Recently, well-known investment consulting firm Forture released a new issue of market insights into the digital payment industry.

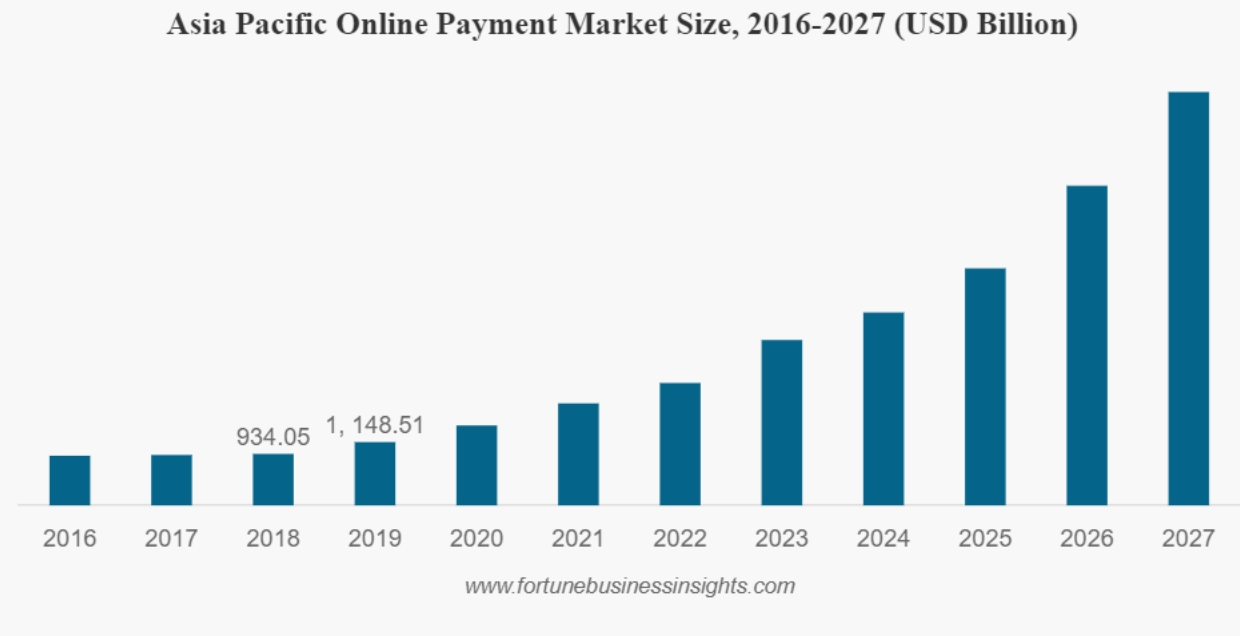

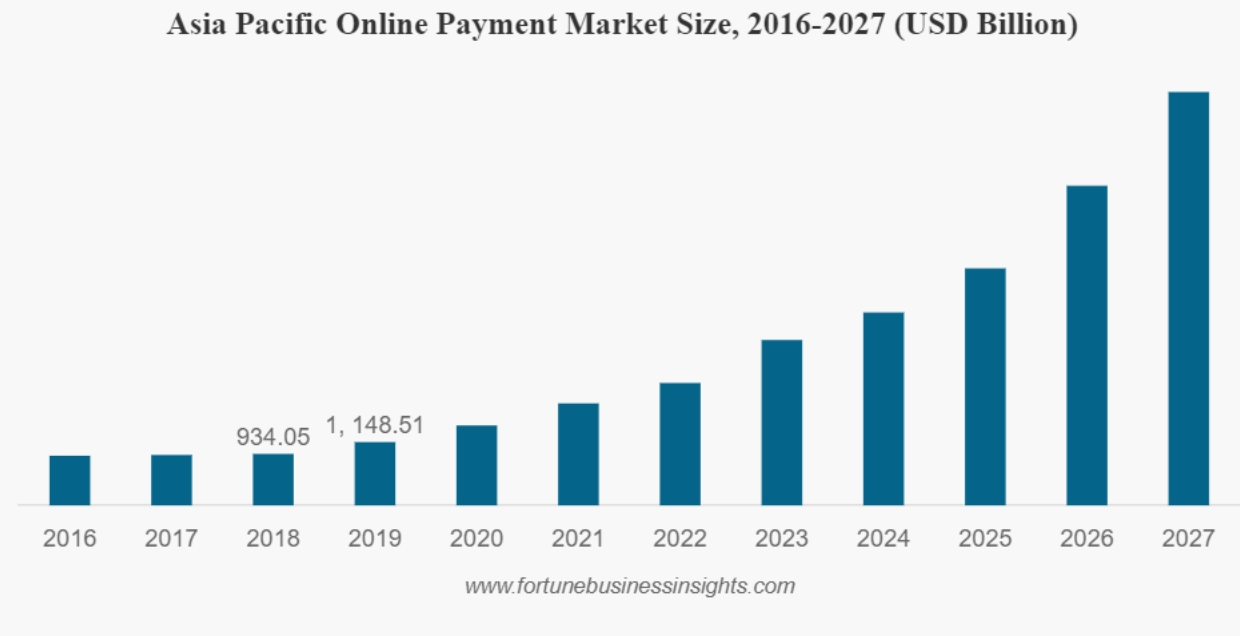

Forture said that the global digital payment industry will continue to experience outbreaks in the next three years, with a total scale expected to reach US$17,643.35 billion by 2027, with a compound annual growth rate of 23.7%.

The future development of the digital payment industry will benefit from three major benefits.

First, traditional payment methods have changed after the epidemic.

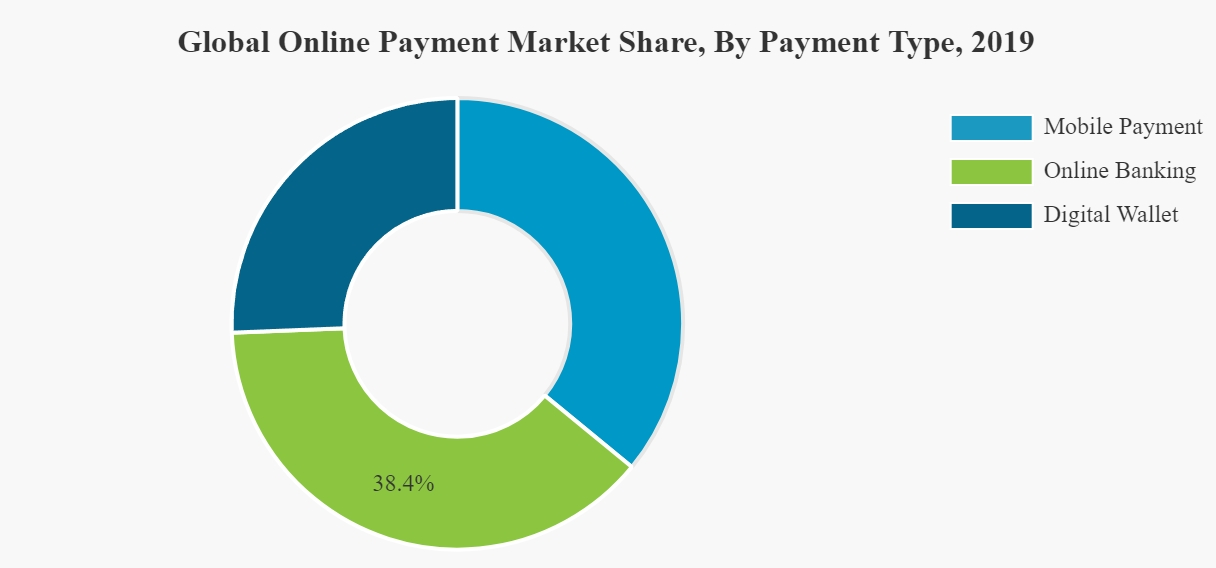

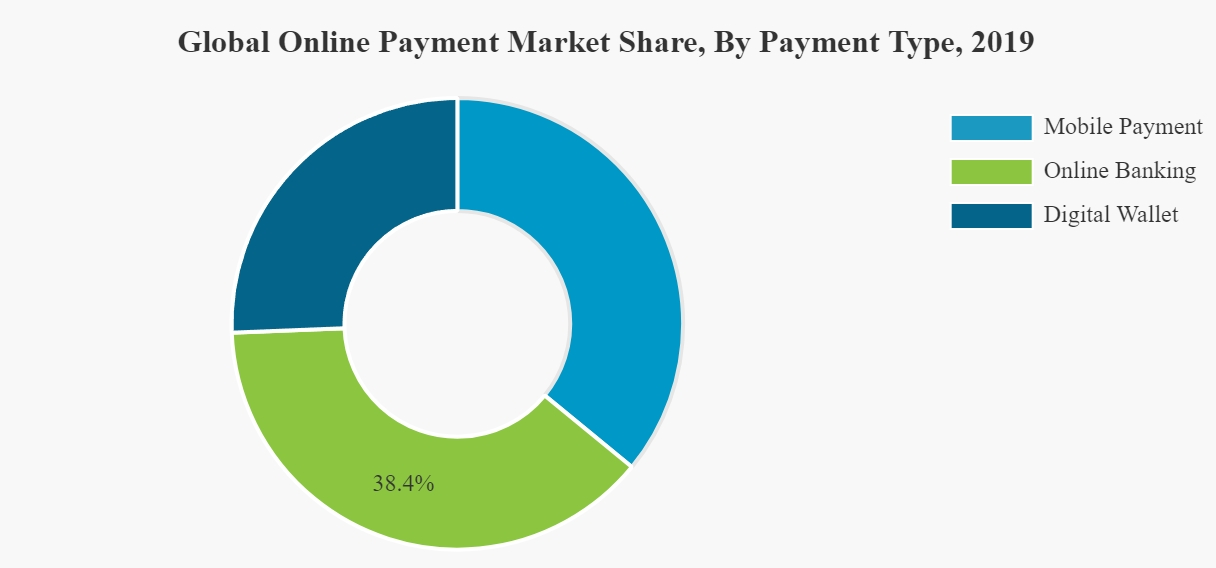

Data shows that the outbreak of the COVID-19 epidemic has greatly changed consumers 'spending habits, which has led to the popularity of contactless transactions, the growth of e-commerce and a surge in the use of digital wallets.A MasterCard study showed that 79% of consumers around the world choose contactless payments to reduce the risk of infection.The study also found that 46% of cardholders have shifted their payment methods from traditional credit cards to contactless options such as mobile payments, digital wallets and online banking.

Consumers have also said they will continue to use these payment methods even if the epidemic ends.

Given that credit cards and cash can be carriers of the spread of the virus, the World Health Organization recommends that people use contactless payments whenever possible.This trend prompted PayPal to add 7.4 million new user registrations in April.Therefore, it is expected that demand and growth in the payment industry may increase significantly after the COVID-19 epidemic.

Second, the help of the development of artificial intelligence.

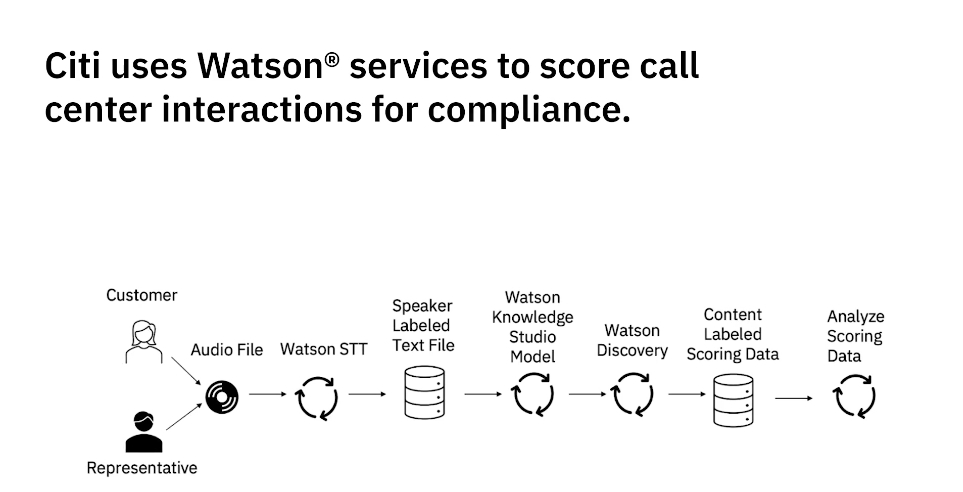

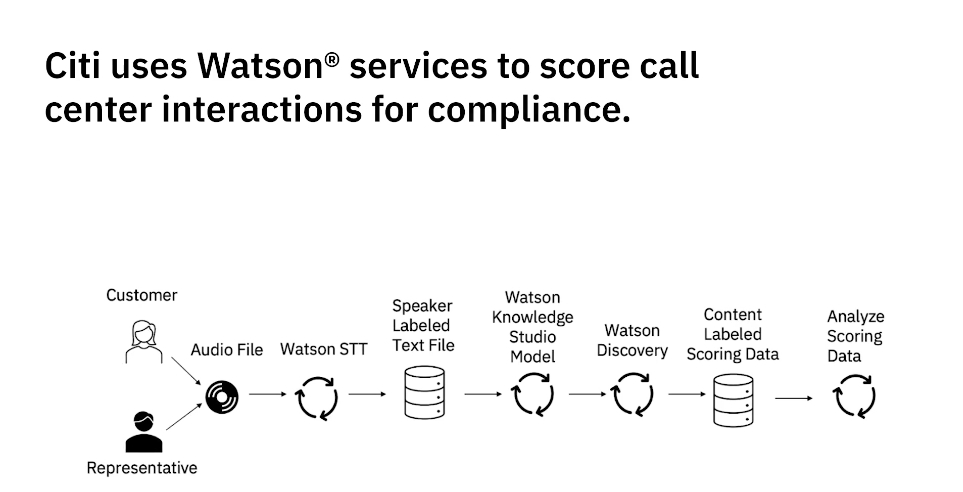

With the rapid popularization of artificial intelligence, artificial intelligence technology is gradually being introduced in the payment field to cope with the increasing transaction scale and optimize payment processes.At the same time, in order to effectively identify and prevent payment fraud, artificial intelligence is also used to efficiently monitor and analyze user data.

Machine learning technology, an important part of artificial intelligence, has also shone in the field of digital payments.Using machine learning technology, the backend can quickly identify potential fraud patterns and provide early warning before problems occur.In addition, AI can also improve customer experience by analyzing transaction data and provide more convenient and personalized services.

Currently, Citigroup has begun to use AI technology through its Finance and Trade Solutions division to simplify the payment process for accounts.As the technical process deepens, it is expected that the application of these technologies will continue to feed back the digital payment market in the future.

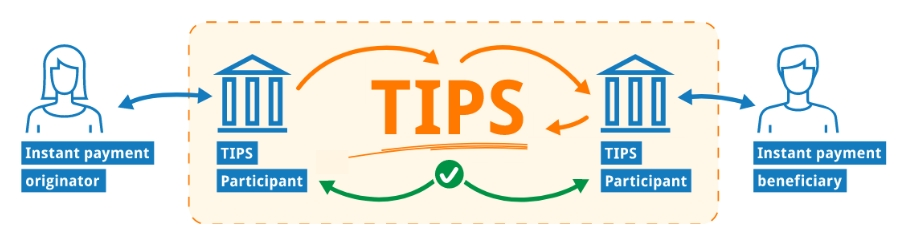

Third, the government provides strong support.

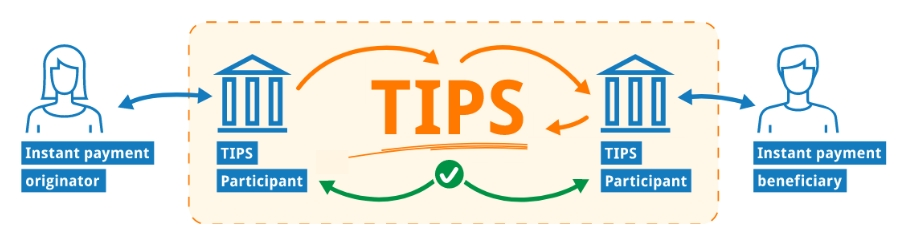

Globally, more and more governments are adopting digital payment systems to make transactions with businesses and citizens faster and more convenient.For example, the European Central Bank has launched the Target instant payment system through digital payment technology, a service that allows merchants and consumers in 19 European countries to quickly complete funds transfers.

The introduction of online payment platforms not only improves the transparency and security of transactions, but also helps reduce corruption and fraud.According to a 2017 World Bank study, the Mexican government has successfully reduced costs by 3.3% through an online payment system to distribute pensions and wages.Similarly, according to a 2020 report released by NITI Aayog in collaboration with the International Energy Agency, the Indian government saved approximately US$8.8 billion between 2013 and 2020 by paying fuel subsidies through online banking.

Forture expects that the efficiency improvements and resource savings brought by digital payments will help the online payment market continue to grow in the next few years.

How should ordinary people grasp the dividends of digital payment for development?

If you know how to pick stocks, you can do it according to your own judgment, but remember to control your positions and master basic investment discipline.

But for a novice Xiaobai who can't pick stocks, buying an ETF may be a safer choice.

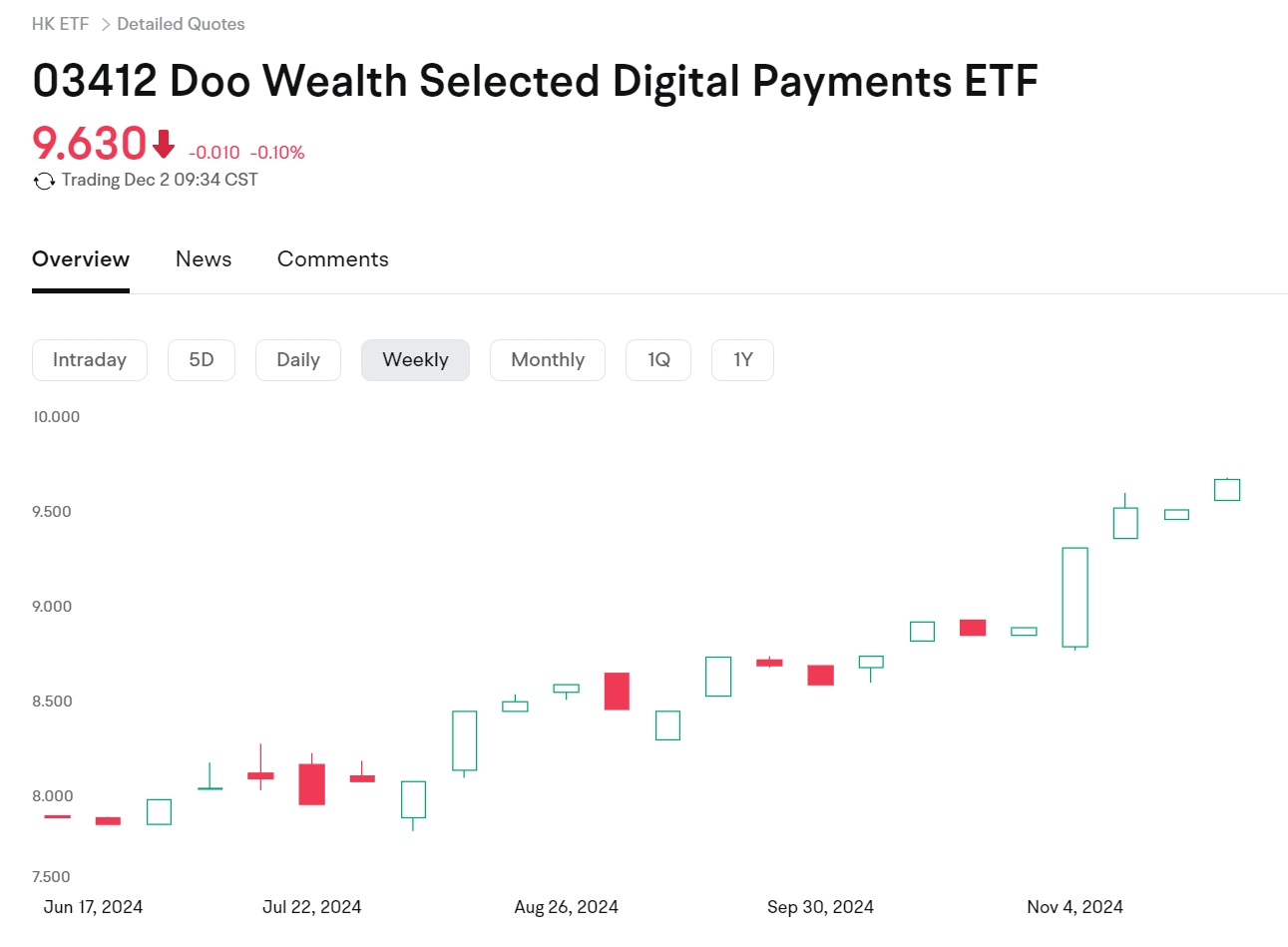

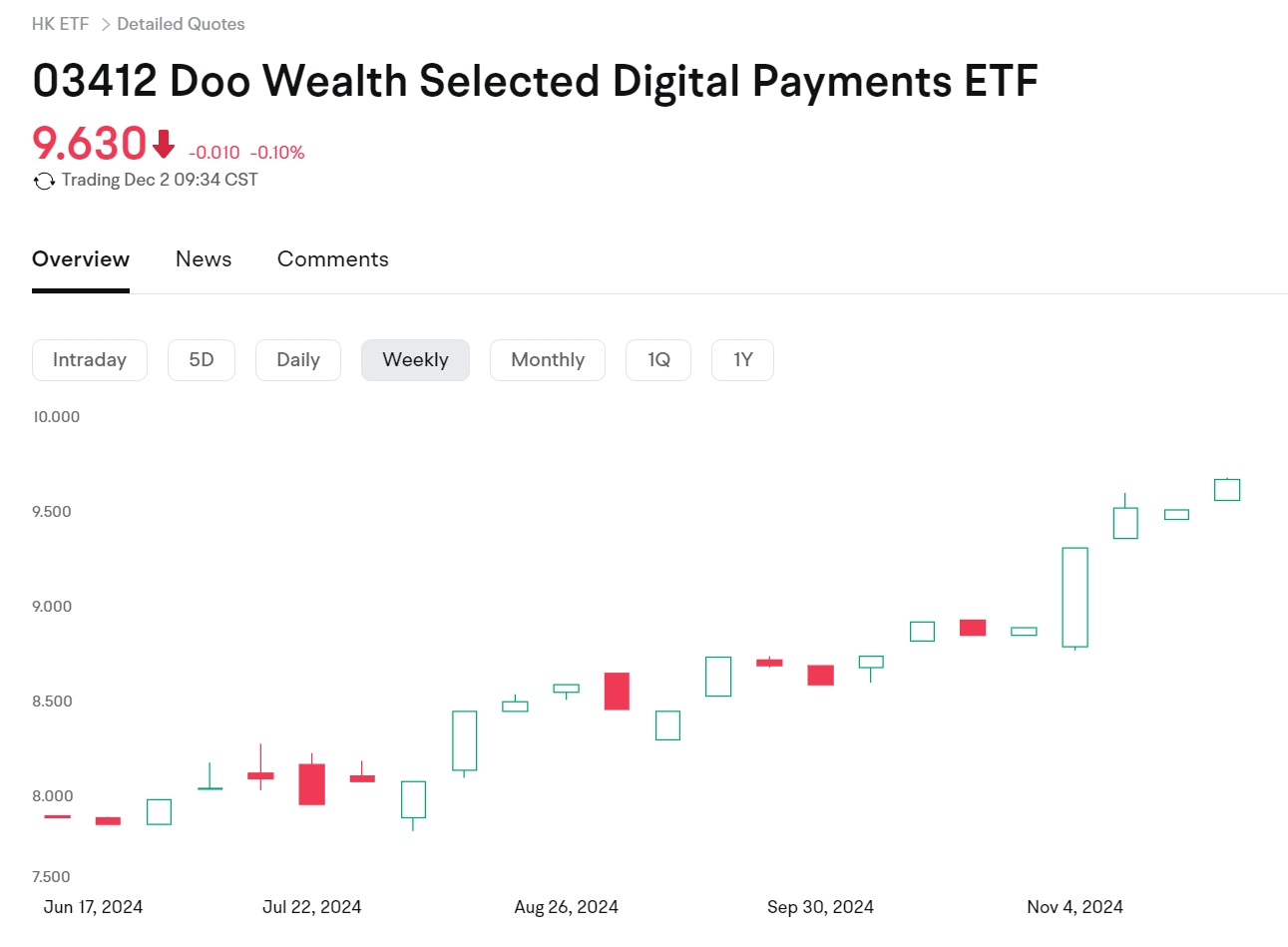

The following are some of the more representative electronic payment ETFs & indexes on the market. They are not recommended for investment but are for reference only.

It can be seen that as the industry bottomed out, many targets have recently emerged from a wave of market.Due to the advantage of ETF's "even rain and dew", investors can avoid the trouble of stock selection,"package" all the stocks in the concept, and receive dividends from a basket of stocks.

On the other hand, the selling price of ETFs is also cheaper than buying individual stocks alone, which can also greatly lower the threshold for investing and participating in the digital payment market, and is relatively friendly to investors.

Moreover, ETFs do not face the risk of suspension or delisting.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

For ordinary investors, mastering cash flow means mastering the ability to resist risks, while ETFs 'low threshold and risk diversification attributes are undoubtedly very suitable for novice investors.

Here is a summary of the major players in the digital payments market from Hawk Insight (in no particular order):

Alipay Limited (Hangzhou, China)

Adyen (Amsterdam, Netherlands)

American Express Company (New York, USA)

ACI Worldwide Inc. (Florida, USA)

JPMorgan Chase & Company (New York, USA)

Facebook Inc. (California, USA)

MasterCard Company (New York, USA)

Apple Inc. (New York, USA)

Amazon (Washington, USA)

PayPal, Inc. (California, USA)

Visa, Inc. (California, USA)