Infineon's Largest Power Semiconductor Plant Under-Construction in Malaysia

Infineon is set to build its largest power chip factory in Kulim, Malaysia, enhancing Malaysia's position in the global semiconductor supply chain.

According to reports, Infineon, a leading European chip manufacturer, has commenced construction of its largest power chip factory in Kulim, Malaysia, significantly boosting the country's influence in the global semiconductor supply chain.

Infineon stated that the factory, which focuses on electrification applications for industries such as renewable energy, electric vehicles, and AI data centers, is expected to reach full production capacity within the next five years, becoming the world's largest silicon carbide (SiC) factory.

Jochen Hanebeck, CEO of Infineon, noted that the early commencement of construction was partly due to a virtual connection established with the company's main development and production center in Villach, Austria.

Malaysian Prime Minister Anwar Ibrahim also attended the event, emphasizing the government's commitment to attracting larger-scale chip investments globally and cultivating more technical talent.

It is understood that Malaysia is Infineon's largest chip production base in Asia and its largest global operation center for chip packaging and assembly. Ng Kok Tiong, Senior Vice President and Managing Director of Infineon’s Kulim plant, mentioned that Infineon has around 15,000 employees in Malaysia, more than anywhere else in the world, including its headquarters in Germany.

As a market leader in power and microcontroller chips, Infineon is focusing on various types of wide-bandgap semiconductors for next-generation power solutions, including SiC and gallium nitride (GaN) based semiconductors.

Wide-bandgap semiconductors are noted for their higher temperature and voltage tolerance compared to traditional silicon-based chips. SiC chips are crucial for high-power electric vehicle charging solutions and renewable energy infrastructure, while GaN chips, with their higher energy density, can be used to produce smaller chargers and adapters.

Raj Kumar, Senior Vice President of Technology and R&D at Infineon's Kulim plant, stated, "Compared to silicon-based power solutions, SiC can double the power density at the same size or achieve the same power at half the size."

Infineon expects its SiC-related solutions to generate at least 600 million euros in revenue for the fiscal year ending September 2024. Additionally, the company plans to invest an extra 5 billion euros in the second phase of the Kulim plant's construction, having already secured 1 billion euros in advance payments and approximately 5 billion euros in customer design win commitments.

The demand for wide-bandgap semiconductor devices is driven by the need for energy efficiency and higher power output across sectors such as electric vehicles, 5G infrastructure, and power converters. Research firm Gartner projects that the market size for wide-bandgap devices will reach 13 billion dollars by 2028, with a compound annual growth rate (CAGR) of 29.9% between 2023 and 2028.

However, industry executives have pointed out that SiC chips in power solutions are still three to four times more expensive than silicon-based solutions. The material is fragile and difficult to process, requiring a single process to be produced at high temperatures of 2,000 degrees Celsius. The most advanced SiC chips have just begun transitioning to 8-inch wafers, while cutting-edge processor chips are already being manufactured on 12-inch wafer substrates.

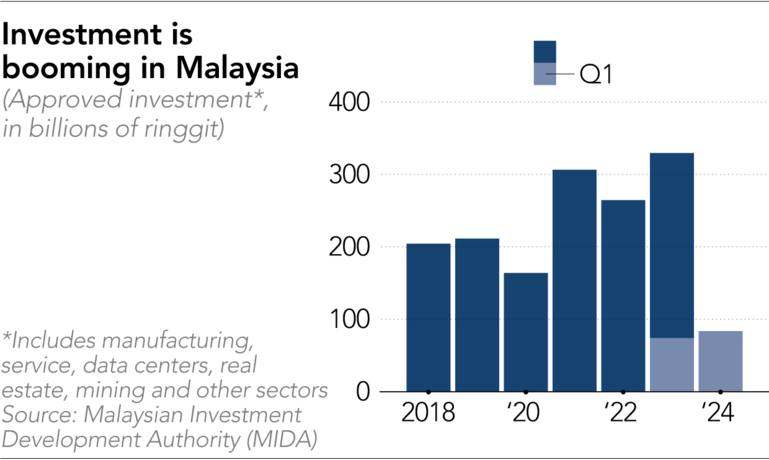

Expansion plans by companies like Infineon are good news for Malaysia, which has seen increased investment amid U.S.-China trade tensions. In 2023, Malaysia's investment reached a record high of 329.5 billion ringgit, an increase of more than 24% compared to 2022. Additionally, data centers, the hottest sector in Malaysia's tech industry, have also received substantial investments.

According to the Malaysian Investment Development Authority, over 45% of the investments in 2023 were related to the electrical and electronics, information, and communication industries.

Keat Yap, Joint Head of Operations and Performance for the Asia-Pacific region at U.S. consulting firm Kearney, stated that Malaysia's role in the chip supply chain is expanding. The country has attracted significant investments, with strong talent reserves, an ecosystem, and government support. However, competition for semiconductor investment remains fierce.

"In an increasingly competitive environment, Malaysia must not only sprint towards its goals but also seize new growth opportunities to maintain its competitive edge."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.