Xiaomi refutes rumors that it will acquire Evergrande Auto

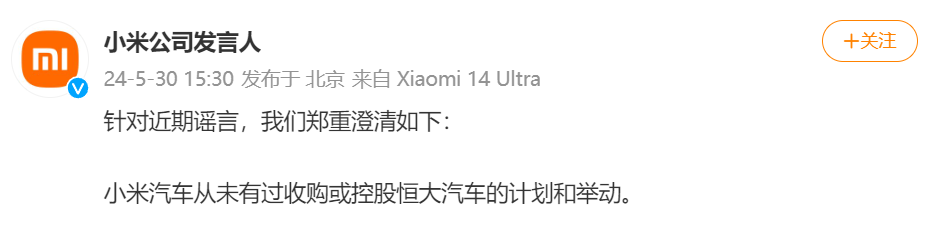

On May 30th, a spokesperson for Xiaomi Auto debunked rumors that they had never had any plans or actions to acquire or control Evergrande Motors.

On May 30th, a spokesperson for Xiaomi Auto debunked rumors that they had never had any plans or actions to acquire or control Evergrande Motors.

This seemingly outrageous rumor has not appeared for the first time.

As early as Xiaomi announced its car manufacturing, there were rumors in the market that Xiaomi wanted to acquire 65% of Evergrande Auto's shares. Xiaomi Motors denied rumors of negotiating the sale of Evergrande Auto's shares at the end of 2023.

Although Xiaomi started car manufacturing much later than Evergrande, currently, the development of the two is vastly different.Xiaomi Motors has been brewing for three years and released its first car, the Xiaomi SU7, at the end of March this year. The car went viral as soon as it was launched. According to data from Xiaomi Motors, as of April 30th, the cumulative number of lock orders for the Xiaomi SU7 series has reached 88,063; As of May 15th, the cumulative delivery of new cars in this series has exceeded the 10,000 mark; The goal is to deliver over 10,000 new vehicles per month by June.

Morgan Stanley once pointed out that Xiaomi's first electric vehicle had optimistic sales performance, and if the company can continue to lead the industry in advanced driving assistance systems (ADAS) and intelligent cabin functions, the bank believes that Xiaomi is likely to become a disruptive force with huge growth potential.

Currently, Xiaomi is facing a "happy worry" that its SU7 production capacity cannot keep up with demand.

Xiaomi Group President Lu Weibing stated during the Q1 performance conference that due to the actual delivery time of consumers being earlier than the time on the Lock Order APP, the factory's production capacity is being fully accelerated, and the company plans to start dual shift production in June. Xiaomi previously promised to deliver over 100,000 vehicles in 2024 and plans to sprint for 120,000 vehicles.

In contrast, Evergrande Automobile appears much more desolate.

According to previous disclosures by Evergrande Auto, as of the end of last year, the company had delivered a total of 1389 vehicles. Due to poor sales, Evergrande Motors is also facing significant challenges in its performance. According to the company's previously disclosed financial reports for 2021 and 2022, Evergrande Automobile suffered a loss of up to 84 billion yuan between the two years!

Although Xiaomi Group has a considerable amount of cash reserves, it is also unable to withstand such a bottomless pit. Some netizens exclaimed that this rumor is too outrageous, money is not spent in this way.

Earlier this week, Evergrande Auto mentioned in a statement that the company is currently facing a serious shortage of funds. Evergrande Auto revealed in its announcement that its factory in Tianjin has stopped production operations since the beginning of this year. As of the date of the announcement, the factory has not yet resumed production. Its Tianjin factory ceased production in April last year and announced a full resumption of production in May last year.

In the latest announcement, Evergrande Auto also announced that nearly one-third of the company's shares will be acquired.

Evergrande Automobile stated that the joint and individual liquidators and representatives of China Evergrande Group (in liquidation), Evergrande Health Industry Group Co., Ltd., Acelin Global Limited ("potential sellers") and a third-party buyer independent of the company and its affiliates ("potential buyers") have entered into a term book. The potential seller and potential buyer may enter into a final purchase and sale agreement for the sale of Evergrande Automobile shares held by the potential seller.

After reaching a purchase and sale agreement and being bound by its terms and conditions, the preliminary plan is to immediately acquire 3.145 billion potential unsold shares of Evergrande Automobile, which account for approximately 29% of the company's issued shares. At the same time, there are 3.203 billion potential shares for sale, accounting for 29.5% of the company's issued shares, which will become the subject of a feasible option for potential buyers to exercise within a certain period of time after the purchase and sale agreement date.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.