Tiger Brokers2 the best way to get into the gold.

This article introduces Tiger Securities 2 kinds of deposit process, Wise deposit and Bank of Malaysia international wire transfer, with a complete set of steps to teach, deposit fees and precautions to help you easily complete the deposit action.。

After successfully opening an account with Tiger Securities Tiger brokers, the next step is to remit real money and start trading in Hong Kong, U.S. and other financial derivatives.。

This article will organize 2 ways to enter the gold tiger securities, with a complete step-by-step teaching, deposit fees and precautions, and finally will choose the most economical and convenient way to enter the gold, to help you easily complete the deposit action.。Content recommended Malaysia, Singapore user reference。

How to get into Tiger Securities?

Founded in 2014, Tiger Securities has a branch in Singapore to handle Southeast Asia operations.。The accounts registered by users in Xinma are all owned by Tiger Securities (Singapore) and managed by the Singapore branch, and the funds will be dispatched mainly by the Bank of Singapore.。

At present, Tiger Securities' deposits are mainly bank remittances, which are divided into three categories: local deposits from Singapore banks, e-remittances from banks outside Singapore, and e-remittances through Wise.。

Supports user transfers to USD, SGD, HKD, AUD and EUR。

Tiger Securities deposit method and cost comparison.

Tiger Securities and its recipient bank, DBS DBS, do not charge any fees when users send money into the deposit.。However, if a user uses a bank outside Singapore to remit money, the remitting bank and the transit bank will charge a fee.。The fees vary depending on the currency received, depending on the actual bank charges.。

Tiger's securities account can hold multi-currency funds at the same time.。At present, the deposit of SGD is zero cost, it is recommended that you can remit SGD.。After that, if you want to invest in Hong Kong stocks, U.S. stocks, Chinese A-shares, use the built-in currency exchange function, transfer to Hong Kong dollars, U.S. dollars, RMB can be。

The following is a summary of Tiger Securities' deposit methods, currencies, fees and arrival speeds for easy reference and comparison.。

| remittance bank | Supported Currencies | Transfer Method | Arrival time | 费用 |

| DBS/POSB | new dollar | DDA deposit | 5 minutes | 0 |

| SGD / HKD / USD / EUR / AUD | Domestic Transfer | SGD up to 15 minutes Other currencies require 1 to 2 working days | 0 | |

| Bank in Singapore (non-DBS / POSB) | new dollar | Domestic Transfer (FAST) | 15 minutes fastest | 0 |

| HKD / USD / EUR / AUD | International Wire Transfer (TT) | 1 to 3 working days | Charged by remittance bank, transit bank, between US $25 / HK $200 / A $35 / EUR 25 | |

| Banks outside Singapore | SGD / HKD / USD / EUR / AUD | International Wire Transfer (TT) | 1 to 3 working days | Fees fluctuate and are charged by remittance banks, transit banks |

| Supported Payment Currencies: Rmb / Rupee / AUD / CAD / GBP / EUR | Wise links in Tiger App | Depends on Wise arrival speed | Fees Floating, Charged by Wise |

Which deposit method to choose?

The best arrangement of the gold tiger fee is as follows: Singapore DBS / POSB binding DDA deposit (zero fee, fastest arrival) > DBS / POSB ordinary domestic transfer > other Singapore domestic bank transfers > Wise deposit > other regional bank international wire transfer (TT)

For Malaysian users, generally unless you have a bank account in Singapore, it is most convenient to use Wise to remit money to the ringgit to the account.。It is expected to arrive within 1 hour.。This is because Wise international remittances do not need to go through a transit bank and the currency conversion rate is also calculated at the medium-market rate (Mid-Market Rate).。The exchange rate is more favorable and does not incur the international remittance fees of the average bank, so Wise charges much cheaper fees than wire transfers.。

Second, is the use of Malaysian banks to do international remittance (TT)。However, the wire transfer fees charged by local banks are more expensive。

* Of course, you can also open a Singapore bank account to get into gold at these U.S. stock brokers based on the CIMB SG, which we wrote earlier, which you can also open at home.。

Moreover, it will be cheaper to wire the funds to the Singapore bank account first through Wise, and then use the Singapore bank account into the gold and U.S. stock account!

Tiger Securities into the gold note.

1.You can deposit money only after you have successfully opened an account.。

2.Tiger Securities has no minimum or maximum deposit.。New users can get 1 share of Sofi stock (NASDAQ: SOFI) as a reward after registering a new account through the Tiger Exclusive Benefit Link.。Initial deposit of more than S $2,000, one free share of stock worth between S $25 and S $1,200。

3.The tiger side does not charge any fees at the time of deposit, but uses a bank outside Singapore to deposit money by international wire transfer (Telegraphic Transfer, TT), which will be charged by the remittance bank and the transit bank.。Subject to actual bank charges。

4.In order to prevent money laundering activities, Tiger stipulates that only bank accounts with the same name as Tiger's account can be used to initiate deposits, and does not accept third-party bank accounts, joint bank accounts, third-party payment platforms, checks, cash and other methods of deposit.。Credit / debit cards, e-wallets, Google Pay, PayLah, GrabPay and other deposit methods are also temporarily not supported.。

Tiger Securities into the gold process teaching (multi-figure)

Next, we will teach and explain in detail, step by step, two ways to enter Golden Tiger Securities in a multi-graphic format, namely.

◇ Wise Electric Incoming Gold

◇ Deposit from Bank Malaysia International Wire Transfer (TT)

In both cases, you choose to earn your money in ringgit and get the SGD.。

You can deposit gold through the official website of Tiger Securities or Tiger Trade App, the following teaching will be based on Tiger Trade App, traditional Chinese interface, about 5 minutes to complete the deposit action.。You can switch to Simplified Chinese or English at any time。

The method is to go to my > upper right corner settings > general > language settings > App display language > select the desired language, click save。

Wise Inflow Process

◇ Applicable object: Wise account has been opened

◇ Handling fee: Tiger's handling fee is $0, Wise levies wire transfer fees

◇ Arrival time: It will be displayed when the deposit is made.

Wire transfer via Wise is a new deposit method recently launched by Tiger Securities, allowing users to complete international wire transfers with cheaper transfer fees and faster arrival times.。

Usually we have to use Telegraphic Transfer (also known as international money transfer) to get into a gold and U.S. stock brokerage firm.。In the process of cross-border remittance, it will go through the local remittance bank, the transfer bank, the remittance bank, and finally the designated overseas receiving bank to the account.。Layer by layer, with different fees to pay。As a result, fees are expensive using traditional bank wire transfers。

Wise is an internationally renowned third-party remittance platform that specializes in handling cross-border remittances.。Its advantage is that international remittances do not need to go through a transit bank, but rather arrange the dispatch of funds in a peer-to-peer (Peer-to-peer) matchmaking manner for remittances.。And using the medium-term market rate (Mid-Market Rate), the exchange rate is more favorable and does not incur the international remittance fees of ordinary banks.。So Wise charges much cheaper fees than wire transfers.。

In the past, U.S. stock brokerages generally did not accept deposits from third-party platforms such as Wise to prevent money laundering activities.。Now that Tiger Securities and Wise have partnered, users can initiate Wise deposits on the Tiger Trade App, which is more cost-effective and less expensive.。

To start using Wise Deposit, you must first register a Wise account。You must initiate a deposit from the Tiger Securities website or Tiger Trade App, not directly from Wise, otherwise Tiger Securities cannot receive the remittance。

Step 1: Log in to your Tiger account and select the deposit method - Wise Transfer

After the account is successfully opened and approved, the deposit is required to start trading.。

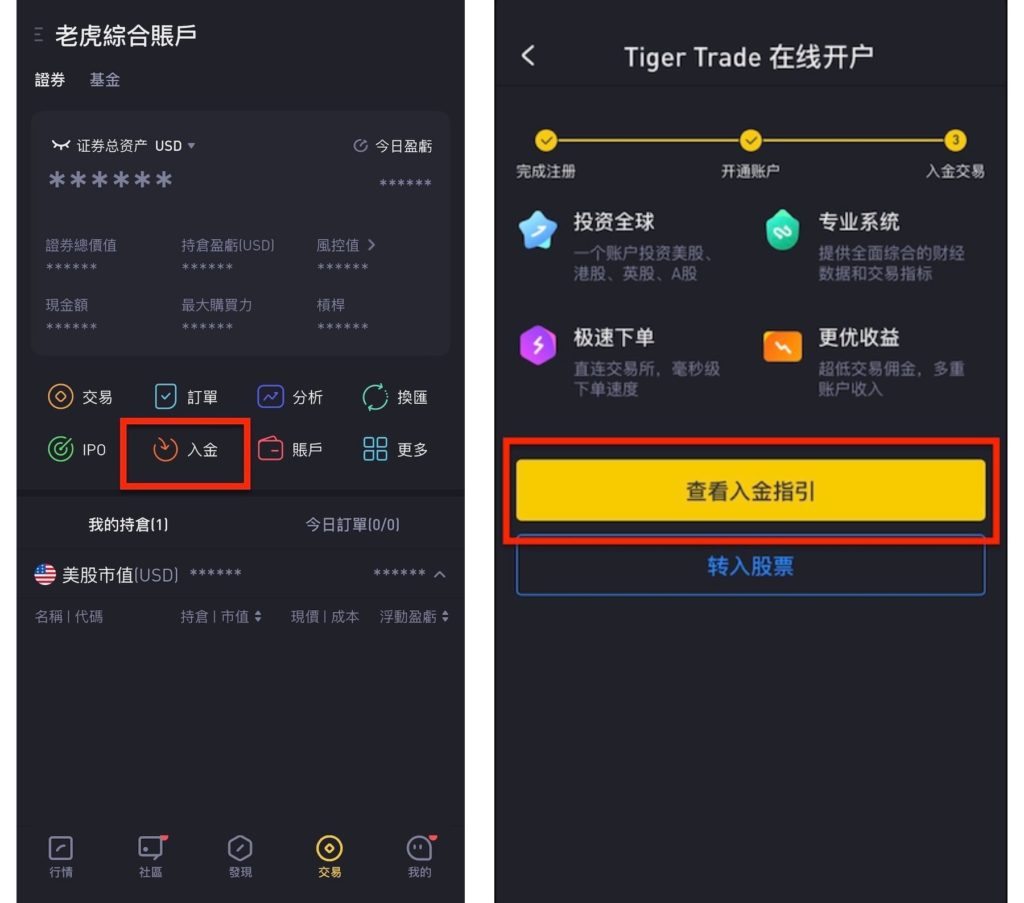

Log in to Tiger Trade App > click on "Trade"。

◇ First deposit, click "View deposit guidelines"

Once in gold, click on the "gold"

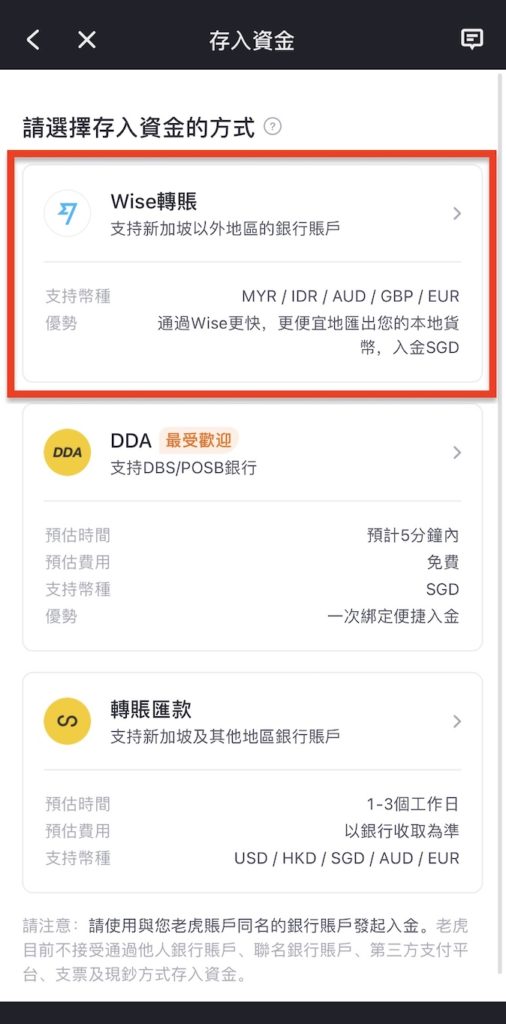

You will see that there are 3 ways to deposit money: Wise transfer, DDA and transfer remittance.。Here we choose "Wise Transfer"。

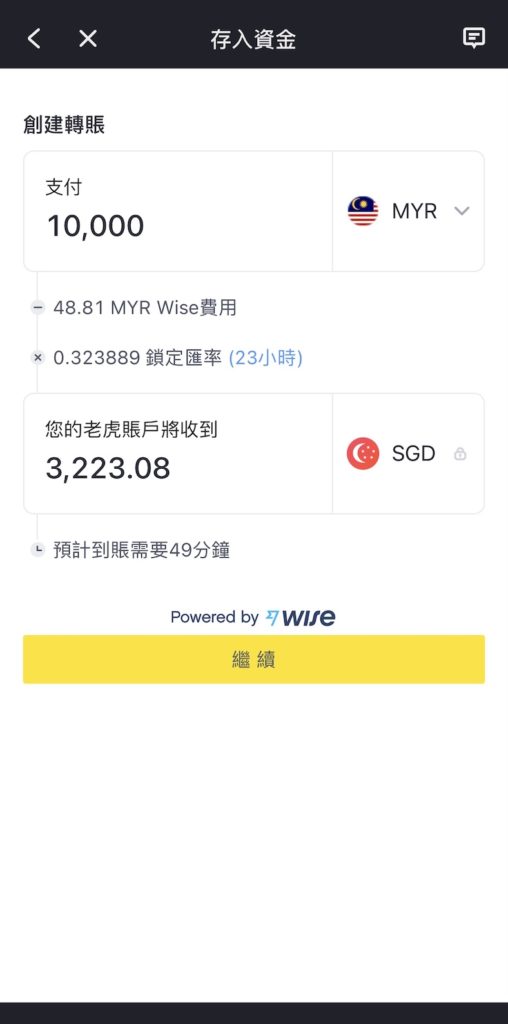

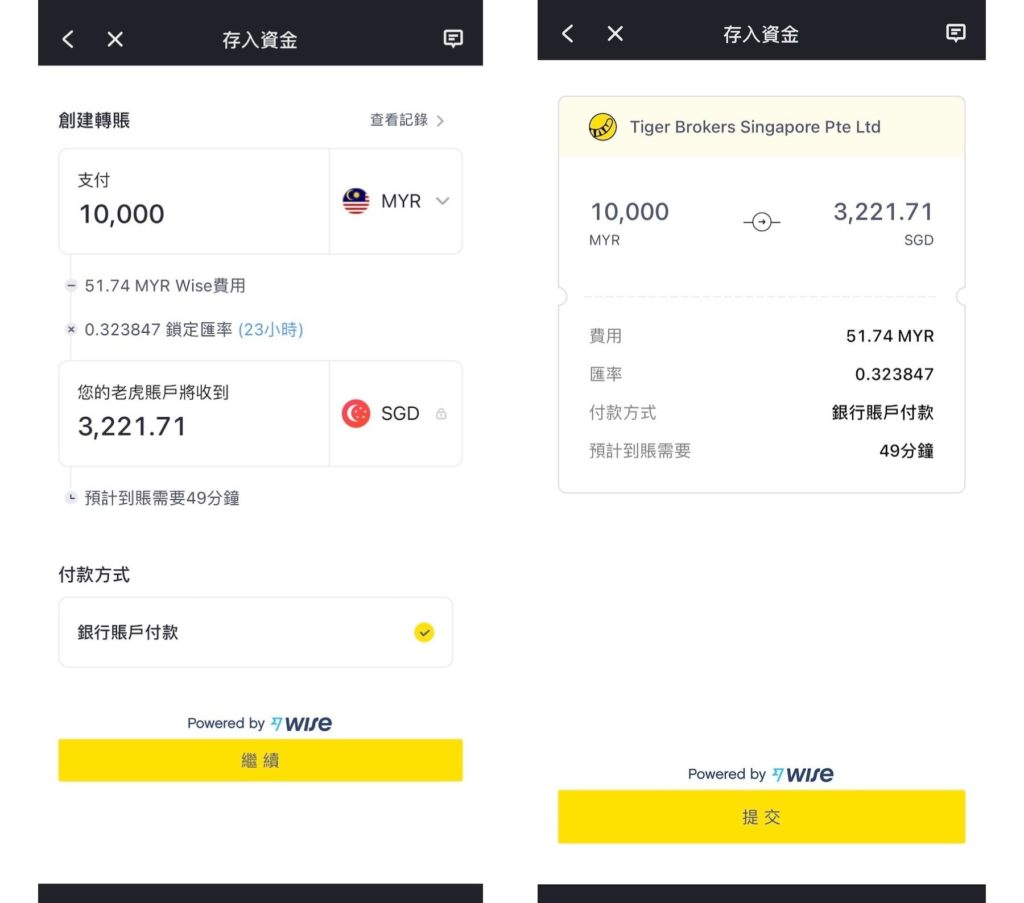

Step 2: Select the currency and amount to transfer the deposit

Select the currency and amount used for this transfer deposit。Currently supported Wise payment currencies are: ringgit (MYR), rupee (IDR), Australian dollar (AUD), British pound (GBP), euro (EUR)。

Here we choose "ringgit."。The final currency of the Tiger account is the New Dollar (SGD).。

The system will automatically display the cost of this Wise deposit, the locked exchange rate, the final amount of Singapore dollars and the time it takes to get to the account.。

Click Continue to go to the next step。

The first time you use Wise Transfer, this step can be filled in at will。Because you must first bind the Wise account and the Tiger account, and then enter the currency and amount of the real transfer.。

Step 3: Bind the Wise account with the Tiger account (the first transfer must be operated)

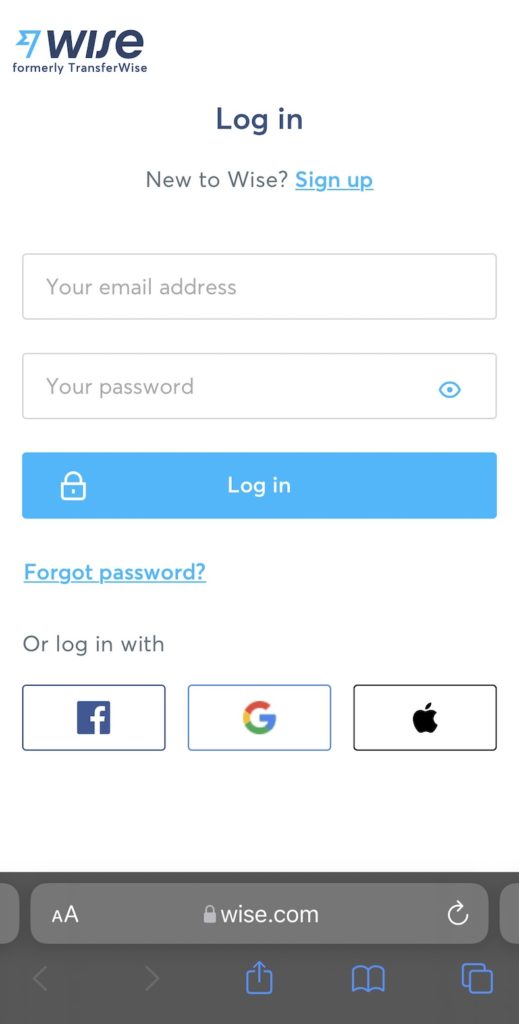

For the first time, you need to bind a Wise account to a Tiger account.。Click "Bind your Wise account," the system will jump to the Wise login page, enter your email and password, login account。

Wise asks if you confirm binding Tiger account, agrees to allow Tiger Securities to access your Wise account information, use Balance foreign currency account balance payment transfers, etc.。Click "Give Access"。

After completing the binding, the system will automatically jump back to the Wise deposit page of Tiger Securities。

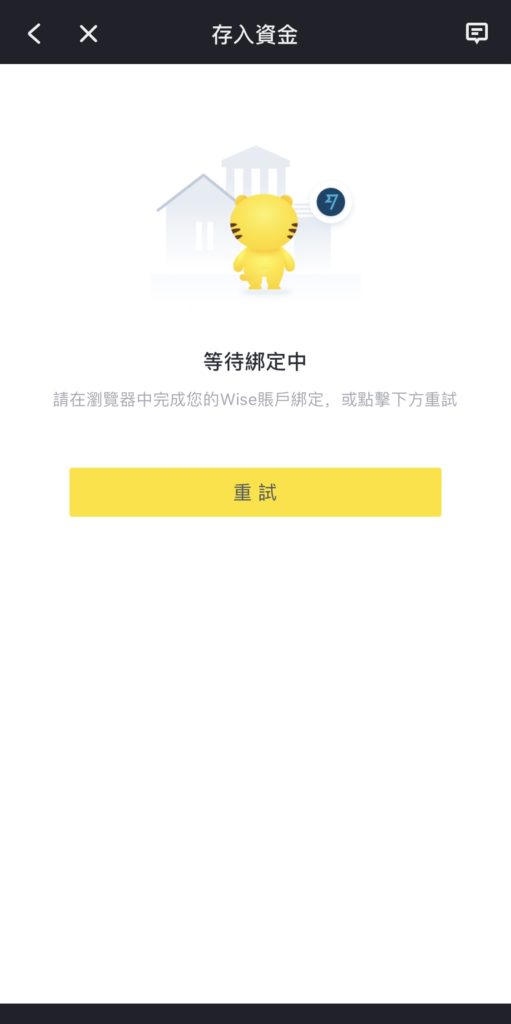

If you cannot bind the Wise account in the Tiger Trade App (after clicking Give access, the screen jumps to "Waiting for Binding - Retry"), you can log on to the official website of Tiger Securities to bind the account.。After successfully binding Wise, you will receive a confirmation email from Tiger。

Step 4: Select the currency and amount to be transferred again

Enter payment currency and amount again。The default payment method is Bank Account Payment。Click "Continue" to go to the next step, then click "Submit"。

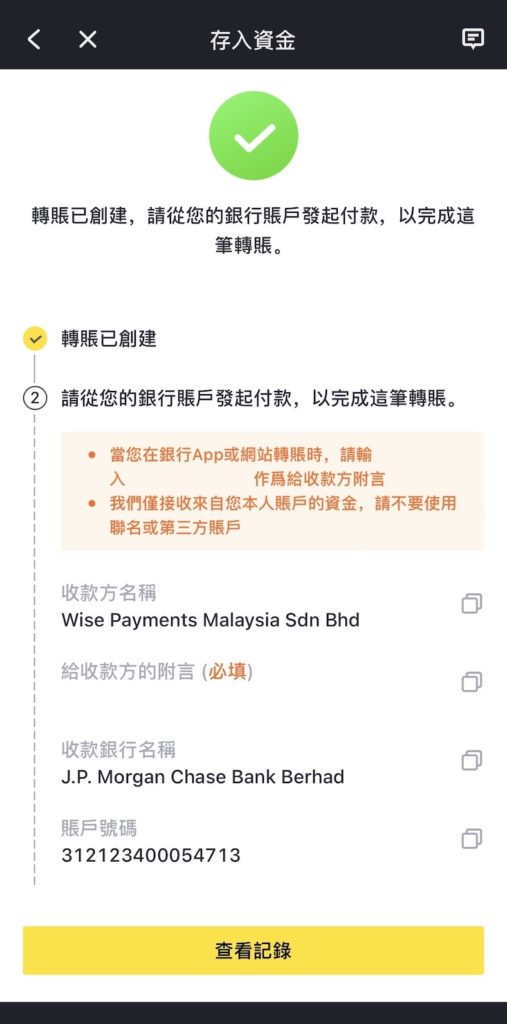

Step 5: Get the transfer information

Next, the system will show that this transfer order has been successfully created, you will see Wise Malaysia's bank collection information, you need to transfer funds from your personal bank account, like the usual bank transfer to others, transfer funds to Wise Malaysia's bank account, complete this transfer deposit。

The system displays detailed transfer information, including payee name, postscript to payee, payee bank name, account number, payment amount and currency, payee bank address。These are the information that needs to be entered when transferring funds.。

The payee name is Wise Payments Malaysia Sdn Bhd and the payee bank is J.P.Morgan Chase Bank Berhad。

Postscript to the payee: This is an important basis used by Tiger Securities to review and reconcile funds, so be sure to fill in the Recipient Reference for the transfer.。

Step 6: Make a local bank transfer

Next, you can choose to transfer money through online banking or to the bank's counter / ATM machine.。Select any one of the bank transfers.。

When transferring money, remember to use Instant Transfer instead of IBG, mainly because IBG takes longer to arrive.。

Be sure to fill in the postscript to the payee in the Recipient Reference so that the Tiger team can confirm the remittance.。

Step 7: Wait for the deposit to arrive and receive notification

After transfer, wait for Wise to remit funds to Tiger Securities。You can check the arrival status of funds in Wise Transfer > View Record in the upper right corner。

After the deposit is received, you will receive an app push and email notification from Tiger Securities.。

If you have not received the notification for more than 2 working days, click the customer service window in the upper right corner of the deposit page to ask the online customer service。

Wise Transfer Deposit Measurement

My measurement is that at 11 o'clock in the morning to initiate the Wise deposit order, complete the bank transfer, the same day at 12 noon to receive the deposit completion notice, about 1 hour to the account, the speed is not bad.。

Bank of Malaysia International Wire Transfer (TT) Deposit Process

◇ Applicable object: Have a Malaysian bank account

◇ Handling fee: The handling fee on the tiger side is 0 yuan, and the remittance bank and the transit bank charge a fee.

Arrival time: 1 to 3 working days

If you don't have a Singapore bank account and don't want to transfer money through Wise, using traditional wire transfers for cross-border remittances is the simplest and most direct way to do so, but the cost will be slightly higher.。This is because international wire transfers can involve local remittance banks, China Transfer Banks, overseas receiving banks, etc.。Each of these banks will have a fee.。

You can choose any Malaysian bank, online banking or wire transfer to the bank's counter / ATM machine.。Tiger Securities does not charge any fees, but remitting banks (i.e. Bank of Malaysia), transit banks, and receiving banks will charge fees。

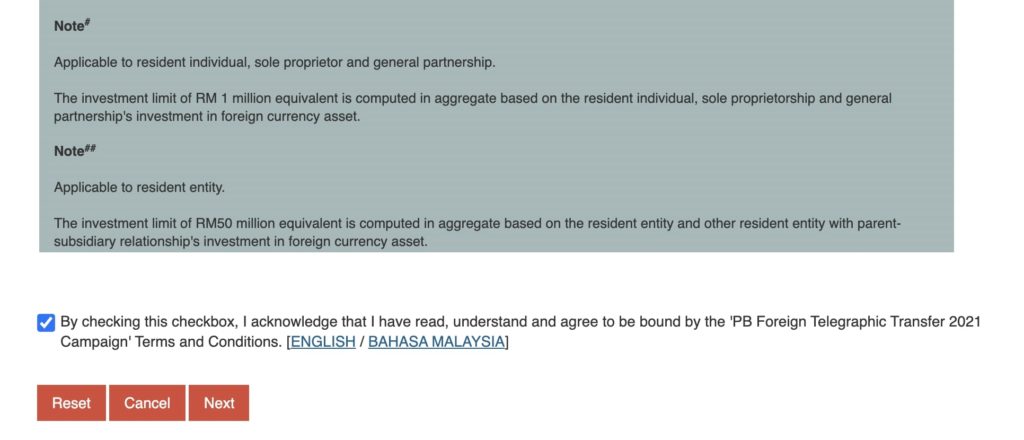

Local remittance banks will charge fees such as service charges (Commission) and cable charges (Cable charges) for cross-border wire transfers.。China transfer bank, overseas collection bank is not necessarily.。

For example, Public Bank charges a service fee of RM2 and a postal fee of RM30 for each wire transfer.。And these fees are calculated on a per-view basis and do not adjust to the size of the wire transfer amount。Simply put, the local bank charges for wire transfers of RM1,000 and RM10,000 are the same.。

Therefore, one of the ways to save on international wire transfer costs is to make each wire transfer a little higher.。It is recommended to deposit at least S $2,000 per deposit to avoid small deposits and drive up investment costs.。

Step 1: login account, select the deposit method - transfer remittance

The first step is to log in to Tiger Trade App > click "transaction"。

◇ For the first deposit, click "View deposit guidelines" ◇ For those who have been deposited, click "Deposit"

You will see that there are 3 ways to deposit money: Wise transfer, DDA and transfer remittance.。Here we choose "Transfer money"。

Step 2: Select the currency to be credited (Singapore dollar)

Select the currency you want to deposit gold, currently supported currencies are: Singapore dollar, US dollar, Hong Kong dollar, Australian dollar, euro。Here we choose to deposit Singapore dollars.。

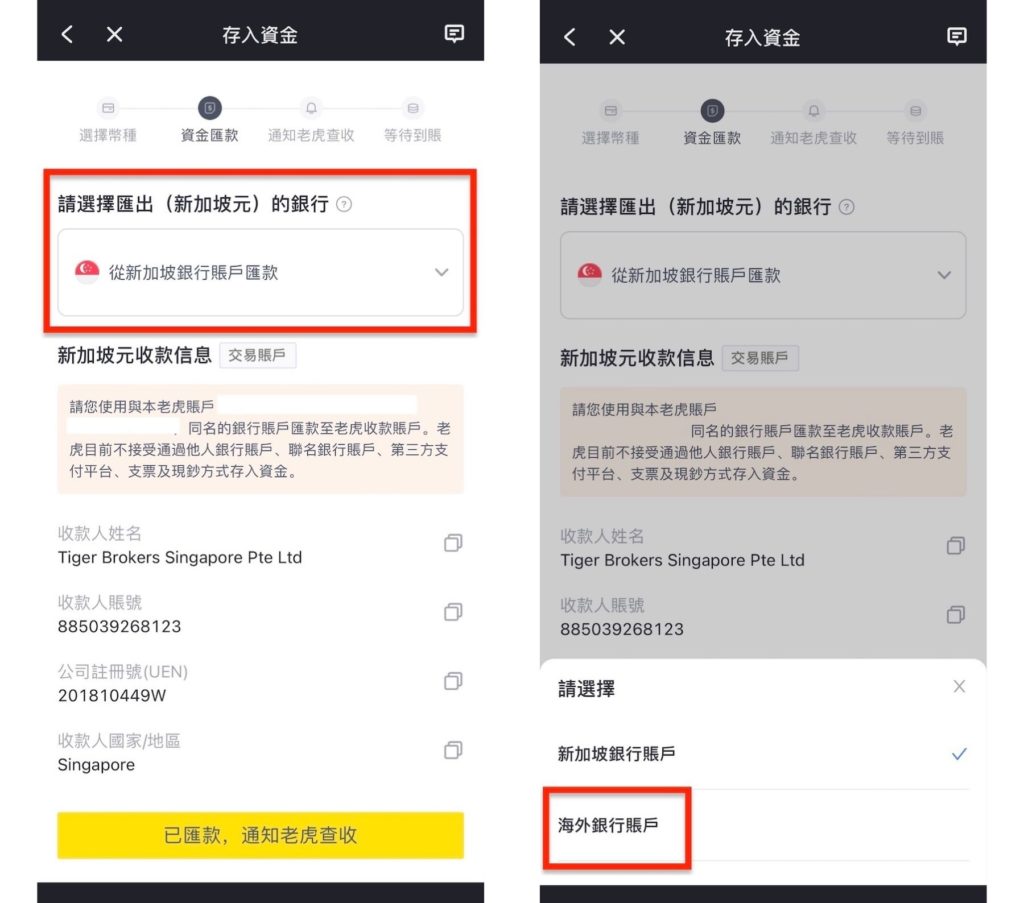

Step 3: Select the remitting bank

Choose to send money from Singapore bank or overseas bank, here we choose "overseas bank account"。

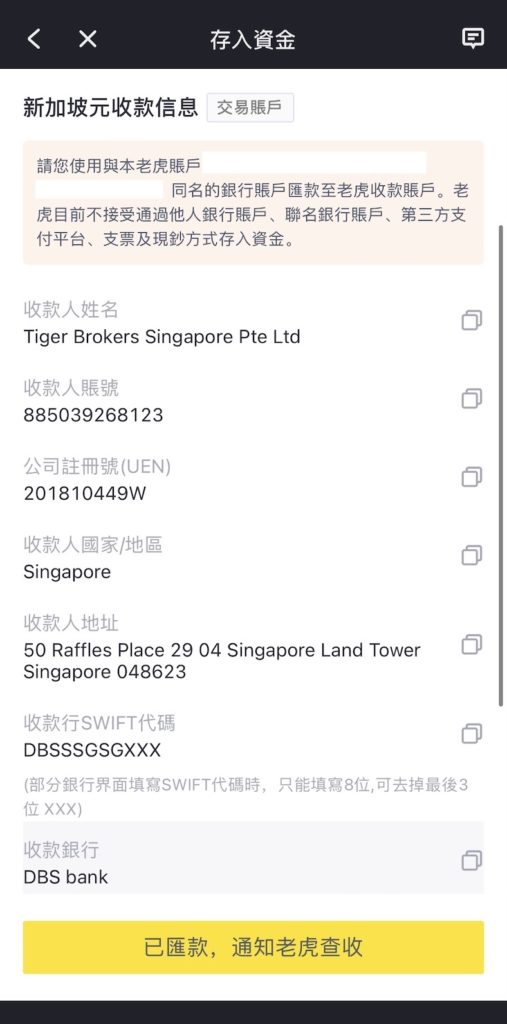

Step 4: Get the transfer information

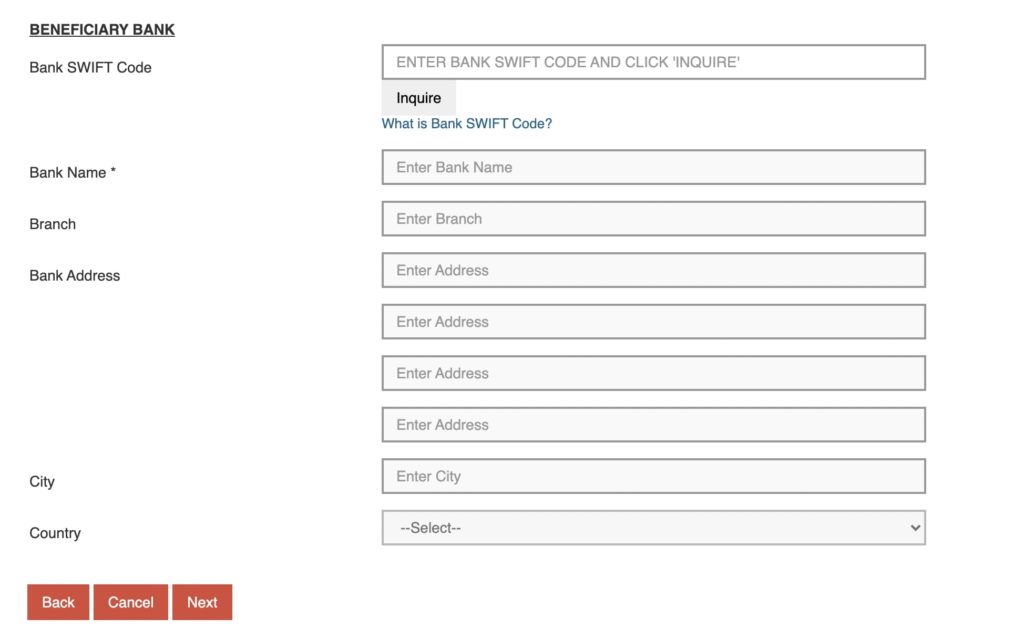

Next, you can see the bank collection information of the custodian of Tiger Securities, who is the custodian of DBS DBS Bank.。

The system displays detailed transfer information, including the payee name, account number, company registration number (UEN), payee country, address, payee SWIFT code, payee bank, and transfer postscript。These are the information that needs to be entered when transferring funds.。

Transfer postscript: Contains your Tiger account number and name, which is an important basis for Tiger to review and reconcile funds, so be sure to fill in the Recipient Reference for the transfer.。

Step 5: Make a Malaysian Bank Wire Transfer

The next step is to make a wire transfer, which can be done using online banking or at the bank's counter / ATM machine.。

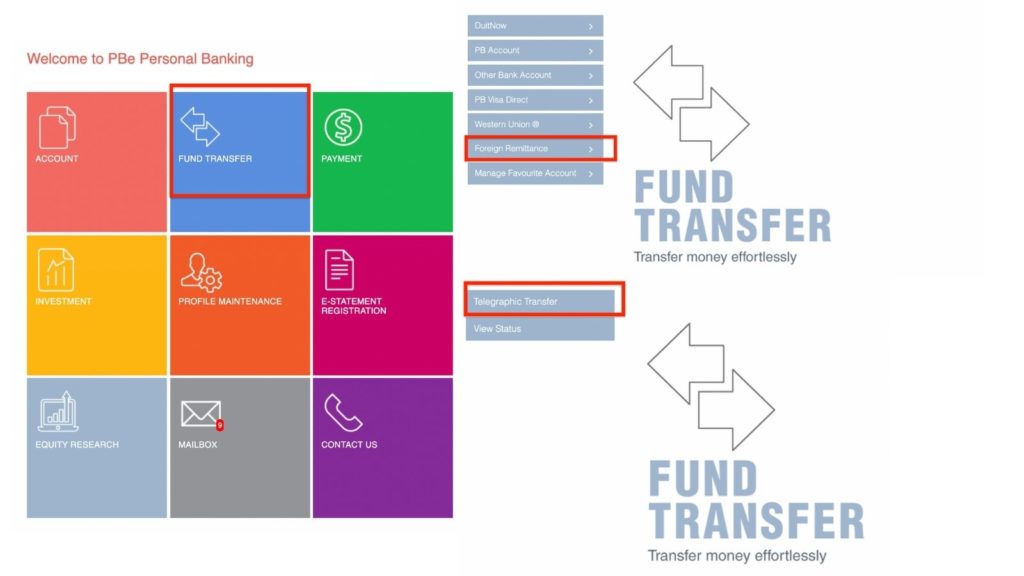

We will demonstrate the wire transfer process using Public Bank online banking.。Other banks have similar wire transfer processes.。

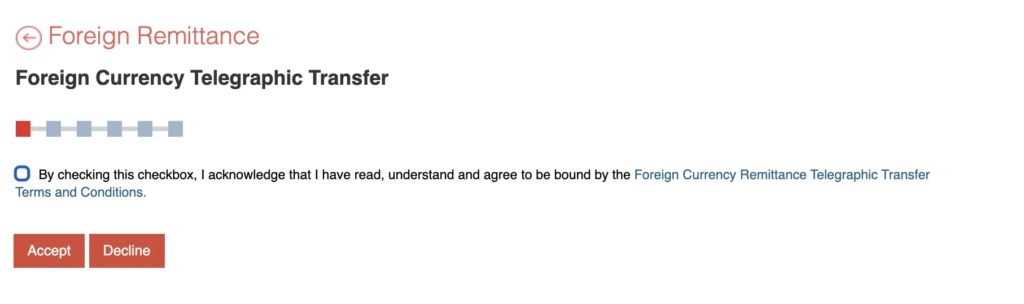

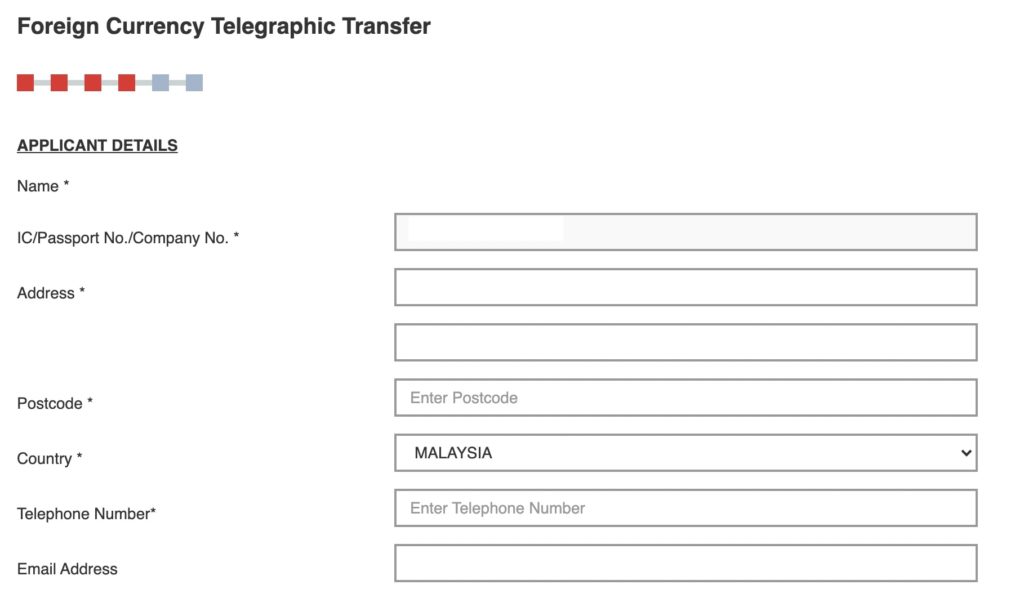

Log in to Public Bank Online Banking > Click on Fund Transfer > Foreign Remission > Telegraphic Transfer to initiate wire transfer instructions > ️ Express Agree to the Rules and Terms, click Accept to go to the next step。

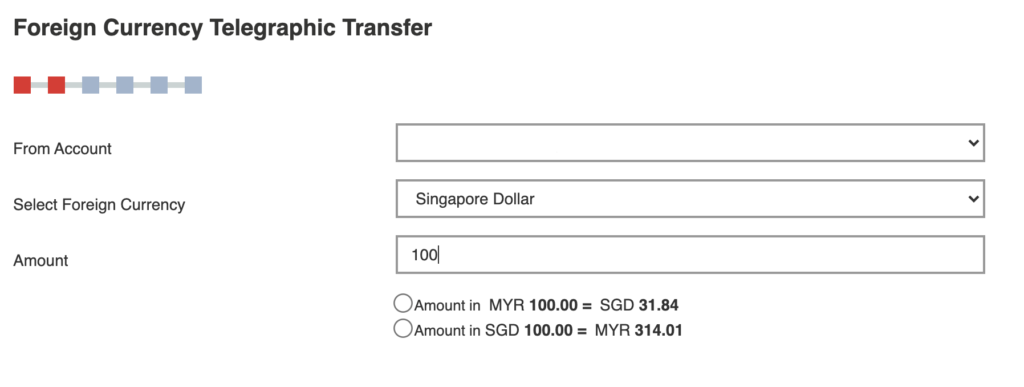

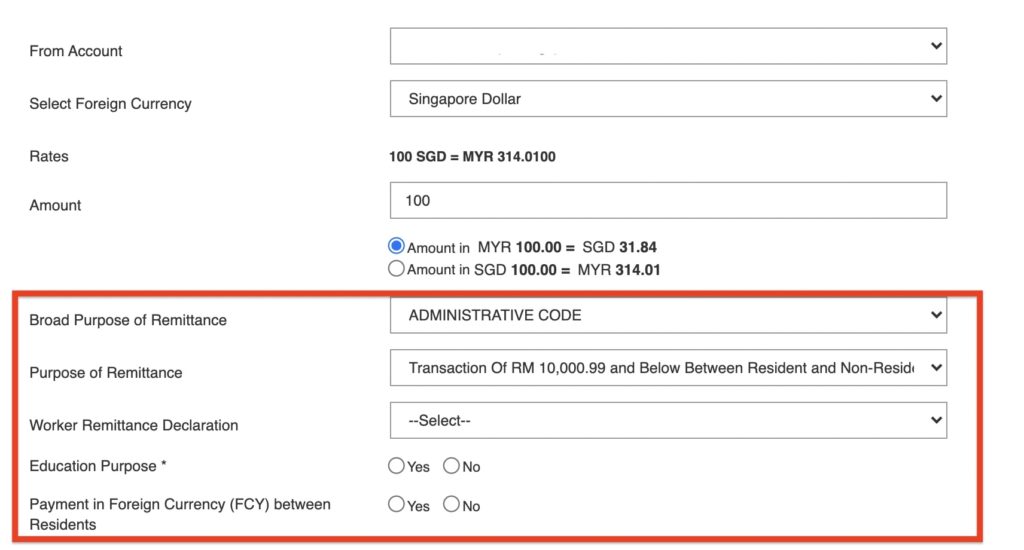

Go to the wire transfer page and select the bank account of the remittance, the currency of receipt (Foreign Currency), and the amount of wire transfer (Amount)。The system will provide 2 amount options: remit the specified amount in ringgit or receive the specified amount in foreign currency.。Choose according to individual needs。

◇ Amount in MYR = SGD: Export RM100 to SGD31.84

◇ Amount in SGD = MYR: SGD100 to account, RM314 to remit.01

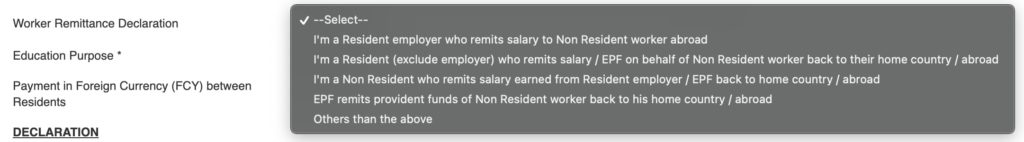

The purpose of reporting this wire transfer: whether to pay employee compensation remittance, education purpose, and foreign exchange remittance between nationals (Payment in Foreign Currency between Residences)。Here I choose No.。

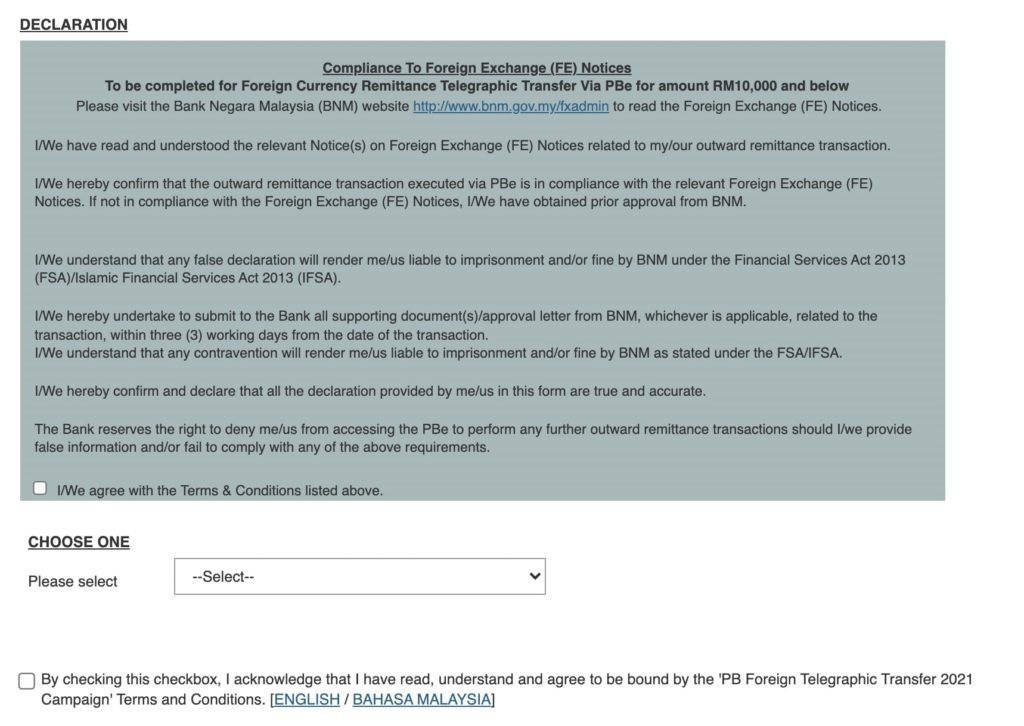

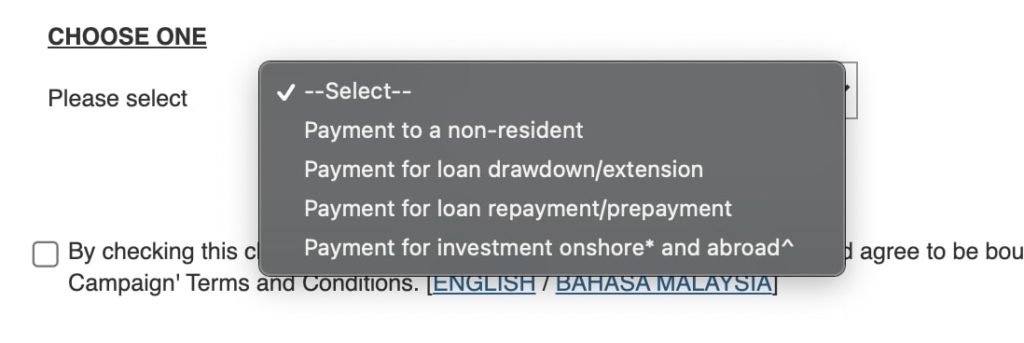

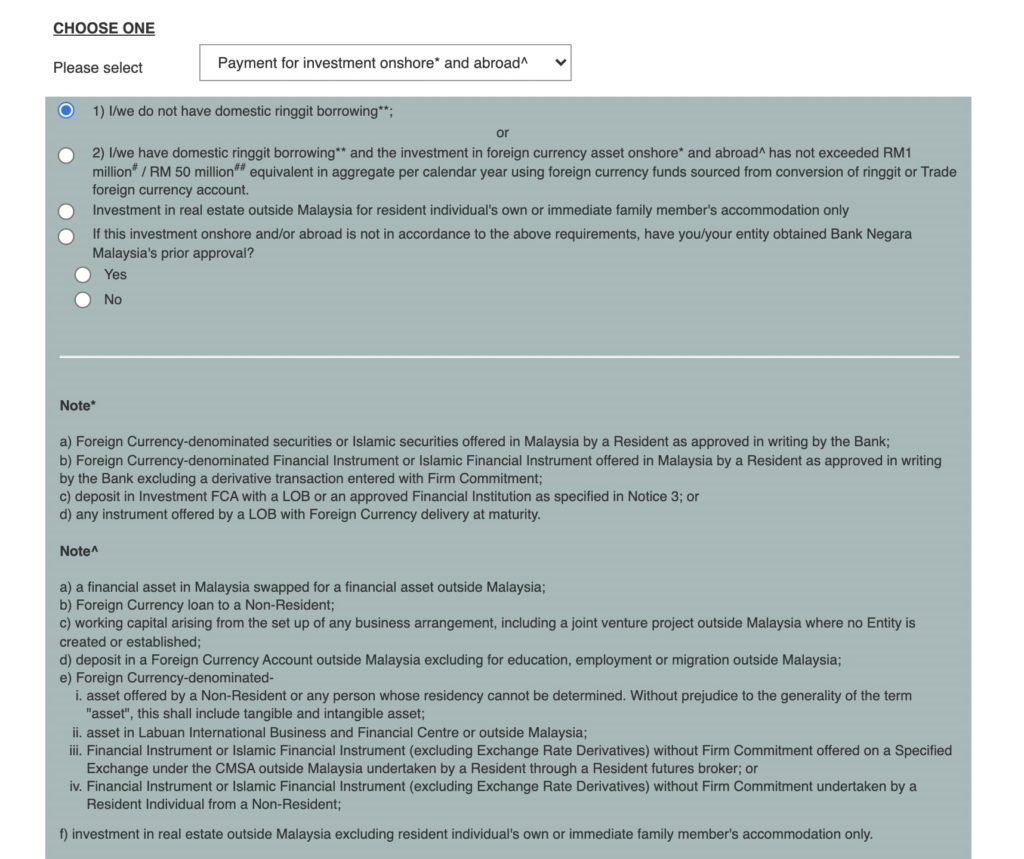

Then, in accordance with the regulations of the National Bank, declare the purpose of this wire transfer, such as remittance to non-nationals, payment of loans, payment of overseas investment, etc.。Finally, you agree to the Regulations and Terms and click Next to go to the next step.。

Confirm that the cost of this wire transfer is paid by the recipient (Beneficiary), or paid jointly by the sending and receiving parties (Shared)。

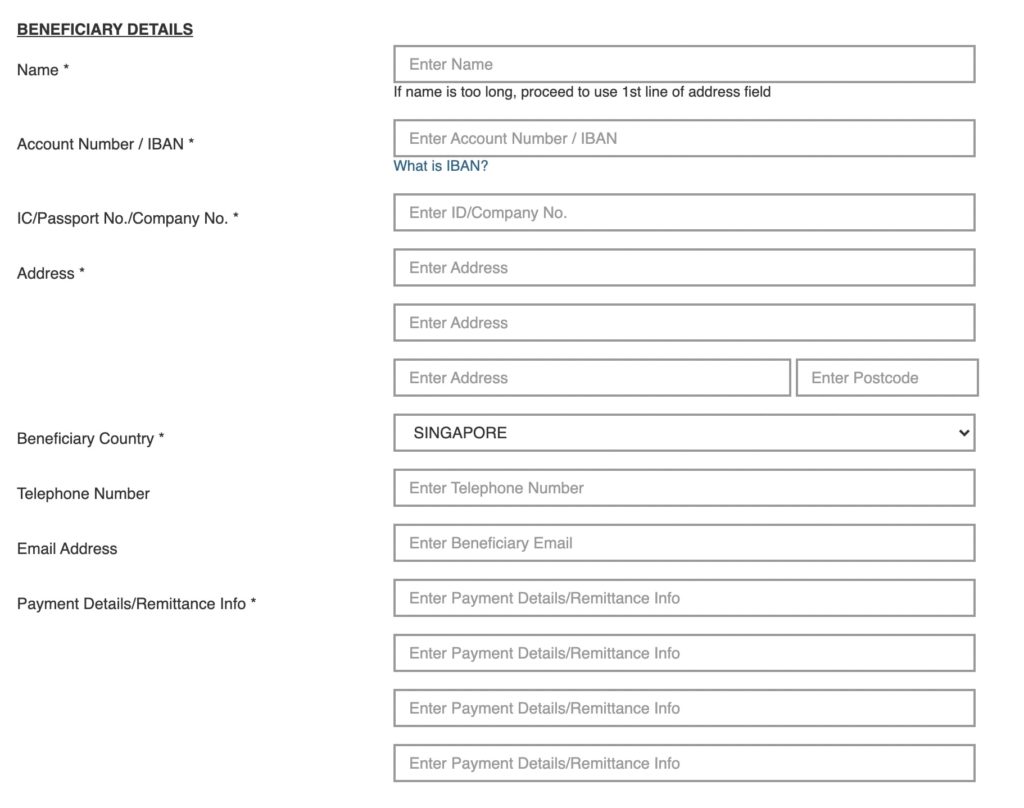

Fill in the wire transfer information, including:

1, the sender (that is, your own) information.

2, the payee (Beneficiary) information, such as name, account number, etc., according to the tiger securities bank collection information to fill in.

3, the receiving bank (Beneficiary Bank) information, such as the receiving bank SWIFT code, bank name, etc., according to the tiger securities bank collection information fill in.

Click Next to go to the next step, the system will send a PAC six-digit verification code, enter the PAC, click Confirm, and the transfer will be completed。Remember the screenshot or download the remittance voucher (Receipt)。

Step 6: Upload remittance voucher and issue deposit notice

Return to the deposit page of Tiger Trade App, click "Remittance has been sent, notify Tiger to check," upload the remittance voucher (Receipt) and fill in the remittance information, including:

1. Remittance bank account: fill in the information of the remittance bank used.

2. Currency remitted: Singapore Dollar

3. Amount remitted

4, remittance voucher: remittance receipt (Receipt)

Finally, click "Submit deposit notice," the deposit is completed, Tiger Securities will review the deposit.。

Step 7: successful deposit, receive notification

It usually takes 1 to 3 working days for wire transfer transfer to arrive at the account.。After the success of the deposit, you will receive Tiger Securities App push and email notification。

If you have not received the notification for more than 3 working days, you can click the customer service window in the upper right corner of the deposit page to ask the online customer service。

SUMMARY

To sum up, Malaysian users are the first to use Wise transfer, which is one of the fastest and cheapest ways to deposit money, and the process is similar to ordinary bank transfers.。Measured about 1 hour can be credited to the account。

Of course, if you want a faster way to deposit money, it is recommended to open a Singapore bank account (teaching), then use Wise to transfer money from the Bank of Malaysia to the Singapore bank account (measured posting time less than 1 minute, teaching), and then use the Singapore bank to deposit gold tiger securities, about 15 minutes to the account。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.