Bank of Japan paves way for exit from YCC to allow long-term interest rates to rise to 1%

If you look at the policy continuity of the Bank of Japan alone, everything the bank is doing now is showing the market that the Bank of Japan will gradually withdraw from this protracted YCC operation, paving the way for the subsequent normalization of monetary policy.。

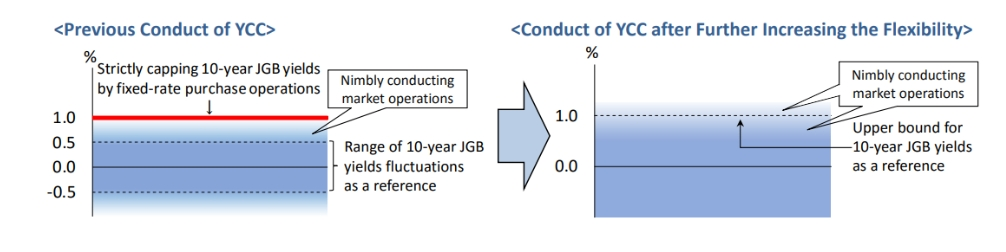

On October 31, the Bank of Japan announced its interest rate resolution, keeping the benchmark interest rate at an all-time low of -0.1%, while announcing a 10-year Treasury yield target of around 0%, largely in line with market expectations。The only surprise was that the Bank of Japan said it would use the 1% debt ceiling as a reference for yield curve control, while controlling yields through large-scale purchases of Japanese bonds and flexible market operations.。

As soon as the news came out, the yen fell in response, the dollar against the yen short-term pull up, once again rose above the 150 mark; 10-year U.S. bond yields short-term down 4bp。Dollar expands intraday gains against yen, up 0.8% at 150.24。In addition, stimulated by the news, the Nikkei 225 index once quickly rose to 0.7%, Japan's TSE up 0.7%。

Move YCC first, then negative interest rate

The biggest bright spot in the Bank of Japan's interest rate decision is undoubtedly the loosening of the YCC.。

In 2013, in order to boost the ailing economy and stimulate inflation, the Bank of Japan launched a massive two-volume qualitative easing (QQE) policy.。As part of the policy, Japan's negative interest rate policy and YCC policy came into being。

Under the negative interest rate policy, corporate and individual depositors deduct even more fees from banks and other financial institutions than interest when saving; under the YCC policy, the Bank of Japan, in addition to keeping short-term interest rates at -0.In addition to 1%, there is a need to try to keep the 10-year Treasury yield near zero by buying Treasuries。Then-Prime Minister Abe argued that aggressive measures were needed to reverse the situation and bring inflation back to its target level of around 2 per cent。

A decade later, this protracted stimulus is finally having an effect, and as of last month, Japan's inflation rate has been above the central bank's target for 17 consecutive months。In July of this year, Japan's inflation rate once again surpassed that of the United States after eight years.。

However, in the world, under the framework of YCC, the Japanese currency market is under great pressure.。As major central banks, including those in Europe, the United States, the United Kingdom, Canada and Australia, have raised interest rates, the spread between Japan and other markets has widened and depreciated.。In both 2022 and 2021, the yen fell more than 10% against the dollar.。This year, dragged down by the central bank's ultra-loose policy, the yen is also the worst-performing currency in the G-10.。The Japanese economy is no longer as unstable as it was a decade ago, and in the current situation, the yen is indeed being dragged down by the YCC。

According to the trajectory, the Bank of Japan should first gradually relax the YCC until it exits the YCC policy, and then move on to negative interest rates.。At present, Japan is the only country in the world that is still implementing a negative interest rate policy, and it is true that some of them are somewhat out of place with major national banks.。

The conditions for the Bank of Japan to abandon YCC are gradually taking shape.

At its July policy meeting, the Bank of Japan also eased its YCC policy, allowing the 10-year Japanese government bond yield to exceed zero for a period of time..5%, let it in 0.Floating within 5% -1%, but will strictly limit the fluctuation of 10-year Japanese government bond yields below 1% through fixed-rate purchase operations。This time, the Bank of Japan adjusted the YCC again in its interest rate decision, allowing its yield to rise to 1%, effectively continuing the easing of the YCC on a previous basis.。

In response, the Bank of Japan said in a policy statement that in the face of great uncertainty in Japan's domestic and foreign economic and financial markets, the Bank of Japan believes that it is appropriate to increase the flexibility of yield curve control so that financial markets can smoothly form long-term interest rates in accordance with future developments.。Implementing a 1% cap on fixed-rate operations could have significant side effects that would become even greater if the yield cap remained rigid。

The Bank of Japan also said that it will continue to maintain the price level from a sustained and stable manner, pay close attention to changes in economic activity and inflation, including the virtuous cycle between wages and prices, and achieve the 2% inflation target in a sustainable and stable manner.。

In addition, the policy statement was released at the same time as the Bank of Japan released its inflation forecast for this year and next.。According to the document, the Bank of Japan expects Japan's core inflation in 2023 and 2024 to far exceed the bank's 2 percent target.。Specifically, the Bank of Japan expects the core CPI for fiscal 2023 to be 2.8%, previously 2.5%; core CPI for FY2024 is expected to be 2.8%, previously 1.9%; core CPI expected to be 1 in FY2025.7%, previously 1.6%。

Tom Nash, portfolio manager at UBS Asset Management, said the interest rate decision is in fact the Bank of Japan is exiting YCC policy: if the bank changes to raise its yield target ceiling every time the 10-year Japanese bond yield approaches its ceiling, then the bank's yield ceiling is not the ceiling。

Indeed, if you look at the policy continuity of the Bank of Japan alone, everything the bank is doing now is showing the market that the Bank of Japan will gradually withdraw from this protracted YCC operation, paving the way for the subsequent normalization of monetary policy.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.