oil prices rebound?OPEC + Reaches Production Cut Agreement Australia and New Zealand: Brent Crude Oil Rises to US $100 at End of Year

On June 4, OPEC + reached an agreement to extend the production cuts already agreed in 2023 until the end of the year and to adjust its production target to 40.46 million barrels per day from 2024.。

On June 4, OPEC + reached an agreement to extend the production cuts already agreed in 2023 until the end of the year and to adjust its production target to 40.46 million barrels per day from 2024.。It is estimated that this means that OPEC + producers could cut production by a total of nearly 1.4 million barrels per day.。The OPEC + statement said it was taking action to "achieve and maintain a stable oil market" and that it was continuing its recent "proactive, pre-emptive" approach.。

On the same day, the Saudi energy ministry said the country would extend its voluntary 500,000 bpd production cut until the end of 2024 and implement an additional 1 million bpd in July.。The ministry also said the additional Saudi production cuts would last for a month and could also be extended.。After the announcement, Saudi Energy Minister Abdulaziz described the additional voluntary Saudi production cuts in his usual vivid language: "This is a Saudi lollipop.。"

In addition, Russian Deputy Prime Minister Alexander Novak also said on the 4th that the country's measures to reduce crude oil production by an additional 500,000 barrels per day will be extended until the end of 2024, which was originally scheduled to end at the end of this year.。It is estimated that by 2024, Russian crude oil production is expected to be cut to an average of 932 per day..80,000 barrels。

Boosted by the news, WTI crude oil opened up 3% to 74 on June 5..$11 / barrel。NYMEX's most active WTI crude oil main futures contract opened within one minute of buying and selling the market instantly traded 5061 lots, the total value of the trading contract 3.$6.4 billion。

U.S. oil drilling total fell for five consecutive weeks in May, the average hourly wage of the labor force increased by 4.3%

In terms of data, on June 3, Baker Hughes (Baker Hughes), a famous oil service, announced the total number of oil wells drilled in the United States for the week to June 2.。According to the disclosure, the data recorded 555, lower than the forecast of 571 and the previous value of 570, the fifth consecutive week of decline, the largest decline since September 2021.。Some analysts say that after the outbreak dissipated, the global crude oil market long-term capital expenditure is insufficient, oil supply elasticity suffered a blow.。At the same time, the world-wide energy transition accelerated, the rebound in U.S. shale oil production encountered bottlenecks, and overall, oil supply and demand were tight.。According to the latest global oil market monthly report released by the International Energy Agency (IEA), the global oil supply and demand gap is expected to reach 2 million barrels per day in 2023.。

In addition, according to OPEC data, by the end of 2021, the average daily production of OPEC members is about 26.36 million barrels (including condensate), accounting for about 37% of global daily production..86%。In short, against the backdrop of declining shale oil market share, OPEC + 's voice in the crude oil market will further increase。

However, a series of data released by the United States last week also brought some worries。

Last Thursday, the United States released the May ISM manufacturing PMI index, which fell further to 46.9, and for seven consecutive months below the boom-bust line, even weaker than the expected value of 47。Among them, the U.S. ISM Manufacturing New Orders Index remained in contraction, recording 42.6, up from 45 in April.7 down by 3..1 percentage point, reflecting the continued plunge in new orders。In addition, the U.S. ISM Manufacturing Price Payments Index unexpectedly fell 9 percentage points from its previous value, recording only 44.2, well below the expected value of 52.0 and previous value 53.2。Since the report mainly measures industries closely related to oil, or foreshadows potential risks to oil demand。

On Friday, U.S. non-farm payrolls in May sharply exceeded expectations, recording 33.90,000, the largest increase since January 2023, but the unemployment rate was 3.4% to 3.7%。It is worth noting that the average hourly wage of the U.S. labor force increased by 4% in May..3%, the month-on-month increase was also maintained at 0.At a high of 3%, some analysts believe that the Fed needs to raise the policy rate further above 6% to control inflation.。

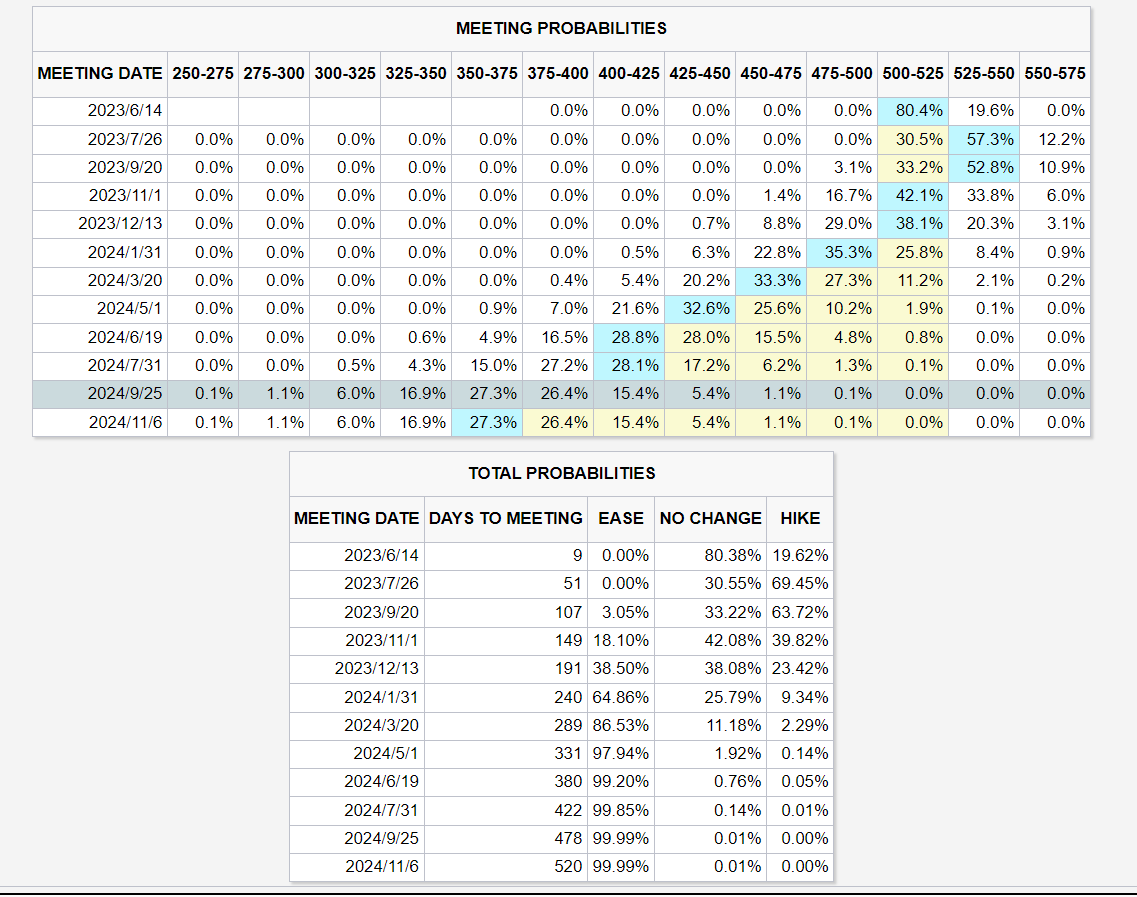

As of press time, according to CME Fed Watch, the market expects the bank to temporarily keep interest rates unchanged at its June policy meeting to assess the effect of the policy, and then restart its rate hike in July by 25 basis points, with one rate cut during the year and a terminal rate of 5.25%。It is worth noting that the data show that the market pricing the probability of the Fed keeping interest rates unchanged in December this year and the probability of a rate cut are quite close, 38, respectively..08% and 38.50%, do not rule out the possibility of two interest rate cuts during the year。

Some analysts believe that although the Fed's monetary policy has limited impact on oil prices, the policy of raising interest rates may put pressure on the overall liquidity environment, which in turn will impact financial markets.。In addition, after the suspension of the debt ceiling bill, the U.S. Treasury is expected to launch a wave of "new debt tsunami" to quickly replenish its own coffers, which have fallen to their lows since 2015, but this will again consume the dwindling liquidity in the financial system and increase the risk of crisis.。

JPMorgan Chase strategist Nikolaos Panigirtzoglou (Nikolaos Panigirtzoglou) said that large purchases of U.S. Treasuries will exacerbate the impact of quantitative tightening on stocks and bonds。He also said that this trend, coupled with the Fed's tightening policy, is expected to reduce liquidity indicators at a rate of 6% per year, equivalent to the liquidity contraction that occurred during the economic crisis.。"It's a very large liquidity drain:" It's only in the 'Lehman crisis' that you see this contraction。In addition, Citi also said that after such a large liquidity reduction, the median decline of the S & P 500 index in two months may reach 5.4%。

Overall, while recession risk concerns remain and monetary policy is still likely to rise, OPEC + production cuts may guide oil prices towards a rebound。ANZ said the possibility of a sharp rebound in oil prices has risen sharply, maintaining the year-end Brent crude target price at $100 a barrel, in addition, in the spot market before signs of tightening, short-term price increases may be limited。

As of press time, WTI crude oil rose nearly 2% in the day and is now trading at 73.$29 / barrel。

Brent crude up 1 in the day.81 per cent, reported 77.$57 / barrel。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.