OPEC + Production Cut Meeting Has Little Effect U.S. and Saudi Arabia Speak Opposites International Oil Prices Down for Days

HSBC said OPEC + "s recent additional production cuts had exhausted the group's" last bullet "as it faced mounting spare capacity problems.。

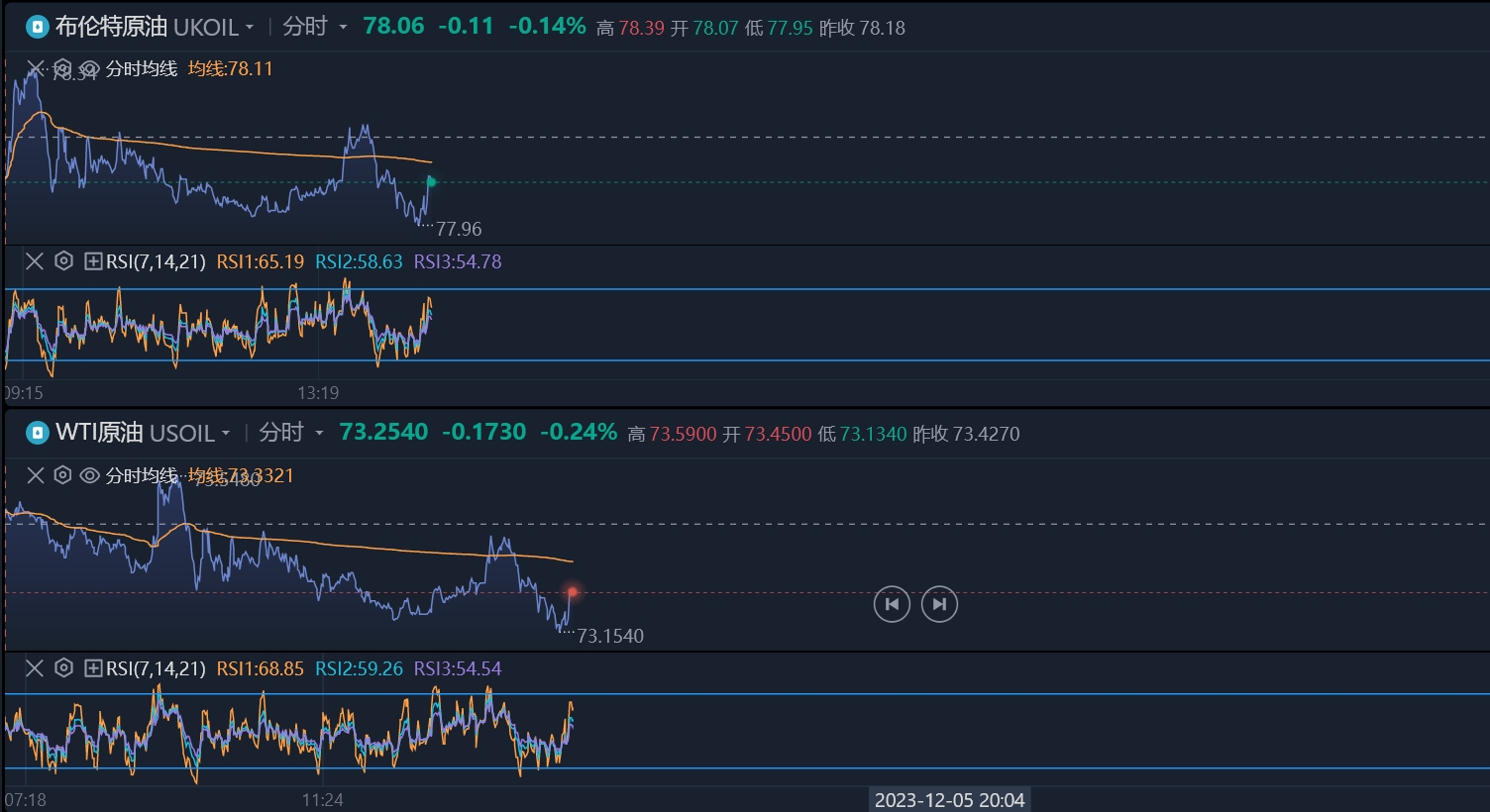

On December 5, international oil prices continued yesterday's decline。Cloth oil down 0 as of press time.14%, currently trading at 78.06 USD / bbl; WTI crude down 0.24%, currently trading at 73.$25 / barrel。

OPEC + production cut meeting fails to boost markets due to concerns about implementation

In the last trading day, oil futures fell 0.$85 a barrel, down 1.08%, closed at 78.03 USD / bbl; WTI crude oil falls by 1.39%, closed at 73.04 USD / bbl, reaching the low since July 10 touched on November 16, supported at 72.Near $15 / barrel。

Last Thursday, after many difficulties, OPEC + finally reached an agreement on oil supplies, and the organization agreed to further reduce its daily oil supply by 1 million barrels.。Meanwhile, Saudi Arabia announced it would extend its policy of additional voluntary production cuts of 1 million bpd.。

The most surprising thing about this meeting is that Brazil joined OPEC +。According to the latest monthly report of the International Energy Agency (IEA), Brazil's average daily production will reach 3.5 million barrels this year and increase to 3.81 million barrels next year, all of which are record highs and may hit oil prices in the future.。

Obviously, the market is not happy with this OPEC + production cut agreement。On Thursday, the decline in WTI crude oil widened to 2% after the announcement of supply cuts。

Lipow Oil AssociatesPresident Andrew Lipow said the market had decided (OPEC + production plan) would not have that much impact, and the plan was more about style than substance.。Craig Erlam, an analyst at OANDA, a leading brokerage firm, agrees that the 'deal' reached by OPEC + last week is, to say the least, unconvincing.。He said the measure was simply not deep enough as the market seemed to expect a further economic slowdown next year。

According to a survey released on Friday, global manufacturing activity remained largely absent in November due to weak demand, especially as factory activity in the euro zone continued to shrink, casting a cloud over the global economic outlook.。

Other analysts said the OPEC + production cuts announced last week were voluntary in nature, raising doubts about whether producers will fully implement them and investors are uncertain how to measure them.。

Opposing Saudi Arabia, U.S. crude oil production hit a new high.

U.S. crude oil production hit a record for the second consecutive month in September as OPEC + discussed production cuts。According to the U.S. Energy Information Administration, U.S. crude oil and condensate production increased by 224,000 bpd in September from August to 13.24 million bpd.。Since the fourth quarter, a significant increase in U.S. domestic production has led to the accumulation of crude oil inventories and weaker prices.。

On Monday, Deputy Energy Secretary David Turk said the United States would buy back as many oil reserves as possible.。He said the U.S. would take advantage of low oil prices to replenish its reserves, but that U.S. oil reserve replenishment was limited due to physical constraints.。

U.S. crude oil production increase is the last thing Saudi Arabia wants to see。As one of the main drivers of OPEC + production cuts, Saudi Arabia cannot allow the United States to offset the effectiveness of OPEC + production cuts behind the scenes。

In an interview, Saudi Energy Minister Saud bin Abdul Aziz said: "I am confident that the new OPEC + production cut of 2.2 million bpd will be delivered.。He went on to say that the production cuts could continue beyond March next year if needed.。Speaking about his approach to the COP28 summit, he said Saudi Arabia would not agree to a text calling for a gradual reduction of fossil fuels.。

At COP28, a number of countries, including the United States and the European Union, made a key demand for an agreement calling for a phase-out or reduction in the use of fossil fuels, although the language must be agreed upon.。

HSBC said OPEC + "s recent additional production cuts had exhausted the group's" last bullet "as it faced mounting spare capacity problems.。Analysts, including Kim Fustier, believe the group and its allies lack an exit strategy to unwind production cuts.。Assuming the current implementation rate of the broader cuts is about 50 percent, OPEC's spare capacity is expected to increase from the current 5 million bpd to 5.5 million bpd in the first quarter of next year.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.