Singapore Industrial Property Market Slows Down, Long-Term Outlook Remains Positive

Singapore's industrial property market has begun to cool after two years of rapid growth. Although rents continue to rise, the rate of increase is slowing. REITs have shown strong resilience despite rising costs and economic challenges.

As Singapore's economy stabilizes after the pandemic, the industrial property market has begun to cool after two years of rapid growth. Although rents continue to rise, the growth rate has slowed, with rents rising by only 1% quarter-on-quarter in the second quarter of 2024, the lowest increase since the beginning of 2022.

However, industrial properties remain a stable source of income, and major real estate investment trusts (REITs) have shown strong resilience despite rising costs and economic challenges.

Market Overview: Resilient but Slowing Growth

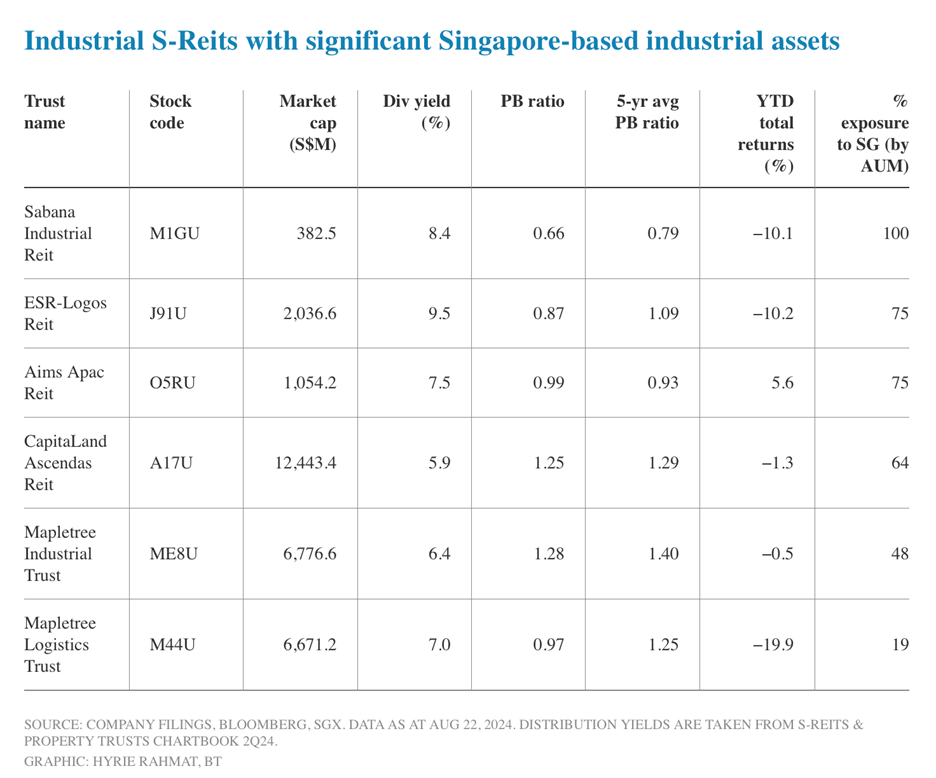

In the second quarter of 2024, Singapore's industrial property rents increased by 6.6% year-on-year, and occupancy rates rose slightly by 0.3% to 89%. Among Singapore's six major industrial-focused real estate investment trusts (S-REITs), their performance in the domestic market has been mixed.

Except for Mapletree Industrial Trust (SGX: ME8U), other REITs have seen a year-on-year decline in distribution per unit (DPU) due to higher borrowing costs and increased operating expenses.

Mapletree Industrial Trust Outperforms

In 1QFY2025, Mapletree Industrial Trust reported a 1.2% YoY increase in DPU, driven by strong contributions from its recently acquired Osaka Data Centre and good lease renewals across its portfolio, with occupancy rising to 91.9% and average rental growth of 9.2% for Singapore properties.

Rent reversals across sectors generally positive

Despite mixed financial results, all six Industrial S-REITs achieved positive rent reversals ranging from 2.6% to 16.8%. Sabana Industrial Trust (SGX: M1GU) led the way with a 16.8% rent reversal rate, marking its 14th consecutive quarter of positive rent growth.

Strong balance sheets support growth flexibility

Financially, the REITs' balance sheets remain strong, with an average leverage ratio of 37%, well below the regulatory cap of 50%, providing room for further growth through acquisitions and portfolio optimization.

For example, ESR-Logos REIT (SGX: J91U) leveraged its financial strength to make S$772.6 million of strategic acquisitions in Japan and Singapore, further diversifying its portfolio and in line with its green and sustainable development strategy.

Valuation: Discounts present investment opportunities

Despite the solid financial position of these REITs, their share prices have fallen by an average of 6.1% this year due to the high interest rate environment and global uncertainty. Currently, they are trading below their typical price-to-book (P/B) ratios, providing potential opportunities for value-seeking investors. Among them, Mapletree Logistics Trust (SGX: M44U), ESR-Logos REIT and Sabana Industrial Trust show the largest discounts relative to their five-year historical averages.

Outlook: Stability and potential upside

In the long term, the outlook for Singapore's industrial REITs remains positive. These assets continue to provide stable returns, second only to the total returns of data centre REITs. In addition, a possible interest rate cut in September is expected to boost investor confidence and drive renewed interest in the sector.

For investors seeking a combination of stability and growth, Singapore Industrial REITs offer attractive opportunities amid market volatility.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.