ON TIME's second application for listing in Hong Kong was previously valued at about 5.4 billion yuan.

In the February order compliance rate growth ranking, Ruqi Travel ranked second, behind Cao Cao Travel.

On March 25, according to HKEx disclosure documents, such as ON TIME (Chenqi Technology Limited) again submitted to the HKEx main board listing application, by CICC, Huatai International and Agricultural Bank International for its joint sponsors.

On August 18, 2023, Ruqi Travel also presented the table at the HKEx.

According to public information, ON TIME is an innovative mobile travel platform jointly invested by well-known enterprises such as GAC Group, Tencent and Guangzhou Public Transport Group, mainly for ride-hailing and Robotaxi services; technical services; and fleet management and services.

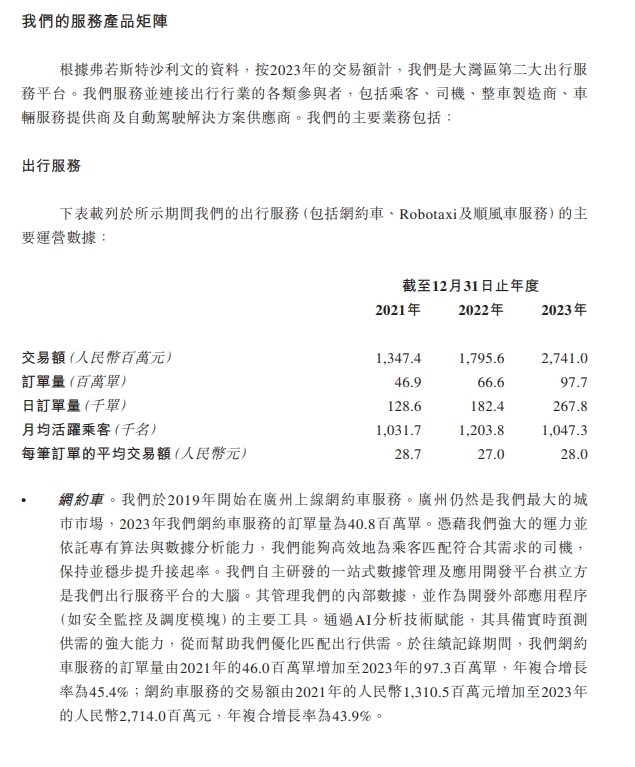

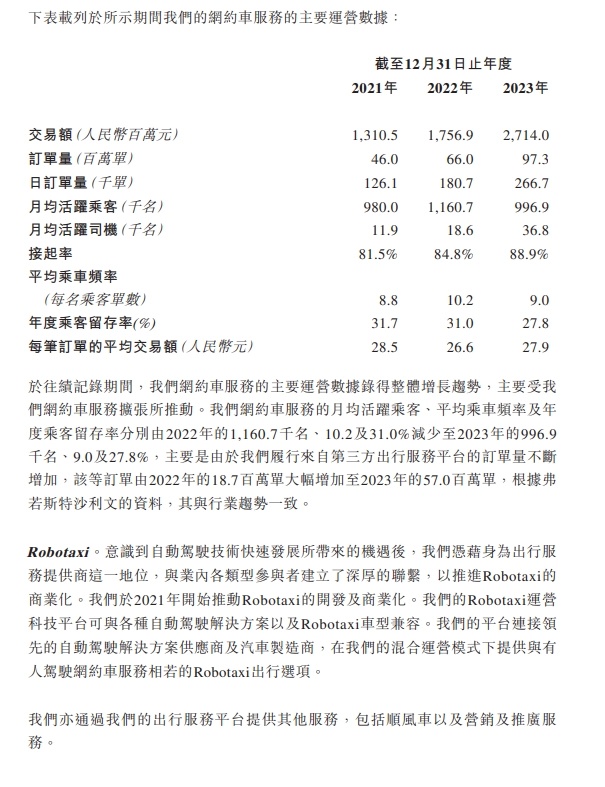

The listing application form shows that Ruqi Travel's total revenue in 2021 will be 10.135 billion yuan, 1.3 billion yuan in 2022 is 68.4 billion yuan, 21.611 billion yuan, with losses of 6.846 billion yuan, 6.268 billion yuan, 6.928 billion yuan.

According to the recently announced operation of domestic online car-hailing in February 2024, China's online car-hailing regulatory information interaction system received a total of order information in February 7.75 billion single, down 14.9%.

Among the top 10 platforms in terms of order volume, according to the order compliance rate (referring to the proportion of orders for which both drivers and vehicles are licensed), Rukchi Travel ranked first, and the top 10 were Ctrip, Timely Car Use, Enjoy Road Travel, Wanshun Car Call, T3 Travel, Sunshine Travel, Cao Cao Travel, Didi Travel, and Flower Pig Travel.

In the February order compliance rate growth ranking, Ruqi Travel ranked second, behind Cao Cao Travel.

As of February 29, 2024, a total of 341 online car-hailing platform companies nationwide had obtained licenses to operate online car-hailing platforms, an increase of 2 from the previous month; a total of 671 online car-hailing driver licenses were issued in various places..30,000 copies, 282 vehicle transportation certificates.10,000 copies, up 1.5%, 0.3%.

It is understood that in August 2023, such as Qi travel has completed 8.42 billion yuan B round of financing, led by GAC Industrial Group, a number of industrial funds and financial investors with investment.。After this round of transactions, such as Qi travel valuation of 53.6 million yuan。After the completion of the new round of equity transfer, GAC Industrial Group will hold 20.31% stake; GAC Group, through Zhonglong Investment, holds 14.8% equity.

Analysts pointed out that such as Qi travel listing application, showing its confidence in the capital market。The company's rapid growth in travel services has attracted the attention of many investors.。The analysis also said that despite the strong momentum of development, the market is still somewhat divided on its post-IPO valuation and performance expectations.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.