Is First Securities Firstrade safe??

Today's financial review series for you to open the box Firstrade first securities, including the advantages and disadvantages of Firstrade, commission rates, brokerage security and applicable objects.。

In the investment sector, cross-border Internet brokerages that want to enter the U.S. market, such as Moomoo Securities (MOOMO), Tiger Securities, TD Ameritrade, etc., are all high-profile options.。However, Firstrade First Securities is unique in this highly competitive field, and is unique in providing users with a comprehensive Chinese trading platform.。

Today we will field-test Firstrade First Securities, a brokerage firm that has been around since its inception in 1985 with innovative trading techniques, in-depth research and analysis, quality educational resources and excellent customer service.。Firstrade First Securities has more than 35 years of history, accumulated a wealth of experience, so in the industry reputation。In the past, Firstrade has been named one of the best online brokers by mainstream industry publications such as Barron's, Forbes and Smart Money.。

Over the past four years, Firstrade First Securities has been in Stockbrokers..com performed well in the selection, and was rated as 4 in "ease of use" for four consecutive years.5 stars and won 4 in "commissions and fees" in the 2018 Web Broker Rating..5 stars。This fully reflects Firstrade's excellent performance in user experience and cost control。

Today's financial review series is for you to open the box Firstrade First Securities, including:

① Advantages of Firstrade

② Disadvantages of Firstrade

③ Firstrade trading commissions and other fees

④ Firstrade account security

⑤ Who is the right person to use Firstrade?

Background Introduction to Firstrade

Firstrade was founded in 1985 by Chinese-American entrepreneur Mr. Liu Jinhang, and in 1997, Firstrade.com was officially launched, becoming one of the few online brokerages at the time and one of the first U.S. brokerages to provide all-China cultural services.。Headquartered in Flushing, New York City, USA, Firstrade now offers online trading services in 19 countries, with major operations in all 50 states.。

In addition, Firstrade is a member of the U.S. Financial Industry Regulatory Agency (FINRA) and the U.S. Securities Investor Protection Organization (SIPC).。With Firstrade, users can invest in financial investment products such as stocks, ETFs, REITs, options, bonds, and more than 11,000 funds.。

Firstrade is also a "zero fee" trading platform for U.S. stocks.。Currently, there is zero commission per transaction, no minimum deposit requirements for opening an account, and no account idle and maintenance fees are charged by Firstrade.。In addition, Firstrade also offers investors 0.1 second transaction guarantee, extended session trading and 7-day 24-hour Chinese service, allowing investors to invest with peace of mind。

The following is a brief summary of Firstrade's key information:

| Year of Establishment | 1985 |

| Trading platform | Firstrade Mobile App |

| Account Type | Managed Account (Custodian Account) |

| tradable market | 美国 |

| Investment products | Stocks, ETFs, REITs, Options, Bonds, Mutual Funds |

| Minimum account opening threshold | 0 USD |

| U.S. Stock Commission | 0 USD |

| US Stock Option Commission | 0 USD |

| Access mode | Bank of America ACH deposits, checks, international wire transfers. |

| Minimum amount of deposit and withdrawal | 0 USD |

| Access fee | 25美元 |

| Account idle fee | None |

Advantages of Firstrade

① Zero commission transaction

There are a number of brokerages in the market that offer free trading in U.S. stocks, such as TD Ameritrade。However, Firstrade not only offers free trading of U.S. stocks, ETFs, and mutual funds, but also zero trading commissions, contract fees, execution options, and option transfer fees for options.。Trading in Firstrade can be said to be free of any hidden fees and transparent prices.。

② Chinese culture platform services

Firstrade is one of the first brokerage firms to provide a Chinese interface trading platform, in addition to English, users can switch between Simplified and Traditional Chinese at any time.。In addition to providing free Chinese financial instant information, the e-mail and international telephone customer service specialist services provided by Firstrade are also available for communication in Chinese.。This can be said to provide a perfect Chinese investment trading platform for Chinese people all over the world.。

③ Fast online account opening, no minimum account opening threshold

Firstrade offers free online account opening, and the account opening process is fast and convenient, and there is no minimum deposit threshold for account opening.。The online account opening process takes just 3 minutes, after uploading a valid passport and filling in the basic information yourself。The SSF team measured that after submitting the application for opening an account, it only took 1 working day to pass the review and complete the account opening.。

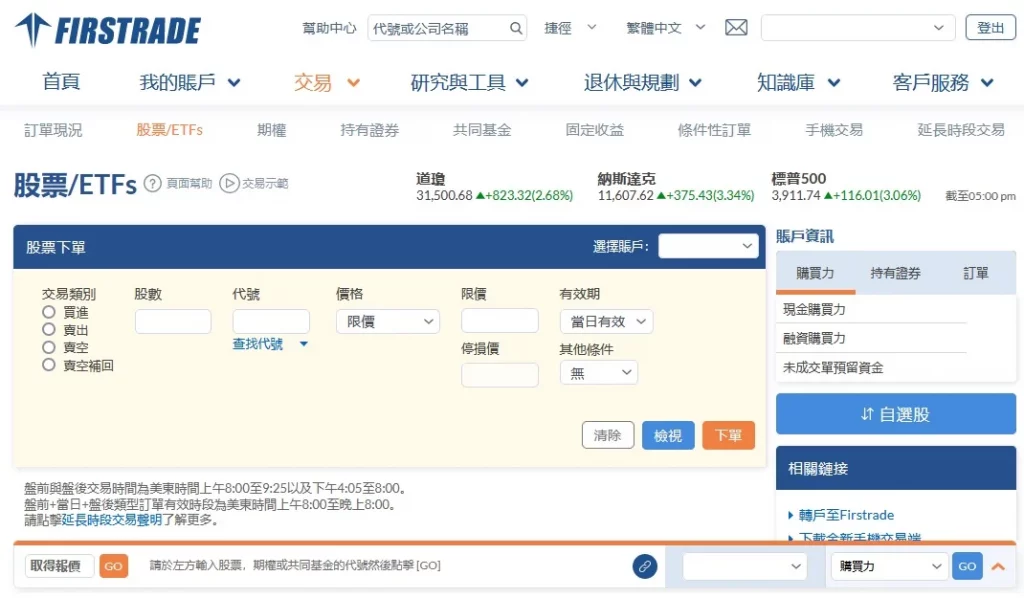

④ Firstrade trading platform is simple and easy to use

Users can trade stocks, ETFs, options, etc. using the Firstrade web (Web) or mobile app (APP) platform.。The Chinese and English interface provided by the Firstrade platform is simple and easy to understand, and the novice friendliness is very high, which is quite suitable for investing in Xiaobai。Users do not need to worry about being disturbed by complex, dense numbers or line graphs and feel that investing is a difficult task.。

For experienced investors, trading with Firstrade can also be handy, quickly adapt to platform operations, and save time exploring platform features。Firstrade provided by user 0.1 second transaction guarantee, allowing users to experience fast trading。In terms of ease of use, Firstrade also gets Stockbrokers..com positive, for 4.5 stars。

⑤ Free comprehensive research report and teaching resources

Firstrade also offers free Morningstar, Briefing.Com, Zacks and Benzinga's stock market authority media's real-time stock market quotes, individual stock analysis and research analysis reports.。At the same time, the Firstrade web page also provides investment teaching videos, providing comprehensive investment teaching information for users with different levels of investment experience.。

Firstrade offers Extended-Hours Trading

Firstrade supports pre-market and after-market trading, allowing users to make more timely investment decisions and take advantage of investment opportunities in the stock market in the pre-market or after-market hours, i.e. 08: 00am - 20: 00pm EST.。

Firstrade Disadvantages

① Only US market investment products can be traded

Firstrade currently only covers the US market.。Through Firstrade, financial products such as stocks, ETFs, and futures are listed on U.S. exchanges, such as NASDAQ, NYSE, and AMEX.。Compared to other brokerages, such as Interactive Brokers, Tiger Brokers, etc., cover multiple markets.。

② Does not support fractional shares trading (Fractional Shares)

Firstrade does not support zero-share trading。Zero-share trading means that investors can buy less than 1 unit of stock.。The minimum unit for trading shares in Firstrade is 1 unit。

For investors with small funds, it is more difficult to invest in companies with higher stock prices such as Google (Alphabet Inc, NASDAQ: GOOG), which is trading at $2,372 per share.。Users need $2,372 to buy 1 unit。However, if the broker supports zero-share trading, the user will be able to buy less than 1 unit of stock, such as 0.3 units of Google for only $712。

③ Slow response from online customer service, better email speed

Although Firstrade provides 24 / 7 Chinese service and official WeChat service number, the SSF team does not get a reply when using WeChat to contact。In contrast, use email to ask Firstrade customer service and get an email response from Firstrade in almost 3 minutes。

④ Lack of watch function, no virtual account

Although the Firstrade trading platform is simple and easy to understand, for users with rich investment experience, the interface of Firstrade is too simple, lacks the function of looking at the disk, is not suitable for in-depth analysis, and also lacks the function of two-step secure login.。

In addition, the Firstrade platform does not have a virtual account, users can not practice the investment order process, but directly in the market to trade.。

Is it safe and legal to invest in Firstrade??

Firstrade has been around for 37 years since it was founded in 1985 and is trusted by users.。Firstrade First Securities is not only regulated by the Securities and Exchange Commission (SEC), but is also a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).。

This means that the securities in a Firstrade user's account are covered by basic insurance capped at $500,000 from the Securities Investor Protection Organization (SIPC), of which cash insurance is capped at $250,000.。

This also means that if Firstrade faces a collapse, Firstrade will first convert the remaining assets into cash and return them to users.。If the amount is insufficient, the rest of the arrears will be paid for by SIPC's basic insurance.。

In addition, Firstrade has additional guarantees。Through Apex Clearing Corporation, Firstrade's delivery company, the user's account is now also covered by a $150 million "SIPC Extra Insurance" offered collectively by a number of London insurers (Lloyd's of London Syndicates is the main insurer).。

Each user can receive a total of $37.5 million in asset insurance, including a cash cap of $900,000, through SIPC and SIPC Additional Insurance.。

SIPC additional insurance is provided to cover the remaining amount after SIPC claims.。Simply put, if SIPC basic insurance cannot cover the total assets of the user's account, then SIPC additional insurance will take effect to compensate the user, which will maximize the security of the user's funds.。

In summary, Firstrade is regulated by a number of top institutions, and with the additional protection provided through Apex Clearing Corporation, it is relatively safe to invest with Firstrade。

How to open an account in Firstrade?

Firstrade can apply for an account on the whole line, open an account free of charge, just 3 minutes can be completed。Wait 1 to 2 working days to receive the approval notice。

What are the commissions and fees for Firstrade accounts??

| Stock | 0美元 |

| ETFs | 0美元 |

| Option | 0美元 |

| Payment Charges | 25美元 |

| Platform charges | None |

| Data Charges | None |

| Account Idle Charge | None |

Who is fit to use Firstrade?

Firstrade is ideal for the following types of investors:

1.Novice investors: Firstrade's trading platform, whether it is a web version or a mobile app APP version, is simple and easy to use, has a bilingual interface, and the account opening process is simple and fast, very suitable for novice investors。

2.Investors with high trading frequency: Trading U.S. stocks, ETFs, and options on the Firstrade platform is free and suitable for investors with high trading frequency.。

3.Long-term focus on U.S. stocks, options, fixed-term U.S. stocks, ETFs, low-cost trading investors: Firstrade offers zero-commission trading, especially for those who want to focus on U.S. stocks, options, fixed-term U.S. stocks, ETFs, low-cost trading investors.。

However, it is important to note that Firstrade only covers the U.S. market and is therefore not suitable for investors who want to diversify their investment risk by investing in multiple markets.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.