How about Exness's social transactions?

Want to profit from the foreign exchange market but do not know where to start.?Exness's Social Trading May Be Your Perfect Solution。

Social trading is very popular today, and this method of trading has opened up new opportunities for many people and is the best way to profit from the market.。The practice dates back decades, when people got together to discuss investment opportunities and pooled their money to invest in a project.。

Modern social trading began in 2010 when social trading platforms emerged that could be accessed from anywhere in the world.。

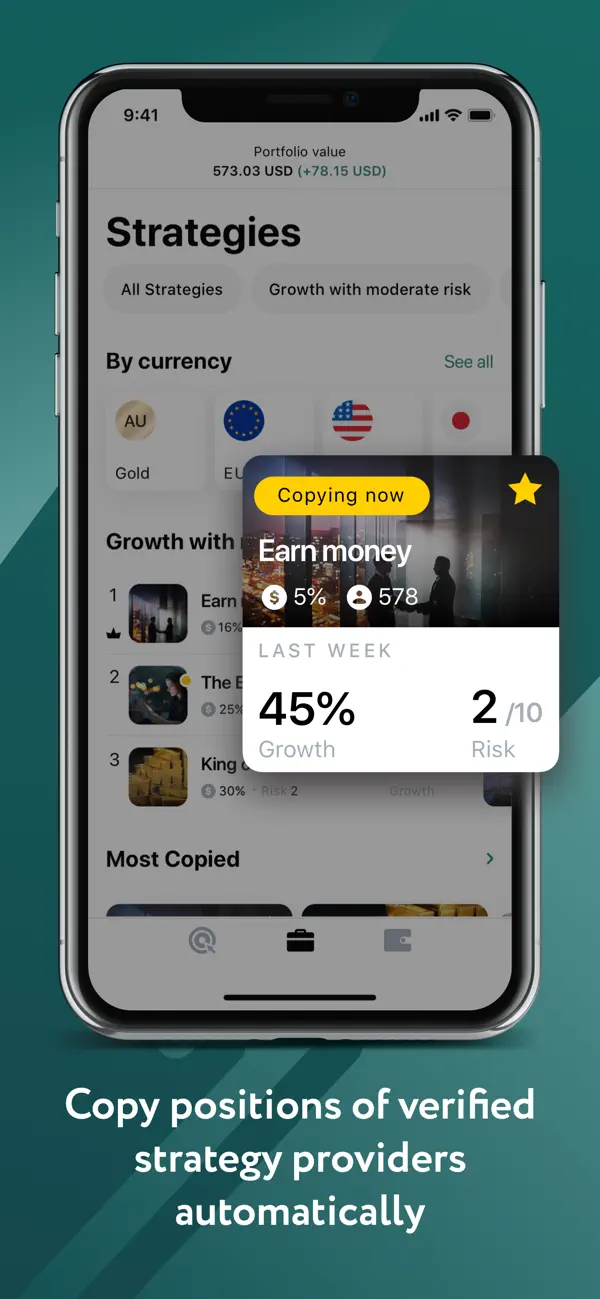

The Exness social trading platform allows investors to copy the trades of experienced traders (i.e. strategy providers) and investors can benefit from the expertise of professional traders without having to do any research or analysis themselves.。Once you have found the strategy provider you want to follow, just click the "Copy" button and the platform will automatically execute the same trade as the strategy provider。

Exness social trading platform is a great way for investors to enter the world of trading and a great way for investors to diversify their portfolios and reduce risk。

Exness Social Trading Platform Overview

Exness launched its own social trading platform in 2019。In just three months, the number of participants has reached 30,000.。Now it has become one of the most reliable social trading platforms。

The Exness social trading app has a user-friendly interface that traders can easily navigate through。Currently, the Exness social trading app is available on iOS and Android。

The app has been downloaded more than 100,000 times on the App Store and Play Store。In addition, the app received 4.2 points (Play Store) and 5.Good rating of 0 points (App Store)。

1.Policy List

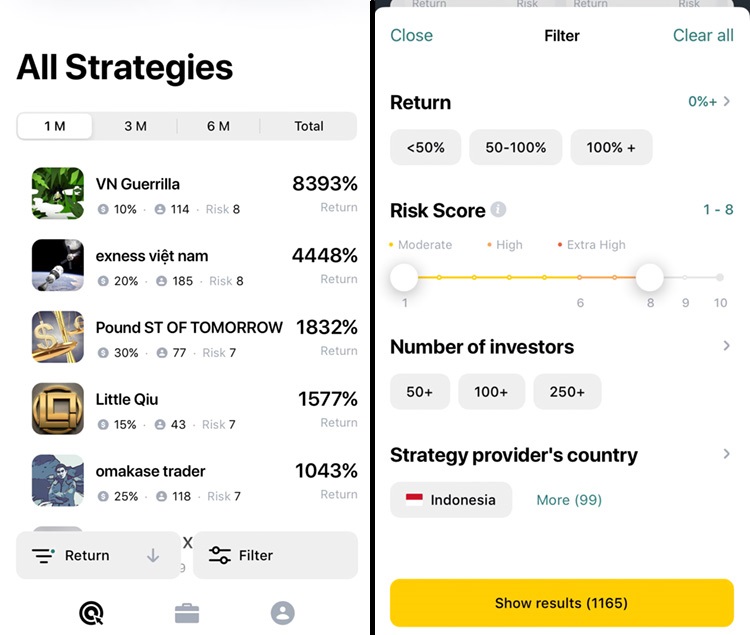

Here, investors can browse various strategies and sort them according to different criteria, such as currency, maximum replication, return, risk, commission, and number of investors。If you want a more specific answer, you can add additional filters such as time period, return, risk, number of investors, and strategy provider country to the Exness social trading app。

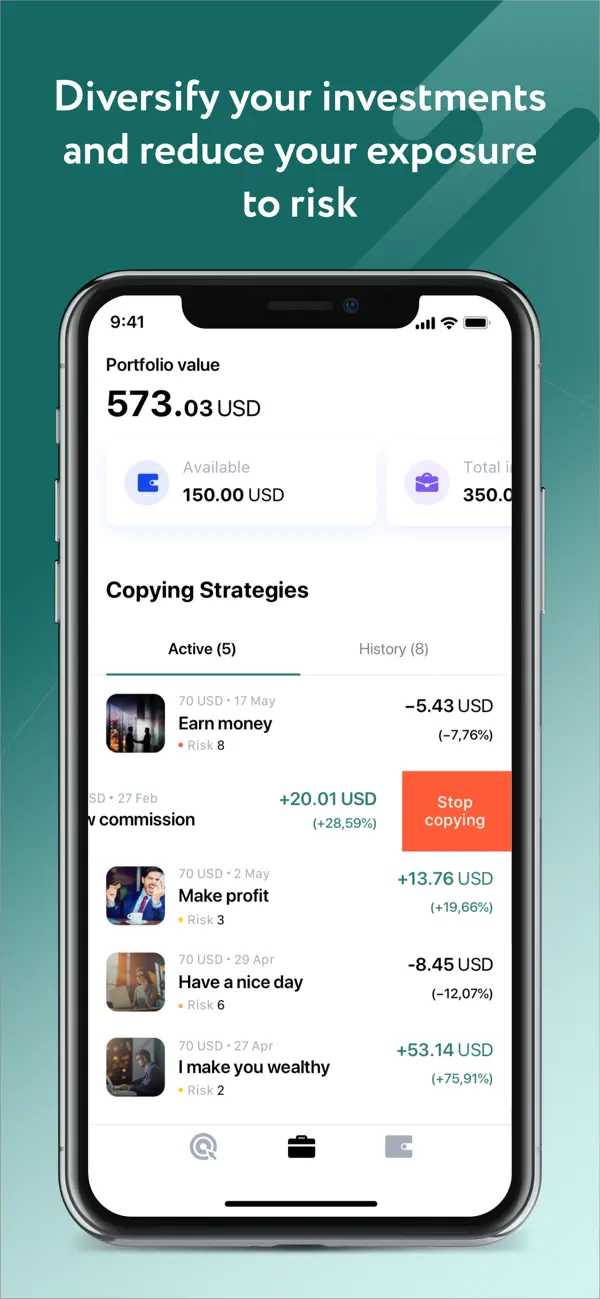

2.Portfolio

Here you can see all your active investments as well as copy history and also see the current available balances and manage them。

In this section, investors can diversify and reduce risk。You can choose a medium to low risk strategy or a strategy that matches your expected return。In addition, investors can apply for withdrawals by clicking on the wallet icon in the portfolio section。

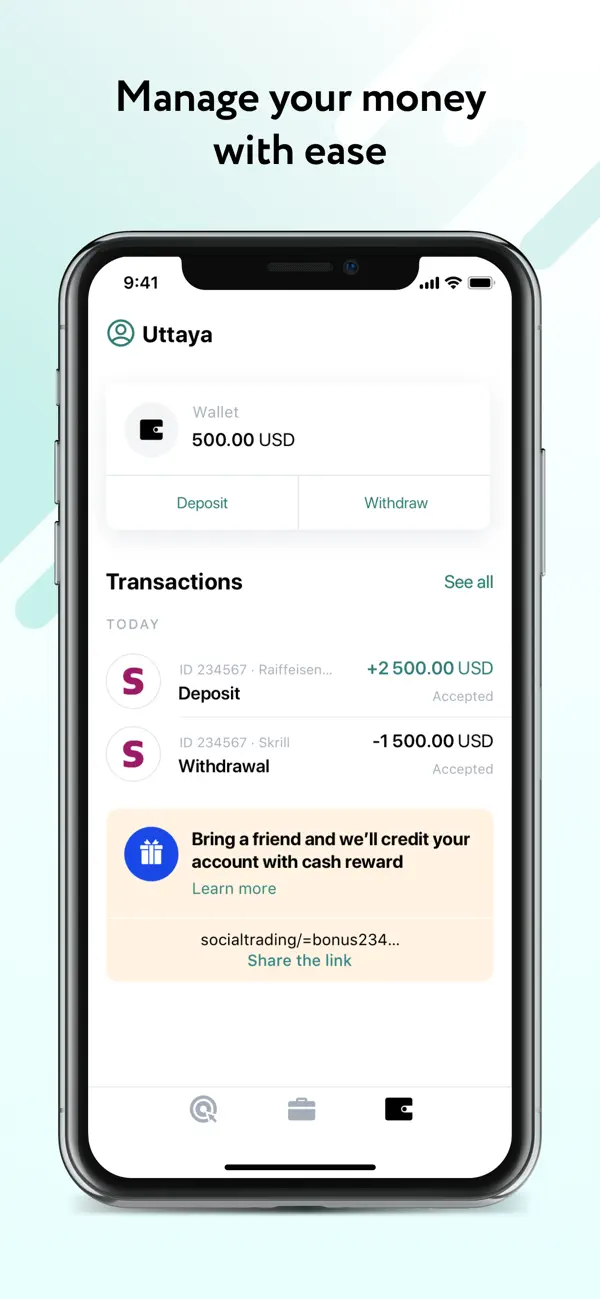

3.Account

The Accounts section is your central hub for accessing and managing all your personal information, and it offers a variety of features to ensure a seamless trading experience。In this section, you can customize your account settings, verify important documents, easily contact customer service, find links to partners, and easily make a deposit or withdrawal。

In addition, the "Accounts" section provides powerful security options to protect your Exness social trading account。You can establish additional levels of security, such as setting a password, transferring to a new Exness account, using fingerprint verification, or leveraging FaceID。These security measures are essential to prevent unauthorized access and protect your account from misuse by criminals。

In addition, in the "Account" section, you can view the amount of deposits in your account and track the complete transaction history, check your financial activities at any time, and understand the status of your funds.。

Investors will still be protected when the master strategy loses money or eventually reaches zero net worth。In this case, the trade will be automatically closed and the investor should stop copying the strategy。

If the investor makes a profit during the trading period, they only need to pay a commission to the strategy provider; if the investment loses money, the investor does not need to pay a commission until the investment profit exceeds the loss in the subsequent trading period.。

How to Use Exness Social Trading?

1.Open the social trading app and log into your account。If you already have an Exness account, just enter your data and click "Login"。

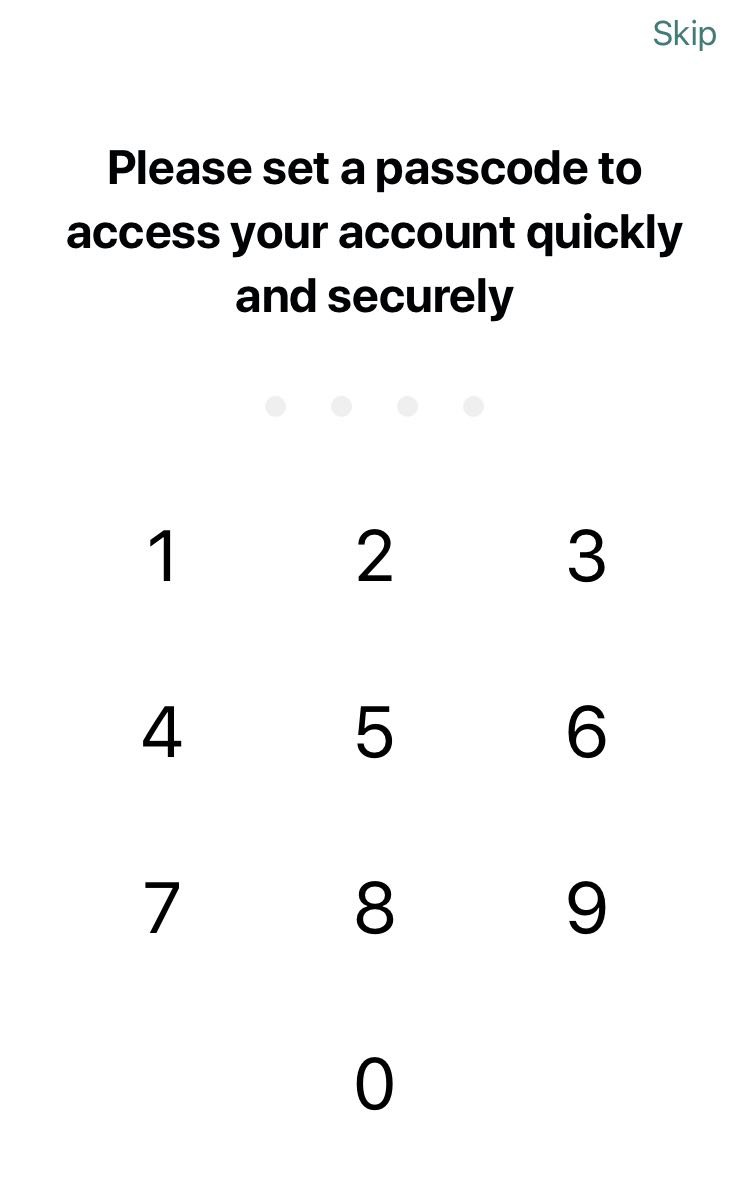

2.For security reasons, you need to set a password to open the app and access your account。

3.After successful login, you can browse the policies you are interested in in the "main policy area," and you can also add filters to customize the search。

4.Review policy information to ensure it meets your criteria and risk tolerance。

5.To copy a policy from the Exness social trading app, click Start Copying。

6.Select the amount to invest, ensuring that the minimum investment amount set by the strategy provider is exceeded。

7.You can monitor and manage your active investments in the Portfolio tab。

How to deposit and withdraw money?

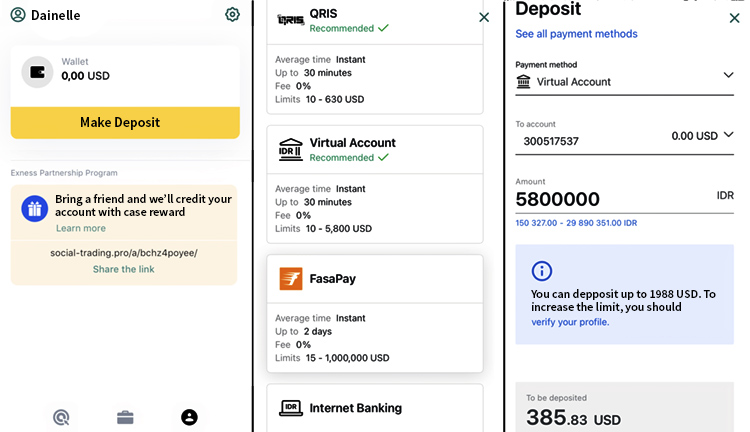

Investors can make deposits and withdrawals through the Exnesss social trading platform app and website。

Deposits

To deposit money to your Exness social trading account, follow these simple steps:

Log in to your Exness Social Trading account and navigate to the Accounts section。

Find and click on the wallet icon to enter the "Deposit" option。

Choose from the available payment methods provided and carefully follow the on-screen instructions to complete the deposit。

Once the deposit is in your wallet, you can use the funds to invest in replication strategies and start benefiting from the Exness social trading platform。

Withdrawal

Meanwhile, to withdraw funds from the portfolio section, follow these steps:

Sign in to the social trading app。

Navigate to the "Portfolio" tab and click Wallet。

Selection of withdrawals and payment methods (depending on the payment method used for deposit transactions)。

Set withdrawal amount and currency。

Enter the verification code sent to the account registration email address, or send the verification code to the account registration phone number via SMS according to the selected security type。

Finally, click "Verify" to complete the withdrawal.。

Your money will appear in your wallet soon, depending on the payment method you use。If your funds do not show up after some time, please contact Exness Support for assistance。

To ensure the integrity of the trading process, you cannot withdraw money when your investment is active。In addition, investors cannot make internal transfers。If you use a credit card to fund any trading account in your Personal Area (PA), you must initiate a credit card deposit refund from your Personal Area (PA) before withdrawing any funds from your social trading wallet, which will ensure that financial transactions are processed properly and regulatory requirements are complied with。

Tools and Features

Exness provides a variety of tools and features in its social trading app that enable investors to choose strategies, monitor performance, and assess profitability. Here are some key features that investors need to know:

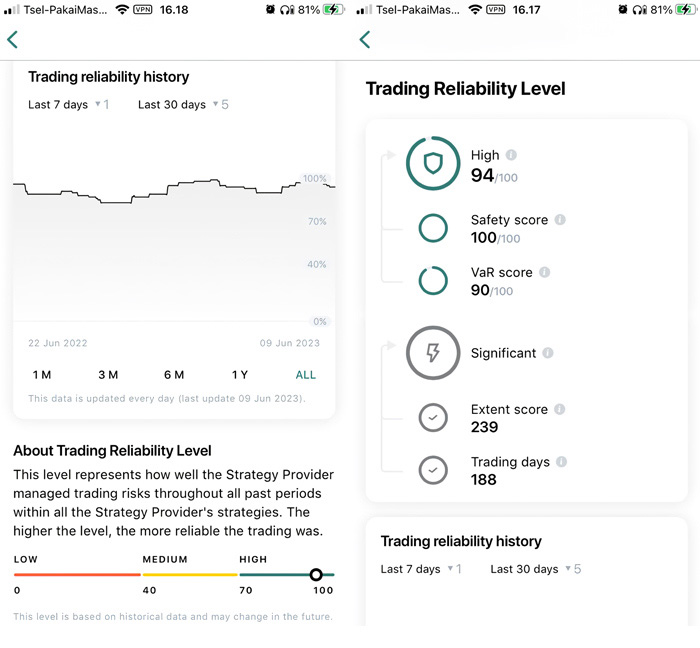

1.Transaction Reliability (TRL)

Transaction Reliability (TRL) is a tool that measures the ability of a strategy provider to manage transaction risk. Its calculation combines two factors: safety score and value at risk (VaR) score。The security score measures the likelihood that the strategy provider will lose all of its capital, while the value-at-risk score measures how much money the strategy provider is likely to lose in the worst case scenario。

Trading Reliability (TRL) is a numerical evaluation of a strategy provider or portfolio manager (SP / PM) based on its trading performance, ranging from 0 to 100。The higher the TRL, the higher the reliability of the trader's performance。

It is important to note that the calculation of TRL can only be performed 30 days after the strategy or fund executes the initial trade。

TRL levels are classified as follows:

- Low: TRL range 0 to 40。

- Medium: TRL range from 41 to 70。

- High: TRL range from 71 to 100。

Please note that TRL is based on historical data and cannot predict future performance。However, investors can still use TRL as a measure of the professionalism of a strategy provider。

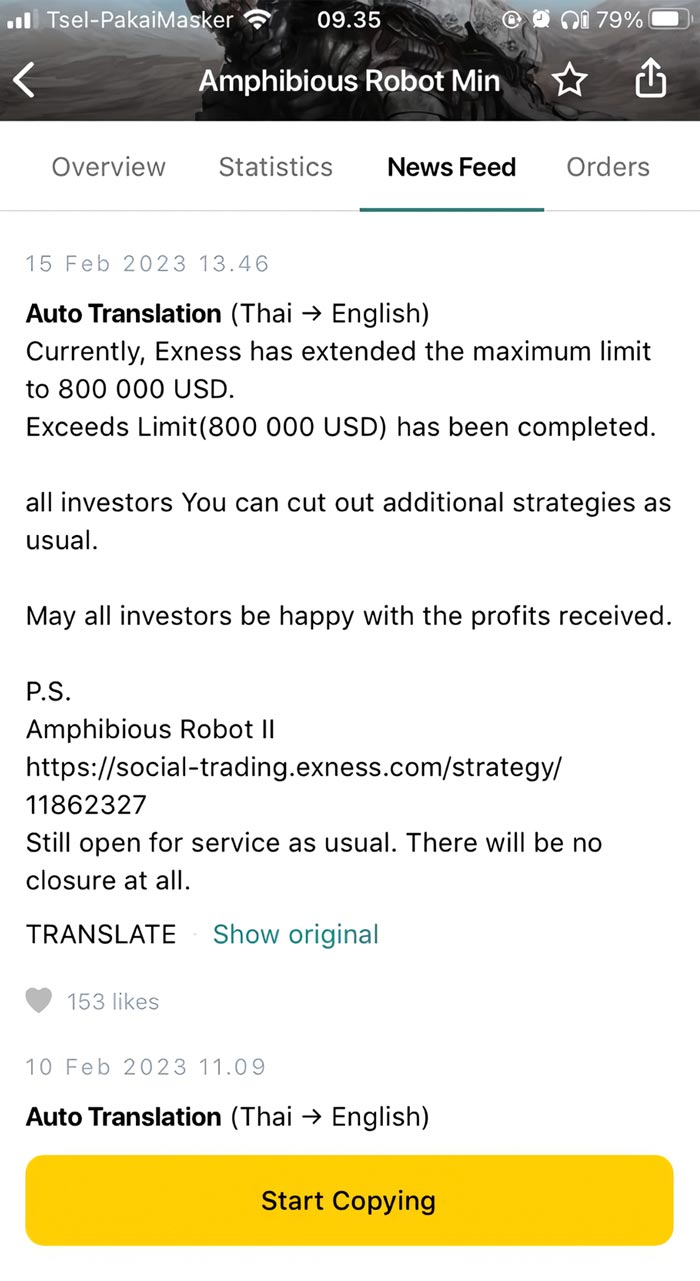

2.News Summary

News Feed is a section of the social trading platform where strategy providers can share up-to-date information with investors, including news or information about strategy performance, upcoming trades, and any other relevant。

Investors in the Exness social trading app can use the News Feed to keep up with the latest developments in the strategy and make informed decisions about whether to continue copying the strategy。The news feed also supports translation functions to make it easier for investors to understand the updated information of the strategy provider。

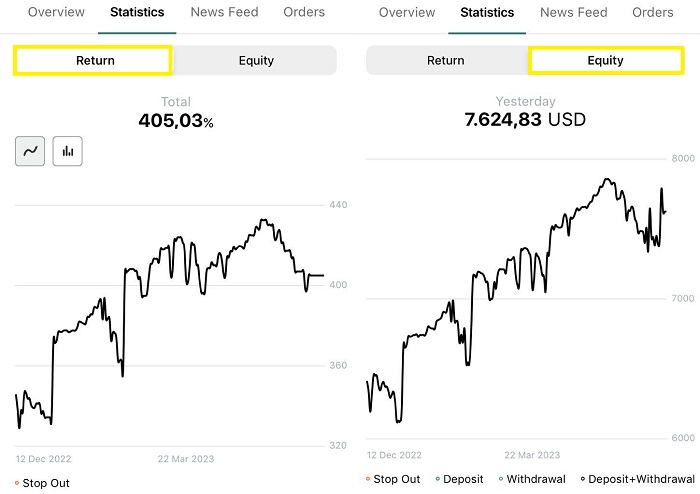

3.Statistics

Statistics is a tool in the Exness social trading app that allows you to view the benefits and net worth of your strategy。

Here is a detailed explanation of each indicator:

Earnings: The indicator shows how much money the strategy has made or lost over a period of time。These daily statistics calculate the change in a user's net worth from the beginning of the month to the end of the month and offset any deposits / withdrawals。

Net: The indicator shows the total amount of funds currently available in the strategy account。is calculated by adding the profit and loss of the strategy and any additional deposits or withdrawals。

Investors can flexibly customize the visual representation of charts and data in the statistics tab according to a specific time frame, such as 1 month, 3 months, 6 months, etc.。

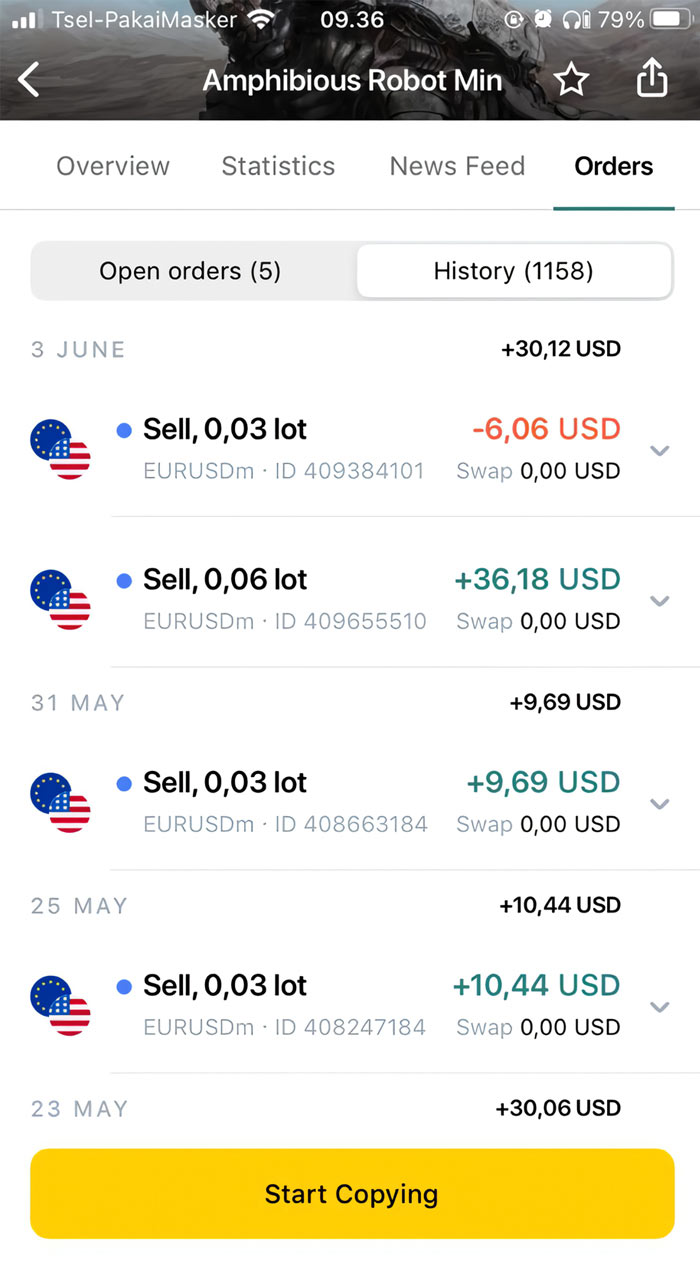

4.Order Tab

In the "Orders" tab, investors can monitor all open orders as well as historical orders for the strategy, and clicking on any item in the list will display its details。

It is important to pay attention to the information displayed in the Orders tab, which provides insight into the profitability of the strategy provider in executing orders。

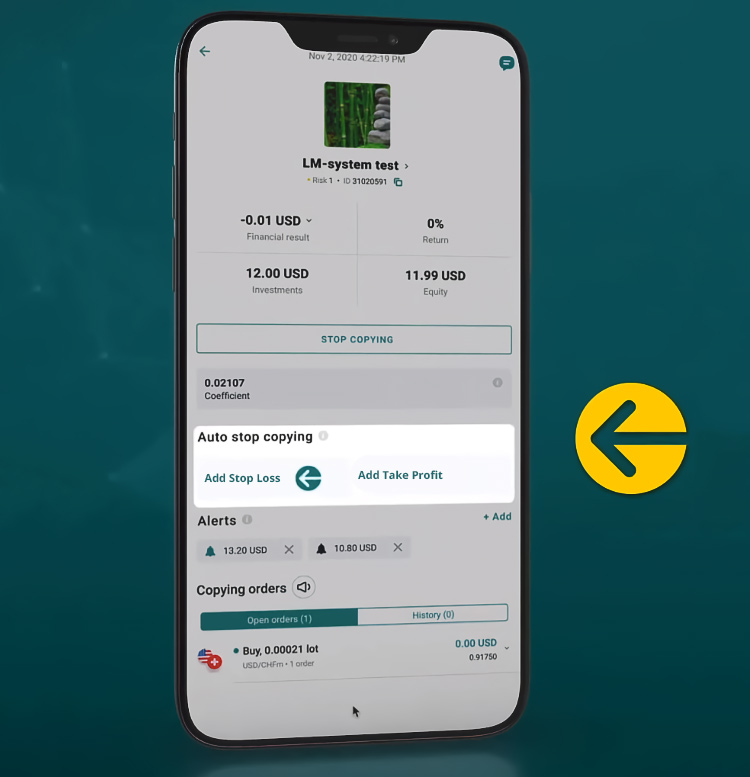

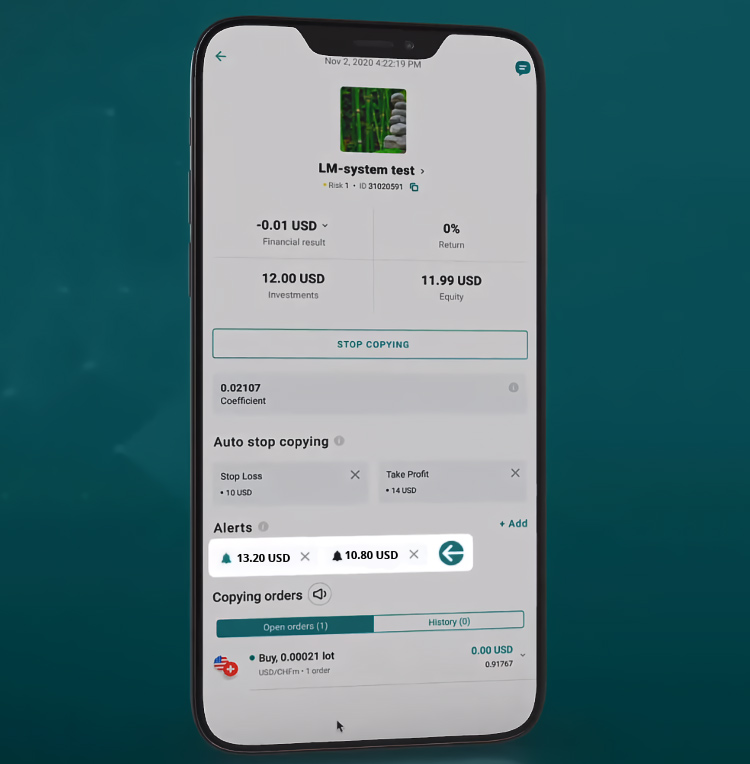

5.Stop Loss and Take Profit

It is highly recommended to install the feature in the policy of your choice。The tool protects the value of the user's investment and avoids unexpected price fluctuations when investors are not paying attention。

To set stop loss and take profit, click on the investment strategy and then click "Add stop loss" or "Add take profit" under "Auto stop copying"。Enter the required price limit and click Add, then confirm。

After confirming the installation, your investment will automatically close when the price limit is exceeded。Investors can change the applied limit price by clicking on the stop loss and take profit numbers。

6.NOTICE

Exness social trading provides investors with the option to set an alert, and when a specific equity level is reached, you will be notified via a message notification on your mobile device。

This feature allows you to closely monitor investment performance。By default, there will be pre-installed alerts, but you can modify or delete them according to your preferences。

How to find the right strategy?

Before you start copying an Exness trade, you should choose the first replication strategy, and it is important to review the strategy to ensure that it has a good chance of bringing you profits。

You can find all the in-depth information you need on the policy page。To view the page, simply click on the strategy from the "Strategy Main Area" or "Portfolio" and click on "Overview"。

You can collect several types of information, such as:

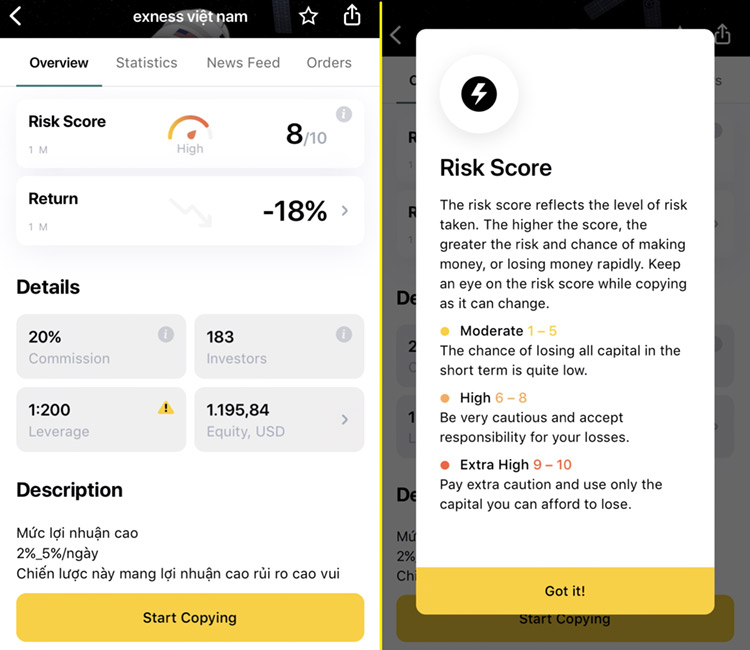

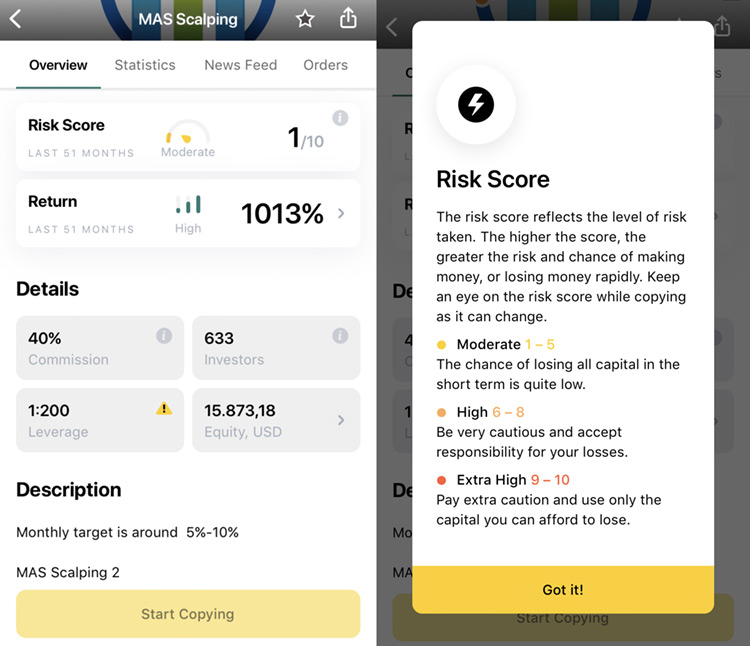

Risk Score

It reflects the risk level of the strategy。Basically, the higher the score, the greater the risk。Keep in mind that while high-risk strategies can bring you more benefits, they can also make you lose money faster.。

Scores range from 1-10。Let's look at the table below for more information on risk score measurement。

| Risk Score | Grade | DETAILS |

| 1-5 | 中 | The risk of losing your entire investment in the short term is low.。 |

| 6-8 | 高 | Be very careful and take responsibility for your losses。 |

| 9-10 | superelevation | Be extra careful and only use the money you can afford to lose。 |

The risk score displayed by a strategy represents the highest level of risk achieved on that day.。However, the score is recalculated every 20 minutes and will only be increased if it exceeds the highest score of the day.。In addition, strategy providers can improve their risk scores by trading with a smaller portion of strategy capital within 30 days。

Updated whenever a strategy achieves a higher risk score。For 9 and above strategies, as a default precaution, the strategy is automatically hidden from potential investors。

A risk score of 6 indicates a high level of risk。The higher the score, the less free margin available for the strategy, making it more vulnerable to potential vulnerabilities。

Return

The return on Exness social trading shows the growth of a specific strategy and is updated daily。The statistics are designed to calculate the change in the strategy from the beginning of the month to the end of the month。

The calculation method takes into account different periods determined by specific operations (such as account deposits, withdrawals and internal transfers), collectively referred to as balance operations (BO)。Return values are determined by multiplying these time periods between balance operations and are presented as percentiles。Whenever the strategy provider withdraws or deposits, the yield calculation is not affected in any way to prevent artificial results。

Revenue calculations are based on balance operations, which include deposits, withdrawals and internal transfers。Unlimited number of balance operations。

In addition to risk scores and returns, there are other aspects to consider:

Commission

This shows the amount of commission that needs to be paid to the strategy provider。

Leverage

Shows the ratio of the strategy provider's own funds to the borrowed funds invested in the strategy。High leverage means increased market exposure due to increased contract size。However, this does not affect the risk score。

Investors

Displays the number of investors currently replicating the strategy。

Currency

The currency of the strategy and the total value of the account after all positions are closed.。

描述

This area shows the thought process behind the strategy。At the bottom, you can also see when the policy was created。

Provider Information

Contains basic information about the policy provider, including name, time of Exness transaction, and country of origin。If you want to know more, please click "More details"。

Trading cycle

This is the interval in which commissions are paid, ending on the last Friday of the month。

All of the above details are important in determining whether a strategy is worth replicating。Remember that in addition to the policy itself, you also need to make sure that the policy provider is reliable。Therefore, it is also important to view the policy provider's profile。

How much should be invested?

Investors can make a profit from social trading, but it can be challenging for investors with limited funds。This is because if the chosen strategy is successful, the investor needs to pay a commission to the strategy provider。

Typically, reputable strategy providers charge commissions ranging from 20% to 40%。If your goal is to make a quick profit, you need to take a big risk。

Exness requires a minimum investment of $10。But if you want to pay commissions and trade on more flexible terms, it is recommended that the budget be at least around $100 to $200。

In addition, some strategy providers on Exness offer advice on minimum investment to ensure that potential profits outweigh costs。For example, MAS Scalping strategy provider Jemmy Alwiyandu recommends a minimum investment of $500 for investors.。

When to Stop Executing a Policy?

After investing with the strategy of your choice, it is important to regularly monitor its performance。By monitoring investment performance, you can help ensure that your investment is on track to achieve your goals。

In Exness social trading, knowing when to stop following a strategy is a key decision that should be based on several key factors。While there are no clear rules, some of the following indicators may signal that it is time to stop following a particular strategy.

Continued loss

If the strategy continues to lose money over a significant period of time, this may indicate that the strategy is ineffective or that market conditions have changed。Continuous losses can be identified by the Orders tab in the History section。

Check shrinkage

Another important indicator to watch is shrinkage。Shrink is the maximum amount a strategy loses in a period of time。High shrinkage indicates that the strategy is risky and may lose a lot of money in a short period of time。To see if a policy provider often shrinks, you can view the provider's statistics section。

Lack of transparency

Transparent and reliable policy information is essential。If you find that the information provided by the policy provider is not clear or transparent enough, this may be a warning。Incomplete or vague information about strategic approaches, risk management, or historical performance that may erode trust and lead to termination。

Significant changes in strategy

It is normal to change strategies in trading to adapt to changing market conditions。However, if the strategy provider makes significant changes to the strategy without a clear explanation or reason, this may mean that the strategy lacks stability or deviates from the original principles of the strategy。Assess whether these changes are in line with your investment objectives and are worth continuing to track。

Deviation from personal goals or risk tolerance

Each investor has its own unique goals and risk tolerance。If the strategy is inconsistent with your personal goals or exceeds your risk tolerance, it may be time to consider stopping use。Your financial situation should always be a priority。

How to stop a replication policy?

To stop copying a strategy, investors can do so on the strategy page where they want to stop copying。You can follow these steps:

- Sign in to your Exness social trading app。

- Find and select the strategy you want to stop。

- After opening, you will see the "Stop copying" option at the top of the main area。

- After you confirm the action, you will no longer copy the policy。

It is important to note that if you choose to stop copying when the market is closed (for example, on weekends), there are two possible outcomes:

- If it is more than 3 hours before the market reopens, the investment will stop at the last market price。

- If it is less than 3 hours before the market reopens, the investment will not be stopped and an error notice will appear。You can stop copying after the market reopens。

Conclusion

Exness Social Trading is a service that allows investors to copy the trades of expert traders (i.e. strategy providers)。For investors, this is a great way to learn from experienced traders, and it is possible to make money without in-depth research or analysis。

Exness provides a range of effective tools and features in its social trading app that allow investors to choose strategies, monitor performance and assess profitability, enabling investors to make informed decisions and closely track their investments in the Exness social trading app。

Exness is a Forex and CFD broker offering clients cross-market trading services at the most stable and reliable prices in the industry, offering spreads as low as 0 pips and maximum leverage of 1: 000。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.