Is prop trading the future of CFD brokers?

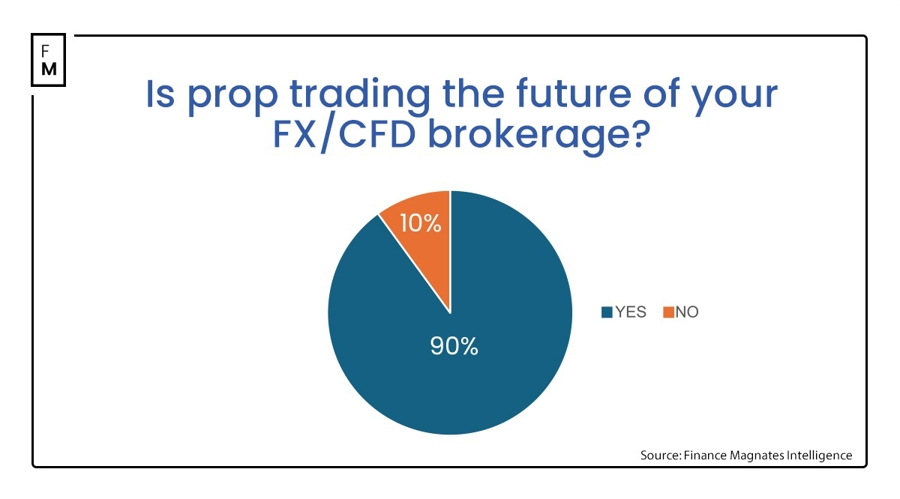

90% of respondents believe that prop trading could be the future of the retail trading industry and the direction in which FX/CFDs will evolve.

According to statistics, 90% of respondents believe that prop trading may be the future of the retail trading industry and also the direction for the development of FX/CFDs.

Modern prop trading gains attention

Modern prop trading firms enable retail traders to trade with substantial company funds without taking risks. However, most trades are now conducted with virtual funds, yet the profits are entirely real.

Traders involved typically pay a fee, undergo an evaluation process, and prove their trading skills through simulation. Successful ones gain access to funded accounts and retain a significant portion of their profits, usually between 60% to 80%.

"Prop trading presents a great opportunity for traders to test if trading suits them, or for experienced traders, it offers the chance to trade with higher capital levels, advanced technology, and extensive market data," said Crystal Lok, Head of Emerging Markets at OANDA. "It also provides a learning opportunity for traders at any level, as the cost is merely an entrance fee to the challenge."

Brokers entering the prop trading arena

Currently, four previously renowned brokers in the FX/CFD field now offer dedicated prop trading services. OANDA has launched OANDA Labs Trader, Hantec Markets created Hantec Trader, IC Markets established IC Funded, and as the first in this domain, Axi provides Axi Select.

However, the most significant point is that the vast majority believe prop trading is the future of retail trading.

"I believe it's evident," commented Maciej Wojciechowski, Business Development Lead at OnEquity. "Brokers with long-term strategic planning have identified a niche and promotional opportunity in prop trading."

Prop trading: The future of FX/CFD brokers

According to surveys, 90% of respondents believe that prop trading services will be the future of contracts for difference brokers. By offering prop trading alongside traditional trading accounts, brokers can attract more clients.

"In the past 18-24 months, there has been a significant increase in demand for this product," observed Bashaar Gokal, Operations Manager at Hantec Trader. "Recent industry turbulence has prompted traders to seek reputable institutions they can trust."

This development emerged after MetaQuotes suspended licenses for non-broker proprietary companies, resulting in a series of closures, service interruptions, and payment obstacles.

Some proprietary company users have waited over three months to access their funds, a situation that enables competing platforms and brokers to offer retail traders safer, regulated prop trading conditions, entering a new, undeveloped market with lower customer acquisition costs compared to the CFD field.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.