How First Securities (Firstrade) buys and sells U.S. stocks?

First Securities (Firstrade) is the only brokerage in the United States to offer a comprehensive Chinese trading platform.。The platform not only supports English browsing, but also can switch to traditional or simplified Chinese at any time, providing users with a more convenient trading experience and eliminating language barriers.。With Firstrade, investors can easily invest in a variety of financial investment products listed on U.S. exchanges, including stocks, exchange-traded funds (ETFs), options, and more.。

First Securities (Firstrade) is the only brokerage in the United States to offer a comprehensive Chinese trading platform.。The platform not only supports English browsing, but also can switch to traditional or simplified Chinese at any time, providing users with a more convenient trading experience and eliminating language barriers.。With Firstrade, investors can easily invest in a variety of financial investment products listed on U.S. exchanges, including stocks, exchange-traded funds (ETFs), options, and more.。

The operating process of the Firstrade trading platform in buying and selling U.S. stocks and ETFs is described in detail below to help investors more easily trade their favorite U.S. stocks。

Content includes:

◇ Firstrade U.S. stock trading process teaching

◇ What order types and validity periods does Firstrade offer

◇ Commissions and other fees for Firstrade U.S. stock trading

Small reminder before buying and selling stocks

After successfully opening an account and merging it into Gold Firstrade, you can choose to log into the Firstrade APP mobile app or the official website to place an order transaction.。

You can download Firstrade from the App Store or Google Play Store。

Use the official website or Firstrade App only after opening an account for formal operation and trading, so you can watch, track the performance of individual stocks and place orders anytime and anywhere.。

Introduction to the interface of the first securities trading platform

After opening a successful account, you can start trading U.S. stocks, ETFs and other financial products listed in the U.S. market.。

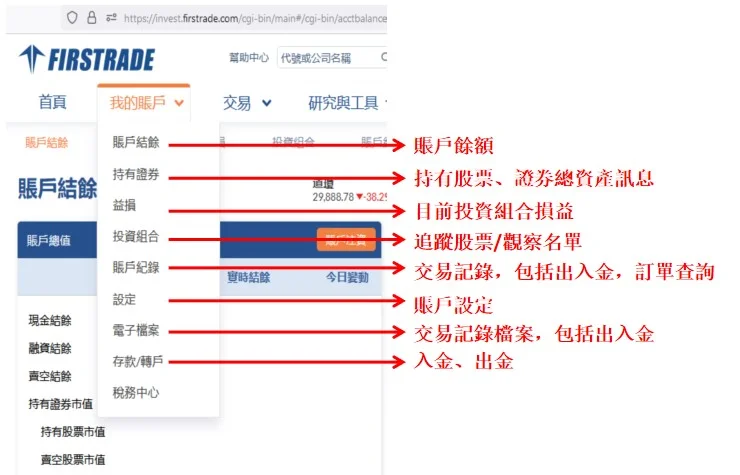

Log on to the Firstrade website and click on "My Account" to filter different functions, including viewing account balances, browsing total asset information, position gains and losses, tracking stocks on watch lists, and more.。

At the same time, you can also view transaction records and files, open the deposit, deposit function.。

The following is your introduction to the Firstrade official website interface。

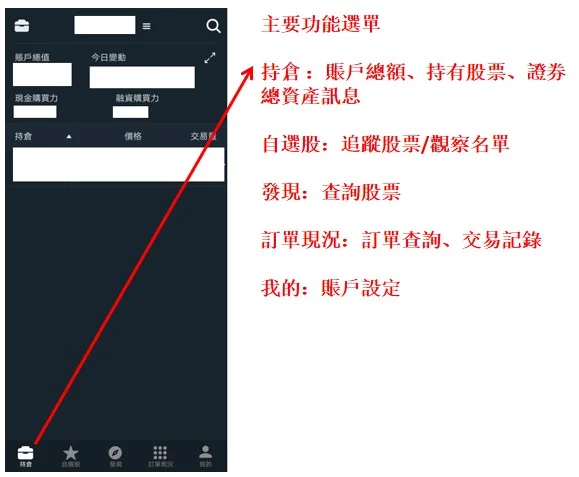

The following is your introduction to the Firstrade APP interface。

Firstrade Purchase Order Process

The process for placing an order to buy stocks and ETFs on the Firstrade website is as follows.

① Search for stocks / ETFs you want to buy

② Select trading direction: buy, sell, short sell, sell to make up for

③ Set the order information (order type, price, quantity, validity period, before and after the market, etc.)

④ Confirm the order information and send it out

Next, we will introduce each step of Firstrade's order to buy stocks and ETFs in a multi-graphic format.。The order placing process will be mainly in Simplified Chinese on the official website of Firstrade, and the order placing can be completed in as little as 1 minute.。

You can switch to English or Traditional Chinese at any time。Click the top left corner > choose Simplified Chinese or English。

Step 1: Select the stocks / ETFs you want to place an order for

After registering a Firstrade account and remitting the deposit, you can start placing an order.。Log in to the official website of Firstrade, the default main interface is the home page。Click "Trade," in the options click "Stocks / ETFs"。

Come to this page, you can enter the codes of stocks, ETFs。For example, Amazon Amazon (code AMZN), Coca-Cola (code KO), Tesla Tesla (code TSLA), SPDR S & P 500 ETF Trust (code SPY) tracking S & P 500, Invesco QQQ Trust (code QQQ) tracking NASDAQ-100。

If you don't know the code, you can click "Find Code" and enter the company name to search.。

For example: place an order for Amazon Amazon (code AMZN), enter AMZN in the box, Amazon's market information, such as price, change, bid, asking price, volume, etc. will be automatically displayed.。

* Note that the shares mentioned in the text are for demonstration purposes only and are not investment advice.。All investments are risky and it is recommended that you do your homework and risk planning before entering the market.。

Step 2: Choose the direction of the trade: buy, sell, sell short, sell short to make up for it.

In the Transaction Category, select Buy, Sell, Short, Short to make up。

Buy

Buy the stock you enter the code。

Sell

Sell the shares you hold.。

Short Selling

Short selling is also called short selling.。Users first borrow shares from Firstrade to sell, and then when the stock falls, they buy them at a lower price and return them to Firstrade to "buy low and sell high" to earn the spread.。

Note: Users must have a financing account to sell short。You can click My Account > Account Balance > Financing Purchasing Power to see how much you can finance。

Short selling to make up for

When you make a short sale, you can choose to "sell short to make up for it" to make up for the stock you sold short and return it to Firstrade.。

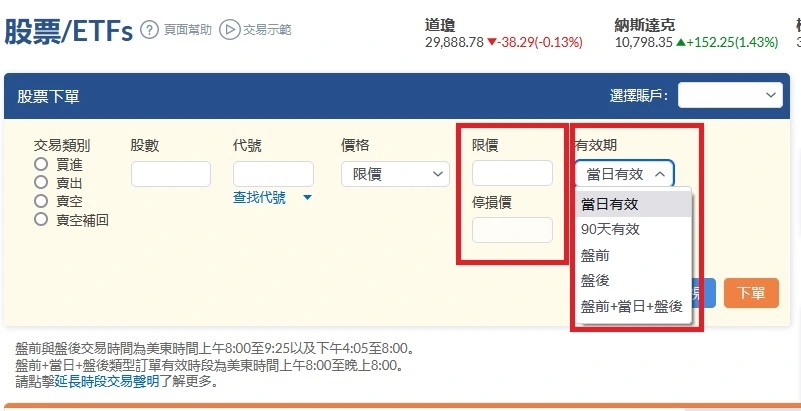

Step 3: Set up the order information (quantity, order type, price, validity period, before and after the plate, etc.)

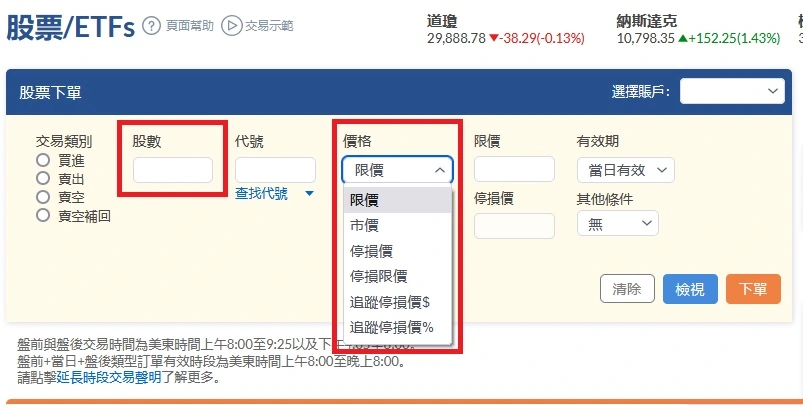

Then, set up the order information, including quantity, order type, price, validity period, pre-market and post-market settings.。

Quantity / Number of Shares

Enter the number of units to buy or sell in Number of Shares。U.S. stock minimum unit is 1 share, Firstrade does not support broken stock trading。

Order Type

Click "Price" to see the 6 orders offered by Firstrade, including Limit Order, Market Order, Stop Order, Stop Limit Order, Trailing Stop $Order and Trailing Stop% Order。The next section will detail the differences between these 6 orders.。

Price

If you select an order type that is not a market order, such as a limit order or a stop loss order, you must set a buy or sell limit price (or stop loss price)。

Validity Time-In-Force

Select the validity period of the order, including valid on the same day, valid for 90 days, before, after, or before + on the same day + after。

◇ Day (Day): Orders are only valid during the stock market trading session on the day the order is placed, and unfilled orders are automatically withdrawn after the close of the day, Firstrade trading session is 09: 30am - 16: 00pm EDT.

◇ 90-day validity (GT90): Orders are only valid for 90 days after placing an order, and unfilled orders are automatically cancelled after 90 days.

◇ Pre-Mkt (Pre-Mkt): Orders are only valid in pre-market hours, unfilled orders will be automatically withdrawn after the opening, Firstrade pre-market trading hours are 08: 00am - 09: 25am EDT.

◇ After-hours (After Mkt): Orders are only valid during the after-hours period, and unfilled orders are automatically withdrawn after the market closes, Firstrade's after-hours trading session is 16: 05pm-20: 00pm EDT.

◇ Pre-market + day + after-market (Day + Ext): Orders will be valid during pre-market, same-day and after-market stock market trading sessions, i.e. 08: 00am - 20: 00pm EDT, unfilled orders will be automatically withdrawn after the market is closed.

Other conditions

Firstrade also allows users to select order conditions attached to stock orders, including AON, Open, Close。You can choose None if no additional conditions are required。

◇ None: no conditional demand

◇ AON (All-or-None): AON orders will match all the volume of the order at a set price or simply cancel the order, this condition can only be used for orders greater than 100 shares.

◇ Opening: orders with opening conditions will be executed at the official opening prices of the major exchanges.。The order will not be accepted until it is received before 09: 15am EDT.。After 09: 15am EDT, only orders can be cancelled, cannot be modified。After 09: 28am Eastern Time, it cannot be cancelled or modified.。Unfilled orders will be automatically cancelled after the market opens.

Closing: orders with closing conditions will be executed at close to the closing price.。The order will not be accepted until it is received before 15: 40pm Eastern Time.。Orders cannot be cancelled and modified after 15: 45pm EDT。Unclosed orders are automatically withdrawn after the close of trading.

Step 4: Confirm the order information and submit the order

After completing and completing the required information, click "View" to confirm the order information, and then click "Order" to submit the order。

Firstrade Order Type

Limit Order

When you place a Limit Order, you need to set your own transaction price.。When the share price reaches the specified price, or is lower than the specified bid price (sell - higher than the specified ask price), the order is closed。

Market Order

When you place a market order (Market Order), you are placing an order at the current market price and do not need to set your own price.。

Stop Order

When you place a Stop Order, you need to set a Stop Price in the order, and when the stock price reaches the Stop Price, the system automatically submits a buy or sell market order, but there is no guarantee that the execution price will be equal to or close to the Stop Price.。

Stop Limit Order

When you place a Stop Limit Order, you need to set a specified Stop Price and Limit Price in the order, and once the price reaches the Stop Price, the trade will be executed at a specific limit price or better, but there is no guarantee that the execution price will be equal to or close to the Stop Price.。

Use stop-loss limit orders and you may miss the market completely。In volatile markets, you may not be able to execute orders at stop-loss limits or better。

Trailing Stop Order - Tracked by share price ($) or percentage (%)

This is a special stop-loss order, when the stock price of the stop-loss order moves in a favorable direction (e.g., the price of the stock you buy rises), then the tracking stop-loss price will follow the price of the security by the difference in the share price (or percentage), saving the user from losses due to a rapid correction in the share price.。

For example, a user buys ABC Company for $10.。In order to prevent losses of more than $2, but also hoping to benefit from a rise in the share price, a tracking stop loss order was placed.。

When the stock price falls by more than $2, the system will automatically sell the stock to prevent continued losses。

When the stock price rises to $20, the tracking stop loss price will follow suit and the stop loss price will become $18 so that users can enjoy the profit from the stock price rise.。

Fees (commissions, other fees) for trading U.S. stocks in Firstrade

Trading stocks, ETFs, options and other financial derivatives on the Firstrade platform is a free trading platform with zero commissions and fees.。

Firstrade supports pre-market after-market trading

Firstrade's pre-session after-session trading is also known as extended hours trading (EXT)。

◇ Pre-market: 08: 00am - 09: 25am ET

◇ Valid on the same day: 09: 30am - 16: 00pm EST

◇ After-hours: 16: 05pm-20: 00pm EDT

◇ Before + on + after: 08: 00am - 20: 00pm EDT

Considerations for extended session trading:

◇ Zero fee per transaction, commission-free transactions

◇ Limit order must be selected for each transaction

◇ Pre-market or post-market orders are only valid for the corresponding time period.

◇ Orders that select pre-market + same-day + after-market are valid during all trading hours (pre-market, same-day, after-market)

◇ Orders can be modified or cancelled before closing.

◇ Only stocks listed on (NYSE, NASDAQ, AMEX) can be traded

SUMMARY

With the above steps, investors can easily buy and sell U.S. stocks and ETFs on the Firstrade trading platform。When trading, you can choose to trade with cash or financing。Please note that financing transactions may generate interest and are subject to the risk of leverage (leverage), so be cautious before investing。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.