U.S. foreign deposits rise fourth consecutive month

The latest data from the Commodity Futures Trading Commission (CFTC) shows that foreign exchange (FX) deposits of US retail investors rose for the fourth consecutive month.

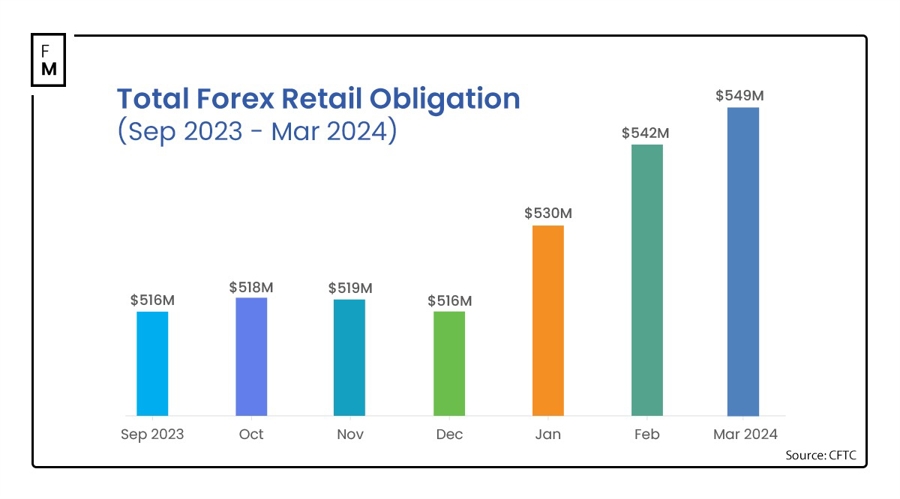

According to the latest data from the U.S. Commodity Futures Trading Commission (CFTC), retail investors' foreign exchange (FX) deposits in the United States have increased for the fourth consecutive month. Statistics as of March 2024 show that total customer deposits have risen to over $549 million, an increase of 1.3% compared to February.

Retail forex total deposits continue to rise for the fourth consecutive month in the United States.

According to CFTC data, in March 2024, the total forex deposits in the United States reached $549.3 million, an increase of over $7 million from the previous month's $542.3 million. This marks the highest level in over a year and the fourth consecutive month of growth since hitting bottom in December last year.

The decline at that time was quite minimal, and since hitting bottom in September 2023, deposits have been steadily increasing, with deposits at that time amounting to $516 million.

Leading the rankings, Gain Capital remains the top broker with deposits totaling $208.4 million, slightly down by 0.5% from February's $209.4 million. According to Charles Schwab, forex deposits also decreased slightly, dropping by less than $300,000 to $62.4 million.

However, retail deposits for the remaining brokers included in the report have all increased. Trading.com recorded the strongest percentage growth, up by 8.9% to $1.8 million. OANDA recorded the largest nominal increase, adding $4.2 million (2.3%), bringing deposits to $183.9 million. OANDA is currently the second-largest broker after Gain Capital.

CFTC Regulatory Reporting Requirements

The U.S. Commodity Futures Trading Commission requires Retail Foreign Exchange Dealers (RFEDs) and Futures Commission Merchants (FCMs) to submit monthly financial condition reports. These mandatory submissions must detail key financial metrics such as adjusted net capital, customer assets, and total retail forex obligations. Retail forex obligations include all assets held on behalf of clients by FCMs or RFEDs, adjusted for any gains or losses.

Among the 62 registered RFEDs and FCMs, prominent entities like Charles Schwab, Gain Capital, IG, Interactive Brokers, OANDA, and Trading.com are all required to publicly disclose their financial commitments. The report states that investments in front-end technology by FCMs are crucial for improving operational efficiency and remaining competitive in the fiercely competitive derivatives market.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.