USD/JPY Sinks Over 2% to 145.77, Dollar Index Plummets Below 102 USD/JPY Sinks Over 2% to 145.77, Dollar Index Plummets Below 102

Key momentsA 2.30% reduction in the USD/JPY exchange rate brought the pair to 145.77.The US Dollar Index experienced a 2.08% decrease to 101.537 on Thursday.Traders lost confidence in the US dollar as

Key moments

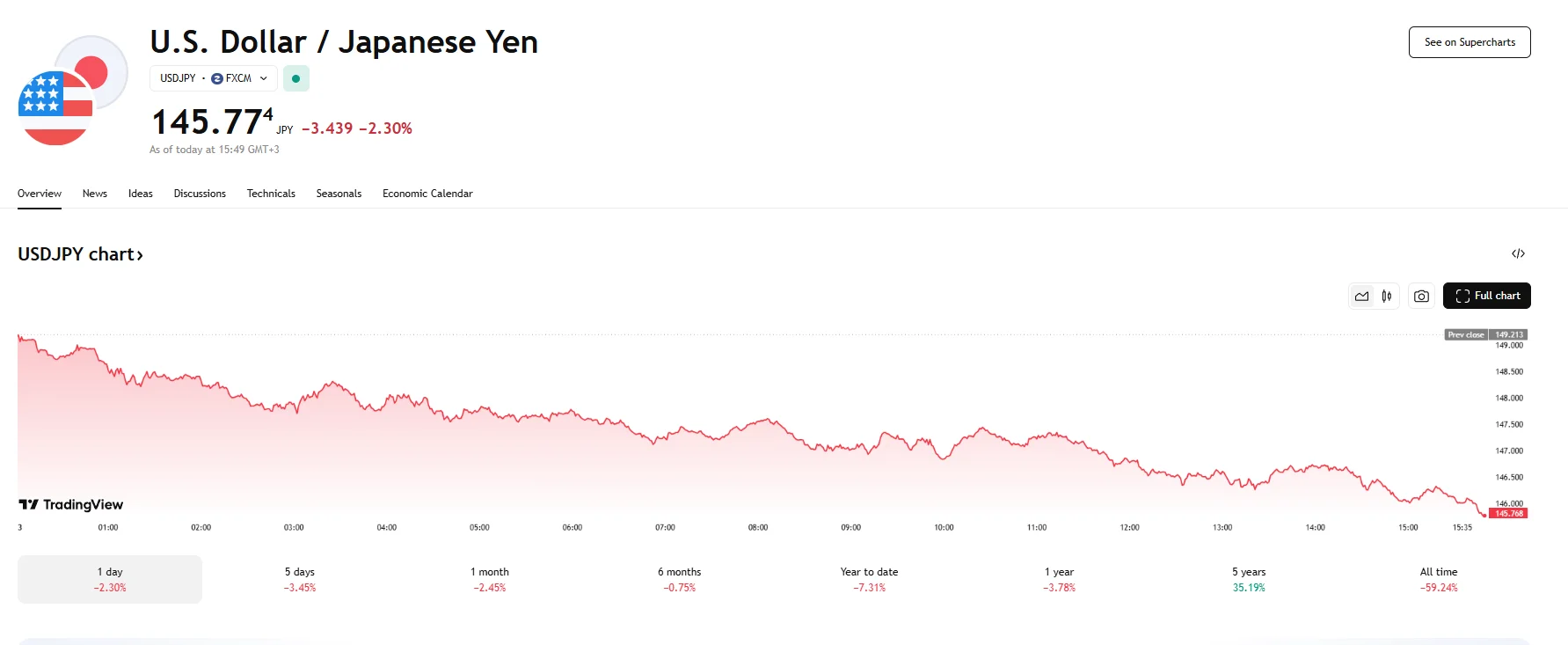

- A 2.30% reduction in the USD/JPY exchange rate brought the pair to 145.77.

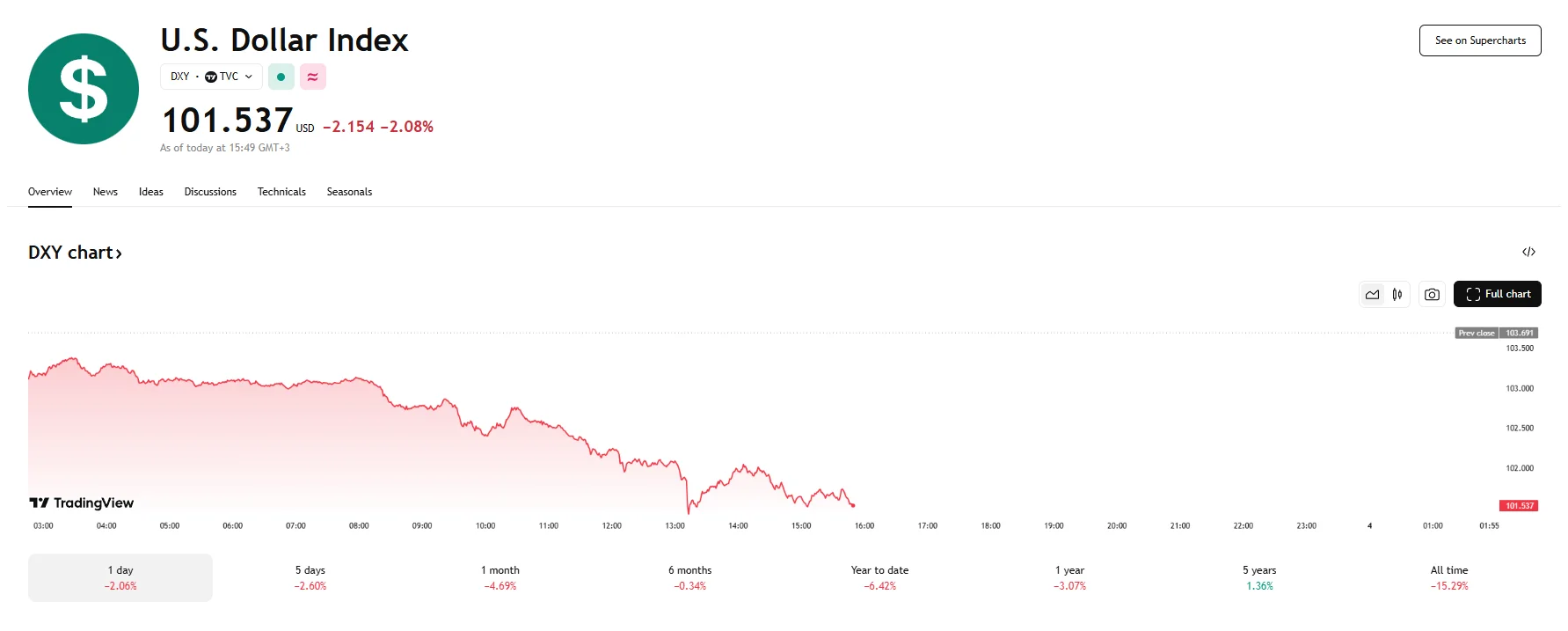

- The US Dollar Index experienced a 2.08% decrease to 101.537 on Thursday.

- Traders lost confidence in the US dollar as President Donald Trump’s newly announced tariffs rocked global markets.

Yen Surges on the Greenback’s Tariff-Fueled Downfall

The Japanese Yen exhibited considerable strength on Thursday, which culminated in a 25-week peak against the United States Dollar. Markets saw the USD/JPY exchange rate drop by 2.30%, reaching 145.77, while the U.S. Dollar Index sank below the 102 mark amid a decrease of just over 2%.

The impetus behind this investor behavior can be largely attributed to the pursuit of safe-haven assets, a reaction to the U.S. dollar’s diminishing value, and the market’s heightened sensitivity to President Donald Trump’s recently implemented tariff policies. These policies have introduced significant uncertainties into global trade, prompting a flight towards more stable currencies like the Yen. Moreover, the downturn in the dollar’s value is part of a broader trend, with the Dollar index having depreciated by over 5.7% in 2025.

Widespread apprehension regarding potential retaliatory actions from U.S. trading partners has further exacerbated market volatility. Fears of an escalating trade war grew following Wednesday’s announcement of a 10% baseline hike across the board, and some countries will be subject to even higher import tariffs. Japan, in particular, was targeted with tariffs of 24%, while Trump imposed a 20% levy on exports from Europe. Investors are also concerned about an impending recession along with a global economic slowdown, and this has persistently weighed on investor sentiments.

Market participants continue monitoring markets as well as upcoming economic events, including the future interest rate policies of the Bank of Japan (BoJ) and the Federal Reserve (Fed). While investors remain hopeful that the BoJ might pursue more interest increases, some have pulled back on expecting aggressive rate hikes. As for the Fed, current forecasts point toward interest rate cuts that are likely to take place later this year.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.