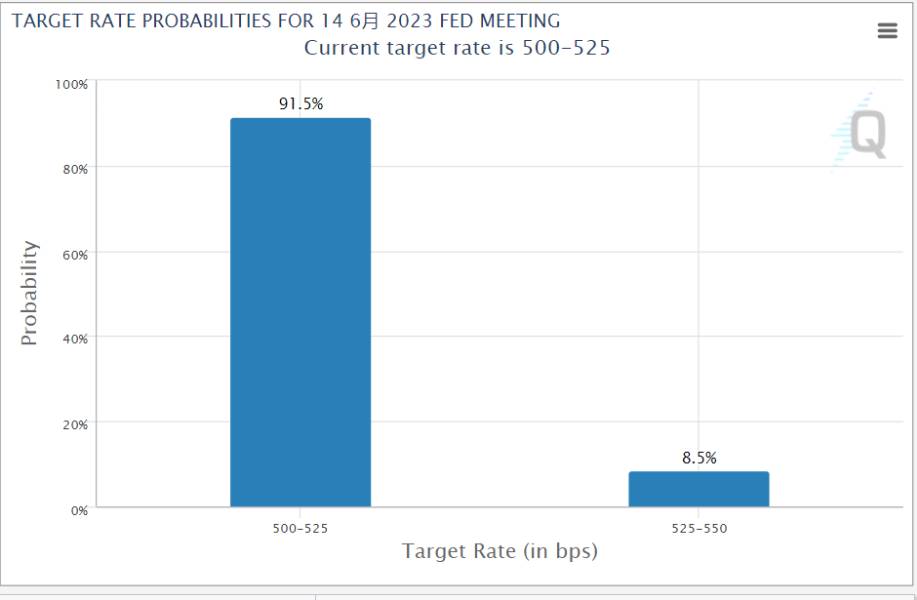

Witness history?Japan's ten-year easing may meet the inflection point The probability of the Fed suspending interest rate hikes in June is more than 90%.

Human joys and sorrows vary, with Japan likely to tighten monetary policy slightly at a time when the U.S. is hoping to pause its year-long aggressive rate hike cycle in June and open a rate cut window by the end of the year.。

On May 11, the Bank of Japan released a summary of the comments of the review committee of the April monetary policy meeting.。According to the summary, the Bank of Japan currently believes that the current easing policy must be maintained given the uncertainty of the global outlook.。

Japan's astonishing quantitative monetary easing (QQE) began in 2013 to reverse the country's low inflation and economic growth rates.。In addition, the negative interest rate policy and the yield curve control policy (YCC) have been gradually introduced by Japan as part of monetary policy.

Under the negative interest rate policy, corporate and individual depositors deduct even more fees from banks and other financial institutions than interest when saving; under the YCC policy, the Bank of Japan, in addition to keeping short-term interest rates at -0.In addition to 1%, there is a need to try to keep the 10-year Treasury yield near zero by buying Treasuries。Then-Prime Minister Abe argued that aggressive measures were needed to reverse the situation and bring inflation back to its target level of around 2 per cent。

However, a decade later, it is clear that loose monetary policy has not been as effective as expected: Japan's inflation rate continues to languish, its balance sheet has increased significantly, and the yen has depreciated significantly.。In response, people began to blame this unprecedented monetary easing, especially the YCC policy.。

Early last month, the Bank of Japan Governor Ueda and the beginning of the new, the market is betting that it will make adjustments to the existing monetary policy, including the abolition or modification of YCC policy, slowly closing the door to monetary easing。Surprisingly, at his inaugural press conference, Kazuo Ueda fell to the doves, saying that the current monetary easing in Japan is very strong and will continue the easing of the previous leader。

But this time, the situation seems to have changed subtly.。

Word for word, the Bank of Japan's policy stance may have loosened.

On April 27, Kazuo Ueda hosted his first policy meeting。Although, according to the central bank's interest rate decision, the Bank of Japan continues to hold back, keeping the benchmark interest rate at -0.1%, in line with market expectations, however, according to a summary of the views of the policy meeting review committee, the Bank of Japan adopted a new term to describe its position of continuing to ease monetary policy on a large scale: "patiently (patiently)"。

At the first policy meeting last month, board members "patiently" discussed maintaining the accommodative policy, which was previously worded as "persistently," according to an English-language opinion summary published on May 11.。On closer inspection, "patiently" is more tolerant of the length of time, but not demanding of inflation; and "persistently," there is a sense of not giving up until the goal is achieved.。

Some analysts believe that this change has actually recognized the shift in Japan's economic reality.。It is reported that the word "persistently" appeared three times in the English version of the March meeting minutes.。In April, "patiently" was used twice, while "persistently" was deleted.。

In response, Ichiyoshi Securities (Ichiyoshi Securities) chief economist and former Bank of Japan official Nobuyasu Atago (Nobuyasu Atago) said: "Communication with global market participants is extremely important for the Bank of Japan.。The Bank of Japan looks at every word very carefully, so this is certainly intentional, indicating a shift in its views。"

In addition, according to the summary of the meeting, while many other members were of the view that the current economic policy "should not be prematurely taken," some members have already pointed out that "there are signs of a virtuous cycle in the economy" and that "the 2 per cent price target is in sight."。

For now, the Bank of Japan's easing may have loosened, but market murmurs need to be removed and clearer and more certain economic signals awaited。The Bank of Japan Review Board says we need to focus on prices and act in a timely manner, and with wages rising, Japan's inflation level may be close to the Bank of Japan's target, but it will take time and uncertainty is high。

Earlier, according to a survey released by the media, most Bank of Japan watchers expect some degree of policy tightening by June this year.。

The Fed's eyes turn to the banking crisis, the debt ceiling is deadlocked again, and the probability of suspending interest rate hikes in June is more than 90%.

Human joys and sorrows vary, with Japan likely to tighten monetary policy slightly at a time when the U.S. is hoping to pause its year-long aggressive rate hike cycle in June and open a rate cut window by the end of the year.。

On May 10, the U.S. Department of Labor released the U.S. April non-quarterly CPI annual rate, which was 5.0%, the predicted value is 5.0%, but the published value is 4.9%, lower than expected and previous values。Among them, the Fed is particularly concerned about inflation indicators, except for housing core services CPl slowed to 5% year-on-year, greatly lowering the Fed's June rate hike expectations。

After the release of the data, spot gold short-term pull up more than $10, and then continue to attack, once approaching the $2050 / oz mark。

The Fed's "mouthpiece" Timiros (Nick Timiraos) said in a letter that the U.S. CP1 rose 4% year-on-year in April..9%, the 10th consecutive decline, a sign that inflation has not worsened and may soon slow down。He believes that the Fed may suspend rate hikes at its June and July meetings, "take a summer vacation" on the way to rate hikes, and then decide in September whether they have taken enough measures to cool the economy.。

In addition, Timiros said the Fed may now be more concerned about pressures in the banking system and the credit crunch than inflation.。He pointed out that to be sure, the April inflation data did not show signs of a significant slowdown, nor is it enough to give Fed officials full confidence in the target of reducing inflation to 2%, but now Fed officials are more concerned about the impact of the recent banking turmoil on economic conditions.。

Fed Chairman Jerome Powell (Jerome Powell) also said at a news conference that the credit crunch will be a particular concern for the Fed now and in the future, but it is difficult to determine how much the credit crunch will affect interest rates at this time.。

On May 9, the Federal Reserve said in its latest Financial Stability Report that some banks have more concentrated exposure to commercial real estate mortgages and that they will suffer higher losses if the commercial real estate environment deteriorates.。Prior to this, U.S. commercial real estate mortgage-backed securities (CMBS) have repeatedly defaulted。

Small U.S. banks could 'bear the brunt' of losses amid tide of defaults。According to the latest Federal Reserve data, commercial real estate loans on the asset side of all U.S. commercial banks totaled approximately 2.91 trillion dollars。Of these, small U.S. banks have 1.96 trillion US dollars, accounting for 67%.4%; large U.S. banks hold $846 billion, or about 29.1%。

Some analysts pointed out that, on the one hand, if the Fed interest rates continue to remain high, the cost of bank liabilities will be correspondingly high;。The combination of the two will severely challenge bank profitability。

In addition to the deteriorating commercial real estate environment, the U.S. debt ceiling crisis is at an impasse.。

On May 9, U.S. President Joseph Biden invited leaders of both parties in Congress to meet at the White House to discuss the debt ceiling.。However, during the hour-long talks, the two sides did not reach a consensus.。

After the meeting, Democratic President Joe Biden said the debt ceiling was "the only important thing" on his agenda at this stage, even higher than the G7 summit.。He said: "If we don't solve this problem at the last minute and the due date happens to be during the trip, I won't go.。A day later, Biden spoke here to pressure opponents.。He said the Republican debt ceiling bill is "effectively holding the economy hostage" and would put 21 million people at risk of losing Medicaid.。

The main disagreement between the two sides is reported to be whether future government spending should be cut.。Republicans, represented by House Speaker Kevin McCarthy, insist that raising the debt ceiling presupposes that the federal government must cut spending, while Democrats argue that no conditions should be attached to raising the debt ceiling, which reflects previous federal spending, and that the budget has been passed by Congress without debate.。

Earlier, U.S. Treasury Secretary Janet Yellen also warned that the deadline was approaching.。She said that at the current rate of federal borrowing, the current statutory debt ceiling could be reached as early as June 1。

According to media reports, before this date, excluding Biden's visit abroad and the recess of the House and Senate, there are only seven days left for the parties to negotiate.。It's no exaggeration to say that the U.S. debt ceiling crisis has been "on fire."。

In such an economic environment, if the Fed still has to choose to continue the rate hike process at its June meeting, it will take a lot of boldness。

According to CME Fed Watch, the probability of the Fed standing still in June is now as high as 91.5%。

The market also expects that the "white knight" of the U.S. economy will be able to loosen the reins of his hand slightly, leaving some breathing room for the fast horse under his feet.

Dollar up 0 yen in day as of press time.30%, currently trading at 134.72, recovering some of yesterday's lost ground。

Dollar Index Erases Yesterday's Decline, Up 0 on Day.42%, reported 101.880。

U.S. 10-year Treasury yields continue to dip, down 0 on the day.40%, reported 3.431。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.