NZD Tumbles After Unexpected Rate Cut by RBNZ

The New Zealand dollar took a dive immediately after the Reserve Bank of New Zealand (RBNZ) announced a 25 basis point cut in the official cash rate (OCR).

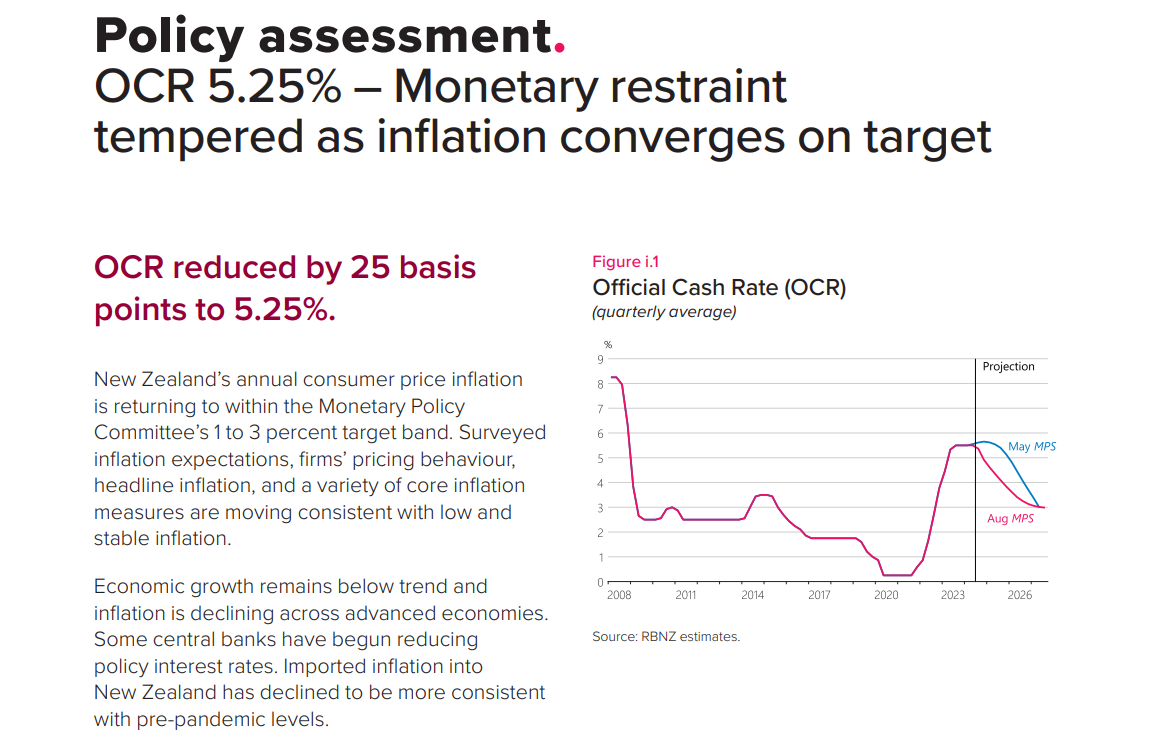

On August 14, the Reserve Bank of New Zealand (RBNZ) announced that it would cut the official cash rate (OCR) by 25 basis points, from 5.5% to 5.25%. This means that after four years, New Zealand has finally officially entered the rate cut cycle.

The rate cut exceeded the expectations of most economists, who had previously predicted that the central bank would stay put. And from the minutes of the meeting released by the RBNZ, the rate cut mainly considered the pressure of the domestic economic slowdown.

The minutes mentioned that the Monetary Policy Committee observed in its July monetary policy assessment that weakness in domestic economic activity became more pronounced and widespread. Headline inflation had declined and corporate inflation expectations had moved back to around 2% in the medium to long term. The Committee indicated that New Zealand's economic activity and recent inflation indicators were now similar to those of countries that had begun to cut interest rates. As a result, members agreed that they could now begin to ease monetary policy constraints.

The minutes noted that the balance of risks had gradually shifted since the May monetary policy statement. The downside risks to output and employment highlighted in July had become more pronounced as a range of indicators suggested that the economy was contracting faster than expected.

The minutes said that surveys showed that medium- and long-term business inflation expectations had picked up to around 2%. All core inflation indicators had fallen, with the CPI component, which is sensitive to monetary policy, falling further. Together with weaker high-frequency indicators of economic activity, these developments gave the Committee greater confidence that headline inflation would return to the target range in the September 2024 quarter.

Members indicated that monetary policy would need to remain tight for some time to ensure that domestic inflationary pressures continue to dissipate. The pace of further easing will therefore depend on the Committee's confidence that pricing behavior continues to adapt to the low inflation environment and that inflation expectations remain stable near the 2% target.

The NZD dived immediately after the RBNZ announced the rate cut. At press time, the NZD/USD exchange rate was down over 1% at 0.601.

The RBNZ has raised interest rates by 525 basis points since October 2021 in an effort to curb inflation, the most aggressive tightening measure since 1999 when the official cash rate was introduced.

New Zealand's annual inflation rate has fallen in recent months, slowing to 3.3 percent in the second quarter, and the central bank expects it to move further into the central bank's target range in the third quarter of this year.

"We expect the RBNZ to continue to cut the OCR steadily by 25 basis points in successive meetings, with the next rate cut coming in October." Nick Tuffley, chief economist at ASB Bank in Auckland, said, "The RBNZ may need to accelerate its return to more neutral policy if inflationary pressures fade faster than expected."

According to the latest RBNZ rate expectations, the OCR will sit at 3.75% by the end of 2025, meaning the RBNZ could cut rates seven times in the next year and a half, with three more cuts in 2026 and a drop to 3% by the end of 2026.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.