Tickmill deposit and withdrawal guide

Tickmill deposits and withdrawals currently rely on nine payment methods, including bank transfers, cards, cryptocurrency payments and electronic payments.。

Tickmill deposits and withdrawals currently rely on nine payment methods, including bank transfers, cards, cryptocurrency payments and electronic payments.。

Tickmill is a leading retail forex broker with a strong track record since 2014 and they have licences issued by a number of institutions, including the Financial Conduct Authority (FCA) and the Seychelles Financial Services Authority (FSA).。

Over the years, Tickmill has been popular with traders for its low-cost trading environment, however, the ease of access to own funds remains an important point in measuring the credibility of any broker.。Therefore, this article will discuss all the key information about Tickmill deposits and withdrawals。

Tickmill Deposit

You can make a deposit in the client area by selecting the most suitable funding option, please follow these steps:

1.Prepare the funds。The minimum deposit for Tickmill varies, with a minimum deposit of $100 for classic and professional accounts.。

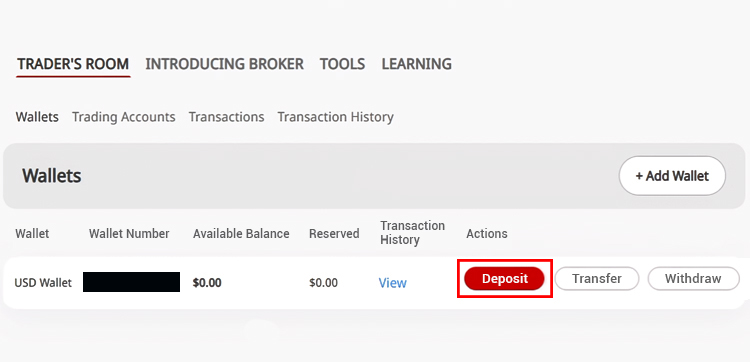

2.Log in to the client area through the Tickmill home page。The first feature is your wallet, the balance of the newly opened wallet is zero, and the "Deposit" button is red。

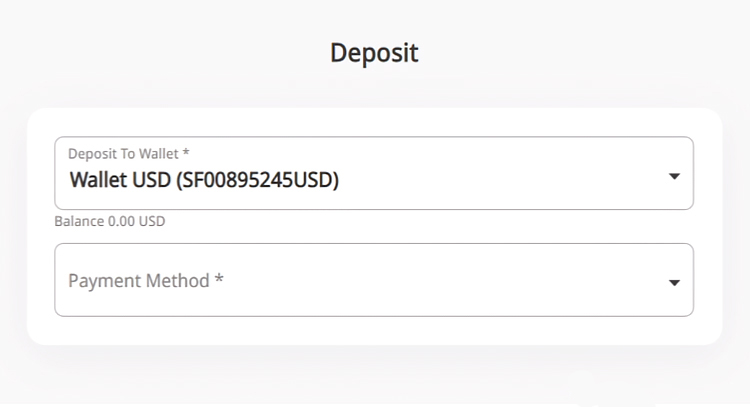

3.Clicking on the "Deposit" option in the Wallet window will take you to another page where you can select your preferred payment method through a pop-up window, the optional payment method may vary depending on your original nationality。The best deals are electronic payments and local bank transfers, but other options are also available。

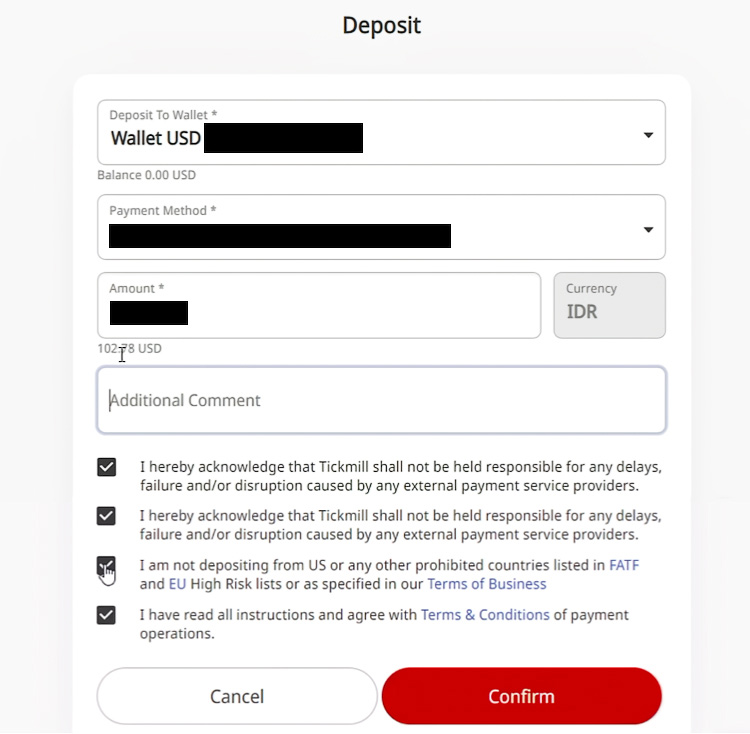

4.Subsequently, you must fill in the rest of the form, especially the amount of funds and the amount of currency, non-required items can be blank。Please make sure all the details are correct and don't forget to check all the checkboxes and click "Confirm"。

5.You will then jump to a third-party service provider (payment gateway) to complete your payment。Depending on your preferred payment method, the procedures on the gateway may be different, but just follow the steps shown on the screen。

6.The deposit will appear in the e-wallet within a few minutes or up to 1 business day after completion。If necessary, please contact the Tickmill help desk to resolve the issue。

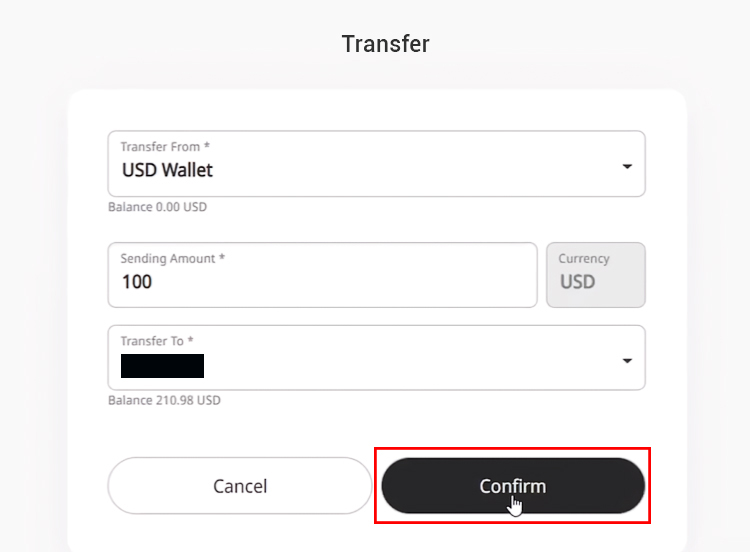

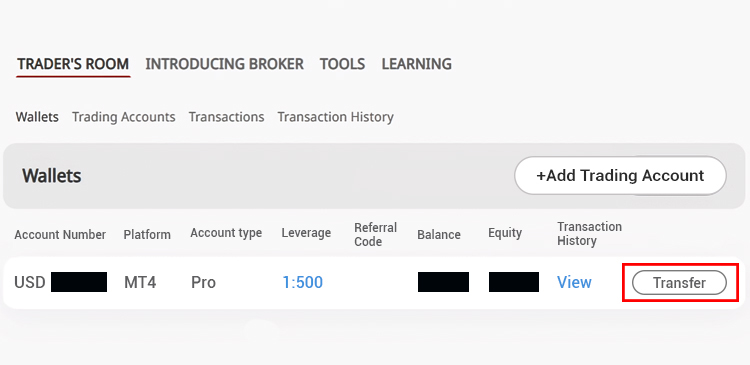

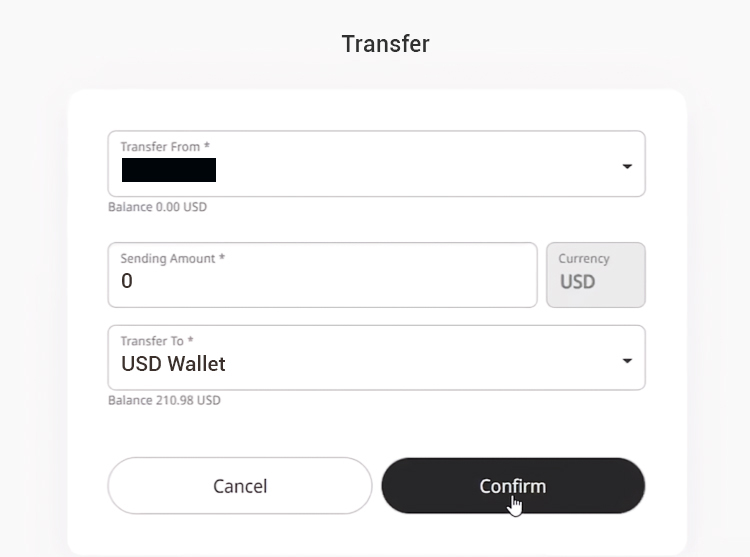

7.You cannot trade directly with the funds in your wallet, you must first click on the "Transfer" option in the e-wallet area to transfer them to your account。In the subsequent transfer window, enter the amount of funds and select the Tickmill real account you want to trade。Finally, click on "Confirm"。

8.The funds will eventually be stored into the account in a few seconds。Note that Tickmill deposits are free, but there may be a charge for the payment method you choose。

Tickmill Withdrawal

Tickmill will usually only process withdrawals back to the same payment method you used to deposit。Here's a step-by-step guide to withdrawing money from Tickmill:

1.Make sure you do not have any open trades before initiating a withdrawal request。

2.Log in to the client area and go to the "Trading Account" menu。

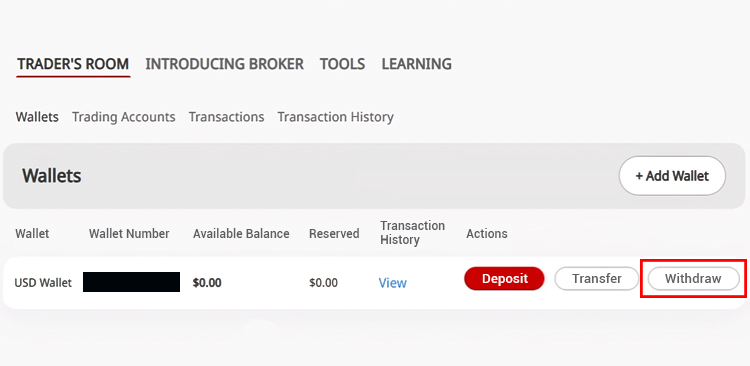

3.You cannot withdraw funds directly from your trading account, you must first transfer funds from the trading account to the e-wallet, which will be transferred in seconds。

4.If your wallet available balance exceeds the minimum withdrawal requirement, proceed to the next step。Click on the "Withdrawal" option on the Wallet and enter the amount you want to withdraw and the payment method in the window below。

Tickmill currently requires a minimum withdrawal of $25 and a zero-fee policy for all payments.。However, there may be charges for the payment method you choose, please calculate these charges。

How long does it take for funds to be transferred from Tickmill to a bank account?Tickmill promises to process all withdrawal requests within one business day。However, the time required for the funds to arrive will depend on the payment method you choose。Bank withdrawals may take 3-7 business days to appear on a customer's account, while withdrawals using a credit or debit card may take up to 8 business days。

FAQs

What base currencies does Tickmill offer??

Tickmill offers three base currencies: USD, EUR and GBP, deposits in any other currency will be converted to the base currency of your account。

What deposit and withdrawal methods does Tickmill support?

Tickmill withdrawals and deposits currently rely on nine payment methods:

- Bank transfer

Cryptocurrency payments in BTC, ETH, or USDT (availability varies by region, see Customer Zone for further information)

Visa or Mastercard credit or debit card

Skrill

Neteller

Alipay

Fasapay

China UnionPay

Webmoney

wire transfer

Local bank transfers are also available in some countries, please contact the Tickmill help desk for more information, available 24 hours Monday to Friday。

Does Tickmill have a deposit bonus??

As of May 2023, Tickmill does not offer any deposit incentives, however, they do offer a $30 welcome account for new traders to trade without a deposit (the profits earned are yours)。

Should other factors be considered when submitting a deposit / withdrawal request at Tickmill?

Yes, you need to pay attention to three points:

First, Tickmill does not accept payments made through third-party sources, and they may impose fines for such malfeasance.。

Secondly, you can only use payment methods that are legally yours and registered in your name, that is, the name used for Tickmill account registration should be the same as the name on your bank account, debit / credit card, etc.。

Third, Tickmill may request additional documents to support your deposit / withdrawal application, and payment may be stopped or refunded if the correct instructions are not followed。

Tickmill is Tickmill Ltd.The company provides trading services through quality products and innovative technologies.。Superior trading conditions, ultra-fast execution, security of client funds and dedicated support are at the forefront of the services it offers。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.