEA Rules are a set of rules implemented by Bank Negara Malaysia under the Financial Services Act 2013 and the Islamic Financial Services Act 2013 to protect the stability and value of the Malaysian currency.。

In this section, you need to choose one of the statements according to your loan situation。

Statement 1: I do not have a loan in ringgit, so I can convert any loan。I undertake to notify the MSSB immediately if I obtain a loan at a later date or meet the requirements of the MSSB。

Statement 2: I hold a loan in ringgit and therefore can only accrue up to RM 1,000,000 in the overseas investments of MSSB and other companies, and the amount of these investments will be within the scope of FEA regulations。I hereby undertake to notify MSSB as soon as my investment amount reaches the maximum interruption。(Note: If you have a PTPTN, car loan, mortgage or personal loan, please select this option)

After selecting the declaration, click "Next"。

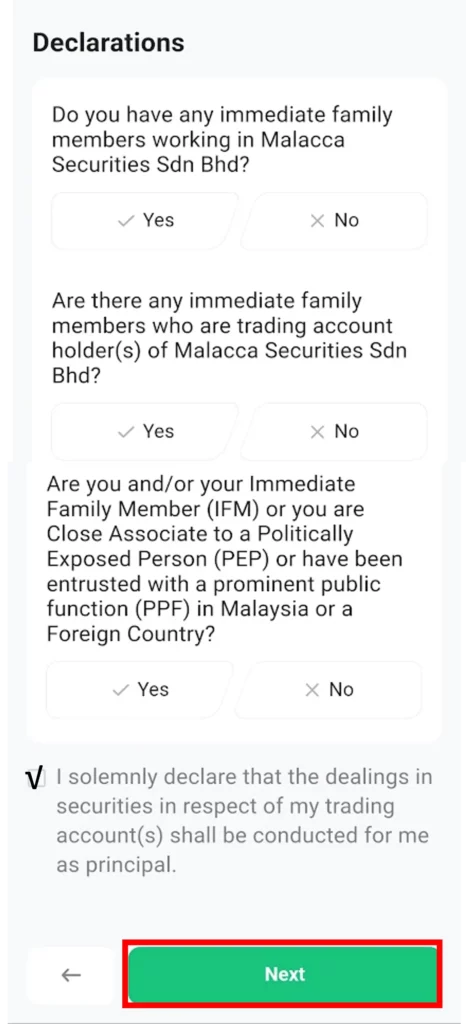

Step 10: Declare the relationship between the immediate family and Malacca Securities Pte Ltd.

If you have an immediate family member who works for Malacca Securities Pte Ltd, choose Yes, if not choose No。

Choose "Yes" when your immediate family member is a trading account with Malacca Securities Pte Ltd, or "No" if not。

Third, if you are personally or directly related to a relative political figure, a public official in Malaysia, or a person who has been declared an important public official abroad, then you need to choose "Yes"。If there is no close contact, then you choose "No"。

Then, tick the column below to indicate that you solemnly declare that your trading account is conducted in your personal name。

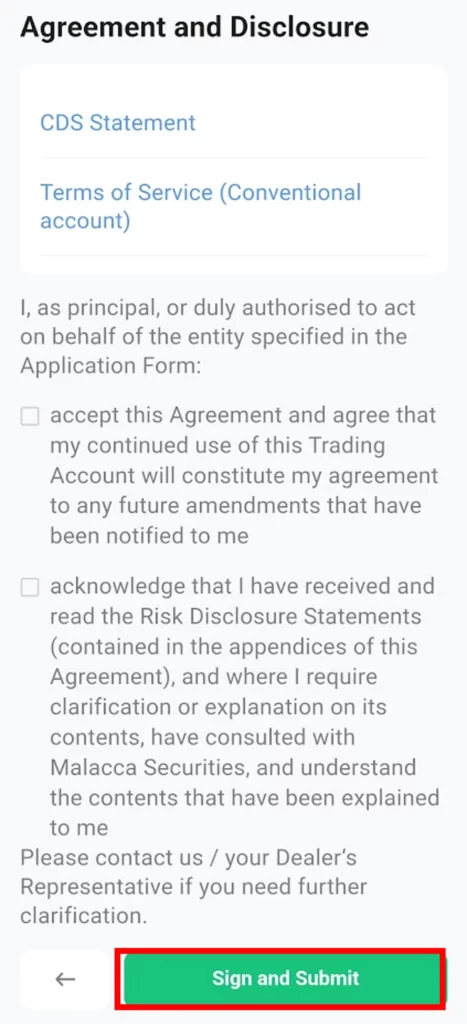

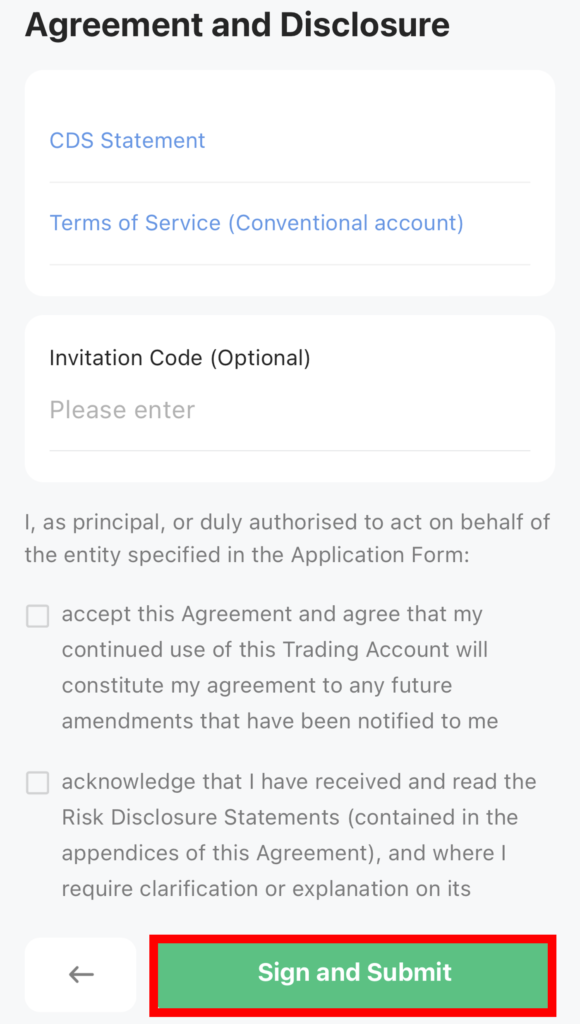

Step 11: Read and agree to the account opening agreement and related disclosures

Click "CDS Statement" and "Terms of Service (Conventional Account" in blue font to read the agreement and disclosure document。

If you agree, tick in the 2 boxes below to indicate that you, as principal, accept the agreement and agree to continue using the trading account and any future amendments to the notice.。Yes, a tick also indicates that you acknowledge that you have received and read the risk statement statement (included in the appendix to the agreement) and understand the agreement.。

If you have any questions about the agreement, you can contact M + Global's customer service staff for further understanding.。

After ticking, click「Sign and Submit」。

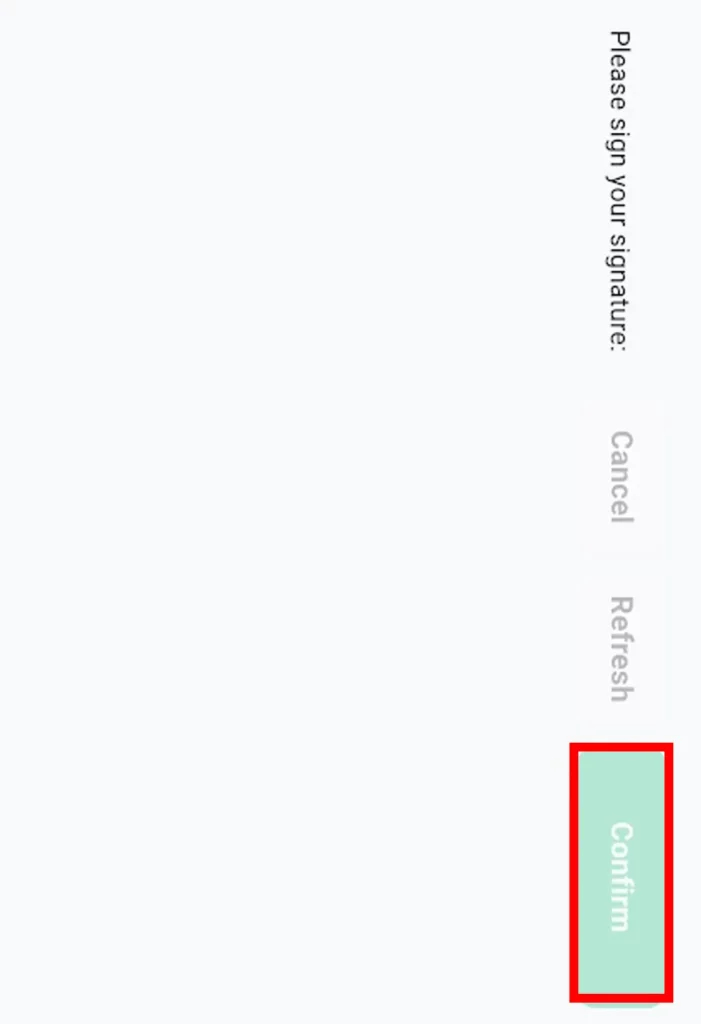

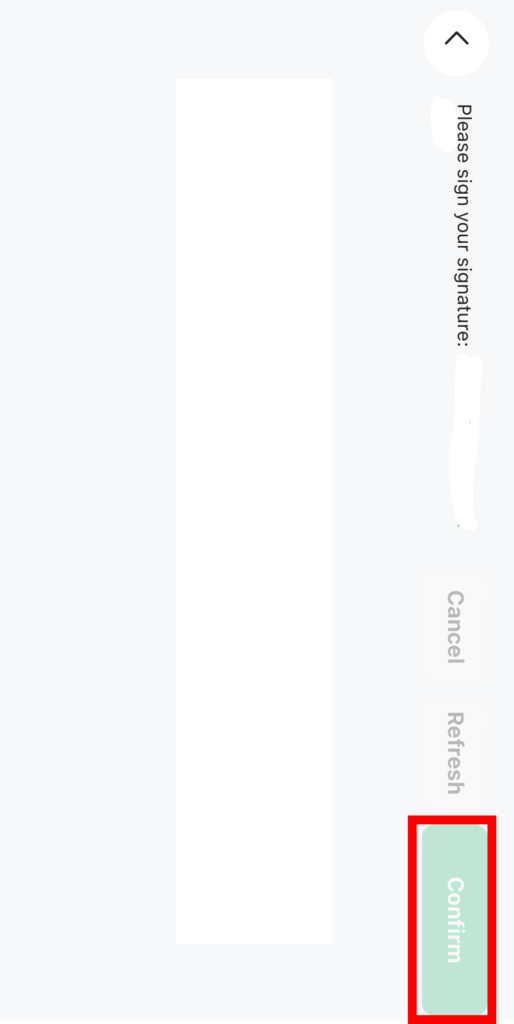

Step 12: Electronic signature

After signing your full name, click「Confirm」Can。

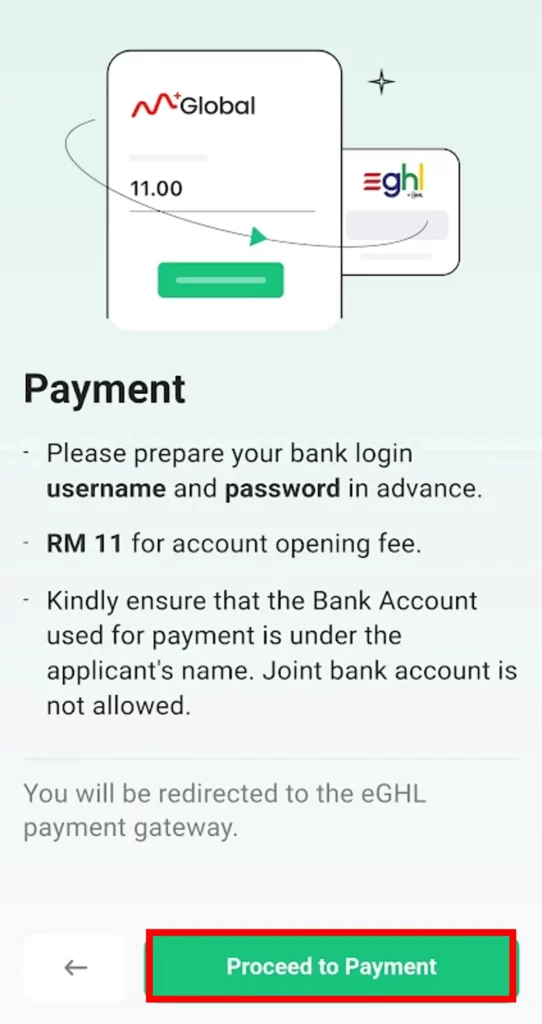

Step 13: Pay account opening fees

You can pay RM 11 account opening fee via online bank transfer。The main note is that you must pay the account opening fee through your own personal bank account and cannot use a joint account。

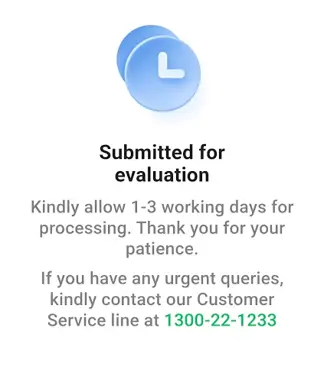

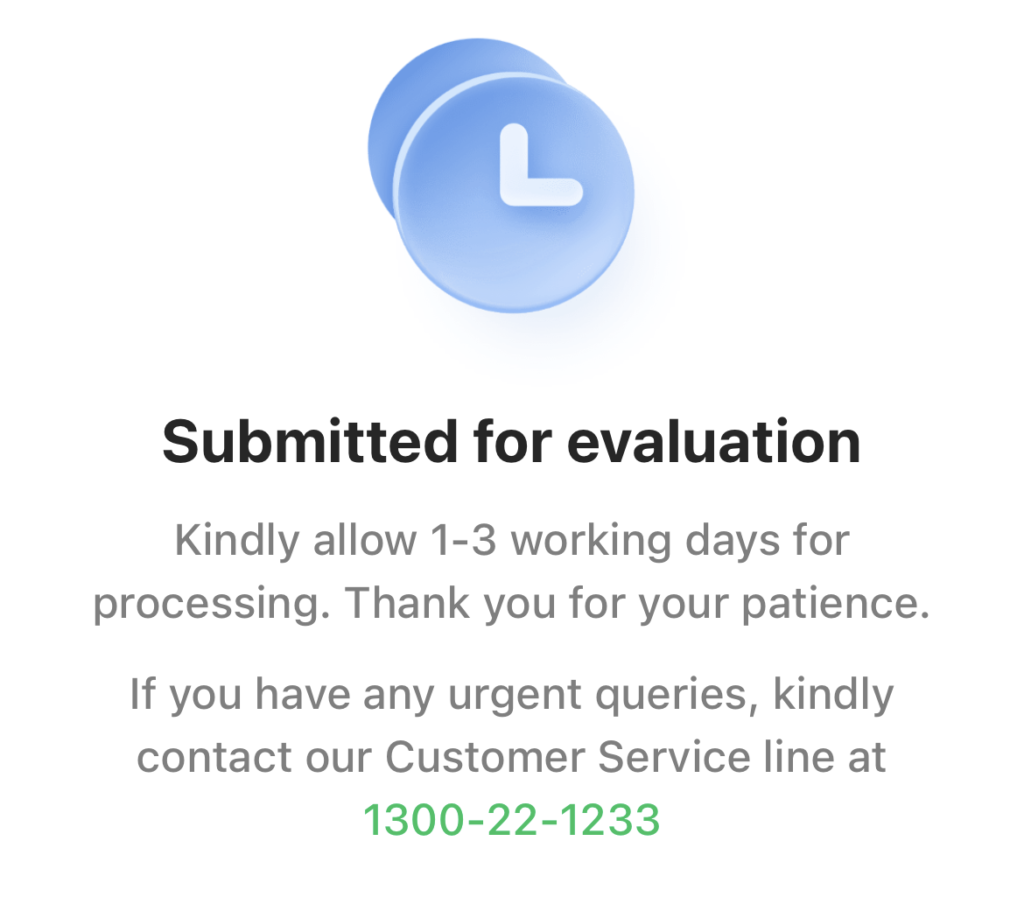

After paying the fee, you have completed the account opening procedure。M + Global requires 1 to 3 business days to review the account。If you have any urgent inquiries, you can call the customer service hotline to check the relevant information。

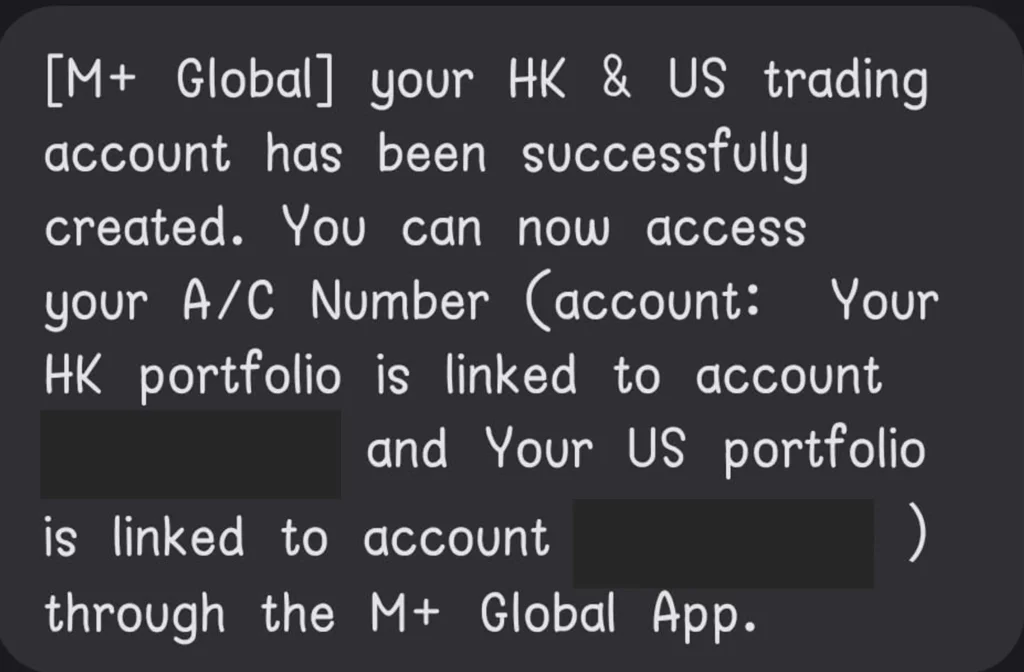

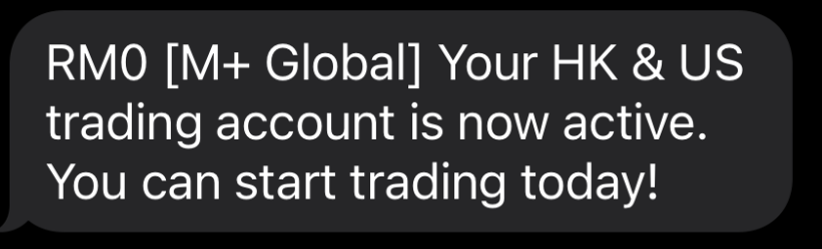

You will receive an information notification when your M + Global account is successfully audited。Next, you can trade U.S. and Hong Kong stocks by simply logging into your M + Global account。

Old users (registered M + Online) can realize the process teaching of M + Global account

If you already have an account with M + Online, opening an M + Global account will no longer charge any account opening fees, just fill in the account opening information at M + Global and wait for the account to jump.。

This section will explain one by one how old users implement M + Global accounts.。

Old user M + Global's account opening process requires only six simple steps:

- Click the exclusive account opening link to enter the registration page

- Log in to the M + global application

- Select Account Type

- Declaration of tax residence

- Read and agree to the Account Opening Agreement and related disclosures

- Electronic signature

Step 1: Click the dedicated account opening link to enter the registration page

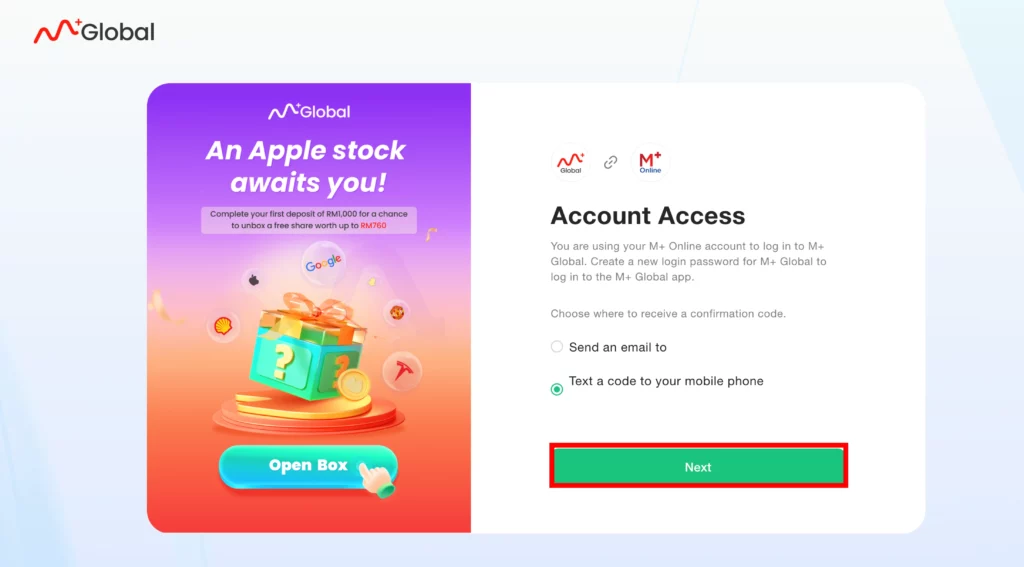

On the registration page you can choose your mobile phone number or Egypt to register an account。After entering the mobile phone number or Egypt to register an account, click「Log in or Sign Up」。

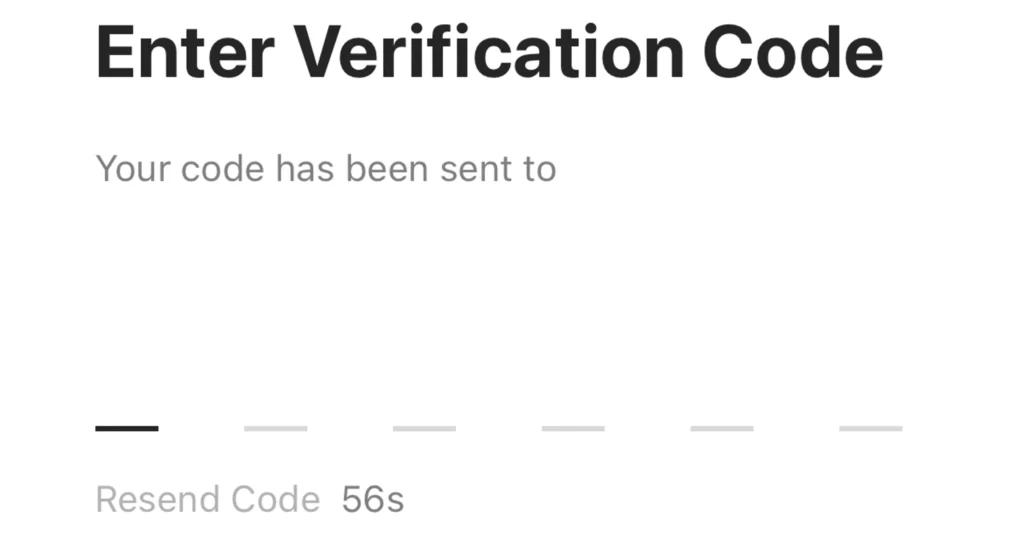

Since you are a user of M + Online, your account profile has been saved to the database。You can get the confirmation code by email or SMS.。After selecting email or SMS, click "Next"。

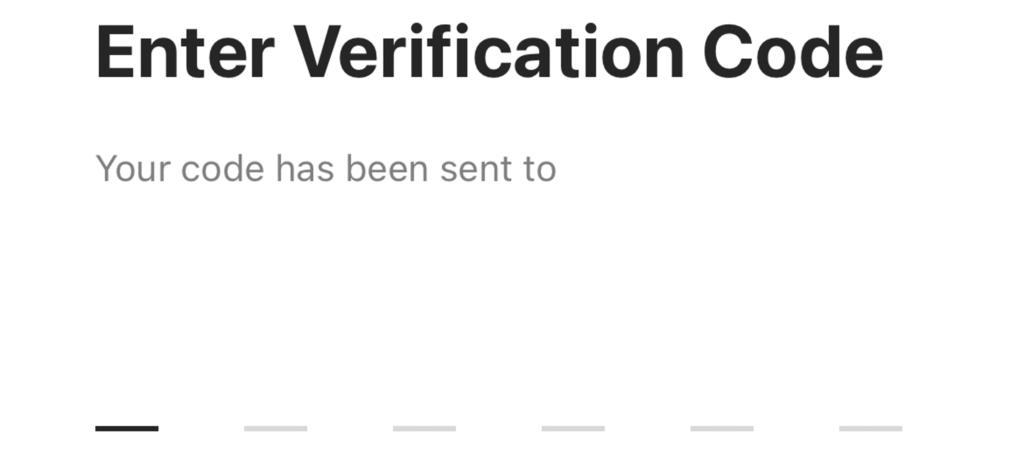

After checking the code by email or SMS, enter the 6-digit verification code。If you have not received any verification code notification, you can ask the system to resend it after 60 seconds of verification。

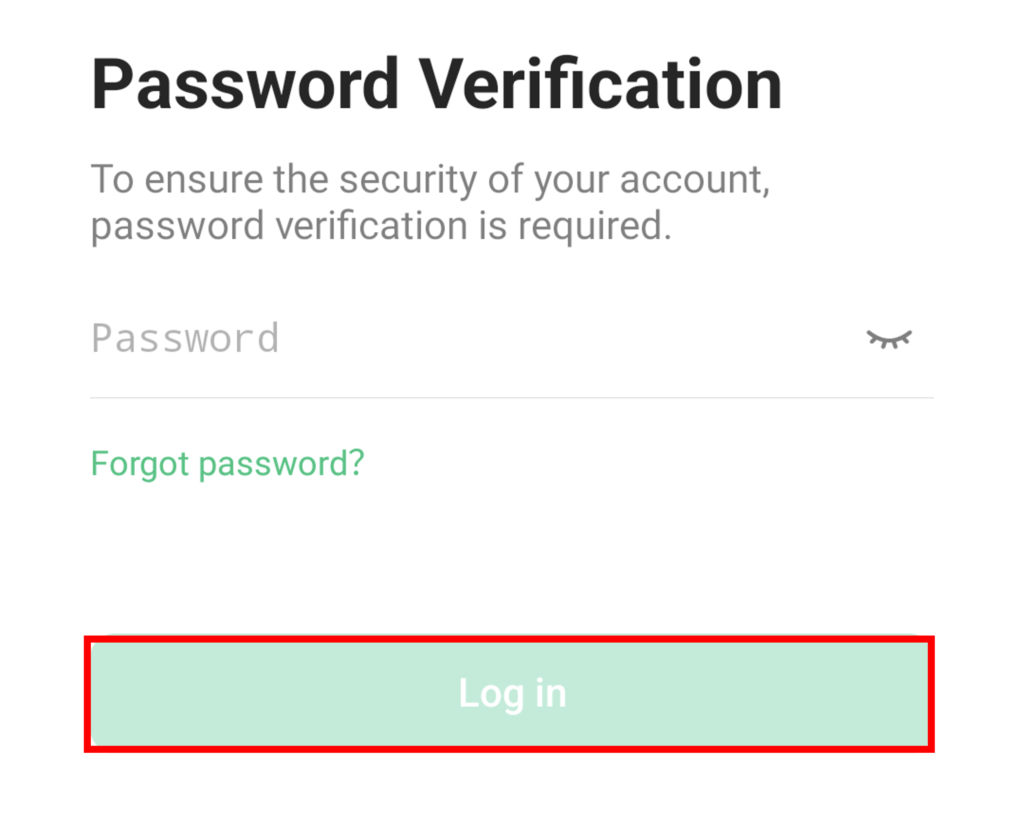

At the same time, you need to set a password。The password you set must be at least 8 characters (up to 20), including at least 1 letter, 1 number, and 1 special symbol。

After setting the password, click "Sign Up"。

You will receive a notification asking you to download M + Global's app。You can scan, download the M + Global app to the web page。

Step 2: Log in to the M + Global application

Log in to the M + Global application by mobile phone number or email。After entering your mobile phone number or email, click "Login or Register"。

After receiving the 6-digit verification code, enter the verification code in the M + Global application。

After entering the password you have set, click "Login"。If you have forgotten your password, you can reset it by clicking "Forgot Password"。

Step 3: Select an account type

By default, the system will open the U.S. and Hong Kong stock financing accounts (Share Margin Financing Account), we recommend that you keep the open status, open the margin account will not incur any fees.。

After selecting the account, click "Next"。

Step 4: Declare tax residence

If you are a tax resident in Malaysia, you only need to select No.。Conversely, if you are not only a tax resident of Malaysia, but also a tax resident of another country, then you choose "Yes" and choose the country name in the country of tax residence.。

Next, select "Yes" in the Do you have a Tax ID Number field to indicate that you have a tax identification number, and fill in your tax identification number in the Tax ID field。If you currently have a tax identification number, choose No。

After selecting "Malaysia" in the column of the country of residence, you need to select the statement according to the FEA regulations (full name in English: Foreign Exchange Administration Rules)。

The FEA Rules are a set of rules implemented by Bank Negara Malaysia under the Financial Services Act 2013 and the Islamic Financial Services Act 2013 to protect the stability and value of the Malaysian currency.。

In this section, you need to choose one of the statements according to your loan situation。

Statement 1: I do not have a loan in ringgit, so I can convert any loan。I undertake to notify the MSSB immediately if I obtain a loan at a later date or meet the requirements of the MSSB。

Statement 2: I hold a loan in ringgit and therefore can only accrue up to RM1,000,000 in the overseas investments of MSSB and other companies, and the amount of these investments will be within the scope of FEA regulations。I hereby undertake to notify the MSSB as soon as my investment reaches the maximum disruption。

After selecting the statement, click Next。

Step 5: Read and agree to the account opening agreement and related disclosures

Click "CDS Statement" and "Terms of Service (Conventional Account" in blue font to read the agreement and disclosure document。

If you agree, tick in the 2 boxes below to indicate that you, as principal, accept the agreement and agree to continue using the trading account and any future amendments to the notice.。In addition, a tick also indicates that you acknowledge that you have received and read the Risk Statement Statement (contained in the Appendix to the Agreement) and understand the content of the Agreement.。

If you have any questions about the agreement, you can contact M + Global's customer service staff for further understanding.。

After ticking, click「Sign and Submit」。

Step 6: Electronic signature

After signing your full name, click "Confirm"。

After the electronic signature, you have completed the account opening procedures。M + Global requires 1 to 3 business days to review the account。If you have any urgent inquiries, you can call the customer service hotline to check the relevant information。

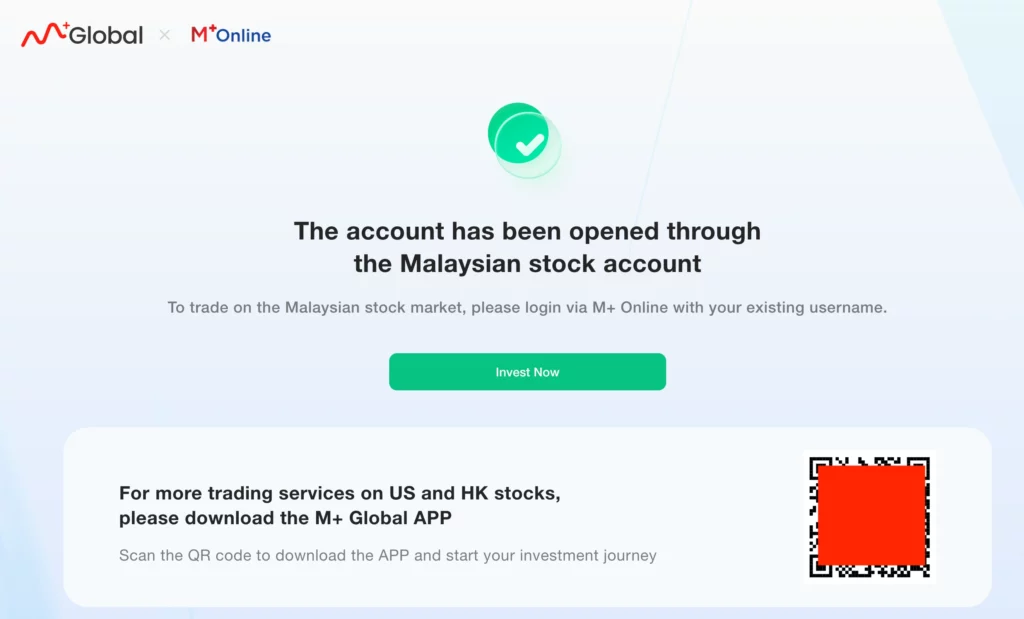

When the M + Global account is successfully opened, you will receive an information notification。

M + Global Account Opening Experience

The process of opening a new user account M + Global

M + Global account is a direct account (Direct CDS Account) audit time is about 1 to 3 business days。The author measured the account opening process for new M + Global users and received a notification of successful account opening on the fourth day。

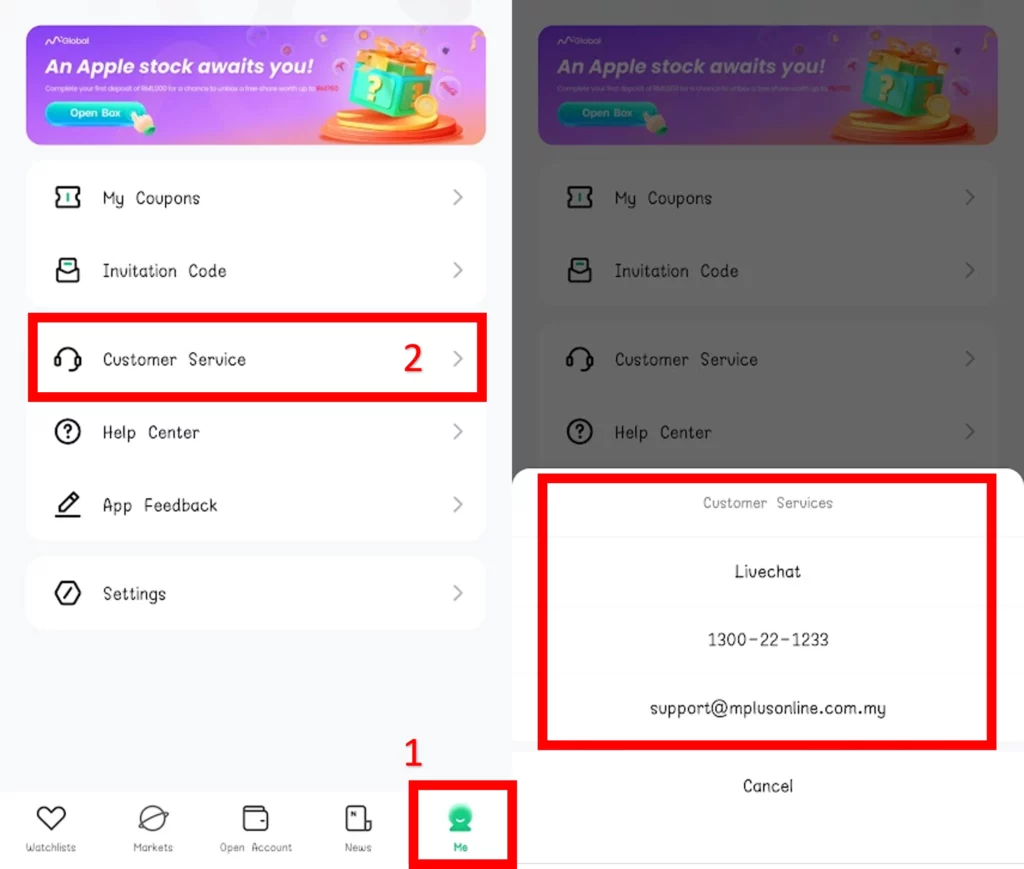

If you have not received a successful account opening notification on the 4th working day after applying for an account, you can click "I" in the M + Global application and then click "Customer Service" to obtain customer service contact information.。

M + Global's customer service is available 24 hours a day, so you can choose to call the customer service hotline, live chat (Live Chat) in the M + Global application or other means at any effective time to contact the relevant personnel.。

The Process of Old User Account M + Global

In addition, the author also measured the account opening process of old users.。Old users have a simpler account opening process than new users, and accounts are quickly approved。The author measured that the old user opened an account at around 7: 30 p.m. and received a notification of a successful account at 8: 42 a.m. the next morning.。

After successfully opening an account, you can obtain funds to start trading Hong Kong and US stocks through M + Global。

If you encounter problems in the process of opening an account, please leave a message to us, our team will try our best to help。

M + Global Account Opening FAQ

How long does it take to open an account??

According to the official website of M + Global, it takes 1 to 3 working days to open an account。As long as the documents and information you submit are complete and meet the requirements, the audit will not take too long。

Assuming no messages for more than 3 days, you can ask M + Global's agent by calling the customer service hotline, the M + Global app's live chat, or by going to [emailprotected]。

Will the account remain valid if you do not deposit money after opening the account??

The account will remain valid。

M + Global does not trade in the horse stock market.。The investment platform focuses on providing users with trading services for Hong Kong and US stocks.。If the user intends to trade horse shares on the M + platform, he or she should choose M + Online.。

It is worth noting that for new users, when starting to use M + Global, the system will automatically allocate M + Online's investment account。This is very convenient for new users as they do not need to apply for another M + Online account again。

When a new user successfully opens an account on the M + Online platform, the system will send 3 email notifications。These emails contain important information such as the user name of M + Online, the activation code, the activation URL, and the temporary password required to log in to your M + Online account。This simple automatic configuration process provides users with a more convenient investment experience。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.