Which Pepperstone is best for you?

There are two types of Pepperstone trading accounts: razor accounts and standard accounts. What is the difference between the two and which one is best for you?

There are two standard types of Pepperstone trading accounts: razor accounts and accounts, what is the difference between the two and which one is best for you?

Merchants will offer multiple trading accounts, and obviously, most merchants tend to assign different trading conditions in each account to suit different types of traders。Therefore, before choosing the right trading account for you, please learn more about each account。

Pepperstone has one of the best trading account options in mass trading, as all Pepperstone trading accounts bear the transaction costs incurred。

Notes to Trading Accounts

A trading account is an important part of trading, here are some important aspects to be aware of when choosing a trading account。

Spreads and margin

The spread is the first factor to consider when choosing the right trading account, and it refers to the difference between the purchase price (buyer) and the sale price (seller) of a security or asset.。Spreads on accounts can directly affect transaction costs, and most traders are looking for the lowest spreads they can find。But in some cases, the increase in commissions may exceed the cost to a trader who trades at an average spread.。Low spread accounts are usually suitable for scalpers or traders who like to trade frequently; however, for new traders, a commission-free standard account is a good choice because it provides greater flexibility。

Minimum deposit

When a trader determines a real account, the deposit is the first fee to be "paid," while the margin is the final amount that the trader should provide when entering the market.。The minimum amount can vary widely depending on the policies and account type of some merchants。Some merchants may not have a minimum deposit requirement, which is good for new traders who tend to provide too much money on their first trade;More。

Leverage

Leverage is an important factor in deciding which trading account to choose because itdirectly affect each customer's ability to transact and thus their program。Usually, each merchant leverage ratio has a different policy, some merchants offer higher leverage (up to 1: 1000 or even higher), but some merchants choose to limit their leverage due to the high risk they pose。It is quite common for some merchants to allow their trading accounts to use 1: 50 leverage, and any leverage below this level has lower risk and is therefore better for new traders。

Available tools

Many traders tend to be caught off guard by the cost of the transaction facilitated, forgetting that they may trade with a limited choice of instruments。While not all traders keep multiple assets in their portfolios, having more options is always good for analyzing market correlations and diversifying risk。Forex, commodities and equity CFDs are the basis of the instrument, and any trading account that provides more services is considered to be part of its product.Outstanding。

Execution Type

Different traders have different types of execution orders,The rigid execution of merchants will directly affect the quality of transactions.。In general, there are two types of execution: the first is market execution, where order execution depends on heavily available market prices, and the second type is instant execution, which means that the trader will execute the order at the price the trader expects.。

Trading platform

The trading platform isWhere traders do most of their trading activity, It also has many functions, such as price charts, analysis tools, automated trading, market depth, news, etc., which can be an excellent tool to support traders。There are currently many trading platforms in temporary use, but traders mainly stick to MT4, MT5 and cTrader, and occasionally internal platforms。Traders should ensure that their traders provide a platform that can be easily used。

Available Scenarios

Factors such as hedging, scalping and even smart trading should be considered when choosing the right trading account。For example, not all brokers allow scalping for a number of reasons。It would be a disaster for scalpers who accidentally chose a no-scalping trading account, as would hedging and EA trading。

Pepperstone Trading Account Introduction

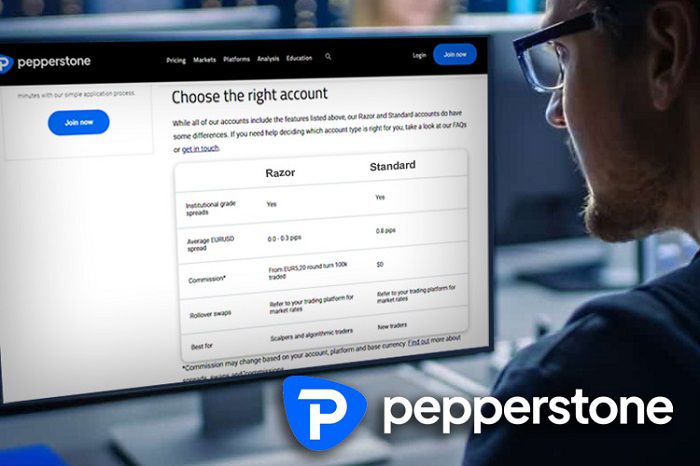

Pepperstone understands that every trader has different needs for trading conditions, so Pepperstone is equipped with two different trading accounts。What is the difference between these two accounts??Which is suitable for beginners, which is suitable for professional traders?

Standard Account

The first Pepperstone trading account to discuss is the standard account。This account type is the "default" account type, so most traders choose this account。This is a good type of account for new traders as it helps them master general trading。Usually, standard accounts have much higher spreads, but no commissions, but what about Pepperstone standard accounts?

Pepperstone's spread over this account is quite low, the standard account's spread is only 0.8, can be considered one of the lowest spread accounts in the market, as Pepperstone uses multiple liquidity providers from Tier 1 banks to provide the lowest spread。In addition, no commission is charged to traders and the account is not exempt from overnight interest, so it is perfect for long-term traders.。

Pepperstone Standard accounts can be accessed through multiple trading platforms, including MT4, MT5, cTrader, and TradingView。In order to open a real account, the trader should deposit some money。Standard accounts do not set a minimum amount, but they advise traders to inject at least A $200 or the equivalent into the account。The account also offers leverage with a maximum amount of 1: 30 and uses the market to execute orders to ensure that traders receive flexible pricing through all available instruments, including forex, indices, commodities, cryptocurrencies and stocks.。

Razor Account

In addition to the standard account, Pepperstone comes with a special account to provide low spreads.。Pepperstone's Razor account was created for this specific purpose。It is the best choice for scalpers and algorithmic traders。

Pepperstone's Razor account offers 0.Spread of 0 points and every 0.01 lots 0.Regular commission from $08。Please note that commission fees may vary depending on the trader's account, platform and base currency。For example, a trader using the Euro as the currency of a trading account will need every 0.01 hand pay 0.06 EUR round commission。

Pepperstone Razor accounts offer a wide selection of trading tools including Forex, Indices, Commodities, Cryptocurrencies and Stocks。All of this can be accessed through various trading platforms such as MT4, MT5, cTrader and TradingView, as well as a maximum amount of leverage of 1: 30。The recommended minimum deposit is approximately the same as the standard account and is executed using a non-trading desk。

Other matters

Despite some functional differences, both Pepperstone trading accounts have similar advantages。First, the minimum number of lots for both standard and razor accounts is 0.01, meaning that traders can hold smaller positions。The two accounts also allow scalping, hedging and EA trading, making them more flexible for a variety of trading scenarios。

Which account is better??

It's hard to choose the best Pepperstone trading account if you don't know what to look for。Objectively, the standard account spread is slightly larger, but no commission is charged, which is better for new traders。However, it may not be suitable for scalpers, because this account may be expensive for them; on the other hand, the spread of the razor account is smaller, which is much better for scalpers。In exchange, the trader must pay a commission。

To better understand Pepperstone trading accounts, check out the comparison below:

| FEATURES | Pepperstone Standard Account | Pepperstone Razor Account |

| Spread | 0.8 o'clock | 0.0 point |

| Deposits | ❌ | Every 0.01 Round 0.08 USD |

| Tools | Forex, Indices, Commodities, Cryptocurrencies and Stocks | Forex, Indices, Commodities, Cryptocurrencies and Stocks |

| Deposits | AUD 200 or equivalent | AUD 200 or equivalent |

| Leverage | 1:30 | 1:30 |

| Available Scenarios | Hedging, Scalping, EA Trading | Hedging, Scalping, EA Trading |

| Platform | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

| Type of execution | Market Execution | Market Execution |

Pepperstoneis aMulti-Asset Cryptocurrency Traders, providing services such as cryptocurrencies, indices, and foreign exchange。The encryption provider is known for high-quality software solutions, ultra-low prices, fast execution speeds of 30 milliseconds, and innovative encryption products.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.