Paying Fees: An Imminent Profitability Threat for Businesses

After COVID, businesses and consumers increasingly relied on electronic transactions, but that convenience came at the cost of paying fees.

After the epidemic, both businesses and consumers are increasingly reliant on electronic transactions, a convenience that comes at a cost. While these fees may seem insignificant on the surface, they accumulate and erode profit margins, especially for growing businesses.

A recent study found that credit card processing fees alone caused American businesses to lose approximately $100 billion in 2023. This figure underscores the necessity of understanding and recognizing the makeup of payment fees. It could be the first step in optimizing your financial strategy to foster business growth.

This blog, drawing on twenty years of experience in payment processing, aims to demystify the complex language of payment fees, offering practical strategies and insights to help you increase your business's profit margins.

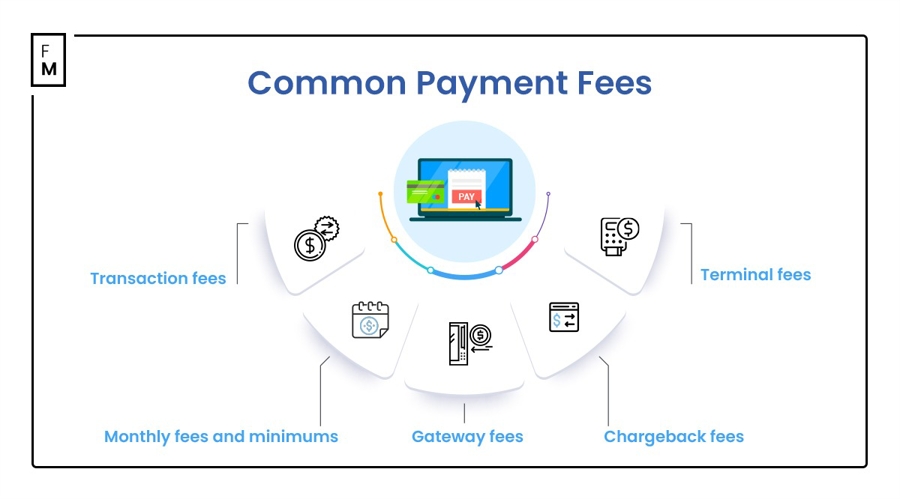

Common Payment Fees

As a business owner, understanding the various types of fees involved in payment processing can help you optimize overall expenses and improve profit margins. Some of these payment fees include:

- Transaction fees: Transaction fees are among the most common and perhaps most direct fees, charged as a percentage of each sale or transaction plus a fixed fee. While these percentages may seem small, over time they can accumulate, affecting overall profitability. Therefore, you should always assess transaction fees based on sales volume to accurately determine their impact.

- Monthly fees and minimum volume requirements: Some payment processors may charge monthly fees for using their services. Additionally, they have monthly minimum requirements, requiring businesses to process a certain volume of transactions, or else face additional charges. Thus, you should choose a payment processor that aligns with your transaction volume, helping you avoid unnecessary fees.

- Gateway fees: Gateway fees apply to businesses using online transactions. These fees cover the use of electronic gateways that transmit transaction data from merchants to processors. Because seamless online transactions are crucial for modern businesses, you should look for integrated payment solutions to minimize additional fees.

- Refund fees: During online transactions, there may be instances of transaction failures. If a transaction is disputed, refund fees may incur. While this situation occurs infrequently, it can result in significant costs.

- Terminal fees: For brick-and-mortar stores, terminal fees apply to physical devices used for processing payments. By investing in efficient and reliable payment terminals, you can justify costs, improving transaction speed and reliability.

The Real Impact of Fees on Costs

The impact of payment fees on operating costs for businesses is far greater than initially anticipated. At first glance, transaction fees of 2-3% per sale may not be worrisome. However, when these seemingly insignificant percentages are applied to higher sales volumes, they can have a significant impact.

Consider a business with an annual income of $1 million. In this scenario, transaction fees alone could result in annual expenses of $20,000 to $30,000. While this figure itself is quite substantial, it represents only a part of the broader payment fee structure. Remember, this doesn't include additional monthly or annual service costs, terminal fees, setup fees, or additional charges like refunds and gateway fees, which can further add to costs.

Strategies to Reduce Fees

Considering all these fees, payment fees can have a significant impact on a business's profit margins and operating costs. Especially for businesses in the growth stage, effective strategies must be devised to minimize these costs and protect their bottom line.

Here are some practical strategies supported by my professional expertise to help businesses reduce their payment processing costs:

- Choose a transparent pricing model: One of the first steps in effectively managing payment fees is selecting a payment processor that offers a transparent pricing model. Hidden fees can quickly accumulate, making it difficult for businesses to identify, forecast, or accurately manage these costs.

- Negotiate better rates: Don't hesitate to negotiate rates with payment processors. Many payment processors are willing to adjust their rates based on your transaction volume or unique business needs.

- Utilize more efficient payment methods: Certain payment methods incur higher processing fees. For example, transactions made with international credit cards or corporate credit cards may incur additional fees due to higher risks or associated rewards programs. By encouraging the use of alternative payment methods or integrating more cost-effective solutions, businesses can lower their overall costs.

- Regularly audit your payment processes: Analyzing your payment processing setup may reveal opportunities for inefficiency or cost savings. These audits can involve identifying services that are rarely used but incurring costs, or pinpointing areas where updated technology could lower overall payment processing rates.

Implement advanced fraud detection tools

Refunds resulting from fraud can lead to significant costs and penalties. By implementing advanced fraud detection and prevention tools, businesses can reduce the risk of refunds. Take action today. Don't confine these strategies to reading alone. Implement them, see them in action, and witness firsthand the tangible difference they make to your financial outlays.

Adopting these strategies can not only streamline your business operations but also significantly improve your bottom line. It's about taking control, fostering your growth, and most importantly, solidifying your financial resilience in an ever-changing business environment.

Addressing Inevitable Costs

Fees are an inevitable part of payment processing. However, by taking strategic measures, you can significantly reduce these costs, turning potential obstacles into opportunities for growth and greater efficiency.

View the strategies to reduce fees as part of an ongoing optimization process rather than a one-time effort. The cumulative effects of implementing these measures can be substantial and beneficial, ensuring that your business remains competitive and financially robust.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.