Is it time to invest in Malaysian stocks??

While negative sentiment over the past five years has dragged down Malaysia's stock market, there are still various underlying positives in the country.。The semiconductor industry is a good example.。

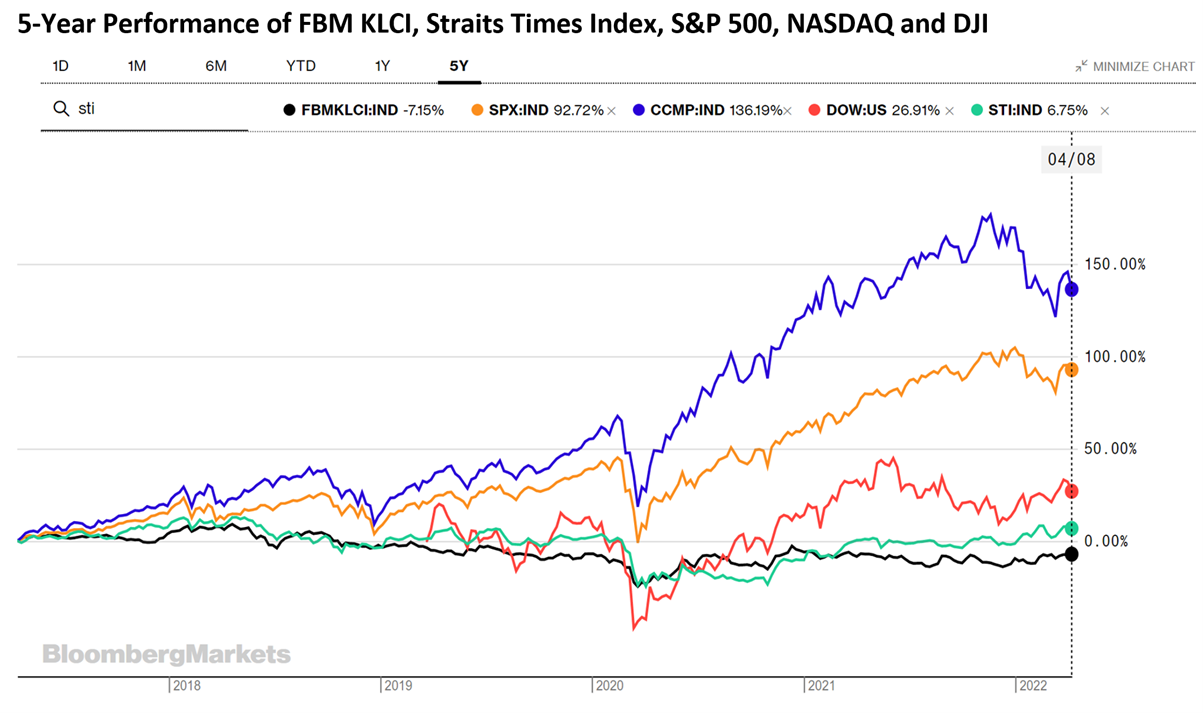

As shown in the chart below, investors can see that the Malaysian stock market has been struggling for the past five years (see chart below)。

The FTSE Malaysia Stock Exchange KLCI Index, also known as the FBM KLCI Index, is a capital-weighted stock market index of the 30 largest companies on the Malaysia Stock Exchange, from 1887 in 2018..75 points down to the close of 1597 on Tuesday (April 12, 2022).13 o'clock。Over the past five years, the FBM KLCI index has fallen 7.2%。By contrast, Singapore's Straits Times Index rose 6.8%。Meanwhile, U.S. stock market indexes such as the S & P 500, the Nasdaq Composite and the Dow Jones Industrial Average each rose 92 percent..7%, 136.2% and 26.9% (see chart below)。

Why Malaysia's Stock Market Continues to Fall?

The investment environment in Malaysia's stock market has been challenging over the past five years, with the pandemic, the changing political landscape and concerns about corporate governance in the country triggered by the 1MDB financial scandal all posing challenges for the Malaysian stock market.。It's hard to tell whether foreign investors are more concerned about political uncertainty in Malaysia or the 1MDB affair involving Goldman Sachs.。In any case, foreign investors' shareholdings in Malaysian stocks have fallen to only about 20 per cent (see chart below).。

In March 2022, foreign investors became the largest net buyers of the Malaysian stock market, with net purchases of RM3.3 billion (7.$800 million)。This is also the third consecutive month of net buying of Malaysian stocks by foreign investors.。Since Malaysia's 14th general election in 2018, foreign investors have made net sales of the Malaysian stock market for four consecutive years, which is a good start for Malaysia.。

Malaysia's economic recovery lags behind that of the region

Malaysian shares lag peers such as Singapore, Indonesia and Thailand despite return of foreign investors。Singapore's Straits Times Index (STI) was the best performer in the first quarter of this year (Q1 2022), rising 9.1%, followed by Indonesia's Jakarta Composite Index (JCI) and the Stock Exchange of Thailand (SET)。Finally, the FBM KLCI index had the weakest gain in the first quarter of 2022, at just + 1.3%。

It's Time to Invest in Malaysian Stock Market

While negative sentiment over the past five years has dragged down Malaysia's stock market, there are still various underlying positives in the country.。The semiconductor industry is a good example.。In fact, Malaysia is one of the important semiconductor centers in the region.。Intel to invest more than $7 billion to build a new chip packaging and testing plant in Malaysia。Malaysia's new advanced packaging plant is expected to start production in 2024。The timing of the entry into the Malaysian stock market is unlikely to be certain, but there are signs that the Malaysian stock market is recovering and foreign investors are gradually returning.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.