The financial report that the whole world is waiting for has finally come out.

After the U.S. stock market closed on November 20, Nvidia, the "general leader" of artificial intelligence, announced its third-quarter financial report for the fiscal year 2025 ending October 27, 2024.

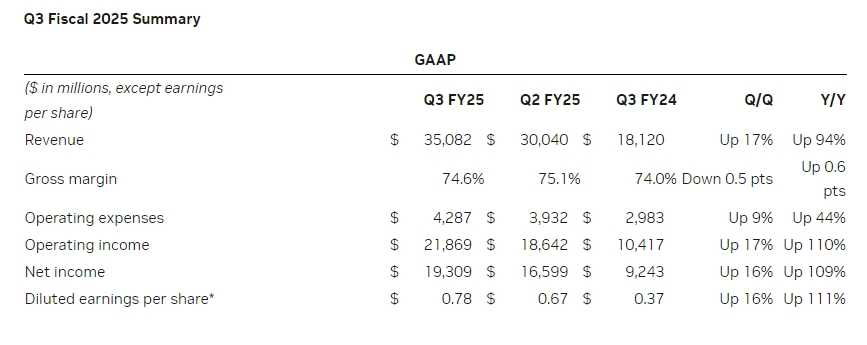

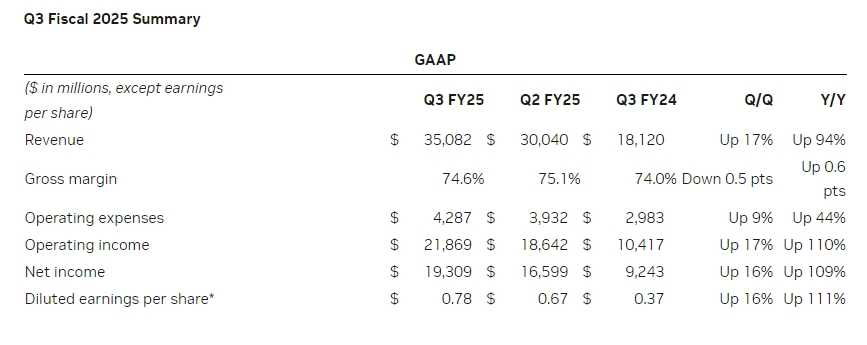

Data showed that in accordance with General Accounting Standards (GAAP), Nvidia's third-quarter revenue was US$35.082 billion, an increase of 94% from US$18.120 billion in the same period last year; net profit was US$19.309 billion, an increase of 109% from US$9.243 billion in the same period last year.Nvidia's revenue and adjusted earnings per share both exceeded analyst expectations.

Overall, Nvidia's revenue continues to set a record high in a single quarter, but the slowdown in growth continues.In the third quarter, Nvidia's revenue growth for the first time year-on-year did not reach triple-digits,"only reaching" 94%.On the one hand, this is due to the gradual increase in Nvidia's revenue, and on the other hand, it is also due to the continuous cancellation of Blackwell chips deployed by the company in the early stage, resulting in core income falling short of expectations.

Although single-quarter revenue of US$35.082 billion is already quite good, it still does not meet the high-end expectations of buy-side analysts.In addition, although Nvidia's revenue outlook for the fiscal fourth quarter also exceeded the average expectations of Wall Street analysts, it failed to meet its highest expectations.Affected by this, Nvidia's share price fell in after-hours trading.

In fact, before the announcement of the financial report, many well-known investment banks had begun to raise market expectations to appease the audience.In particular, Goldman Sachs said that whether Nvidia's earnings report explodes or not will directly determine "the success or failure of the rebound of U.S. stocks."Bank of America also said that the implied volatility of the S & P 500 index is consistent with Nvidia's own implied volatility, which suggests that the financial results pose a higher risk than upcoming jobs and inflation data or Fed meetings.

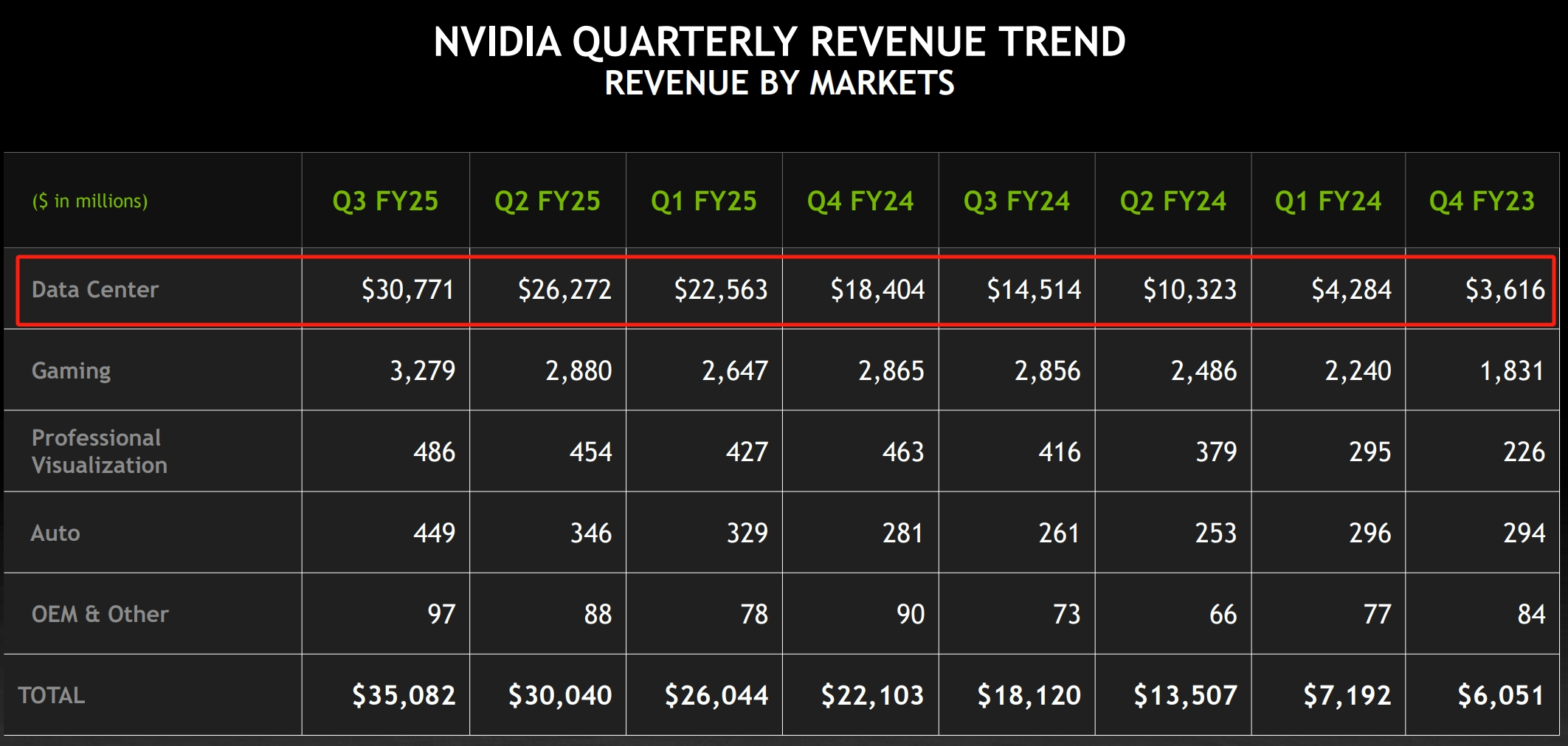

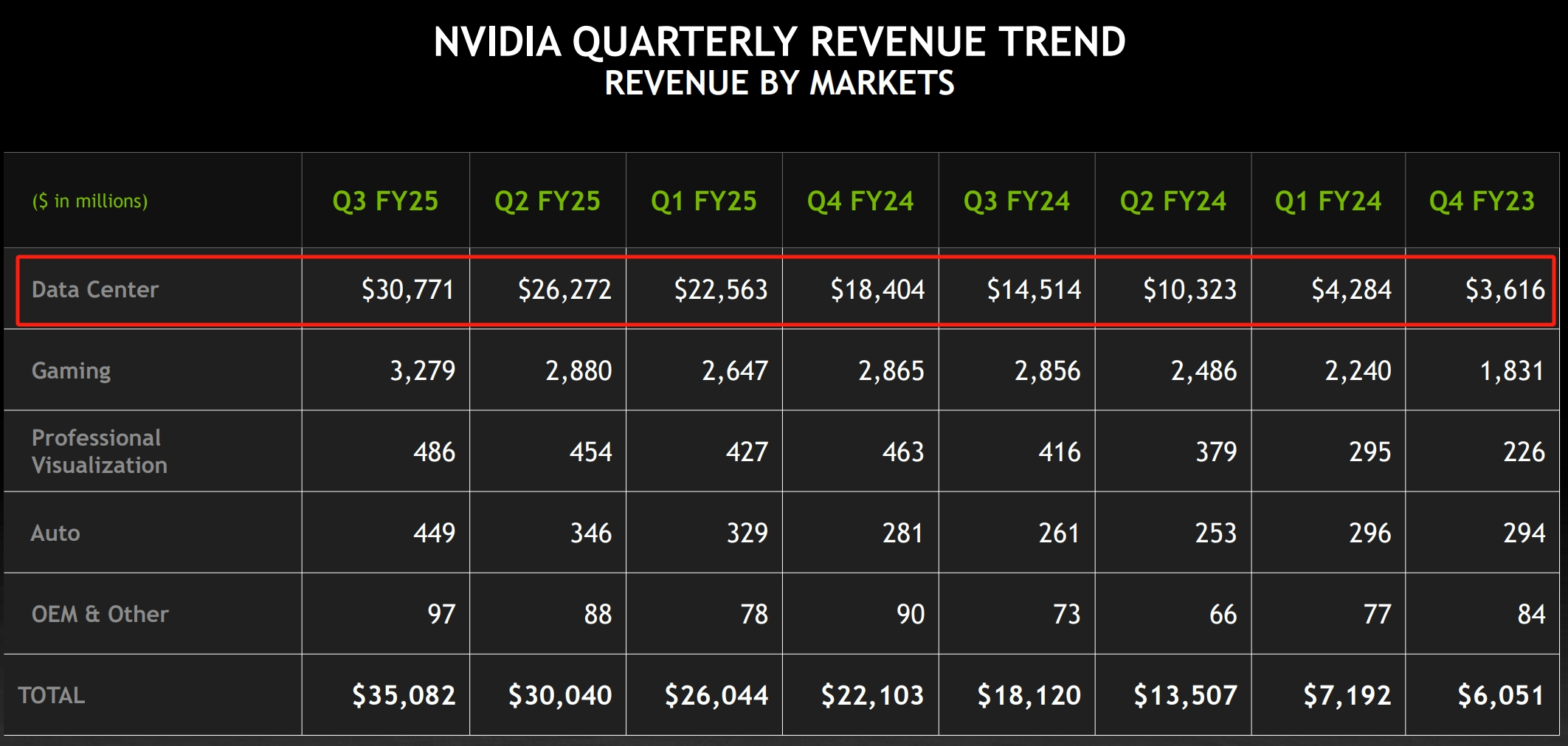

The financial report shows that Nvidia's best performance in the third quarter was still its data center business.The business's revenue during the reporting period reached US$30.8 billion, a year-on-year increase of 112%.The second is the automotive and robot business. Due to its relatively small size, revenue from this business reached US$449 million during the reporting period, a year-on-year increase of 72%.The remaining two businesses, the games and AI PC business, and the professional visualization business, had revenue of US$3.3 billion and US$486 million respectively in the third quarter, up 15% and 17% year-on-year.

Nvidia CFO Kress said that the growth of its data center business in the third quarter was mainly driven by two factors.

On the one hand, demand for the Hopper computing platform continued to grow in the third quarter, and the market's enthusiasm for training and reasoning large language models (LLMs), recommendation engines and generative AI application apps remained undiminished.Kress said that cloud service providers contribute approximately 50% of Nvidia's data center revenue.

On the other hand, demand for Hopper architecture chips has only increased, and chip sales have also brought about a significant growth in Nvidia's business in the third quarter.Buyers in this space include all customers in the computing and networking fields.

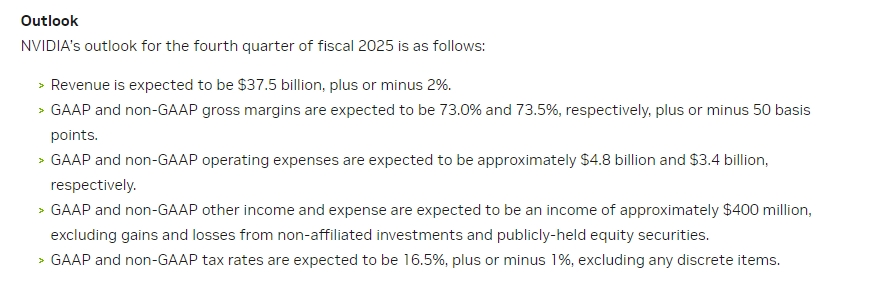

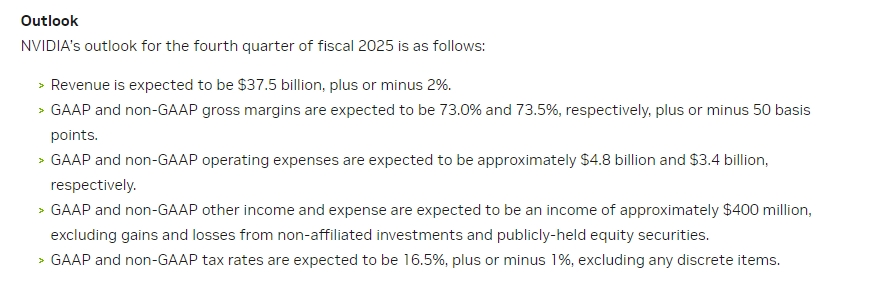

Regarding its fourth-quarter performance outlook, Nvidia forecast that based on the median guidance of US$37.5 billion, fourth-quarter revenue is expected to increase by approximately 70% year-on-year, and revenue growth will further slow down-this is not good news for the U.S. stock market supported by the seven sisters.

However, Kress gave good news about Blackwell's production: Nvidia successfully replaced Blackwell's mask, thereby improving production yields.The company plans to start production and shipment of Blackwell chips in the fourth quarter of this fiscal year, and will accelerate shipments until the entire fiscal year 2026.

Analysts at Morgan Stanley expect that at this pace, Nvidia will produce approximately 450,000 Blackwell architecture-based AI GPUs as early as the fourth quarter, which could translate into more than $10 billion in revenue opportunities if these units are successfully sold during the year.In contrast, Nvidia's own expectations are more conservative, saying that Blackwell will bring "billions of dollars" in revenue to the company-a long way from the $10 billion forecast by Morgan Stanley.

But one thing is certain is that whether it is "billions of dollars" or "10 billion dollars", as long as Blackwell is successfully mass-produced and launched on the market, this product will contribute significantly to Nvidia's revenue.We also have reason to expect that Blackwell's mass production will become an important turning point for Nvidia's revenue growth to rise again.