Introduction to XM Replication Transactions

As a strategy provider, XM copy trading can bring you a lot of income because you can get commissions from people who copy your strategy。

Copy trading is currently being favoured by many traders。This is because the service can generate significant additional revenue for the transaction。While making a profit, you also have the opportunity to make money by sharing your strategy with other traders。

Simply put, if the strategy you share turns out to be profitable, the individual who copied your strategy will "reward" you as a token of appreciation.。In addition, in XM copy transactions, you can choose how much you want to get paid from them。

If you are confident and believe that your strategy can be profitable, you can try to register with XM as a strategy provider, sometimes called a "master."。Their strategies can be copied by many traders and profit from the commissions they pay。

Introduction to XM Copy Trading

XM is a well-known global broker with numerous licenses, including major licenses such as FCA, ASIC and CySEC。The broker has been operating since 2009 and has provided satisfactory service throughout its operations。

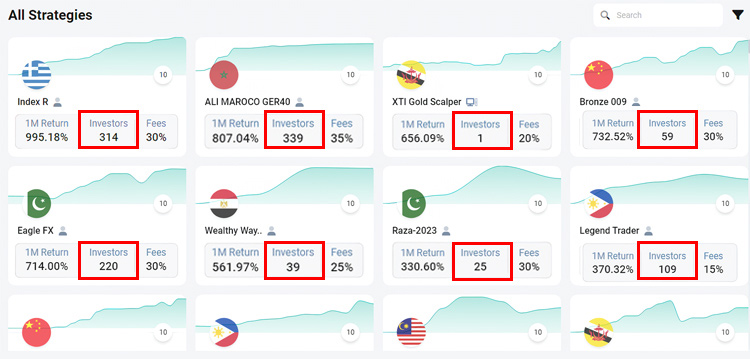

XM Global Limited's XM Replication Trading Service is relatively new as it was just launched in 2023。Still, the service has attracted a lot of interest, with 200 people joining as strategy providers.。

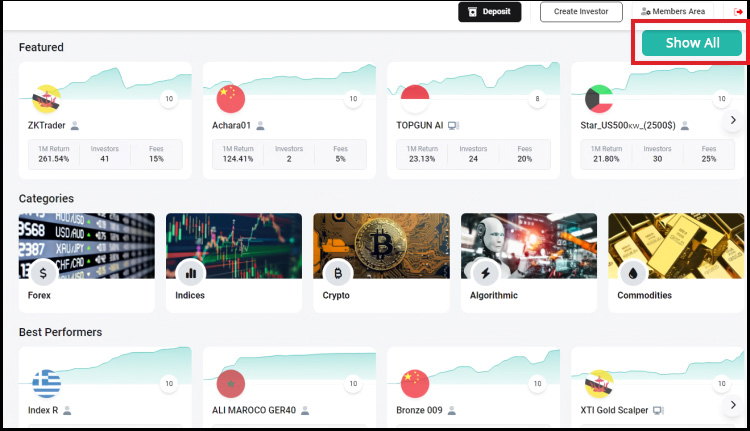

The 200 people came from all over the world, most of them from China, Malaysia, Pakistan and Thailand.。You can view their profile by clicking "Show All" in the Copy Transaction menu。

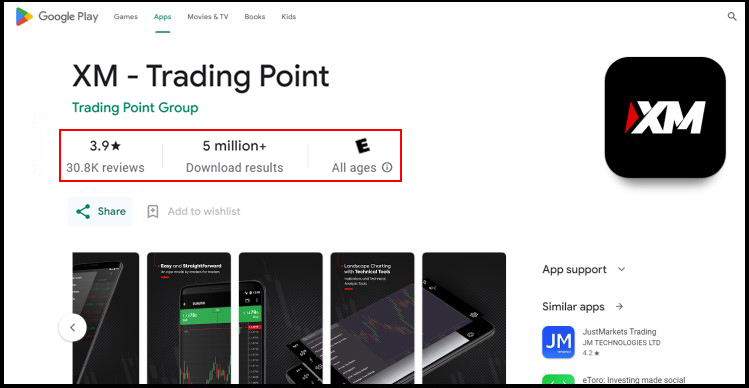

You can access XM's copy transaction service through the website or the mobile app, which can be downloaded from the Play Store and App Store。Currently, to get the XM mobile app on Android, you need to download the APK format。

Currently, there is no app dedicated to copying transactions, but given its popularity, it is likely that an app will be developed and downloaded directly from the Play Store。

XM Trading APP Overview

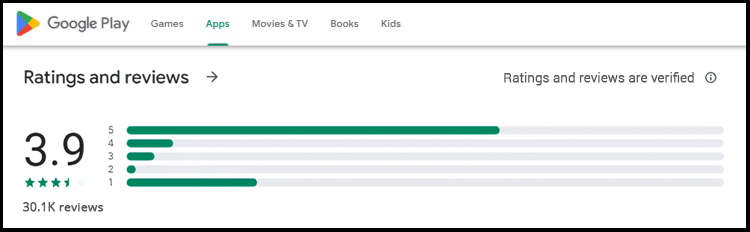

The XM mobile app has a rating of 3 in terms of reviews.9 out of 5 with comments from over 30,000 users。Comments indicate that the XM app is generally well received, with both positive and negative feedback。

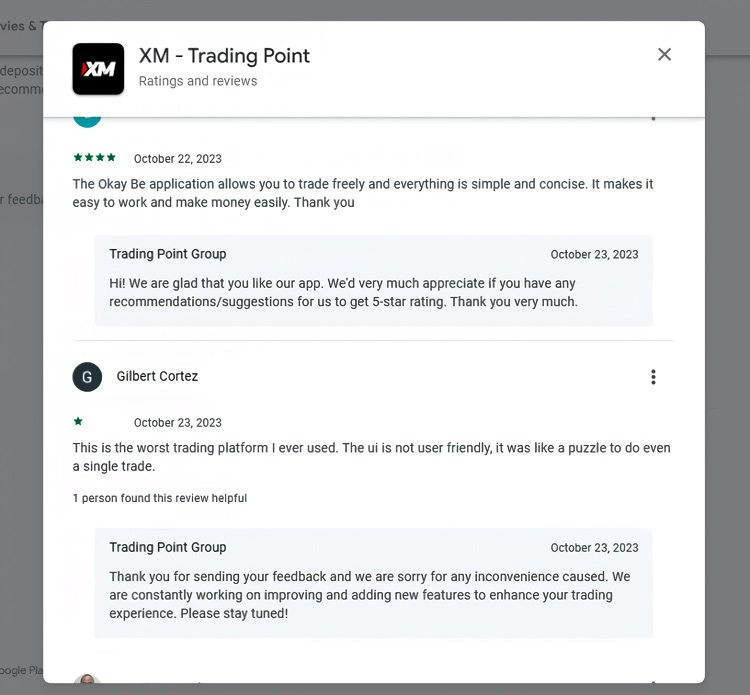

Most positive reviews stated that the app is fast, responsive, and user-friendly in terms of deposit and transaction execution。On the other hand, negative reviews mentioned occasional technical problems such as malfunctions, errors, or freezing。

The good thing is that the XM team responded positively to all comments。When they receive positive feedback, they express gratitude; when they receive negative feedback, they apologize and promise to improve the app in the future。

XM was founded in 2009 as a company called Trading Point of Financial Instruments Ltd..A member of an online brokerage firm。To serve customers worldwide, the company has split into XM Australia and XM Global, as well as XM Cyprus。Each member has a different head office and license, XM Australia is registered under the Australian Securities and Investments Commission (reference number: 443670), XM Worldwide is registered under the International Financial Services Commission (60 / 354 / TS / 19), and XM Cyprus is registered under the Cyprus Securities and Exchange Commission (reference number: 120 / 10).。

XM is one of the more experienced brokers in the online forex trading world today。Since its inception, the broker has undergone many changes, including the addition of an ultra-low account and webinar function, which supports 19 different languages with 35 local instructors in each language。

In terms of trading instruments, XM is known for its diversity of asset providers, ranging from foreign exchange, commodities, CFDs for equity indices, precious metals, energy, to equities。XM prides itself on being an ideal broker for executing trades, providing a statistic that 99.35% of orders executed in less than a second。Trading at XM also offers a strict no-re-quote policy, no virtual trader plug-ins, no rejection of orders, real-time market execution, and the option for traders to place orders online or over the phone.。

In the Ultra-Low account, the spread of all major currency pairs can be as low as 0.6 points, while the spread of other accounts usually starts at 1 point。XM chose to limit their leverage to a scale of 1: 888, rather than offering a maximum leverage of 1: 500 or 1: 1000 (whole numbers), a unique number now widely recognized as a trademark of XM.。

To protect client funds in extremely volatile situations, XM offers negative balance protection for each type of account。Deposits for micro and standard accounts start at $5, while Ultra-Low accounts require a minimum deposit of $50。Traders who open an account at XM can get conditions similar to a penny account environment in a micro-account, where the contract size is only 1,000 units per lot.。If you use the smallest number of lots on the MetaTrader platform, which is 0.01 lots, then a trader can trade only 10 units per trade。

For deposits, XM applies zero-fee deposits in most of its available payment methods。Traders can choose to deposit and withdraw money by wire transfer, credit card, and the most popular electronic payment options such as Skrill, Neteller, and FasaPay。

XM also provides Islamic accounts for Muslim traders who comply with Sharia law that prohibits the use of interest-bearing overnight swaps for each currency pair.。In order to provide their customers with the best trading experience, XM has opened access to MT4 and MT5 platforms, each with more than 6 display formats (PC, Mac, Multiterminal, WebTrader, iPad, iPhone, Android and Android tablets).。

Overall, there is no doubt that XM has gone global, with its deep commitment to providing trading services on a global scale available in more than 15 languages.。In addition to simplifying the trader's experience through mainstream trading platforms and high-quality trade execution, XM is open to all types of traders, from small capital traders to more experienced traders preparing large deposits.。Even a penny trading environment for traders if they choose to register under a micro account。

For their global approach, XM has ensured that traders from various countries can easily access their services.。This results in different domain names for traders in specific jurisdictions。

How to create a policy provider / master account?

To earn extra income from XM copy trading, you need to register yourself as a strategy provider。It must be understood that there are two roles here: strategy provider or guru, and investor。

The strategy provider is the person who shares the strategy, and if the strategy is profitable, they will receive a commission from the investor。At the same time, investors are the ones who copy your strategy。Therefore, the accounts of these two roles are different。

To create a strategy provider account, make sure you already have an XM live trading account。If you haven't already, you can create one.。Then you can do as follows:

First, log in to your real trading account using the registered email and password。

Click the "Explore XM Copy Transaction" button。You will enter the following page。Click the Strategy Manager Area button。Click "Create Policy"。

The registration process takes a little time, please wait a little while until XM finishes processing your policy provider account。

Once you're done, you're ready to set up your policy provider account。Here you can select the platform, account type, leverage and base currency to use。Do not forget to enter the password and indicate whether you wish to receive a deposit reward。Check the agreement box and click "Next."。Next, create your policy。Enter strategy name, description, performance fee, minimum investment, and strategy type。When finished, click "Continue."。It takes about 1 hour to process your request。Finish。Investors will only see your strategy if it has an equity of $50 or more。Once the policy is created, you can see it on the home page。You can also see the number of investors on the homepage。The number of investors is fully visible because it will be displayed in the public profile of the strategy provider。

Policy Provider Features

Policy Management Area

Here you can find all the details related to your policy provider account。You can view:

A list of strategies, including the number of investors who copied them and the fees you earned。Statistics, including daily, weekly, monthly, yearly and calendar year earnings performance percentages。Risk figures, including average profit per trade, average loss per trade, best trade and worst trade。All figures are in US dollars。Trading frequency, showing how often you have opened positions in the last 30 days。Asset configuration, with a history of the assets you trade。Manager fees and expense details, providing a history of commissions you have earned as a strategy provider。Fee details even include subscription ID, transaction ID, amount, currency and processing time。

Create Policy

Using the tool, you can optimize your own trading strategy for investors to copy。From this menu, you can configure the following:

Policy Name: This will appear in the list of policy providers in the copy trade menu。You can name it according to your preferences, the more attractive the better, because this will attract investors。Some use aliases, some use real names, some incorporate trading strategies into their names, and some use random names。

Description: It's like your social media profile。Feel free to fill in。You can describe your strategy like bangfibo or write your career like ZKTrader。Performance Fee: This is a tool to set the percentage of commission an investor must pay you。You can adjust the percentage from 0% to 100%。Currently the lowest provider fee is 10% and the highest is 40%。

Minimum Investment: This is the minimum balance required for an investor to replicate your strategy。You can set it according to your own profile。

Policy types: There are three types to choose from: manual, algorithmic, and supervised algorithms。"Manual" means that you manually trade。"Algorithm" means the use of an Expert Advisor。"Supervised Algorithm" means your use of a combination of EA and manual trading, or a manually controlled EA。

Deposits

As the name suggests, the tool is used to deposit funds into your trading account。The tool is already available on the copy trading page, so you do not need to go to the funds menu in the client area。

If you need a deposit, you can use the tool。After successfully accessing the funds page, the system will guide you to choose the deposit payment method, including wire transfer, mobile banking, credit / debit card, etc.。

You can also view the history of deposits, withdrawals and internal transfers。

Creating investors

This tool is used to create investor accounts。One of the advantages of XM Copy Trading is that you can open both provider and investor accounts。You can activate both accounts at the same time, so if you want to act as an investor at the same time, you can use this tool。

Shading settings

This tool is mainly used to change the screen display, which can be light or dark。If you select "bright," the screen will be mainly bright white。If you select Dark, the screen will be predominantly dark。Just like on social media。You can change it at any time according to your preference。

Contest

Please note that XM organises social trading competitions with prizes worth thousands of dollars。If you are confident enough, you can compete and test your strategy。

You can find multiple sub-menus in the tool, there are real and simulated sub-menus that show the account used by the match。In addition, there is a sub-menu of ongoing, upcoming and finished matches that can show the schedule of those matches。

Social Feed

Social Feed is a tool for strategy providers to share ideas, just like Facebook or X。You can also share interesting insights to attract investors。

Settings

The tool can be used to modify account-related information, where you can change your username and profile, and adjust your language preferences。

FAQs

How the commission for the strategy provider is calculated?

As a primary objective, you must understand how the commission scheme works in the XM Copy Trading System。After signing up as a strategy provider, fill out a profile, attract investors, and then trade until profitable。Once profitable, the investor will pay the commission you set。

As mentioned earlier, as a strategy provider, you are free to set the percentage of commission that investors must pay you。If you set too high a commission, investors may be reluctant to follow you because they have to give up a larger portion of their profits。Especially if your strategy is not profitable。However, if the commission is too low, investors may be more interested because you are "cheap," but this may hurt your own income because there is not much。

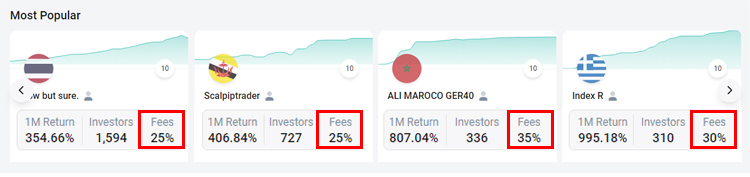

According to the current list of strategy providers, most providers set commissions between 15-30%, with a minimum of 5% and a maximum of 50%。No higher than that, as it would obviously make it difficult for them to attract investors。

For example, among the most popular "Big Four traders," they set commissions at around 25% -35%。

How much money you earn depends on the profit you make, which is then multiplied by the commission percentage。For example:

Let's say you set your commission at 25%, 10 investors follow you, and a successful trade generates a profit of $500:

Commission paid = commission percentage x profit earned x number of investors

Commission paid = 25% x $500 x 10 = $1,250

If you add the trading profit, it will reach $1,250 + $500 = $1,750。

When to Pay Commission?

The investor must pay a commission at the end of the day's trading session, which will be credited to your strategy provider account at the end of the day's trading session。

You don't have to wait too long to get paid.。Once in the account, you also have the right to withdraw。

How to Make Strategies Attractive?

Perfect personal data。Nicknames are the first things investors will see when they browse strategic providers。Therefore, to create a nice, clear, attractive name, it is also best to be short。

Set a reasonable commission。After the name, the investor looks at the commission fee you set。If the commission is too high, the investor will automatically skip and will not be interested in learning more about your strategy and information。In addition, you must compete with other strategy providers。

Introduce your background。In the description and introduction, write something that can support your introduction and make it convincing。You can mention your own experience, such as having 5 years of forex trading experience, winning a trading competition or working as a trader in a financing company。Such a background will certainly give investors more confidence in your credibility。

Improve your portfolio。Investors can get a sense of how you've done so far, how many times you've won, how many times you've lost, winning percentage and so on。If your performance is good, investors will have the confidence to copy your strategy。

Optimize leverage and risk to develop the most reliable strategy。Investors can also consider your strategy in terms of the level of leverage you use, whether you use manual or robots.。Avoid high-risk strategies。The level of risk is also publicly shown。If the number 10 is displayed on your profile, indicating that the strategy you are using is risky, then investors will be reluctant to pay attention to you。

- In addition, as a strategy provider for XM copy trading, you need to be aware of the following:

| ✔️ | ❌ |

| Perfecting personal data with accurate information, investors attach great importance to transparency。Create a professional profile。The name and other details you choose can determine whether investors continue to view or skip。Trade diligently to improve profitability。 | Don't give false information。Do not use risky strategies to avoid increasing the risk level of the strategy。Don't over-commit。While you need to attract investors, you should not commit to things that guarantee profitability or future liability。 |

Important rules for policy providers

There are several important aspects to be aware of when registering as a strategy provider on an XM replication transaction:

You can create up to 10 policy provider accounts。The number of followers of the strategy is unlimited, and the number of investors that each strategy can follow is unlimited。You have the flexibility to set commission rates up to 50% of your followers' profits。No upper limit on commission。The more investors who follow your strategy and the more successful the strategy, the higher your potential return。

Conclusion

XM Copy Trading is a great opportunity to earn extra income from trading。After becoming a strategy provider, in addition to profiting from your own trading, you have the opportunity to earn more money through commissions paid by investors who follow your strategy。

To do this, you can take advantage of the various tools XM offers to optimize your profile and attract a large number of investors。The more investors imitate your strategy, the more commissions you will earn。

At the same time, you should also achieve good trading performance - improve odds, use safe strategies, and keep risk levels low。This way, you can become a successful strategy provider。

XM is an established international company that has become a true leader in the trading industry。The company was founded in 2009 with "fair, credible and reliable" as its main working principle.。XM claims to support repeat-free quotes and real-time execution, allowing traders to choose from 10 trading platforms for all devices.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.