The yen is approaching the 160 mark again! Will the Japanese authorities intervene again?

The Japanese yen exchange rate has fallen for the seventh consecutive trading day, setting a record for the longest consecutive decline since March. On June 21st, the USD/JPY exchange rate once again approached the critical level of 160.

On Friday (June 21st) morning trading, after two months, the USD/JPY exchange rate briefly broke through the 159 mark, once again approaching the critical level of 160.

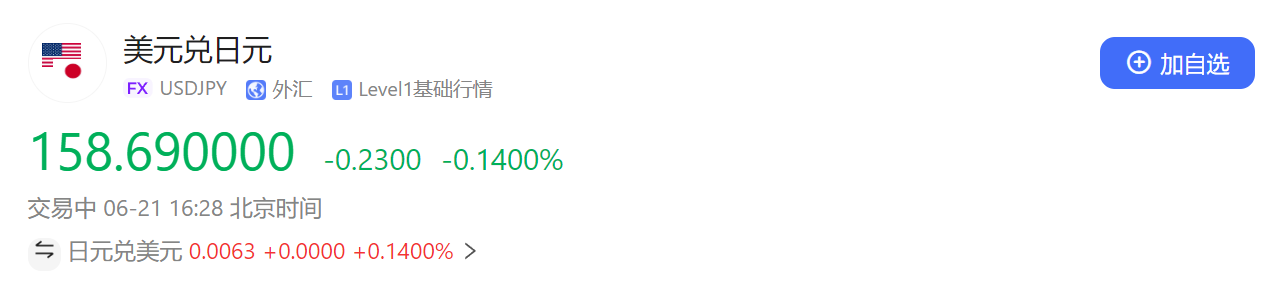

As of publication, the USD/JPY exchange rate is reported at 158.69.

It is worth noting that this is the seventh consecutive trading day of decline in the Japanese yen exchange rate, setting a record for the longest consecutive decline since March, once again raising the alarm for the yen.

On April 29th of this year, the USD/JPY fell below the 160 mark during trading, setting a new record for the lowest level since April 1990. In the afternoon of that day, the Japanese yen suddenly seemed to have been boosted, strengthening significantly and quickly narrowing the morning's decline, pulling the yen back to the level of 155. The market is speculating that the Japanese government intervened in the market.

The data released by the Japanese Ministry of Finance at the end of May confirmed the market's speculation. Data shows that the Japanese authorities spent a total of 9.8 trillion yen on currency intervention from April 26 to May 29. This intervention directly exceeds the total amount of funds spent on all intervention actions in Japan in 2022 (9.2 trillion yen).

In less than two months, the Japanese yen has once again approached 160, and the possibility of Japan intervening in the market again is rapidly increasing.

Masato Kanda, the highest official in Japan's foreign exchange affairs, reiterated on Friday that if the exchange rate fluctuates too much, his position will not change and appropriate measures will be taken. Kanda Masayoshi said, "As long as the exchange rate remains stable and fluctuates according to fundamentals, there is no need to intervene. On the contrary, if there is speculation and excessive volatility in the market, we will take resolute action."

Japanese Foreign Minister Yoshimasa Hayashi also warned yen bears not to lower the yen and stated that authorities will continue to monitor the trend of the exchange rate market. He said at a press conference, "The fluctuation of exchange rates should reflect the fundamentals, which is very important."

As the yen continues to weaken, on Thursday, the US Treasury Department released its semi annual currency report, which mentioned that Japan, along with six other countries, will be included in the foreign exchange monitoring list, and expressed concern about Japan's huge bilateral trade surplus and current account surplus.

Masato Kanda responded on Friday that the report did not indicate that Japan's actions were problematic, and that Japan's intervention in the foreign exchange market does not necessarily mean changing the potential trend of exchange rates.

Japanese Finance Minister Shunichi Suzuki also stated that he does not believe there are any issues with Washington's monetary policy towards Japan. Shunichi Suzuki said at a press conference, "We will closely communicate with the authorities of the United States and other countries based on the consensus of the G7, as excessive and disorderly exchange rate fluctuations may have adverse effects on the economy."

In the past three years, the Japanese yen exchange rate has been steadily declining. Since the beginning of 2021, the exchange rate of the Japanese yen against the US dollar has depreciated by more than one-third. In real terms, the Japanese yen is at least at its lowest level since the 1970s.

The pressure of yen depreciation is mainly due to the huge interest rate gap between the United States and Japan. In this case, investors will sell Japanese yen and buy US dollars to earn interest rate differentials.

At present, the Federal Reserve still does not have a clear path for interest rate cuts, which makes it difficult to see a turning point in the "fundamentals" of the yen's weakness. At present, it is unlikely that market dynamics will change before people's expectations of the US interest rate path change, which will put the yen in a weak position.

Helen Given, a forex trader at Monex Inc., said, "I am increasingly convinced that currency officials in Japan are abandoning the yen. Currently, the yield difference is too large to overcome, and since the United States is only considering a rate cut once this year, there will not be a substantial improvement in the yield difference in the short term."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.