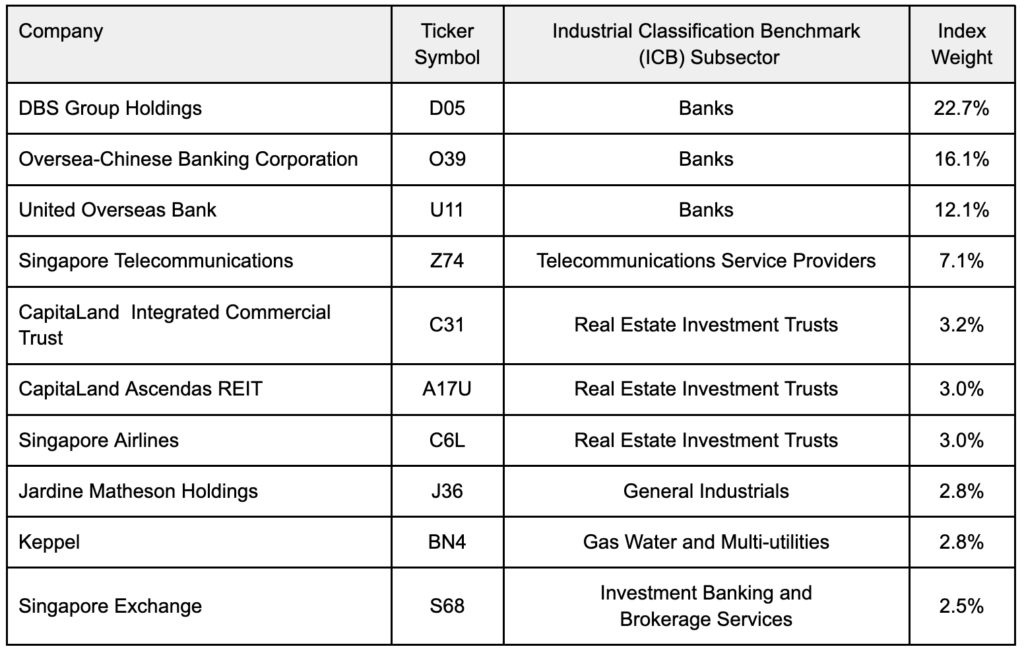

Top 10 Most Influential Blue Chips in STI

A total of 30 blue-chip companies make up the Straits Times Index, but Singapore's three largest banks account for more than half of the index's weighting.

The Singapore Straits Times Index (SGX: ^STI) is made up of the 30 largest companies and is widely regarded as a market barometer for the Singapore stock market. However, they are not equally influential.

The weighting of each constituent stock is based on its market capitalization, so the companies with the largest market capitalization have a greater impact on the overall performance of the index.

Definition of blue chip stocks

STI index constituent stocks are often referred to as blue chip stocks, which generally refer to companies that are large in scale, well capitalized, have long-term operating records and have prominent brand names.

Due to their size, these businesses are often market leaders in their respective industries. However, being large does not mean that a company will remain in the top ten permanently. For example, CapitaLand (SGX: C31) and Wilmar International Limited (SGX: F34) were on this list two years ago but are now off the list.

Top 10 blue chip stocks

Currently, the top ten companies in the SGX Index account for more than 75% of the weight.

The market capitalization of Singapore's three major banks - DBS Group Holdings Ltd (SGX: D05), OCBC Bank (SGX: O39) and United Overseas Bank (SGX: U11) - accounts for nearly 51% of the STI index. Highlighting the importance of the banking sector to Singapore's economy and stock market.

In addition to the banking industry, real estate is also an important industry in STI's top ten stocks, among which CapitaLand Integrated Commercial Trust (SGX: C38U) and CapitaLand Ascendas REIT (SGX: A17U) are notable representatives. Along with other real estate companies in the STI, the industry makes up about 16.6% of the index.

Main industries

Industry, services and telecommunications are the three largest industries in STI. Jardine Matheson Holdings (SGX: J36) represents the industrial goods and services sector, while Singapore Telecom (SGX: Z74), or Singtel, is the sole representative of the telecoms sector.

Interest rate adjustment prospects

The era of high interest rates may be coming to an end. After significant interest rate hikes in 2022 and 2023, the Fed may be close to a policy shift. With the U.S. labor market showing signs of weakness, the Federal Reserve may cut interest rates later this year to stimulate economic growth.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.