What is a Bid?

The bid is the price that a buyer in a market is willing to pay for a security, commodity, or currency.A bid stipulates both the price and the quantity that the buyer is willing to purchase.

In financial markets, the bid refers to the price that buyers are willing to pay for a stock, bond, currency, or commodity, as well as the quantity they are willing to purchase.

Definition of Bid Price

The bid price is the highest price that buyers are willing to pay for a particular security, commodity, or currency in the market. The bid price specifies both the price and the quantity the buyer is willing to purchase. When you place a buy order for a stock, you compete with all other buyers in the market. Typically, buy orders are placed through brokers, who match buyers with sellers.

Example: If you are willing to pay $10 per share for a fictional stock A and want to buy 100 shares, that constitutes your bid. If a seller is willing to sell at that price, the transaction will occur.

Mechanism of Bid Transactions

In stock trading, the bid price and the ask price (the price at which sellers are willing to sell) are two key indicators of market transactions, reflecting the best buying and selling prices at a given moment. For example, if a fictional company, Acme Scuba Corporation, has a bid price of $100, this indicates the highest bid in the market, while an ask price of $105 indicates the lowest asking price.

Bid Volume and Ask Volume

The bid and ask prices usually have an additional number indicating the quantity of shares willing to be bought or sold at the current price. These quantities are typically expressed in "standard trading units," such as 100 shares per unit. Thus, a bid volume of 5 means there are 500 shares available for trading.

Example: Acme Scuba Corporation's bid price might be $100 (10), indicating there are 1,000 shares available at that price. If you want to sell 100 shares, the most likely price you would receive is $100.

Role of Market Makers

Market makers play a crucial role in ensuring good market liquidity, making transactions smoother. They are often banks or large financial institutions, and in some cases, they can also be brokers.

Market makers hold inventories of stocks and can display guaranteed bid and ask prices. When buyers place orders, market makers sell stocks from their inventory to fulfill the orders. They profit from the difference between the bid and ask prices.

The liquidity provided by market makers ensures sufficient trading volume for the market to function smoothly. Without market makers, you may struggle to find enough buyers when you want to sell a stock.

Why is the Ask Price Higher than the Bid Price?

In the stock market, the ask price is higher than the bid price primarily to ensure profitability. This phenomenon is supported by market makers (such as banks or financial institutions) that maintain market liquidity, allowing investors to trade more efficiently.

Profit Sources for Market Makers

Market makers profit by holding stock inventories and leveraging the price difference between the bid and ask. If the ask price were lower than the bid price, market makers would not be able to profit.

Example: Suppose a market maker buys shares of the fictional company Tommy’s Tomatoes at $10 each. They might set the ask price at $10.05 to earn a profit of $0.05 per share. Although this difference seems small, it accumulates significantly at high transaction volumes, compensating for the risk associated with holding large quantities of stock.

Difference Between Bid and Ask Prices

The gap between the bid and ask prices is referred to as the spread. For stocks that are traded in large volumes—meaning they are highly liquid—the spread is typically small. However, there are cases where the spread can be large, and a significant gap between the bid and ask does not necessarily indicate a problem with the stock or the market.

Factors Affecting the Spread:

-

Low Volume: Some stocks have low demand and trade in low volumes. This may be due to the stock being in a niche market or investors waiting for more information. Low trading volume results in lower liquidity, increasing the risk for market makers holding that stock.

-

High Volatility: Certain stocks experience large price fluctuations, indicating high volatility. When stocks are volatile, the bid-ask spread is generally larger than for less volatile stocks.

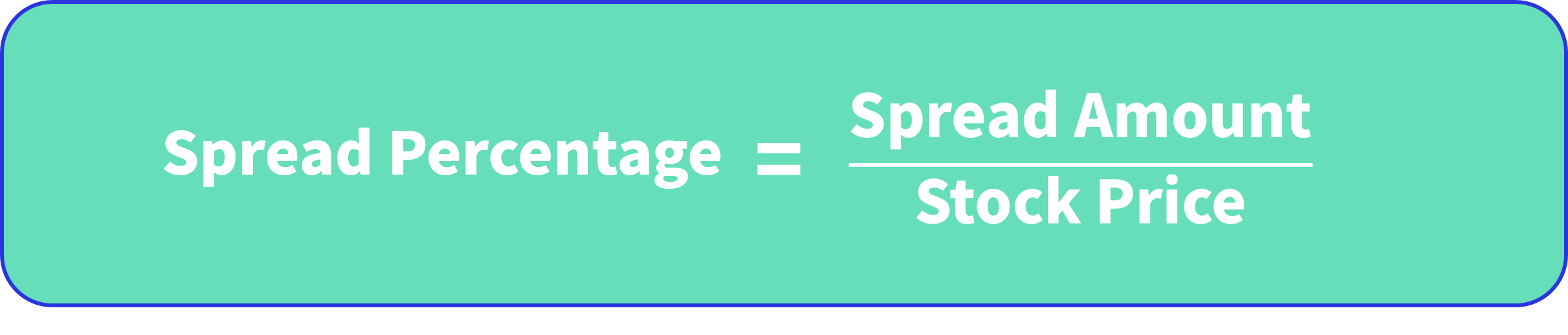

How to Calculate the Bid-Ask Spread Percentage

To understand the bid-ask gap, you can calculate the spread percentage. This is done by dividing the amount of the spread by the stock price:

If the spread percentage is small, it usually indicates that the stock is liquid, making it easier to buy and sell.

Example: Consider two fictional stocks with the following spread situations:

- Teresa’s Tights has a bid-ask spread of $0.02 and a stock price of $10, resulting in a spread percentage of $0.02 / $10 = 0.2%.

- Chad’s Chairs has a bid-ask spread of $0.20 and a stock price of $100, yielding a spread percentage of $0.20 / $100 = 0.2%.

Although Chad’s Chairs has a tenfold higher absolute spread, both stocks have the same percentage spread.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.