VanEck Predicts Bitcoin at $180,000 and Ethereum at $6,000 in 2025

VanEck's Bitcoin prediction for 2025 forecasts a $180,000 peak, Ethereum over $6,000 and Solana at $500, with key market insights.

- VanEck predicts Bitcoin will hit $180K, Ethereum over $6K, and Solana $500 in 2025, with mid-term and year-end peaks.

- Bitcoin may drop 30%, altcoins up to 60%, followed by a strong recovery in the fall of next year.

- US states and countries like Russia and Canada explore Bitcoin reserves to diversify investments and stabilize economies.

Investment firm VanEck anticipates a bullish cryptocurrency market in 2025, projecting Bitcoin to peak at $180,000, Ethereum to surpass $6,000, and Solana to climb beyond $500.

The firm also projects SUI to reach $10 in an impending altcoin season

VanEck is Bullish on Bitcoin

The firm’s Bitcoin prediction expects the asset to reach a mid-term high in the first quarter, followed by a new all-time high in the fourth quarter. The analysis predicts a 30% drop in Bitcoin prices after the mid-term peak, with altcoins experiencing sharper corrections of up to 60% during a summer consolidation.

However, a market recovery is expected in the fall of 2025. Major cryptocurrencies will likely regain momentum and reach previous all-time highs by year-end.

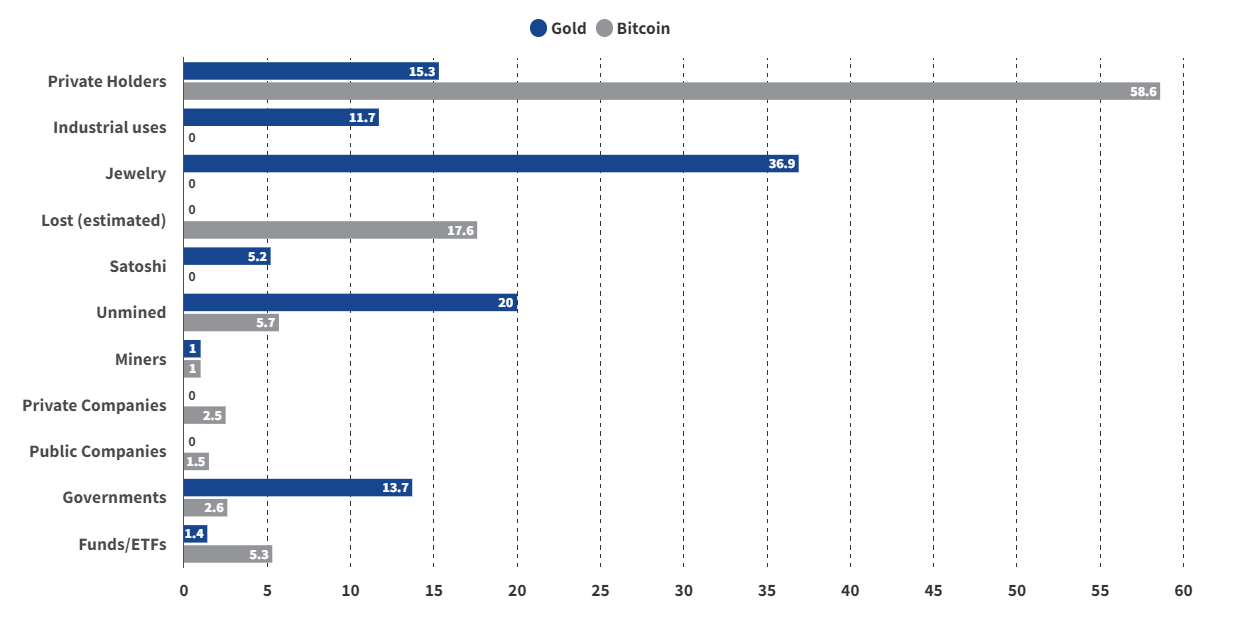

VanEck attributes this bullish Bitcoin prediction to specific market indicators. Sustained high funding rates—where traders pay premiums exceeding 10% for three months or more—reflect speculative market activity.

“Stablecoins are poised to revolutionize payments, with daily settlement volumes projected to reach $300 billion by the end of 2025—tripling from the current ~$100 billion per day,” VanEck posted on X (Formerly Twitter).

Additionally, the firm highlights excessive unrealized profits, where a significant percentage of Bitcoin holders see profit-to-cost ratios of 70% or higher, signaling market optimism.

Meanwhile, VanEck is not the only firm that has made such bullish predictions for the 2025 market. Bitwise also predicts Bitcoin will reach $200,000 by the end of next year, while Pantera Capital predicts $180,000 by August.

A Global Push for Bitcoin Reserve

The return of Donald Trump to the presidency has provided a notable boost to the crypto market. His administration’s appointments of pro-crypto leaders are seen as a shift away from restrictive policies and toward recognizing Bitcoin as a strategic asset.

This includes efforts to end practices like de-banking crypto companies and introduce a more supportive regulatory environment.

VanEck also foresees the establishment of Bitcoin reserves by either the federal government or individual states by 2025. States like Pennsylvania, Florida, and Texas are among the likely candidates.

Pennsylvania recently introduced a bill proposing that 10% of state funds be allocated to Bitcoin to combat inflation and diversify investments.

Similarly, Texas introduced legislation to create a Bitcoin reserve. Earlier this week, State Representative Giovanni Capriglione suggested funding sources such as taxes, fees, and donations.

This trend isn’t confined to the US. Globally, other nations are exploring similar initiatives. In Russia, a State Deputy has proposed a Bitcoin reserve to strengthen financial stability.

Meanwhile, Vancouver’s city council in Canada has approved a Bitcoin reserve to hedge against fiat currency volatility. The city’s Mayor, Ken Sim, has been strongly advocating for Bitcoin’s use in payments.

The increasing adoption of Bitcoin reserves reflects a growing recognition of cryptocurrency’s role in diversifying financial strategies and mitigating economic risks.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.