Less than a year later Apple issues another bond with a maximum maturity of 30 years! 108 basis points over U.S. Treasuries

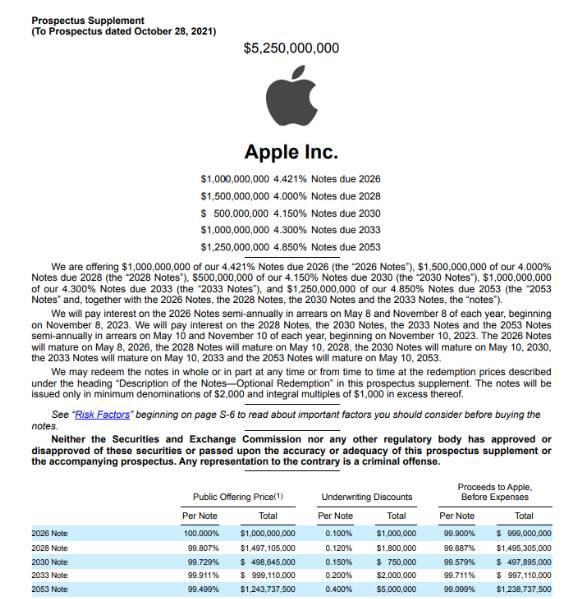

According to the disclosed documents on Apple's official website, the company will issue bonds in five series, with a bond issuance scale of $5.25 billion.

As key inflation data for the United States is about to be released this week, a large number of borrowers are hoping to raise funds before that. Surprisingly, Apple Inc., as a technology company, has also come to an end this time. It is reported that on Monday local time, Apple has entered the US blue chip bond market.

Apple will issue five series of new bonds this time, 108 basis points higher than the US treasury bond

According to the disclosed documents on Apple's official website, the company will issue bonds in five series, with a bond issuance scale of $5.25 billion. A person familiar with the matter said that the longest term of the bond may be 30 years, and its yield may be 108 basis points higher than the 30-year US treasury bond bond. This is already lower than the yield originally proposed by Apple, which was about 135 basis points higher than the US treasury bond bond.

As the world's most valuable technology giant, Apple is currently one of the highest rated companies in the corporate bond market. Moody's and S&P have rated Apple AAA/stable and AA+/stable, respectively.

Apple's last bond issuance was in August 2022, with a scale of $5.5 billion, and the proceeds were used for stock repurchases and dividend payments.

Less than a year later, Apple issued new bonds. And this time Apple plans to use the proceeds from its issuance for general corporate purposes. Insiders suggest that this may include stock repurchases, dividend payments, working capital, capital expenditures, acquisitions, and debt repayment.

Previously, Apple disclosed in its quarterly results released in March that it would give back $23 billion in cash to shareholders during the period, including paying $3.7 billion in dividends and repurchasing $19.1 billion in shares (or 129 million shares). In addition, at the time of announcing the results, the board of directors approved an additional $90 billion share repurchase authorization, and the company also increased its dividend by 4% to $0.24 per share. In terms of debt, Apple's interest bearing debt payable within one year is $12.574 billion, and its long-term interest bearing debt is $149.927 billion.

Some media reports suggest that Apple's decision to issue billions of dollars in new bonds is more to expand cash flow than operational needs. This issuance of five series of bonds will further benefit the company's goal of achieving net cash neutrality.

Rob Waldner, Chief Fixed Income Strategist and Head of Macro Research at Invesco, stated before pricing the deal that it will be welcomed by the market. "We have seen a significant demand for high-quality fixed income."

The size of senior US bonds this week will exceed $30 billion

The United States will release CPI and PPI data on Wednesday and Thursday this week, and some companies hope to raise funds before the data is released. On Monday alone, 11 companies issued new bonds with a scale of $22.55 billion. T-Mobile and Merck&Co. Inc. have also issued $3.5 billion and $6 billion in bonds, respectively.

According to media surveys, with signs of stabilization in the corporate bond market, the issuance of senior US bonds this week is expected to reach $30 billion to $35 billion.

In addition, Apple is the second large technology company to issue bonds after releasing its financial reports. Facebook's parent company Meta Platforms Inc. issued its second bond last week, raising a total of $8.5 billion.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.