Tiger Brokers Review | Is It Safe and Legal to Invest in Tiger Securities?

Tiger Brokers Tiger Securities is regulated by the U.S. SEC and offers full online trading of U.S., Hong Kong and Singapore stocks.。This article provides an in-depth introduction to Tiger Securities' features, fees, security, advantages and disadvantages, and experience evaluation.。

The cross-border Internet securities business in U.S. stocks is becoming increasingly intense, with the exception of the U.S., which has set off a foothold in the market.Demerit TD Ameritrade、Tracker Securities Tracker SecuritiesIn recent years, several technology-based brokerages have entered the narrow competition of Internet brokerages, the most popular of which have been opened for everyone before.Futu Securities moomoo, Longbridge Securities Longbridge, etc.。

Today's financial measurement for everyone listed on the NASDAQ exchange out of the box, by the U.S. Securities and Exchange Commission (SEC) regulation of the U.S. and Hong Kong stocks Internet brokerage - Tiger Brokers (Tiger Brokers)。

Founded in 2014, Tiger Securities features simultaneous trading in multiple international markets in the United States, Hong Kong, Singapore, China, Australia and London, covering a wide range of investment products, including stocks, ETFs, options, warrants, bonds and futures.。And can participate in the United States, Hong Kong, Singapore listed companies IPO to play new, more to attract U.S. stocks to play new no charge.。

This article provides an in-depth analysis of the background, features, fees, security, advantages and latest account opening offers of Tiger Securities, and provides a real experience and evaluation.。

Tiger Securities was founded in 2014, officially listed on the Nasdaq Exchange in 2019 (Nasdaq: TIGR), and entered the Singapore market in February 2020, becoming a very popular U.S. and Hong Kong Internet brokerage in Southeast Asia.。

Tiger Securities is regulated by the Securities and Exchange Commission (SEC), the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS) and is a registered financial services provider in New Zealand.。

The core team has many years of financial and Internet experience, members from Morgan Stanley (Morgan Stanley), Tencent, Baidu, Alibaba, etc., and access to Xiaomi Technology, Real Fund, Xianfeng Evergreen, Huagai Capital, PAC (Prospect Avenue Capital), Oriental Hongtai (Hontai Capital) and other investment institutions strategic investment.。

Tiger Securities focuses on one-stop online investment experience, through the exclusive development of the trading platform Tiger Trade, an account can invest in multi-country markets, to achieve the convenience of night investment in Hong Kong stocks, Singapore stocks, night investment in U.S. stocks.。Tiger Securities provides one of the super-US low-share commissions in the market, the trading process is fast and safe, as well as a wealth of financial market information, financial data of listed companies, chart data analysis and research, valuation functions.。

The following is a brief summary of the highlights of Tiger Securities Tiger Securities.

| Year of Establishment | Established in 2014 |

| Trading platform | TTiger Trade, desktop (Windows, macOS) and mobile app (iOS, Android) |

| Account Type | Managed Account (Custodian Account) |

| tradable market | US, Hong Kong, Singapore, Shanghai and Shenzhen (China A-shares), Australia |

| Investment products | Stocks, ETFs, options, warrants / vouchers, CBBCs, futures, funds, REITs, indices, metals, bonds, etc., to support new stock subscriptions |

| Access mode | Singapore Bank Transfer, International Wire Transfer |

| Minimum amount of deposit and withdrawal | None |

| No access payment | Singapore DBS / POSB / FAST bank payment: free; other bank wire transfer payment: need to pay the remittance bank + transit bank fees; Singapore DBS / POSB / FAST bank payment: free; other bank wire transfer payment: need to pay the remittance bank + transit bank fees bank fees |

| Account idle fee (idle fee) | None |

Tiger Securities 7 Features

Opening an account on the whole line is fast and convenient.

Tiger Securities is very convenient to open an account and canOnline registration and account openingThe operation and management of the account, including deposit, withdrawal, trading stocks, options, etc. are carried out on the whole line, with the use of Tiger Trade mobile app, anytime, anywhere investment transactions.。

Measured account 1 working day, very convenient and convenient。

After opening an account, assuming that you want to experience the familiar Tiger Trade trading platform operation in advance, you can use a $100,000 virtual account for simulated trading.。Then remit real money to start investing.。

Tradable global multi-market capital and investment products

Tiger Securities focuses on one global account trading, users can invest in six markets - the United States, Hong Kong, Singapore, Shanghai and Shenzhen (China A-shares), Australia, the breadth of tradable investment products is also sufficient, including stocks, options (Options), warrants (warrants), ETFs, REITs, futures, indices, metals, bonds, funds, etc., and support pre-market and after-market trading of U.S. stocks.。

One of the lowest commissions in the market

The current trading commission for U.S. stocks and ETFs at Tiger Securities is 0..$005, minimum 0 per transaction.$99; the platform fee is Flowchart 0.$005, minimum $1 per transaction。Yes, a minimum payment of 1 per transaction is required..$99, one of the lowest commissions in the market。

Hong Kong Stock Trading Commission of 0.03% * Transaction amount, minimum HK $7 per transaction; platform fee of 0.03% * Transaction amount, minimum HK $8 per transaction。It means that you have to pay a minimum of HK $15 per transaction, which is also one of the lowest fees in the market.。

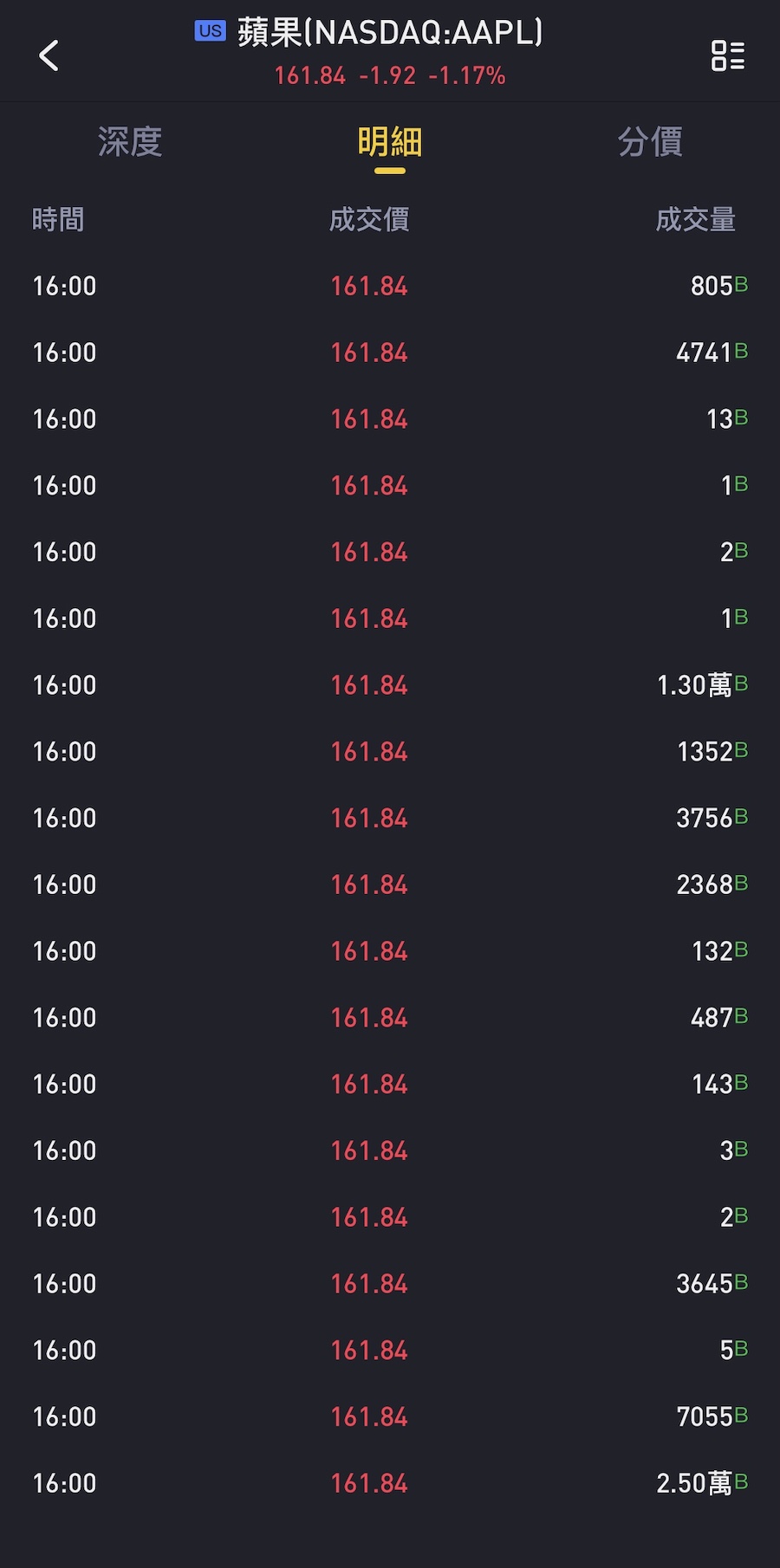

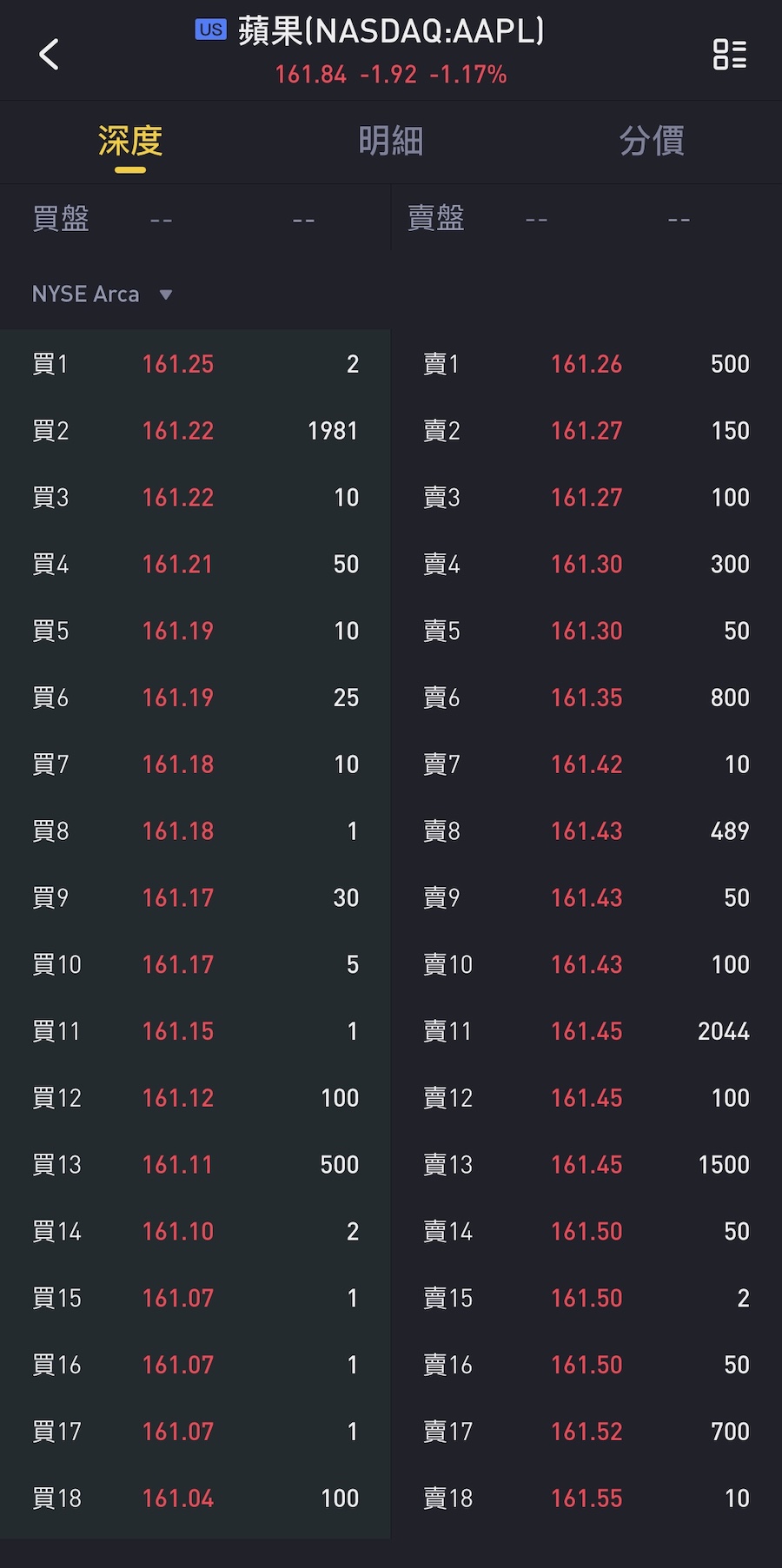

Free US stock level 2 real-time quotes

The secondary market provides more in-depth individual stock quotation information, convenient to help users grasp the price trend of individual stocks in order to more accurate bid, just open an account Tiger Securities, you can get free U.S. stock secondary market intelligence price, you can see the second largest electronic stock trading in the United States, so NYSE ArcaBook up to 40 buying and selling quotes, as well as the volume of different transaction prices.。

Support U.S. stocks, Hong Kong stocks, Singapore stocks to play new.

Tiger Securities supports U.S. stocks, Hong Kong stocks, Singapore stocks to play new, so IPO new share purchase, so that investors subscribe to the U.S. stocks to play a very large number of new targets, such as the earlier Alibaba, Tencent Music, Meituan and other new targets.。

In addition, Tiger Securities provides a complete new share information and new share calendar, including the start of the purchase date, the importance of the purchase, the announcement of the winning bid, dark trading and listing date, so that users can track the complete timeline of the new share purchase.。

In-depth technical strategy analysis and stock selection.

In addition to the performance of individual stocks and complete financial data, Tiger Securities has launched a variety of technical and stock selection function analysis for technical strategies, such as classic stock selection, Tiger Lab, similar to K-line, K-line stock selection, and the use of a large number of visual chart data to help users smart stock selection。

Tiger Lab selects the latest technical strategy research results of Tiger's quantitative team to allow users to maximize their investment returns through different technical investment strategies.。There are currently four sets of strategies, namely: Tiger Trend Wizard, Multi-Factor, Tiger Quantitative Selection, and Growth Momentum Strategy.。

Security and authority regulation is one of the key factors for investors to assess the suitability of a brokerage firm to ensure that funds and investment assets are managed in compliance with brokerage firms and that they are safer, capital and less risky to invest.。

Tiger Securities has been established for 7 years and is a listed company in the United States to date, with companies established in Singapore, Beijing, New York, Auckland and Sydney.。Below we work together around regulators, money custody and strategic partners to assess the platform security of Tiger Securities.。

Regulators

Tiger Securities holds multi-licence regulation, with regulators that are authoritative and key regulators around the world, including the United States, Hong Kong, Singapore, Australia and New Zealand.。

US regulation

It is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Authority (FINRA) under SEC registration number 8-65324 and FINRA Central Registration number CRD: 120583。In addition, Tiger Securities is a certified member of the Securities Investor Protection Corporation (SIPC) and the National Futures Association (NFA).。

Hong Kong Regulation

Hong Kong stocks are traded under the custody of Tracker Securities (Tracker Securities), traded by IB and regulated by the Securities and Futures Commission of Hong Kong (SFC).。

Singapore Regulation

Regulated by the Monetary Authority of Singapore (MAS) and granted a Capital Markets Services License (CMS License)。

Australian regulation

Australian Securities and Investments Commission (ASIC) regulated, holds Australian Financial Services Licence (AFSL) 505213。

New Zealand Regulation

Tiger Securities is a registered financial services provider in New Zealand with registration number FSP473106.。

Asset Custody

In terms of capital and asset security, Tiger Securities enforces a strict policy of segregated custody of user funds and assets, and is separated from Tiger Securities' own capital zone.。Therefore, even if the problems arising from Tiger Securities one day do not affect the user's own assets, they can still be retrieved from the custodian bank's separate trust account.。

The user's funds are hosted at DBS Commercial Bank。The assets are then held in safe custody with a third-party licensed custodian in separate trading markets.

◇ U.S. STOCKS:By Interactive Brokers Xiamen and custody

◇ Hong Kong stocks:Custody by Tracker Securities (Tracker Securities)

◇ Singapore Stock:In the custody of DBS Custodian Bank

As one of the world's top three established brokerages, DBS is Singapore's largest commercial bank, so users' funds and assets are relatively safe and secure.。

Strategic Partners

Tracker Securities (Tracker Securities) is a strategic partner of Tiger Securities, responsible for the trading of U.S. and Hong Kong stocks in Suzhou and the custody of Tiger Securities.。In addition, Tiger Securities has received strategic investments from investment institutions such as Xiaomi Technology, Real Fund, Xianfeng Evergreen, Huagai Capital, PAC (Prospect)))) Avenue) Capital), and Oriental Hongtai (Hontai Capital).。

In summary, Tiger Securities is subject to strict safety supervision, has flexible third-party supervision, is relatively safe in use, there is no risk.。

Is it safe and legal to invest in Tiger Securities??

How to open an account in Tiger Securities?

Tiger Securities can register and open an account across the board without paying any fees, and the account can be opened in about 10 minutes.。

It usually takes 1 to 3 working days to open an account. After the application is approved, you will receive a text message and notify you of the successful account opening.。My actual mapping 1 working day to complete the account, the speed is enough。

What are Tiger Securities commissions and fees??

Tiger Securities is one of the lowest-charged brokerages in the market for commissions, platform fees and other regulatory-related fees for each transaction.。We mainly talk about the charging structure of U.S. and Hong Kong stocks, which is suitable for users in Southeast Asia.。

Commission

| Investment products | Currency | Rate | Charged party |

| U.S. stocks | Dollars | 0.005 / share single transaction minimum 0.99美元 | Tiger Securities |

| Hong Kong Stock | Holes | 0.03% * Transaction Amount Minimum HK $7 per transaction | Tiger Securities |

The current trading commission for U.S. stocks and ETFs at Tiger Securities is 0..$005, minimum 0 per transaction.$99; the platform fee is Flowchart 0.$005, minimum $1 per transaction。Yes, a minimum payment of 1 per transaction is required..$99, one of the lowest commissions in the market。

Hong Kong Stock Trading Commission of 0.03% * Transaction amount, minimum HK $7 per transaction; platform fee of 0.03% * Transaction amount, minimum HK $8 per transaction。It means that you have to pay a minimum of HK $15 per transaction, which is also one of the lowest fees in the market.。

Platform Fee

| Investment products | Currency | Rate | Charged party |

| U.S. stocks | Dollars | 0.005 / share minimum $1 per transaction | Tiger Securities |

| Hong Kong Stock | Holes | 0.03% * Transaction Amount Minimum HK $8 per transaction | Tiger Securities |

My experience with Tiger Securities

Advantage 1: interface design is simple and easy to use, easy to find the information you want

Tiger Securities through the original Tiger Trade trading platform to provide users with securities trading services, whether desktop or mobile App interface is very simple and easy to use, a variety of menus listed, to help users easily find the information they want, such as listed companies to complete financial data, fundamental analysis, technical analysis, valuation analysis, etc.。

Users can also log in to select the desktop version, the page information layout is more rich and complete, can see the quote market changes, trading volume, data analysis, the execution of orders or close trading instructions, etc.。If you don't like the default interface of the system, you can also adjust it in the background and customize the interface layout to make the whole process of research, analysis and ordering more smooth.。

When the Tiger Trade trading platform is very smooth in use, there are almost no system anomalies or problems with the inability to use general functions.。

Advantage 2: sufficient breadth of investment products

Compared to other Internet brokerages, Tiger Securities offers more investment product options, in addition to basic stocks, ETFs, funds, users can also participate in investment options (Options), warrants (Warrants), REITs, futures, indices, metals, bonds, and so on to meet different investment needs.。

Advantage 3: rich information and insights, community discussion and interactive activities

Tiger Securities provides a lot of in-depth analysis and insights on the stock market, current affairs and financial affairs, and in the "Tiger Community," you can often see investors from all over the world share their views and investment strategies on individual stocks, current affairs and the latest policies, and you can leave a message to these investors.。

In order to help users make better investment decisions, Tiger Securities has set up a "school" to share the introduction of small white financial management, U.S. and Hong Kong stocks to play the new guide, options strategy, futures investment teaching, U.S. stock valuation, ETF investment strategy, etc., suitable for beginners to learn different degrees.。

Advantage 4: Support Wise Gold

Wise is an internationally renowned remittance platform that provides users with more favorable exchange rates for cross-border remittance operations.。Currently, most brokerages do not support Wise's direct access to gold securities accounts to avoid being unable to track the source of funds.。

In order to allow users to enjoy a better experience of gold deposit, Tiger Securities recently officially cooperated with Wise to open up users to gold deposit through Wise.。The operation method is to initiate Wise deposit through Tiger Trade App or official website。After connecting the Wise account and the Tiger account, you can enter gold from the local currency to the SGD, convert exchange rates and fees, and save money.。

Disadvantage 1: zero-share trading is not supported

It's a bit of a pity that Tiger Securities does not support zero-share trading and cannot buy broken shares (fractional shares), which are clearly below 1 share.。For small capital investors who want to participate in blue chips above the stock price, such as Amazon (2021) December 3 closing price of 3,389.$79), Tesla (December 3, 2021 closing price 1,014.$97) may be slightly labored。

Of course, not everyone wants to trade zero shares or participate in investing in high-priced stocks, so this varies from person to person.。If you want to trade zero U.S. stocks, consider Interactive Brokers.。

Disadvantage 2: Non-zero commission trading

The moment of non-zero commission trading also varies from person to person, assuming the convenience of long-term investment, or the number of transactions is not frequent, in the case of U.S. stocks, each transaction requires a minimum of 1..$99 is not a burden.。

If you pursue other investment costs, consider TD Ameritrade, which trades U.S. stocks and ETFs with zero commissions and no platform fees.。

Recently, a large number of readers have reported that they have not been able to log on to Tiger Securities' websites and trading platforms.。After testing by the internal team of Spark Finance, it was found that some network service groups (such as Unifi) blocked access to related websites for unknown reasons.。

It is suggested that you can use a legal VPN or modify Google DNS to solve this problem。

Who is suitable to use Tiger Securities?

The advantage of Tiger Securities is that the interface design is active, easy to use, and the breadth of investment products is sufficient to provide comprehensive and rich information.。In terms of technical analysis, more laboratories have selected the latest technical strategy research results of the tiger quantitative team.。There are a few that are doing better than other brokerages.。

If you want to invest in U.S., Singapore and Hong Kong stocks at the same time, or want to explore the Australian and Chinese A-share trading markets, and are interested in investing in options, futures, warrants, etc., Tiger Securities is a good choice, one account can meet these investment needs.。need to invest heavily in accounts, i.e. once again valuable resource management。

Now there are more and more U.S. stocks, Hong Kong stocks brokerage firms and trading platforms in the market, and even traditional brokerage firms have poured into the new alternative of Internet securities, constantly iterating online trading platforms to bring users a better experience.。When choosing a broker, make sure the broker has legal regulation before challenging the platform you use comfortably.。You can also make good use of the virtual accounts provided by brokerages to simulate transactions and then deposit money.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.