How Exness Social Trading Works?

On the Exness social trading platform, traders can act as strategy providers and earn commissions from investors who follow their strategies.。The platform is supported by advanced tools and reward commission payments。

On the Exness social trading platform, traders can act as strategy providers and earn commissions from investors who follow their strategies.。The platform is supported by advanced tools and reward commission payments。

Social trading has revolutionised the way investors engage in financial markets, allowing individuals to connect, learn and profit from the collective wisdom of their communities.。Exness takes this concept to new heights by offering cutting-edge social trading platforms that allow traders to not only follow and follow the strategies of successful investors, but also make money by sharing their trades.。

Exness Social Trading provides a comprehensive platform for strategy sharing, enabling investors to follow orders successfully。The app has many features, and existing Exness customers can easily use the app through their current accounts, acting as both an investor and a strategy provider.。

Strategy providers can create strategies for investors to follow and earn up to 50% commission。In this case, Exness clients can start by setting up powerful strategies that can be followed by traders。

In addition, policy providers can use Exness social trading tools and features to create, monitor, and evaluate the performance of the provided policies, and can also use the formulas provided by Exness to calculate the commission results they earn。

This article is everything you need to know as a policy provider。

Introduction to Exness Social Trading

Exness Social Trading is a social trading platform provided by Exness。The platform itself is powered by Exness Global Limited, which offers a wide range of financial instruments including currency pairs, metals, cryptocurrencies, energy, indices and stocks.。

Exness launched its own social trading platform in 2019。In just three months, the number of participants increased to 30,000.。Given that Exness is one of the most popular brokerage solutions in the trading industry, we can expect the app to improve significantly in the future.。

Currently, the Exness social trading app is available on iOS and Android。The app has been downloaded by more than 100,000 users on the App Store and Play Store。In addition, the application also received 4.2 (Play Store) and 5.Good rating of 0 (App Store)。Downloads and ratings indicate that Exness Social Trading has great potential for strategy providers to "sell" strategies to traders。

Set up a policy provider account

Strategy providers use Exness trading accounts directly from the Personal Zone。However, they must have a verified Exness trading account to allow investors to follow their trades.。To register, follow these steps:

1.Visit the Exness home page and fill in the registration fields under "New Account"。Provide your country of residence, email address, and create a password。

2.After logging into your Personal Area, select "Social Deals" from the main menu on the left。

3.Click "Join Now" and follow the necessary steps to verify your account。

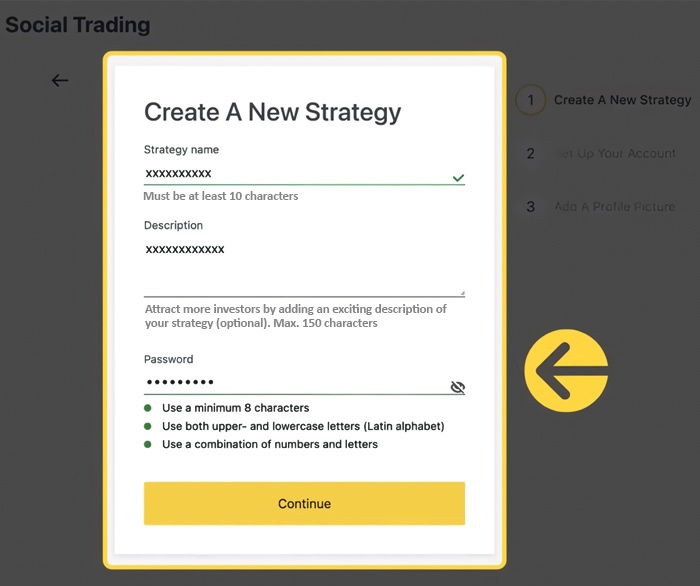

4.You can create a new policy in a new page。Enter a policy name, description, and set a password。

5.Select the account type, commission rate, and leverage and click Continue。

6.Adding a profile picture is optional, this page allows you to upload a picture that meets the requirements。

7.Congratulations! You have successfully created a new strategy and can now continue to deposit。

Tools for Policy Providers

Exness provides features and tools that strategy providers can use to optimize strategy creation, reach investors, and evaluate existing strategies。Here are some of the tools and features of the Exness social trading app that strategy providers can take advantage of。

Strategy development

Strategy providers can use the Exness social trading platform to create and manage their trading strategies, initially setting the strategy's account type, commissions, and leverage。At the same time, after the policy is created, you can edit the name, description, commission rate and minimum investment amount of the policy in the personal area by clicking the gear icon。

Transaction reliabilityLevel (TRL)

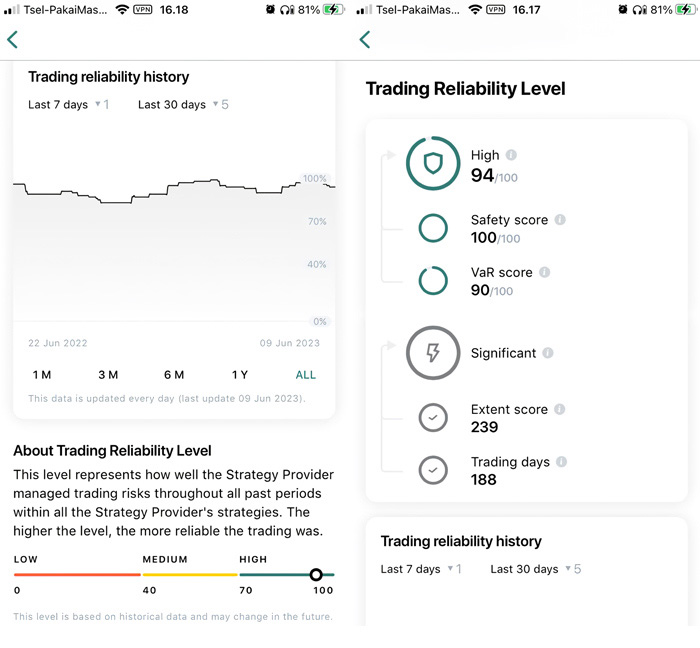

The transaction reliability level (TRL) is a tool to measure the degree to which a strategy provider manages transaction risk. It is calculated by combining two factors: security score and value at risk (VaR) score。The security score measures the likelihood that the policy provider will lose all of its capital, while the VaR score measures how much money the policy provider is likely to lose in the worst case scenario。

Your TRL reflects your historical performance across all strategies and funds, demonstrating your reliability as a trader。Having a high TRL increases the likelihood that an investor will choose to invest with you。Maintaining a high TRL score is critical to maintaining investor loyalty and attracting new investors to your strategy。

Exness divides the TRL level into 3 levels, namely:

- 0-40: Low score

41-70: Medium score

71-100: High scores

Lower TRL scores may result in restrictions on strategies and funds, including maximum investment amounts and new investor participation。Strategy providers can only invite investors, add investors to strategies, and start allocating when they have a high TRL.。

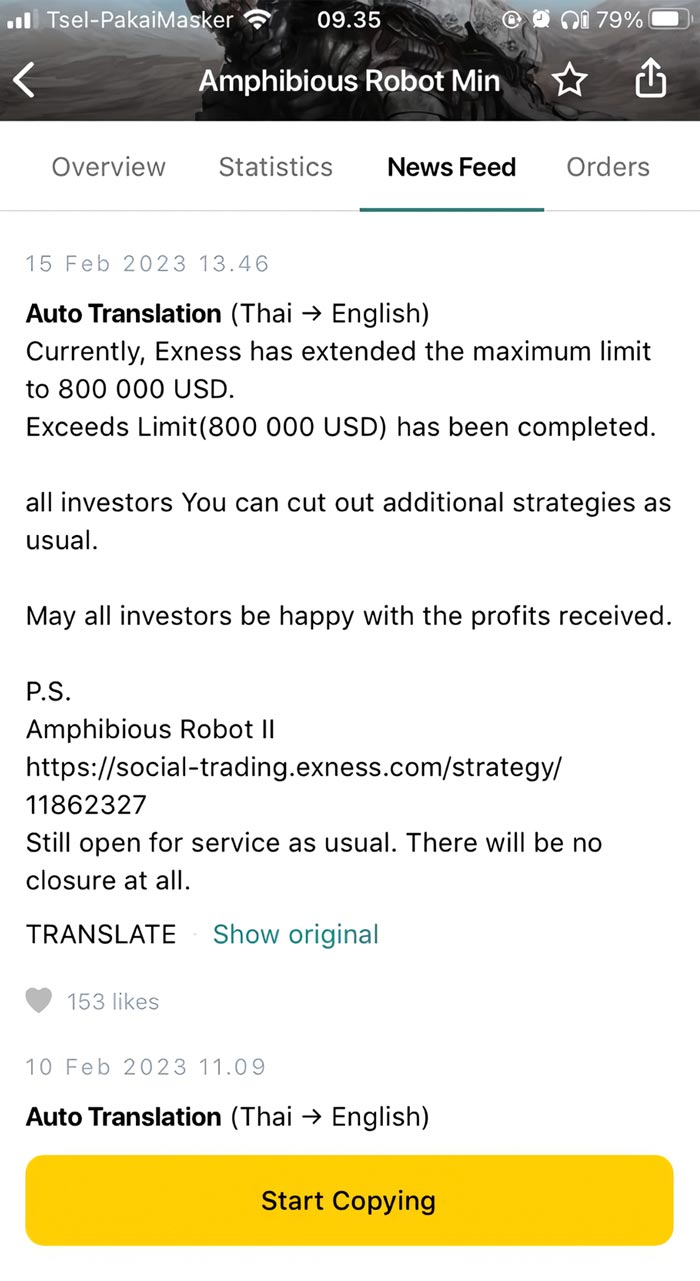

dynamic message

News Feed is part of a social trading platform where strategy providers can share updates with investors, including news or information about strategy performance, upcoming trades and any other relevant。

As a strategy provider for Exness social trading, you can use the translation function to feed back updates to investors in your native language。It is essential to take advantage of this feature and provide regular performance updates to investors。You can build trust and loyalty among your investors, ensuring they are kept informed of your trading activities and performance。

Statistics

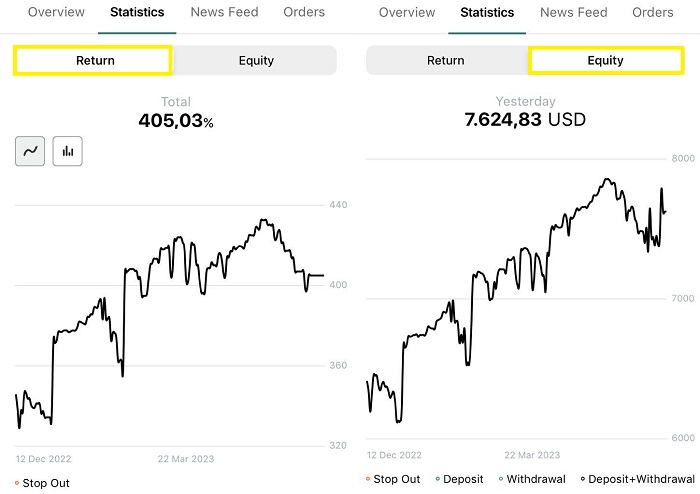

Statistics is a tool in the Exness social trading app that allows strategy providers to view the return and net worth of a strategy。

Here is a more detailed explanation of each indicator:

Return value

The indicator shows how much money the strategy has made or lost over a period of time。These daily statistics calculate the change in a user's net worth from the beginning of the month to the end of the month and offset any deposits / withdrawals。

The calculation takes into account the different periods determined by specific operations such as account deposits, withdrawals and internal transfers, collectively referred to as balance operations (BO)。The return value is determined by multiplying these periods between balance operations and expressing them as percentiles。

In other words, whenever the strategy provider draws or deposits, the yield calculation is completely unaffected to prevent human results。

The profitability of your strategy depends on the rate of return it generates, with higher returns indicating higher strategy profitability。Investors are naturally attracted to high-return strategies, so it is important to target high percentage returns to make your strategy more attractive to potential investors。

Net

The net account value of the strategy represents the total amount of funds available, calculated by considering profits, losses, deposits and withdrawals。Having a higher net worth in a strategic account makes it more trusted and favored by investors。Therefore, it is essential to grow and maintain positive asset levels。

When the net value of the strategy reaches zero or falls into the negative region, the position is forced to close, causing all open trades in the strategy to be automatically closed。Sometimes it may result in a negative balance for the strategy and investments that reflect the strategy may also reflect negative equity。

For strategy providers, it is very important to effectively manage their assets and take measures to prevent negative equity, because it will affect the performance of the strategy and the investments related to it。

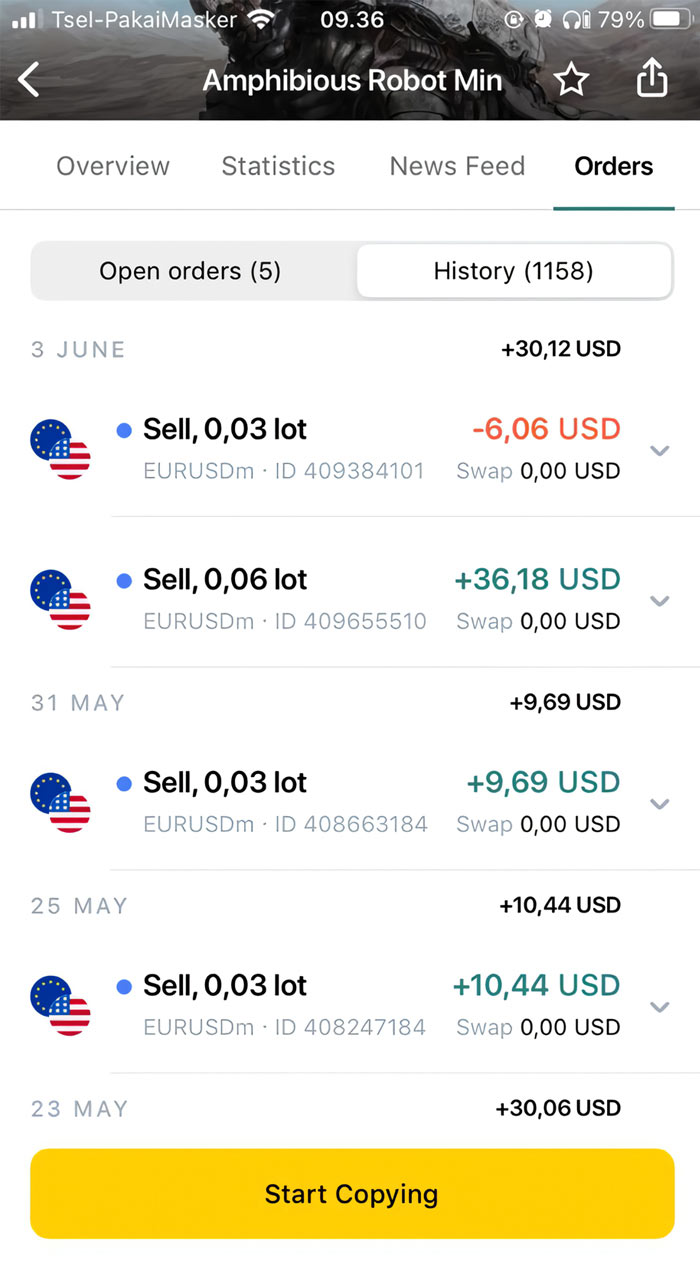

Order Tab

Orders shows all open orders and the history of orders issued according to the policy, clicking on any item in the list will expand its details。

Commission Report

As a strategy provider for Exness, it's important to know how much commission you earn。Exness provides commission reports detailing your investment commission income as well as lifetime statistics。

To access your commission report, you can follow these steps:

- Log in to your Exness Personal Area。

Click the Social Deals tab。

Click the Commission Report button next to the policy you want to view。

In the Commission Report tab, the policy provider will see some of the following details and information:

- Total Commission: The total commission you earn from all investments (closed and open positions)。

Earn Commission: The amount of commission you earn from closed investments。

Floating Commission: The amount of commission you earn from an open investment。

Total Investment: The total number of investments you have made。

AUM (Assets Under Management): The total amount of funds you manage。

Average investment duration: The average length of time an investment remains open。

Filtration Committee Report。

To make it easier to view the data and information presented, the policy provider can filter the data using 3 criteria, namely:

- Trading sessions: You can view commission reports for a specific period, such as the past month or year。

Commission status: You can view commission reports for earned commissions, floating commissions, or all commissions。

Profitability: You can analyze profit, loss or commission reports for all investments。

The status of the investment is displayed as "Active" or "Closed"。An active investment is an investment that is still open, and a closed investment is an investment that has been closed by an investor or strategy provider。

When is the commission paid??

The commission of the strategy provider is paid at the end of the trading period.。The duration of the trading period is one calendar month and ends last Friday at 23: 59: 59 UTC + 0, immediately followed by the start of a new trading period。

At the end of the trading period, all investors' open trades are automatically closed, and the Exness social trading platform immediately reopens these trades at the same price, zero spread。The calculated commission is then transferred to the strategy provider's social trading commission account in their personal area and can be used to trade, transfer or withdraw money。

For your convenience, the whole process is fully automated and the payment is completely accurate。

How to calculateCommission for Strategy Providers?

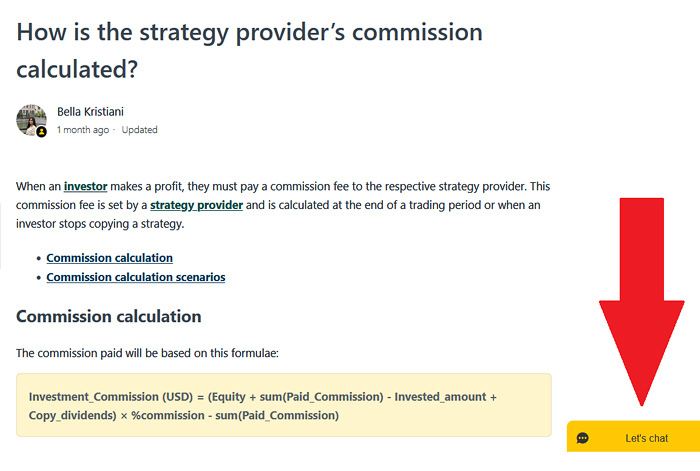

When an investor makes a profit from a documentary trading strategy, a commission must be paid to the strategy provider。The commission is set by the strategy provider and is usually a percentage of the profit, usually calculated at the end of the trading period or when the investor stops the documentary strategy。

Exness has 2 commission calculation formulas, which are classified according to the situation and conditions of the policy provider。

Formula 1: Investment commission (USD) = (equity + commission paid) - (investment amount + reproduction dividend) x% commission - (commission paid)

例子

The investor's starting investment balance is $2,000 and the commission fee is set at 10%。The investor made a profit of $1,000, with an investment interest of $4,000 at the end of the trading period.。The investor had previously paid a commission of $150.。The strategy provider had previously chosen to take a portion of the profits from the strategy and prorated $200 from the investment account.。

Calculated commission = (equity + commission paid) - (investment amount + reproduction dividend) x% commission - (commission paid)

= (4000 + 150) - (2000 + 200) x 10% - 150

= 2050 x 10% - 150

= 205 - 150

= $55

Therefore, the balance of the investment after the investor pays the commission is $4,000 - $55 = $3,945。

At the same time, if the commission was not paid before, the commission formula is:

Investor Commission (USD) = (Equity - Investment Amount + Documentary Dividend) x% Commission

例子

Investors start making new investments in new strategy providers。The starting balance of the investment is $500 and the commission set by the strategy provider is 10%。The investor made a profit of $3,000, with an investment interest of $2,000 at the end of the trading period.。

Calculated commission = (equity - investment amount + documentary dividend) x% commission

= (3000 - 500 + 0) x 10%

= 2500 x 10%

= $250

Therefore, the balance of the investment after the investor pays the commission is $2,725.。

For clarification, the terms in the above formula are explained here。

- Equity: Current investment equity。

Commission Paid: The total commission paid for all previous trading cycles since the strategy was created。

Documentary Dividend: A portion of the profit taken from the strategy provider。

Investment Amount: Opening Balance of Investment。

Commission: The commission rate set by the strategy provider when investing to open a position。

If you are still confused about how to calculate the commission, you can contact Exness Support via live chat。

How to make your strategy more attractive?

There are some important tips to increase the popularity of your strategy and attract investors to follow your strategy, as detailed below:

Choose a clear and compelling strategy name

Your strategy name is the first thing investors see, so make sure it's clear, compelling and spelled correctly。Avoid using all uppercase or special characters, which can make the policy name look unprofessional。Set appropriate policy settings

Investors will want to know how much risk they took when they followed your strategy。Please set appropriate leverage, commission and minimum investment amount settings。Upload professional profile picture

Your profile photo is another way for investors to get to know you。Please upload a professional avatar to make you look trustworthy。Write a detailed resume

A resume is your chance to tell investors in detail about you and your trading style。Be sure to include your trading experience, educational background and any other relevant information。Mention your education platform

To increase credibility and attract investors, strategy providers are encouraged to mention educational platforms, including listing forex training programs, webinars, and even forex training blogs。By providing an educational platform, strategy providers demonstrate their expertise and commitment to sharing knowledge, which automatically increases their credibility and makes their strategies more attractive to potential investors。

In addition to the above points, strategy providers should also understand the considerations for using the Exness social trading platform。You can find them in the following table:

| ✔ ️ To | No. |

| Be transparent: investors want to know who they are investing in and how their money is managed。Be sure to provide clear and concise information about your trading strategy, risk parameters and performance。 | Don't complicate: Investors are very busy and don't have time to read the lengthy, aimless "About" section。Please cut to the topic quickly and concisely。 |

| Stay in line: Investors prefer to go after strategists with a proven track record of success。Please be consistent with your trading strategy and risk parameters。 | Don't over-advertise your strategy: Don't over-advertise your strategy or make promises you can't keep。Investors can tell if you are honest and unwilling to follow your strategy。 |

| Keep communicating: keeping your followers informed of any changes to your trading activities and strategies will help build trust and confidence。 | Don't be afraid to show personality: investors want to invest in people they can trust。Please show your personality in the "About" section。 |

The choice of broker is adjusted according to the needs of each trader. If you only need the basic platform and trading functions with the best attributes, then Exness may be your best choice。

Exness with its 0 only.Advantages such as the low spread from 1 o'clock make up for the lack of changes in its functions, which is very suitable for traders using scalping strategies (Scalper)。Spreads for major currency pairs in some account types can also be as low as 0.0 point, depending on market conditions。

Not only that, traders can also enjoy other advantages such as automatic withdrawals。Exness will process most customer withdrawals immediately without manual inspection; however, depending on the payment provider or method selected, withdrawals may be restricted。

Exness is one of the STP / ECN brokers in Europe, and the safety of traders' funds is also guaranteed。Exness became the official partner of Real Madrid football team for 3 years from July 2017, which also proves that the company has a high degree of stability.。

Exness supports deposits and withdrawals 24 hours a day, 7 days a week。However, it should be noted that the Company does not assume any responsibility if there is a problem with the deposit or withdrawal due to the payment system.。

Traders don't need to worry about transaction fees when making deposits and withdrawals.。Exness does not charge traders any transaction fees, and the chosen payment provider may incur some fees。Exness offers traders a variety of payment methods, including wire transfers, bank cards, Neteller, Skrill and more。

Financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the world's top four accounting firms。

In addition, Exness is one of the most transparent brokers in the online trading industry, and traders can find all the information about the company on the website, such as trading volume, number of active customers, customer deposits, company funds, etc.。

Exness offers different platforms, including MetaTrader 4, MetaTrader 5, web and mobile platforms。This makes it easier for traders to trade on Exness because they can also access the Exness platform anytime, anywhere.。

Over the years, Exness has developed into a broker that attracts traders, who comply with financial regulations such as FCA and CySEC, further strengthening their trust.。

One measure of customer confidence is the volume of transactions。As of December 2018, the monthly trading volume of its clients reached $348.4 billion, with more than 50,342 active traders worldwide.。

With the programs offered by Exness, traders also have the opportunity to earn extra income by becoming their partner。By introducing the Broker (IB) program, partners can earn up to 33% spread commission from each new customer who registers。

Additional income from Exness Partners。Traders who register through the member link can earn up to 25% spread commission per trade.。

Customers can also use their free VPS hosting service when trading at Exness。VPS (Virtual Private Server) provides traders with greater reliability and stability because they can maintain their trading and expert advisors without interruption in the event of unexpected technical problems (such as Internet or power outages)。

It can be concluded from the comments above that Exness is a trader's favorite broker due to its low spreads and flexible account type, ideal for traders with limited funds but need more opportunities to maximize profits。The broker is also known for its maximum support for new and old partners.。

Conclusion

Exness Social Trading provides a strategy sharing platform that enables investors to successfully follow orders。Exness existing customers can easily use the app through their current account, acting as an investor and strategy provider。

Strategy providers can create strategies for investors to follow orders and earn 0-50% custom commissions。They can access order information and commission reports to track their income, with commissions paid at the end of each trading period based on commission fees set by the strategy provider。

In addition to customizable commissions, the platform provides strategy providers with a variety of tools and features, including strategy creation, trade reliability level (TRL) measurement, updated news, and return and equity statistics。

To attract investors, strategy providers should choose a clear and attractive strategy name, set appropriate strategy settings, upload professional profile photos, mention educational platforms, and write a detailed resume。Transparency, consistency and communication are key to building trust and attracting investors。

Exnessis a Forex and CFD broker offering clients trading across multiple markets with the industry's most stable and reliable pricing, offering traders spreads as low as 0 pips and leverage up to 400: 1。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.