How Firstrade First Securities Deposit & Withdrawal

This article will cover how to deposit money from a Malaysian bank (Maybank) into a Firstrade investment account and how to withdraw money from Firstrade to your bank.。

After successfully registering a Firstrade account, the next step is to deposit funds into an investment account to begin trading in U.S. stocks, ETFs, and other financial derivatives。

The following describes how to deposit funds into your Firstrade investment account through Maybank and explains how to withdraw funds from Firstrade to your bank account。This article contains detailed graphic tutorials covering deposit and withdrawal steps, corresponding fees, and things to note。

◇ Firstrade's way of entering and leaving gold

◇ Precautions for Firstrade's deposit and payment

◇ Complete step teaching of Firstrade's gold deposit and gold deposit

◇ Firstrade deposit and withdrawal expenses

◇ Firstrade deposit and payment arrival time

* The teaching content of this deposit and payment is recommended for reference by Malaysian users.。

How to get into Firstrade?

Before you begin, you must register and open a Firstrade account。

Firstrade's current main methods of deposit:

Electronic Transfer (ACH)

Deposits by cheque (check)

Bank Transfer (Wire Transfer)

* Firstrade only supports user transfers to USD。

* Firstrade does not charge users a deposit fee, but the transit bank used by the user will charge a wire transfer fee。

Which deposit method to choose?

In general, electronic money transfer (ACH) and check deposit (Check) methods are only suitable for users with U.S. bank accounts.。

For foreign users, whether you are in Malaysia or other countries, the most direct and easy way is through international bank transfer (Wire Transfer)。The only disadvantage is that the fees levied by the transit bank are slightly higher, but this method also takes a relatively quick time to get into the account.。

Firstrade deposit considerations

① You can deposit money only after you have successfully opened an account.

② Firstrade will not charge a deposit fee, but the transit bank will charge a fee.

③ Firstrade only accepts deposits initiated by a bank account with the same name as the Firstrade account (please make sure the name is the same)

④ Firstrade does not accept remittances from third-party banks or payment platforms such as Wise or Revolut

Firstrade deposit process teaching (multi-figure)

Next, we'll go into more detail in graphic form on how to use Bank of Malaysia to wire money into a Firstrade investment account.。

Users need to get the deposit instruction through the official website of Firstrade first.。The following teaching will be based on the Firstrade official website, traditional Chinese interface, about 5 minutes to complete the gold action。

After logging into the Firstrade account, in the upper right corner, you can click "English," "Traditional Chinese" or "Simplified Chinese" to switch languages at any time.。

When making online wire transfers at Malaysian banks, the web version is also used to facilitate the filling out of information.。

Bank International Wire Transfer (TT) Deposit Process (as described by Bank of Malaysia Maybank)

◇ Applicable object: Have a Malaysian bank account

◇ Handling fee: Firstrade's handling fee is $0, but the remitting bank will charge a wire transfer fee and Firstrade's receiving bank will charge a $25 fee.

Arrival time: 1 to 3 working days

◇ Currency of arrival: US Dollar (USD)

Step 1: Log in to the official website of Firstrade

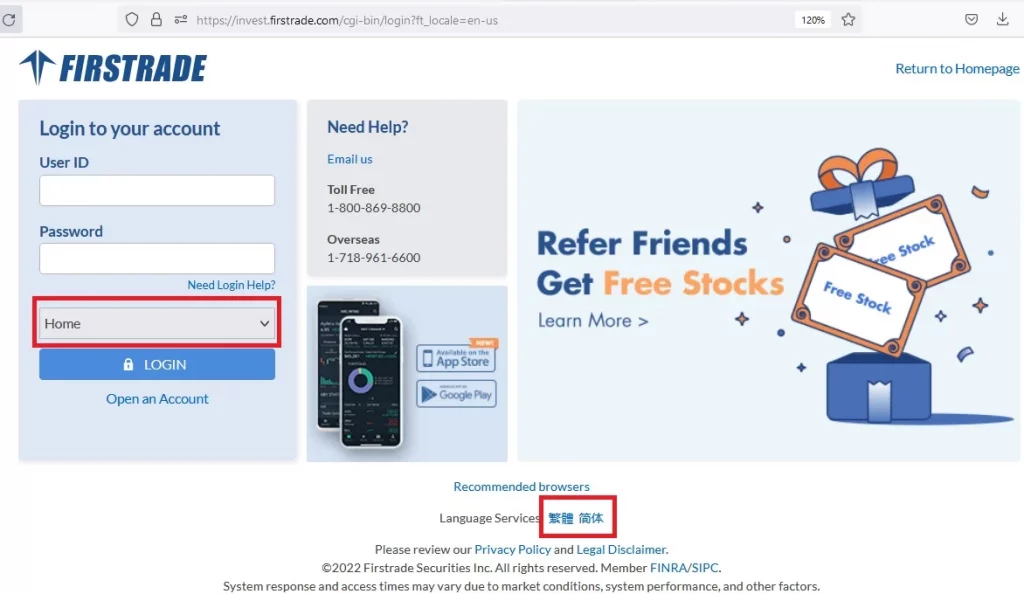

Browse the official website of Firstrade, enter User ID and Password, select the home page "Home," then select "Traditional Chinese" or "Simplified Chinese," then click "Login"。

Step 2: Select a remittance method and obtain wire transfer information

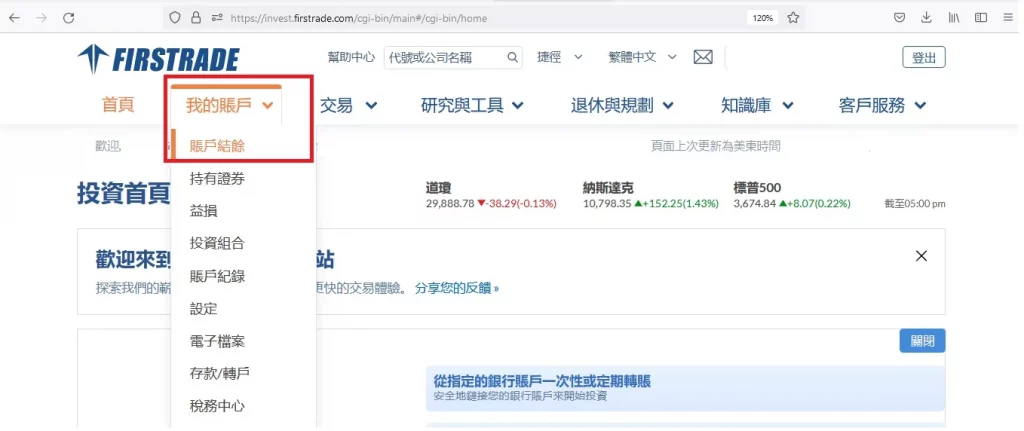

Go to the home page, click "My Account" and select "Account Balance"。

Go to the following page and click on "account capital injection"。

You will then be taken to the deposit / transfer page。Select "Bank Transfer" method and click "International"。

The webpage will display the information you need to enter when transferring funds, including the name of the receiving bank, address, SWIFT Code of the receiving bank, name of the payee, address, bank account number, and remittance postscript.。

Note: For Final Credit To (For Final Credit To) is the basis used by brokers to identify and reconcile the source of funds, you need to fill in the 8-digit account number and full English name of Firstrade.。

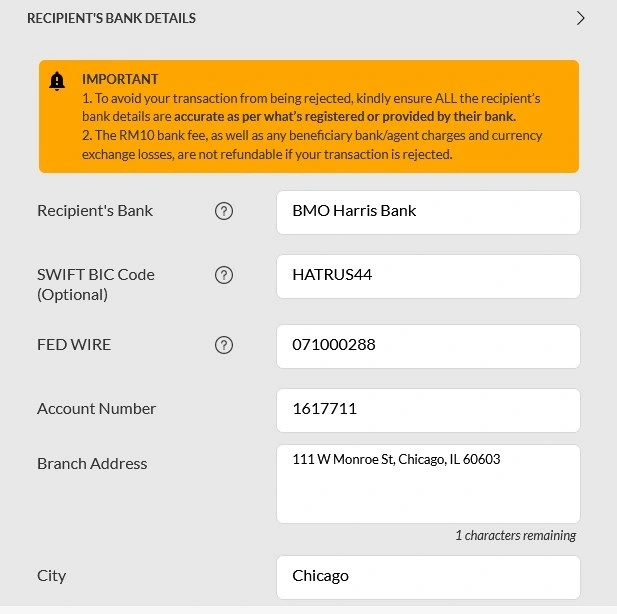

In addition, when selecting the "bank remittance" method, click "in the United States," the page will display the ABA recipient bank international code, rather than the SWIFT recipient bank international code。Although most international remittances use the SWIFT code, the ABA code can also be recorded for occasional needs.。(For example, Maybank needs to fill in the ABA code / FED WIRE when entering the gold)

It is recommended that you copy these remittance information in your computer notes to facilitate the remittance.。

◇ Bank Name:BMO Harris Bank

◇ Bank Address:111 W Monroe St, Chicago, IL 60603(Alternative Zip Code: 60690)

◇ SWIFT Receiving Bank International Code (SWIFT CODE):HATRUS44

◇ ABA Routing Number:071000288

◇ Payee Name (Account Name):Apex Clearing Corporation

◇ Payee's Bank Account Number:1617711

◇ Payee Address (Apex Clearing Address):One Dallas Center 350 N. St Paul, Suite 1300, Dallas, TX 75201

Step 3: Make a Malaysian Bank Wire Transfer

Next, we can use online banking (e-Banking), or wire transfer to the bank counter / ATM.。

We will demonstrate the wire transfer process using Maybank Maybank Online Banking (computer version of the web page).。Other banks have similar wire transfer processes.。

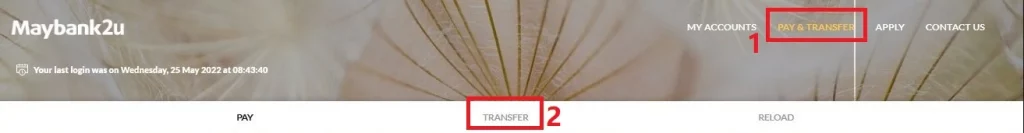

Log in to Maybank Online Banking > Click Pay & Transfer > Transfer and come to the following page。

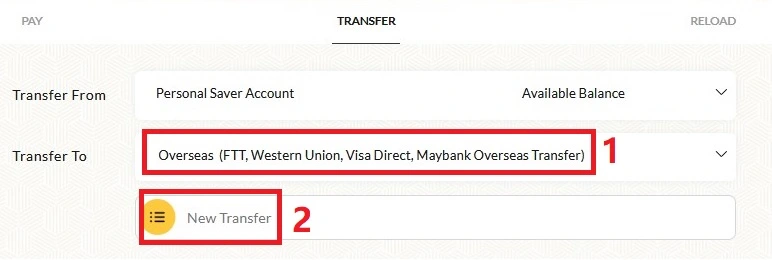

After selecting Transfer From, select Transfer To: Overseas and click "New Transfer"。

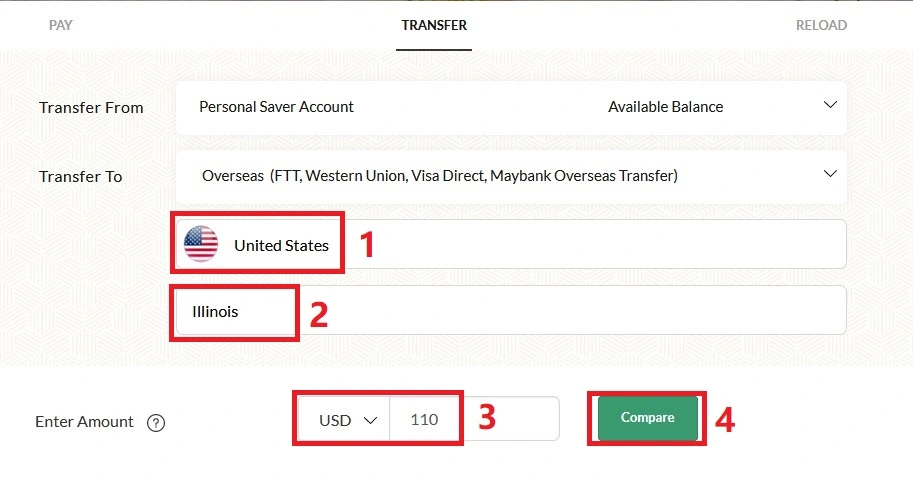

Next, since the Firstrade receiving bank is a U.S. bank in Chicago, select "United States" and its state is "Illinois."。Firstrade only accepts USD deposits, so choose "USD" and enter how many USD you want to deposit, here is enter 110 USD, then click "Compare"。

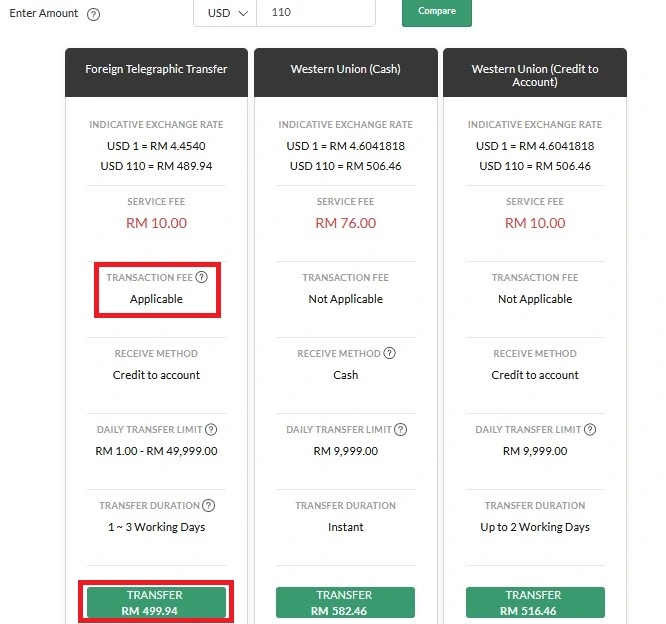

The banking system will display 3 choices, here the Maybank Foreign Telegraphic Transfer service is used instead of the Western Union service, so choose the first one and click "Transfer"。

* Note: It is also noted here that Transaction Fee: Applicable, which is what I said earlier, Firstrade's receiving bank will charge a $25 fee.。

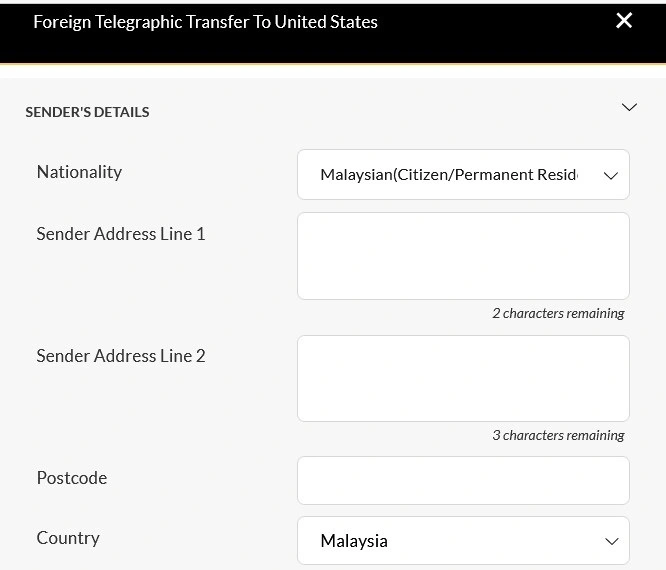

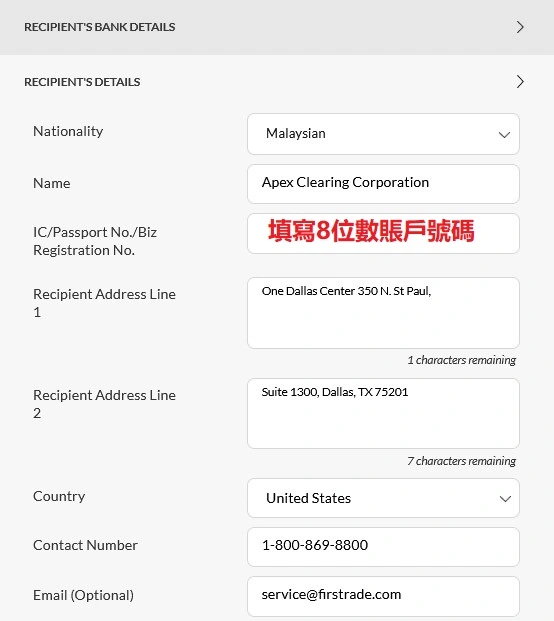

Next, fill in your profile, including international, residential address and country。

Next, fill in the receiving bank information provided by Firstrade's official website.。Maybank requires FED WIRE number, which is the domestic code of the ABA receiving bank.。

Then again, fill in the payee information.。

* Note: In IC / Passport No./ Biz Registration No.users can fill in their Firstrade 8-digit account number。

The last step is to fill in the reprint information, the user can fill in according to the following way, and tick ✔ to agree to the "rules and terms," before clicking on the transfer "Transfer"。

◇ Purpose:Transfer

◇ Sub Purpose:Private Transfer – Other Capital Transfer

◇ Transaction Fees: Sender bear the fee (user will bear the fee)

◇ Additional Info: Fill in your English name and Firstrade's 8-digit account number

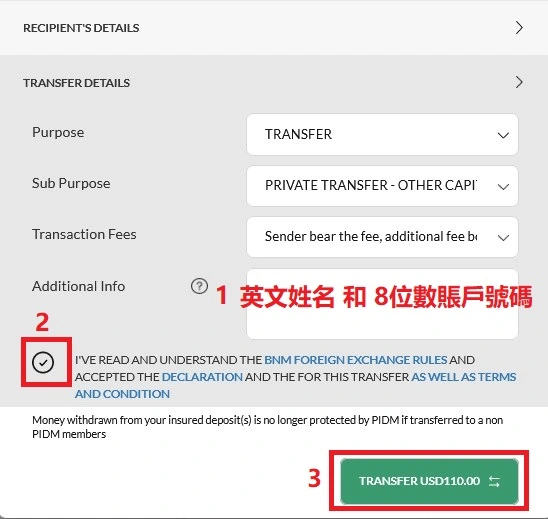

The system will display the following page, you must confirm that the receiving bank information is correct, and click "Confirm"。

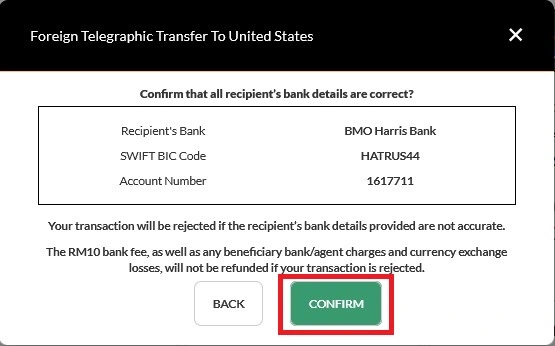

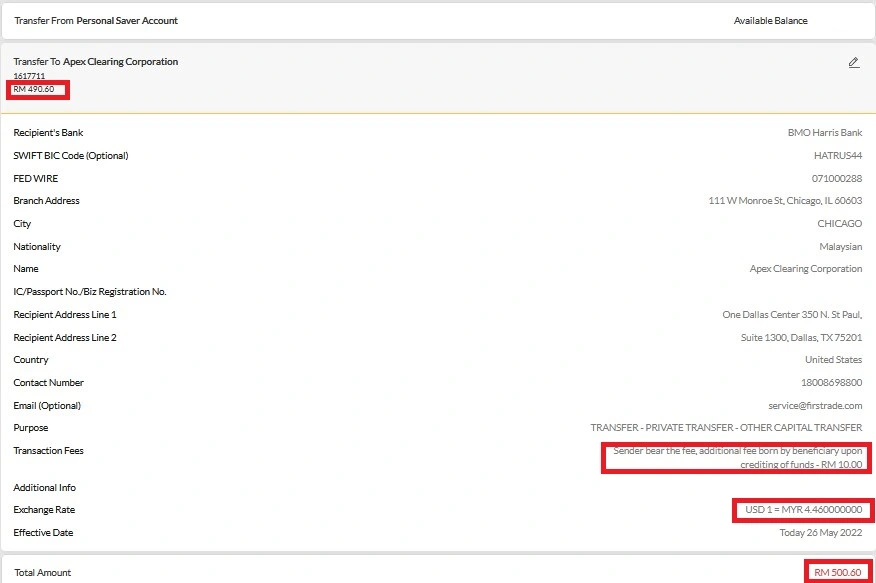

The gold movement has come to an end here.。The system will display the following page, you can see that the transfer amount is 110 US dollars, the exchange rate is USD 1 = MYR 4.46, so the amount transferred to the payee is only USD 110 x RM 4.46 = RM 490.60。You also see that Maybank charges a fee for RM 10, so the total expenditure is RM 10 + RM 490..60 = RM 500.60。

Step 4: Wire transfer successfully to the account, complete the deposit

It usually takes 1 to 3 working days to transfer the deposit by wire transfer to your Firstrade investment account.。You can log on to the official website of Firstrade to see if the funds have arrived.。

By clicking My Account > Account Balance > Tradable Funds。

If you have not received the notification for more than 3 working days, it is recommended to contact Firstrade customer service as soon as possible。

What is the cost of wire transfer??

This wire transfer costs a total of 2:

| Expense Details | Amount | Receiving Party |

| Transfer fee (Transaction Fee) | 10 ringgit | Maybank |

| Collection Fee (Wire Fee) | 25美元 | BMO Harris Bank |

-- wire transfer fee details

This time, the actual deposit was $110, but only $85 was received.。The difference of $25 is the collection fee charged by BMO Harris Bank's receiving bank (Wire Fee)。

My Firstrade Gold Experience

This time, the electricity remittance will arrive in only one working day.。Measured on Thursday morning to apply for deposit, the next morning on the Firstrade platform to find that the funds have arrived。

The cost of remitting money to Firstrade is relatively high because the transit bank will impose a fee.。We recommend that you deposit at least RM5000 for each deposit to reduce the cost of wire transfer fees.。

How to get gold from Firstrade?

Malaysian users want to withdraw money from Firstrade, the same can only choose the wire transfer method.。

Below we will share the payment to the bank account by wire transfer.。

◇ Applicable object: Have a Malaysian bank account

◇ Handling fee: Firstrade's handling fee is $25, which is charged by the remitting bank and the receiving bank.

Arrival time: 1 to 3 working days

◇ Currency of arrival: Malaysian ringgit (MYR)

Firstrade Payment Considerations

① There is no minimum payment amount requirement

② Only personal bank accounts can be paid out (must be the same name as the brokerage account)

③ Firstrade does not accept payments to third-party accounts / payment platforms.

④ Firstrade will charge a $25 fee.

Firstrade cash flow teaching (with diagram)

Step 1: Log in to the official website of Firstrade

Browse the official website of Firstrade, login will come to the home page。Click My Account > Deposit / Transfer。

The second step: choose the way to pay

In Withdrawal from First Securities, select Remittance。Electronic Transfer (ACH) and Checking Deposits are only available to users with a U.S. bank account.。

For the first payment, you need to fill in and provide your receiving bank information.。Click Start to proceed to the next step。

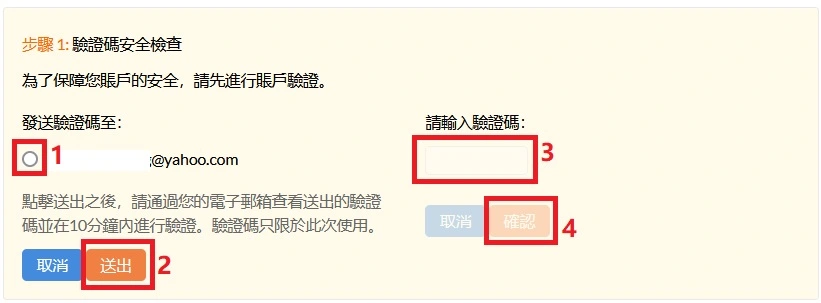

Firstrade will ask for account verification, select your email address and click "Send"。After receiving the email, enter the verification code and click "Confirm"。

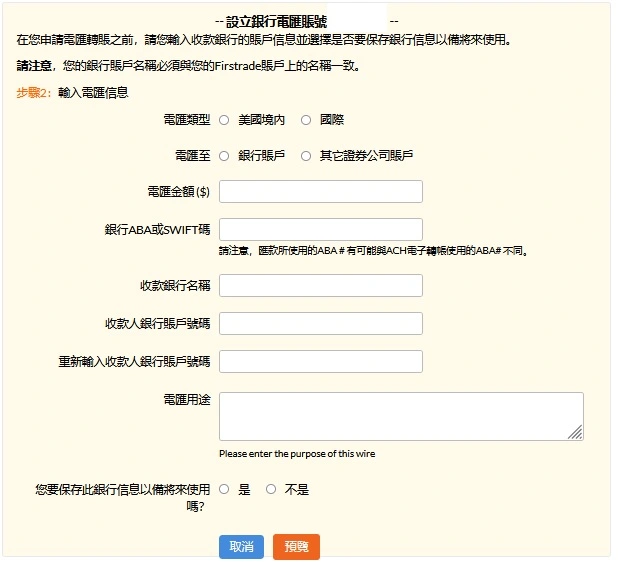

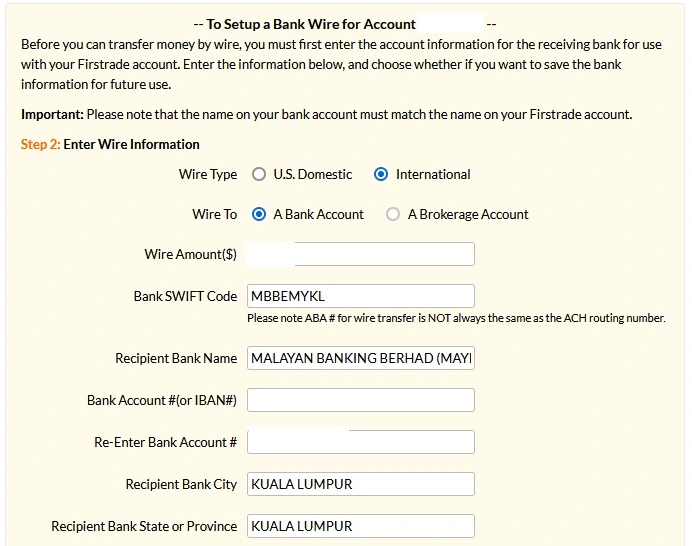

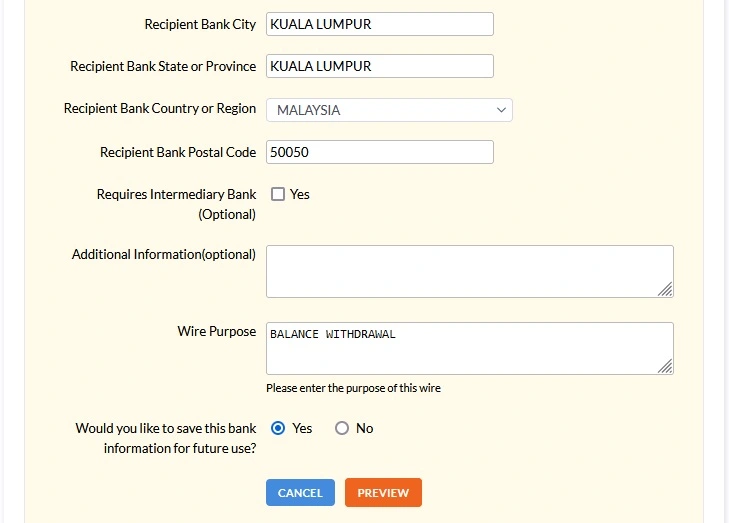

Step 3: Fill in the remittance bank information

Next, you need to enter your receiving bank information。You can follow these steps to complete the fill-in action。

| Wire Transfer Type: International |

| Wire Transfer to: Bank Account |

| Wire Transfer Amount: The amount you want to pay |

| International remittance SWIFT code: Bank SWIFT Code can be found on the bank's official website, or ask the bank's customer service, here is the payment to Maybank, Maybank's SWIFT Code is MBBEMYKL |

| Name of the receiving bank: here the author fills in Malayan Banking Berhad (Maybank) |

| Payee Bank Account Number: Your account number |

| Re-enter payee bank account number |

| The city of the receiving bank: the bank address can be found on the bank's official website, where the author fills in Kuala Lumpur |

| State or province of the receiving bank: the bank address can be found on the bank's official website, where the author fills in Kuala Lumpur |

| The country or region of the receiving bank: the bank address can be found on the bank's official website, where the author fills in Malaysia |

| Receiving bank zip code: bank address can be found on the bank's official website, where the author fills in 50050 |

| Intermediate banks are needed: there is no need to tick here |

| PS: No need to fill in here |

| Wire transfer purposes: you can fill out the payment, here the author fills in Balance Withdrawal |

| Do you want to save this bank information for future use?You can click "Yes" here so that you don't need to fill it out again in the future. |

After confirming that the information is complete, click "Preview"。

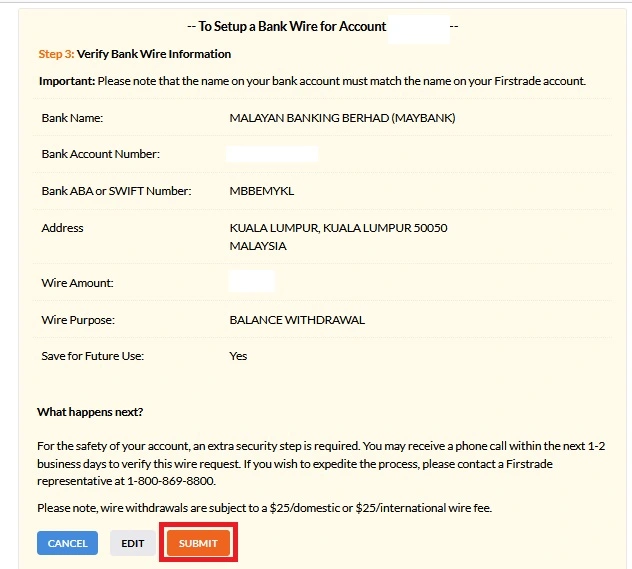

Next, verify that the payee bank information is correct and click Submit.。

Note: It is also stated here that wire transfers will be levied at $25.。

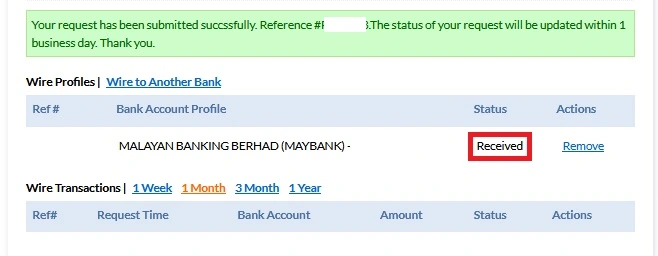

The payment step will come to an end and the page will show that your payment application has been received。

The fourth step: the success of the gold

The time required for the payment is 1 working day.。

You can log on to the official website of Firstrade to see if the funds have been paid out.。

By clicking "My Account" > "Account History"。

If you have not received the notification for more than 1 working day, it is recommended to contact Firstrade customer service as soon as possible。

What is the cost of wire transfer??

This wire transfer costs a total of 2:

| Expense Details | Amount | Receiving Party |

|

Handling fee (Wire Fee) |

25美元 | Firstrade |

| Local Charge (Service Charge) | 5 ringgit | Maybank |

-- wire transfer fee details

My Firstrade gold tips

Firstrade's gold withdrawal process is simple, fast, and can be completed in just 5 minutes。This wire transfer only takes one working day to arrive.。The author actually applied for money on Monday and received it on Tuesday.。

Firstrade will charge $25 when it pays out。The amount I paid this time was 85.$19, after being deducted $25, only 60.$19 was remitted。Maybank charges RM5。In addition, the withdrawal exchange rate (USD 1 = RM 4.326) than the exchange rate of the deposit (USD 1 = RM 4.46) came low, so also lost some amount。

We recommend having a large amount of money to make a gold move, which will be relatively cost-effective。

SUMMARY

The above outlines the complete deposit and withdrawal process for Firstrade。The whole process is very simple, and the funds in the deposit and withdrawal of the account time is relatively short, usually in 1 to 3 working days to complete。

Considering that most Malaysian residents do not have U.S. bank accounts, we must rely on wire transfers as a means of communicating funds.。In view of the high fees for wire transfers, it is recommended that you choose larger amounts when making deposits and withdrawals and avoid frequent operations to ensure more affordable。Such a strategy would be more cost-effective。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.