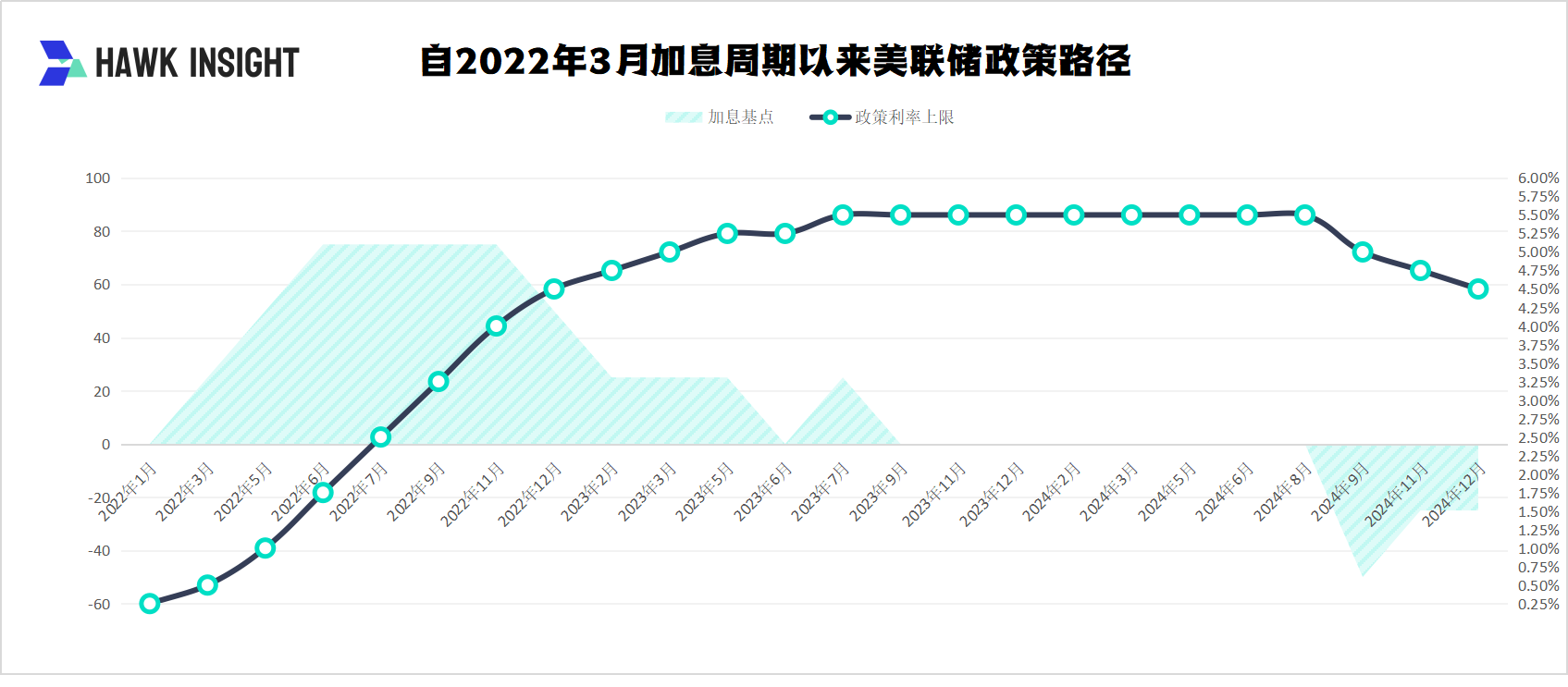

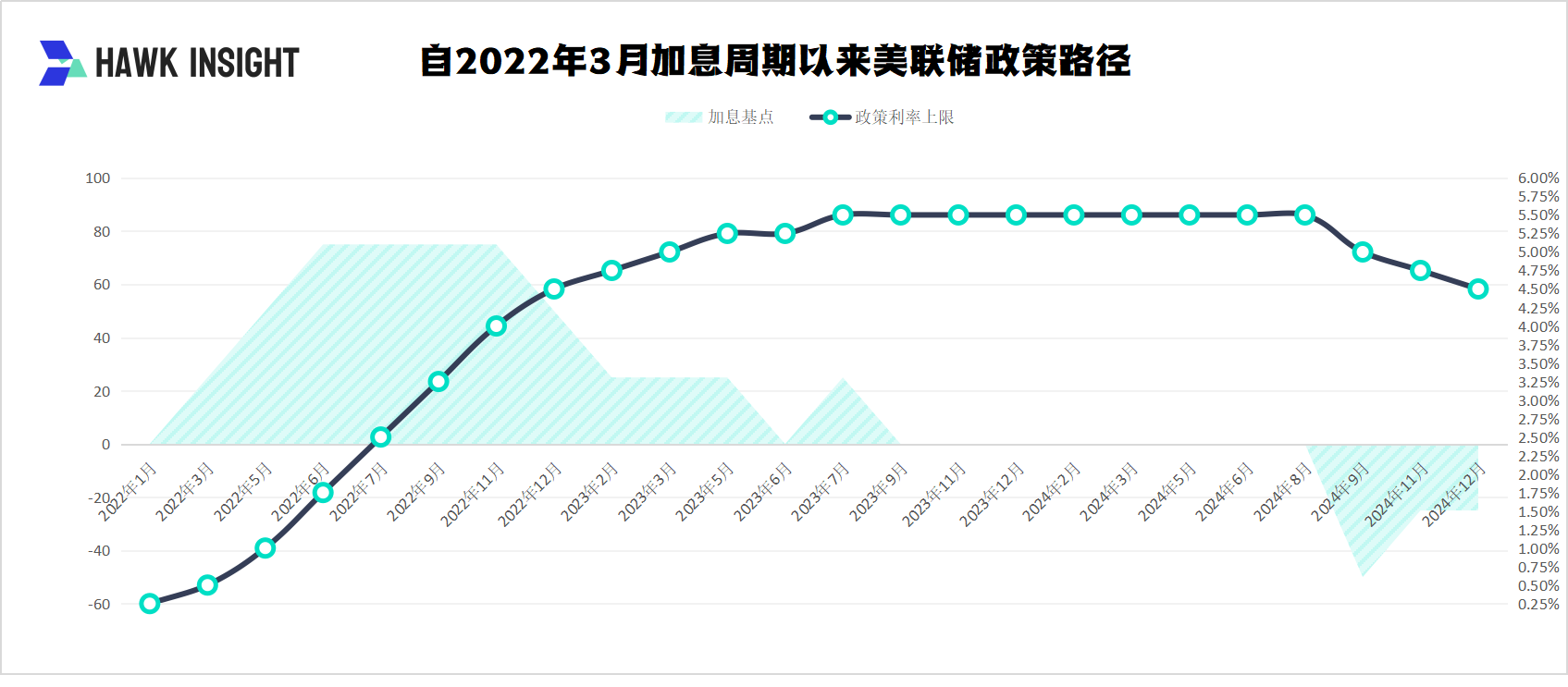

On December 19, the Federal Reserve's "final battle" ended. As expected by the market, the committee announced that it would cut the benchmark interest rate by 25 basis points and lower the target range of the federal funds rate from 4.5%-4.75% to 4.25%-4.50%.This is the third consecutive time that the Federal Reserve has cut interest rates since September 2024 launched the easing cycle for the first time in four years, with a cumulative interest rate cut of 100 basis points (50, 25, 25).

If we just do this, this will be a rate cut that meets market expectations, but what everyone is waiting for is not the rate cut, but the SEP economic forecast.It was this forecast that gave a hawkish attitude that exceeded the market's expectations.

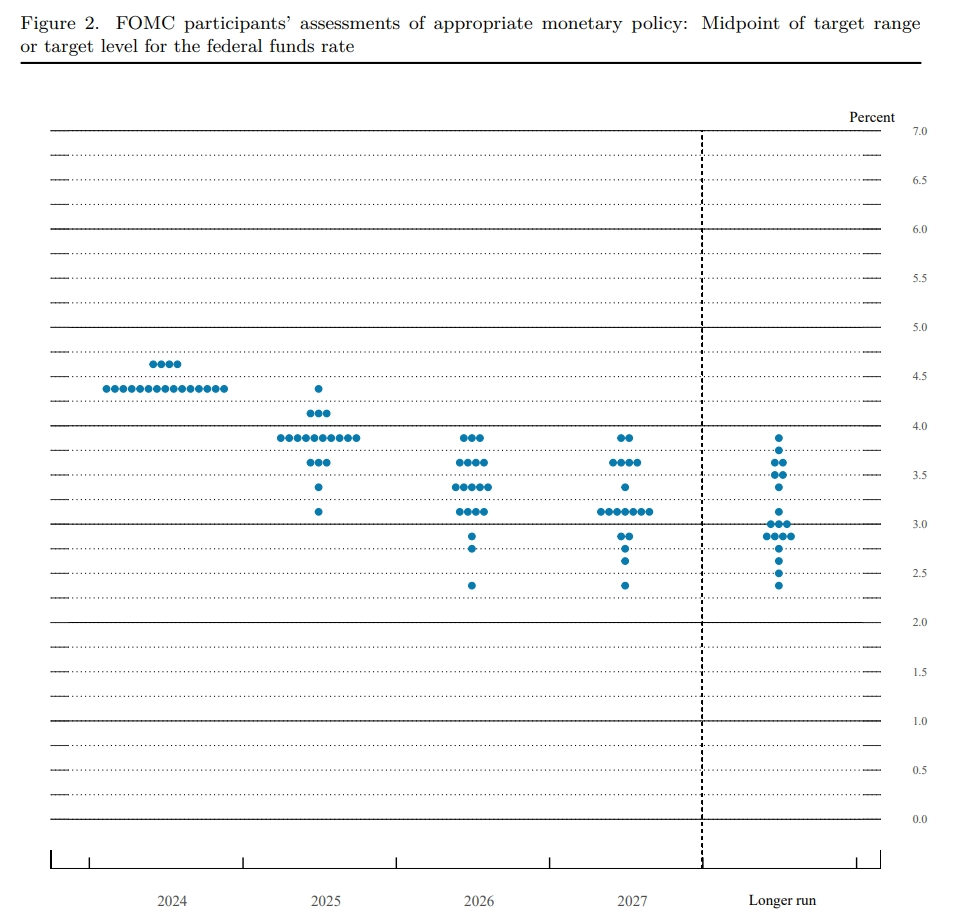

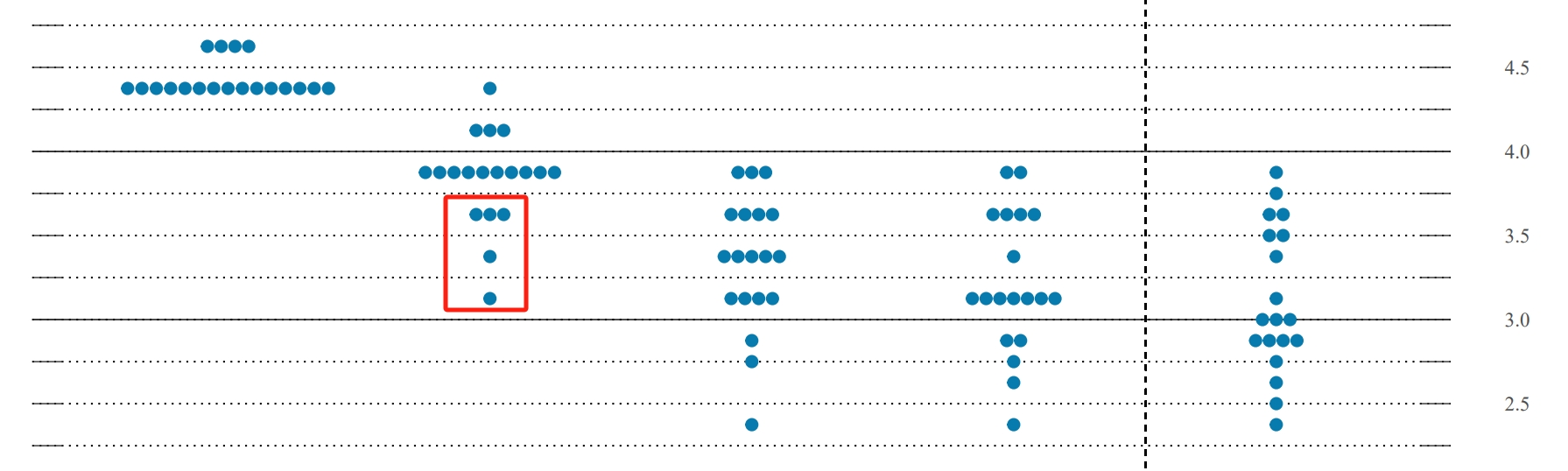

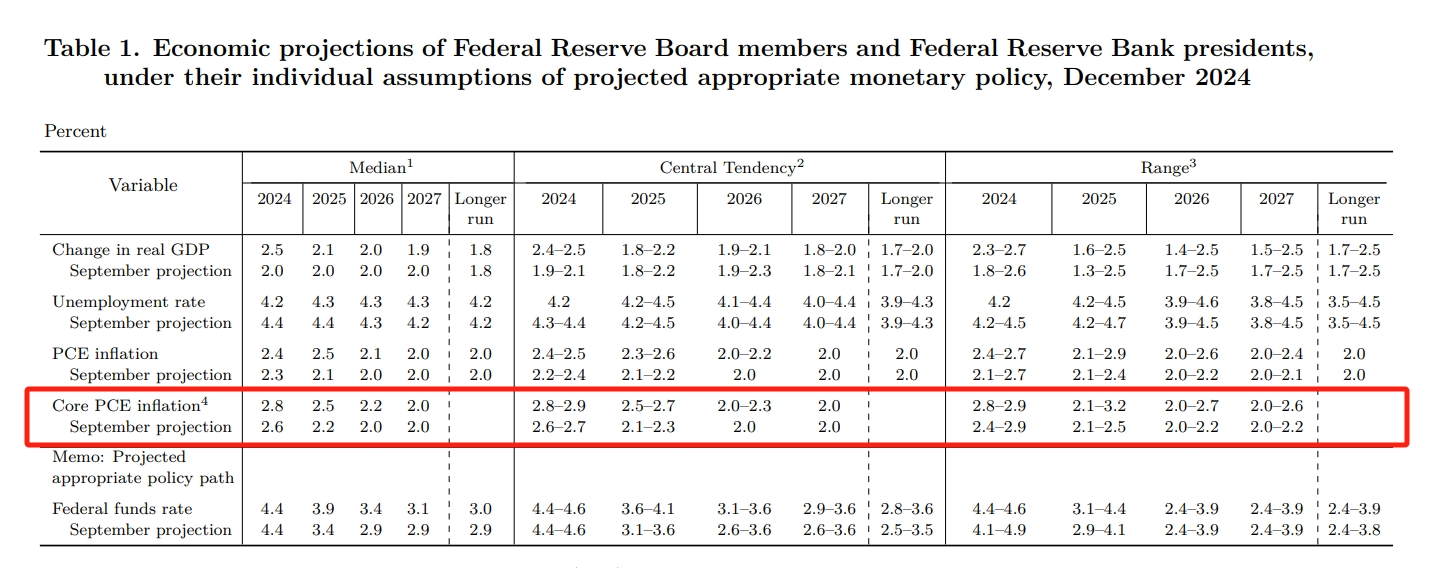

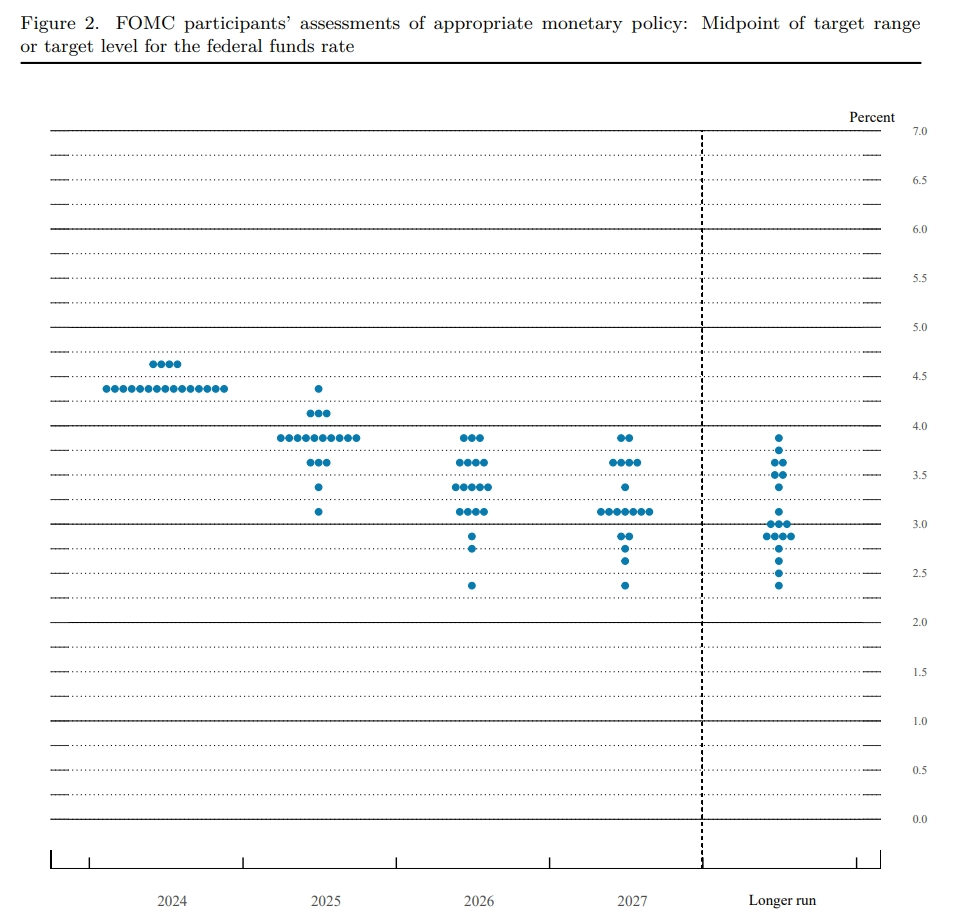

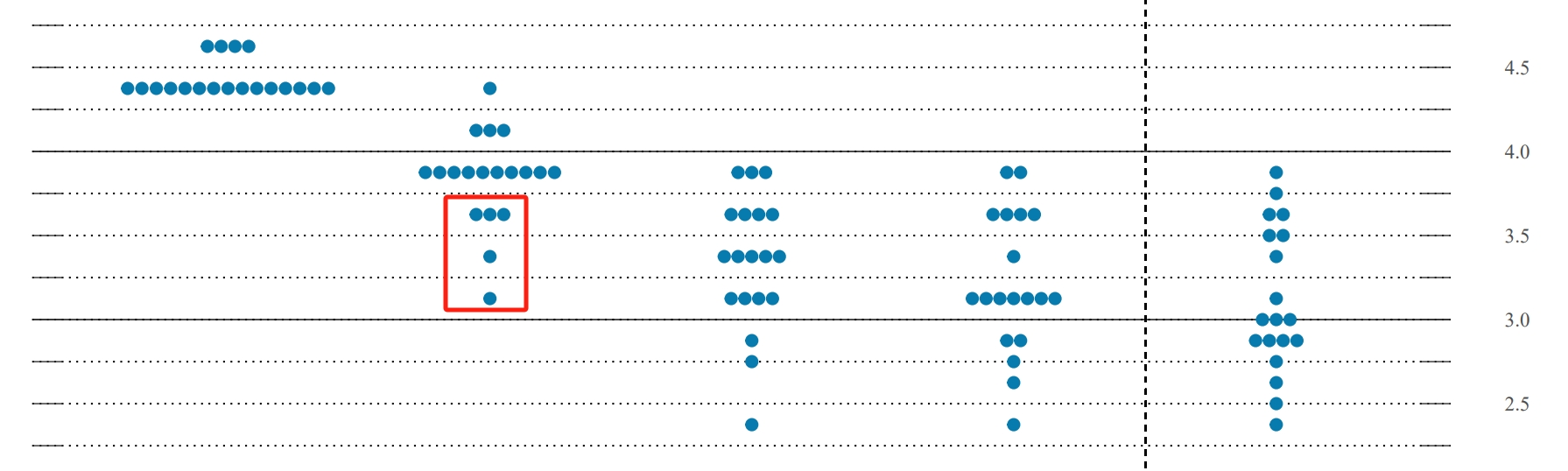

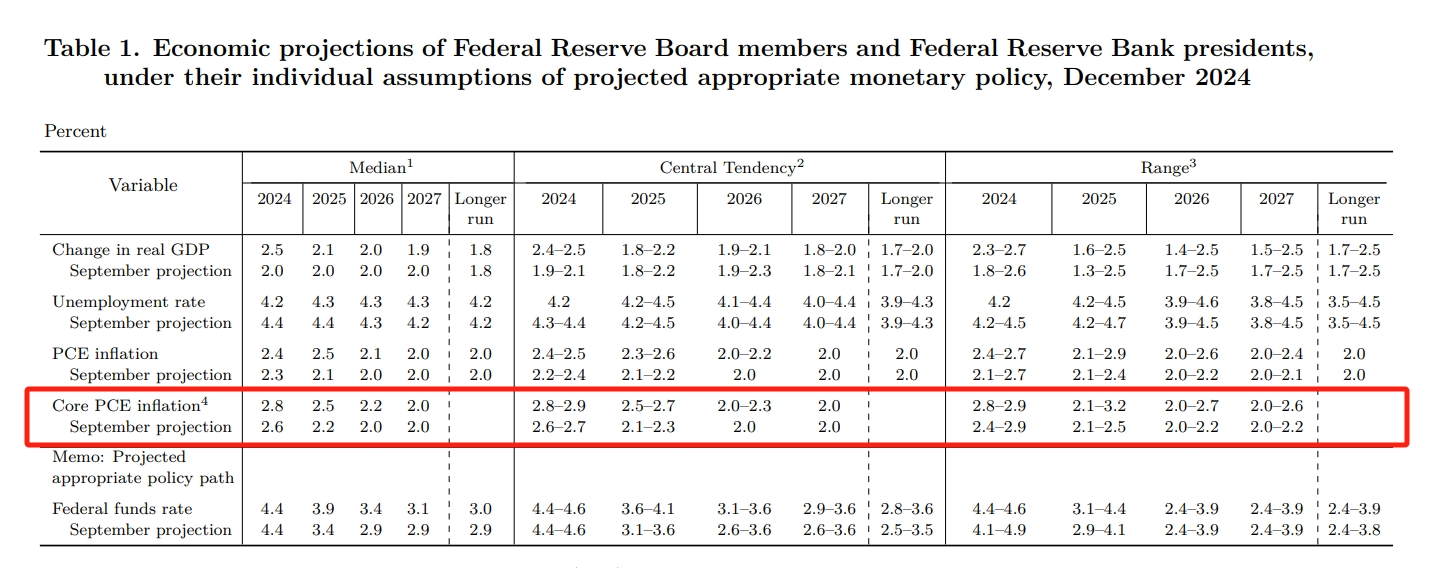

The Federal Reserve announced that officials generally believe there will be fewer interest rate cuts next year than they forecast months ago.Current forecasts are that by the end of 2025, the target range for the federal funds rate will fall to between 3.75% and 4%-suggesting that there may be only two 25 basis points each in 2025, significantly smaller than the previous forecast of four 25 basis points each.

Not only that, of all officials, only five expressed support for more interest rate cuts next year.This suggests that hawks are in the majority on the current committee.

In addition, policymakers have subtly adjusted the wording of the post-meeting statement from the original "consider further adjustments" to "consider the magnitude and timing of further adjustments in policy rates", indicating that the Fed will evaluate multiple factors more carefully during the decision-making process.The previous statement was relatively general and only mentioned "considering further adjustments."

After Trump was elected, the Federal Reserve's attitude gradually shifted

From the beginning of the interest rate cut cycle by 50 basis points to the halving of interest rate cuts next year, the Fed's gradual turnaround is obvious to all.

The reason is that the resilience of the U.S. economy and the uncertainty brought to the economy after Trump came to power account for half.

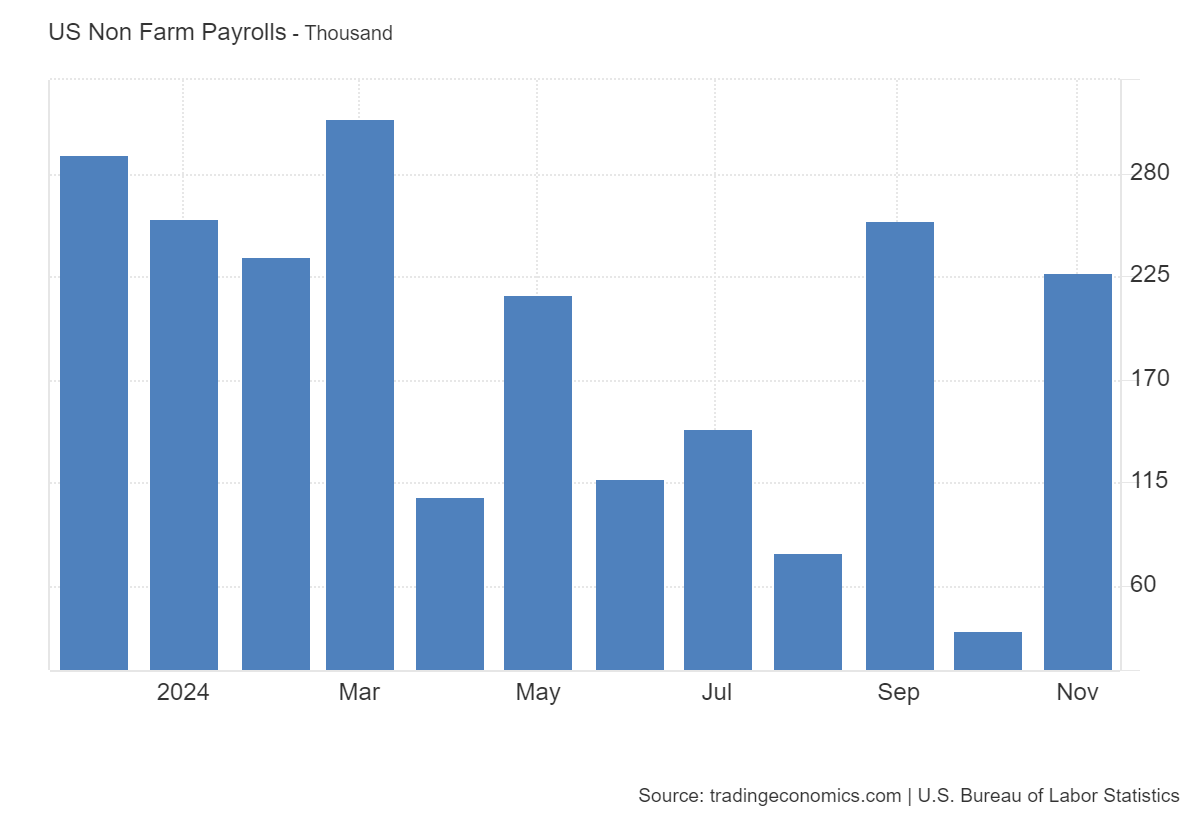

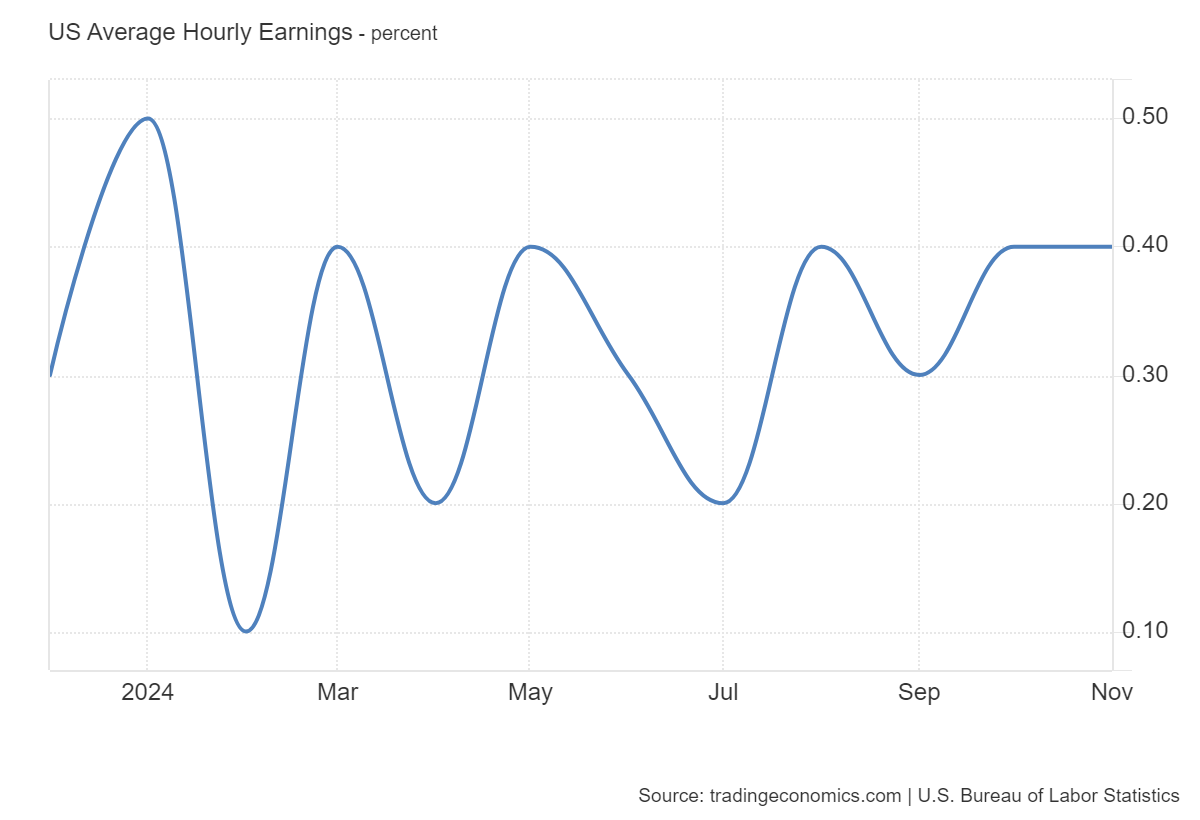

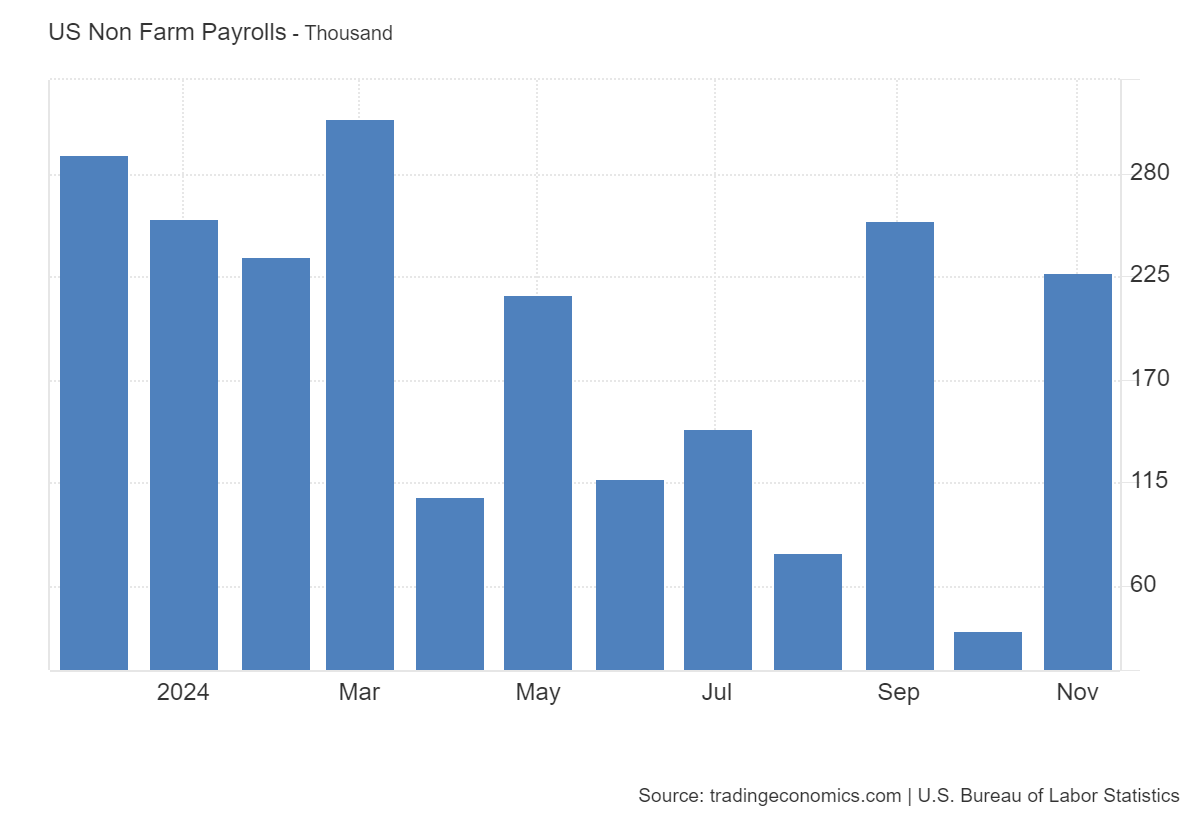

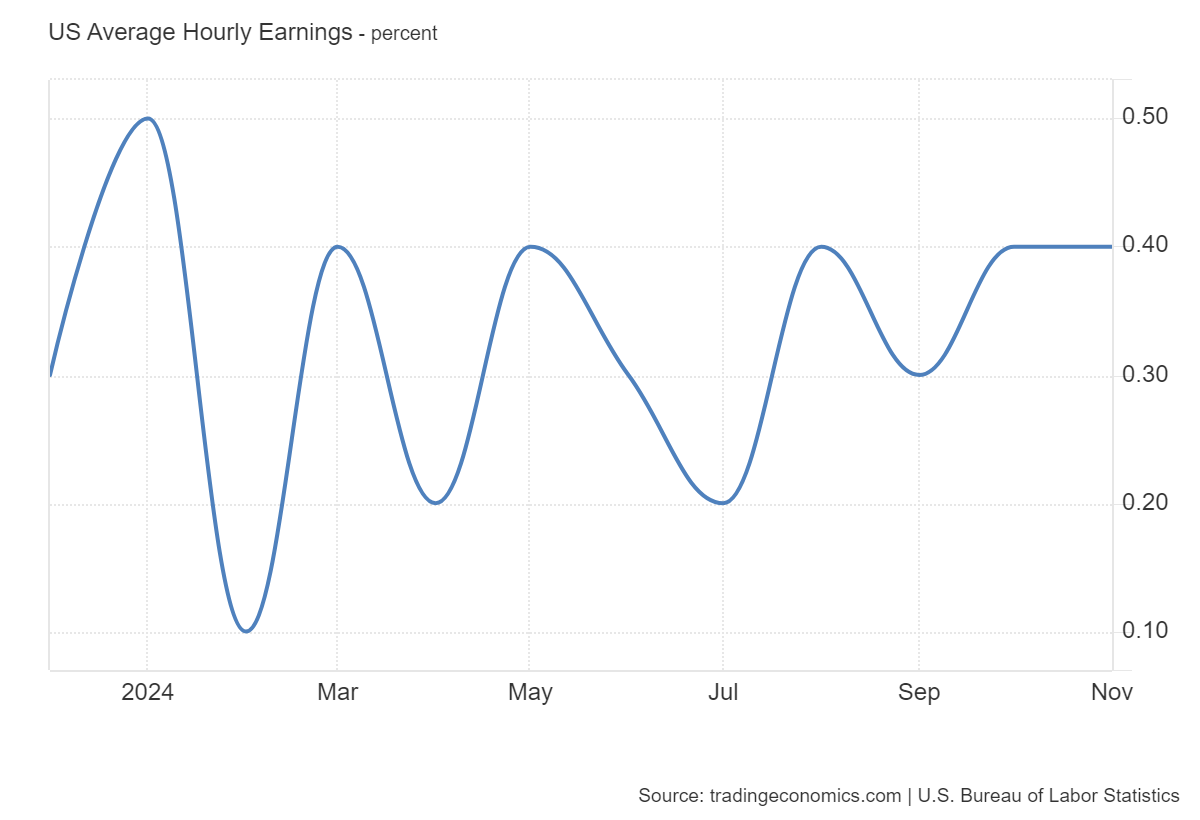

On the one hand, new non-agricultural data rebounded to 227,000 in November, while the number of new jobs in September and October was revised upward, indicating that the U.S. job market continued to recover in the fourth quarter.The labor supply and demand gap recorded 760,000 people in October, which basically dropped to the pre-epidemic level, indicating that supply and demand in the U.S. job market are tending to be balanced.In November, the average hourly wage of non-agricultural employment recorded a month-on-month growth rate of 0.4%, and the average hourly wage of non-agricultural employment remained at 4% year-on-year, and wage growth remained strong.

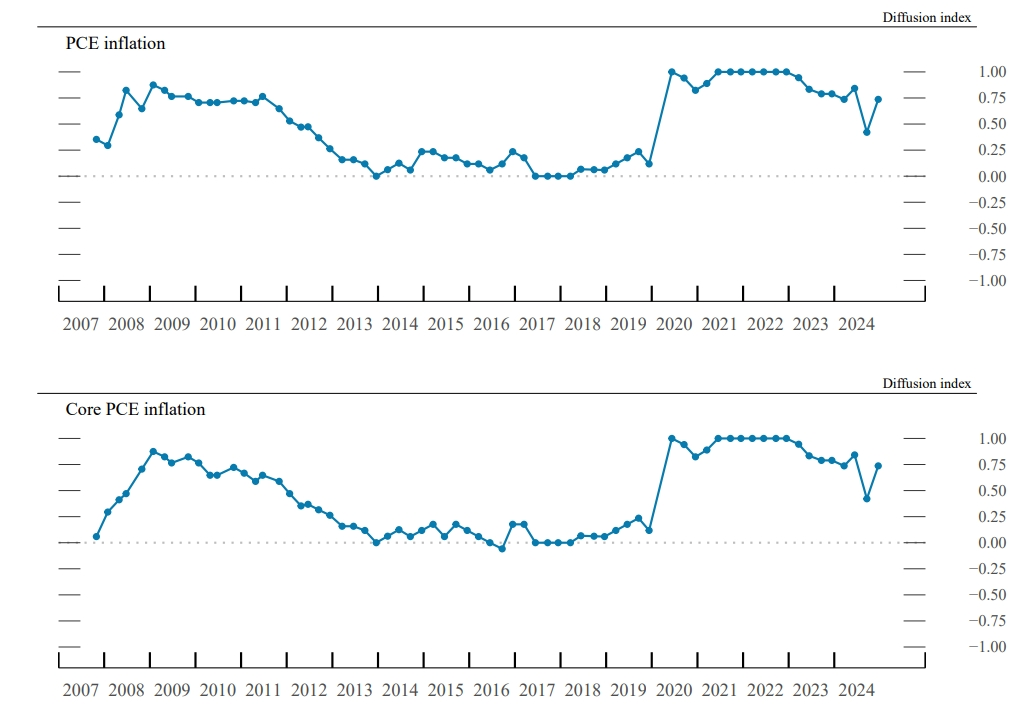

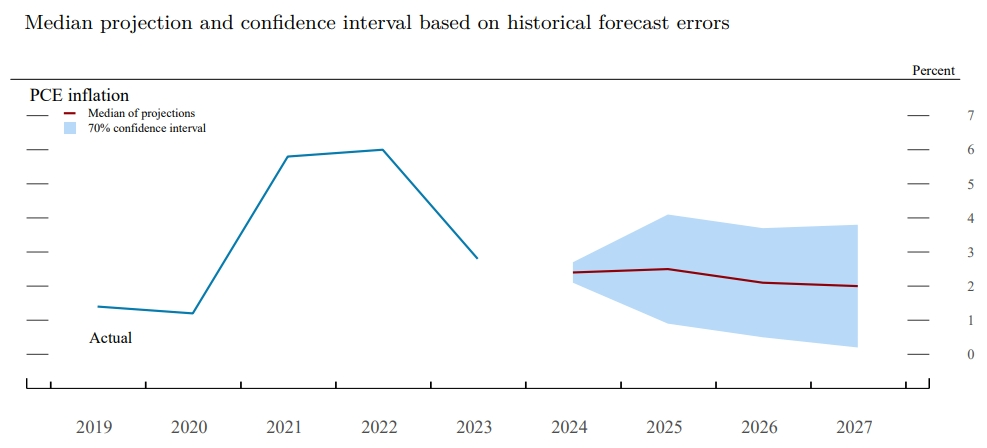

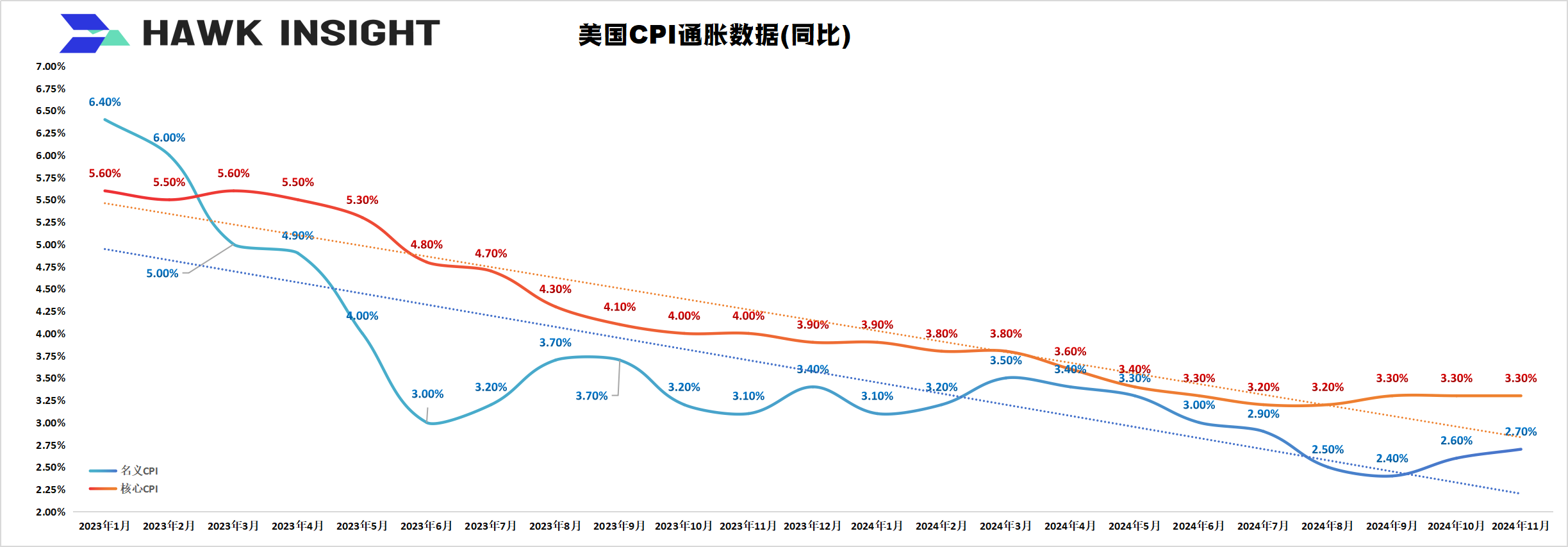

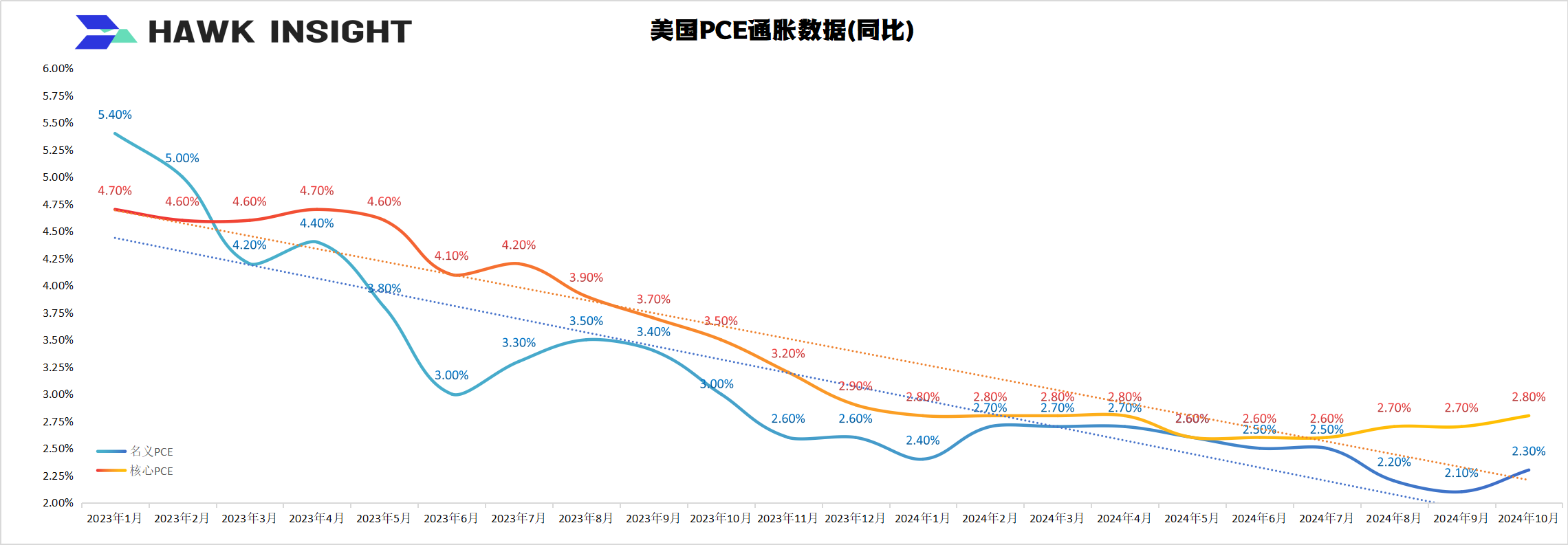

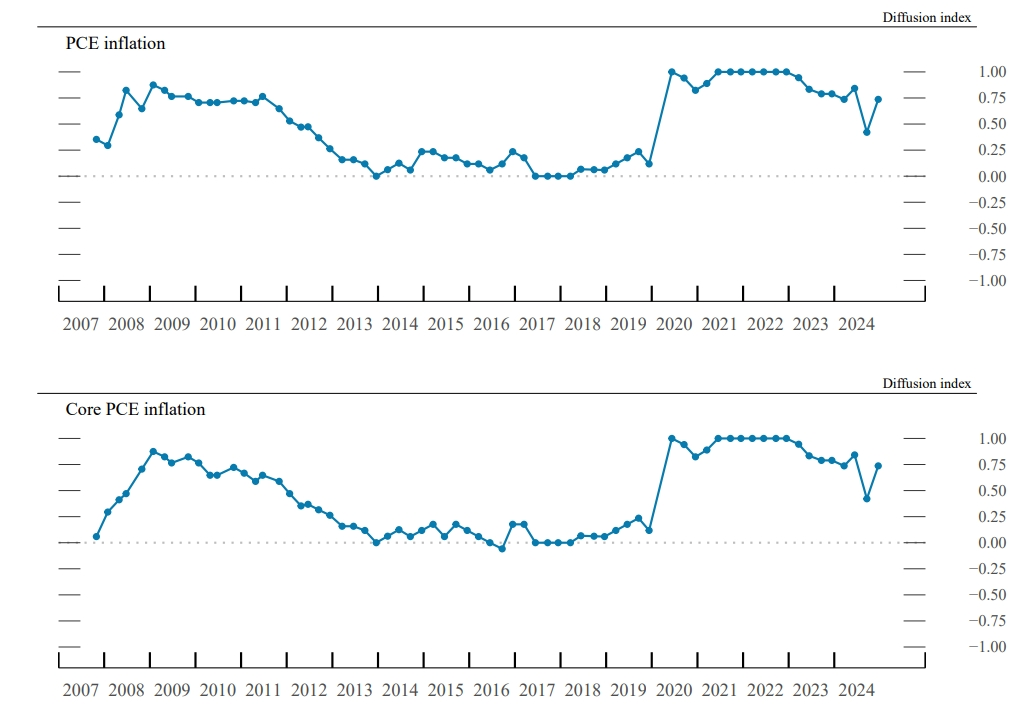

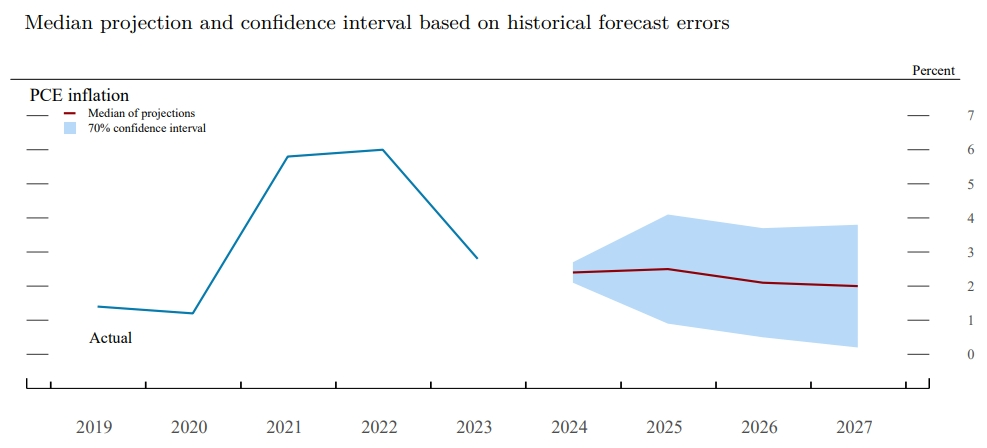

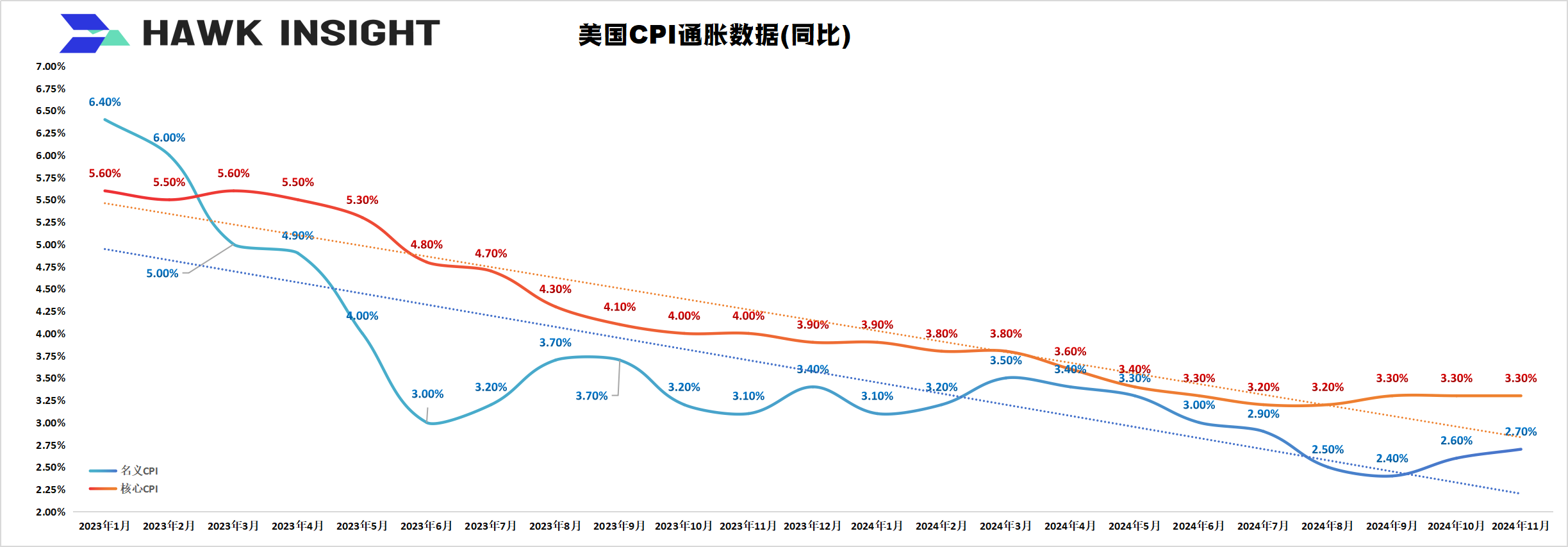

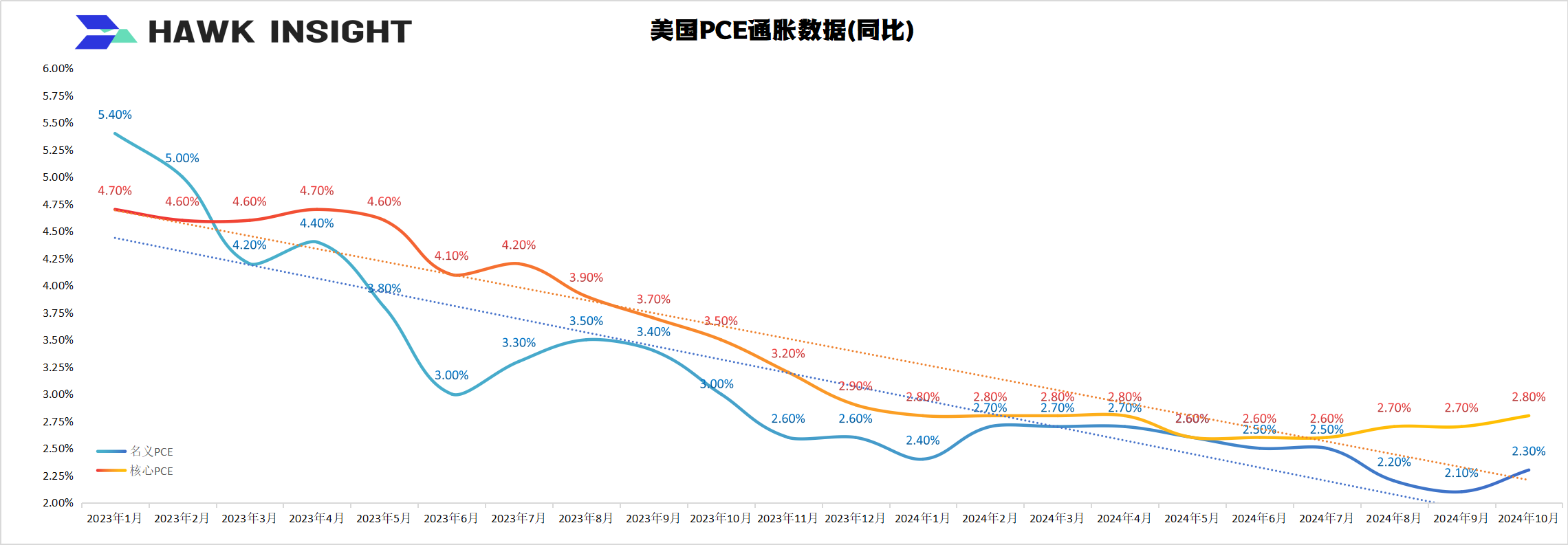

According to the SEP Economic Report, the Federal Reserve has raised its inflation forecast across the board for the next two years: core PCE inflation is expected to be 2.5% in 2025, compared with 2.2% previously expected; core PCE inflation is expected to be 2.2% in 2026, compared with 2.0% previously expected; PCE inflation is expected to be 2.0% in 2027, compared with 2.0% previously expected.Longer-term PCE inflation is expected to be 2.0%, compared with 2.0% previously expected.

"When considering further interest rate cuts, we will focus on improving inflation," Powell said."We have made little significant progress on the 12-month inflation data.

On the other hand, President-elect Trump's proposed trade, immigration and tax policies have also added uncertainty to the inflation outlook.According to some estimates, these policies could put upward pressure on inflation and constrain the labor market.In response, Powell said that the Federal Reserve is modeling and evaluating Trump's proposal, but because the specific form of the policy is not yet clear, it has not yet been incorporated into decision-making.

Gennadiy Goldberg, head of U.S. interest rate strategy at TD Securities, said,"The Fed has sent a signal that they are not going to be as dovish as they have in the past and they tend to cut rates less next year, and I think it's a signal that the market will continue to price with less than two rate cuts."”

After the resolution was announced, the three major U.S. stock indexes "collapsed" in a straight line.The Dow fell 2.58%, the S & P 500 fell 2.95%, and the Nasdaq fell 3.56%.Amazon, American Express and Goldman Sachs fell more than 4%.Tesla fell more than 8%, and Microsoft fell more than 3%.Chinese stocks generally fell.

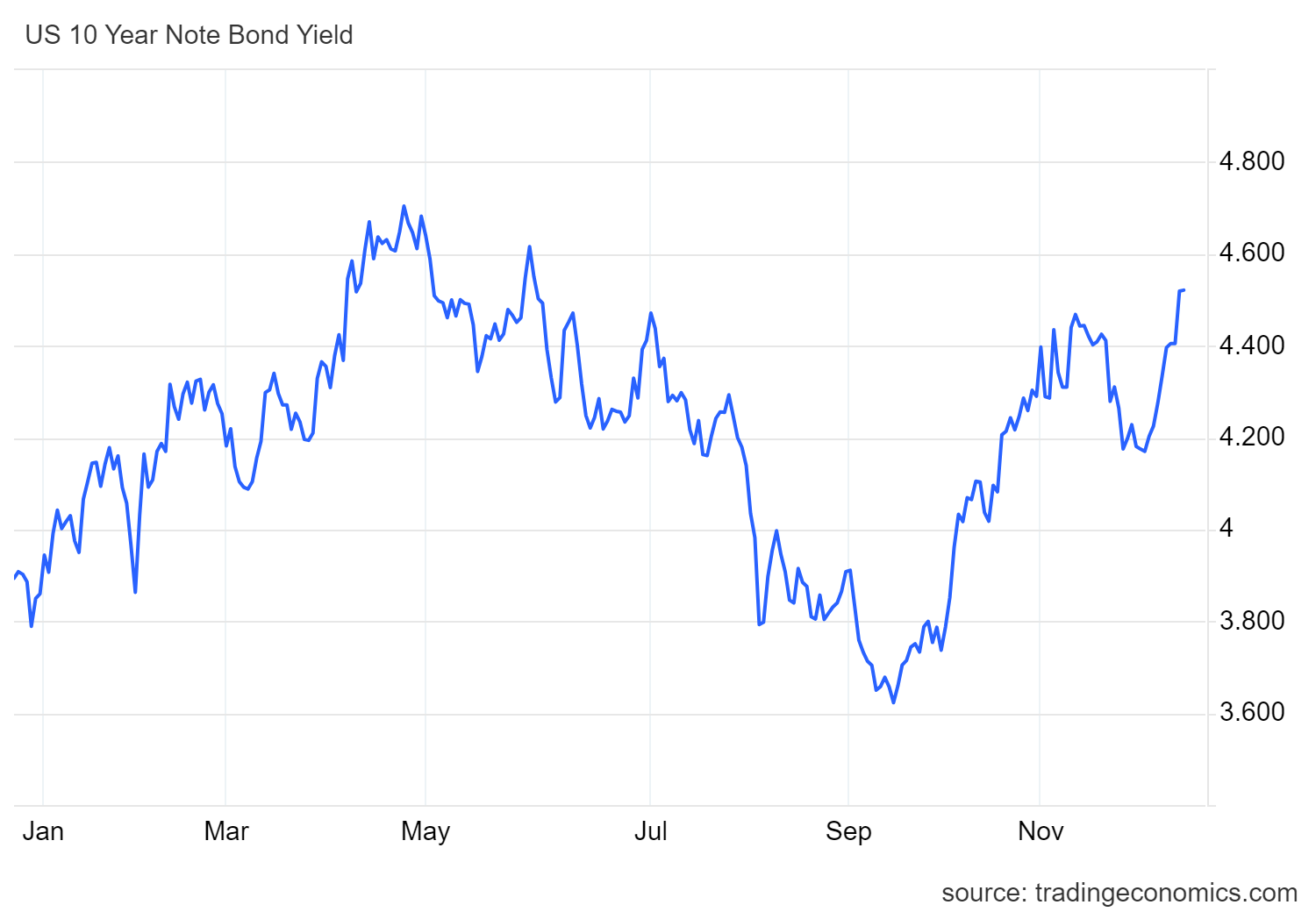

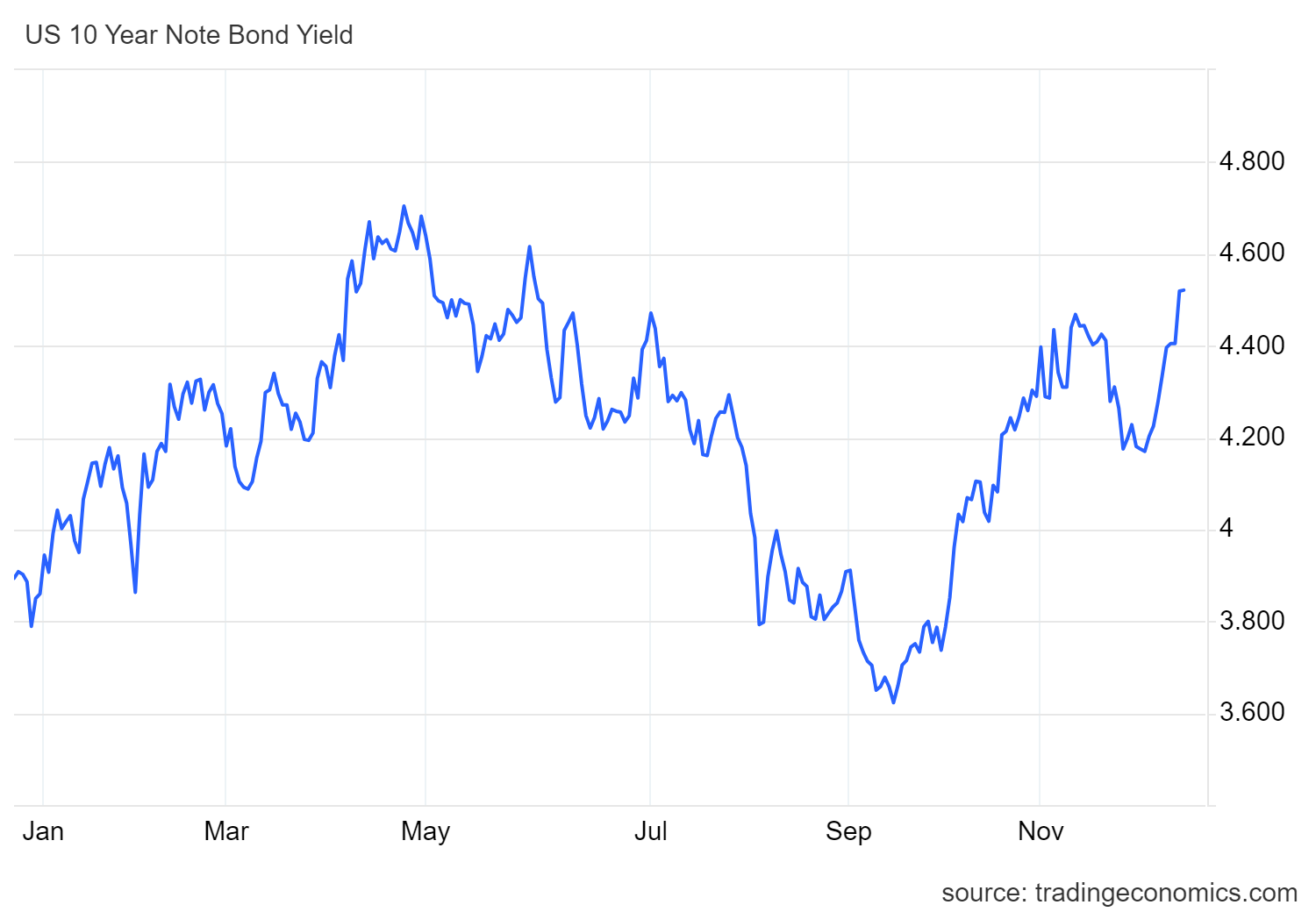

U.S. 10-year Treasury yields reached their highest level since the end of May, rising more than 4%.The US dollar index rose sharply, rising to a high since November 2022.

At a press conference after the meeting, Powell reassured the market.He said a rate hike next year seemed unlikely because the Fed was working to keep the labor market strong while reducing inflation to 2%.

He said that after this interest rate cut, the Federal Reserve has lowered its policy interest rate by a full 100 basis points from its peak. Now that the monetary policy stance is significantly less restrictive than before, policymakers can be more cautious when considering more interest rate adjustments.

He continues to manage expectations: Any Fed decision to cut interest rates in 2025 will be based on upcoming data, not current economic conditions.

Powell gave a positive assessment of the performance of the U.S. economy and believed that the economy has shown strength and resilience.Although the unemployment rate has increased, it has remained low.Fed officials believe that the risks of achieving employment and inflation targets are roughly balanced and the economic outlook is uncertain, so they keep a close eye on the risks of both sides.

The Federal Reserve is particularly concerned about the improvement of inflation.Powell pointed out that consumers are feeling the impact of high prices, not the direct impact of high inflation.Fed officials expect inflation to reach the 2% target in 2027, a delay from the previous forecast of 2026.Powell said it may take another year or two to reach the 2% inflation target.

Regarding Trump's aggressive tariff plan, some Federal Reserve officials have begun to conduct a preliminary assessment of the possible impact of Trump's policies.Powell revealed that it is too early to draw conclusions on how it affects inflation, but the Fed will pay close attention to its potential impact on inflation and the labor market.

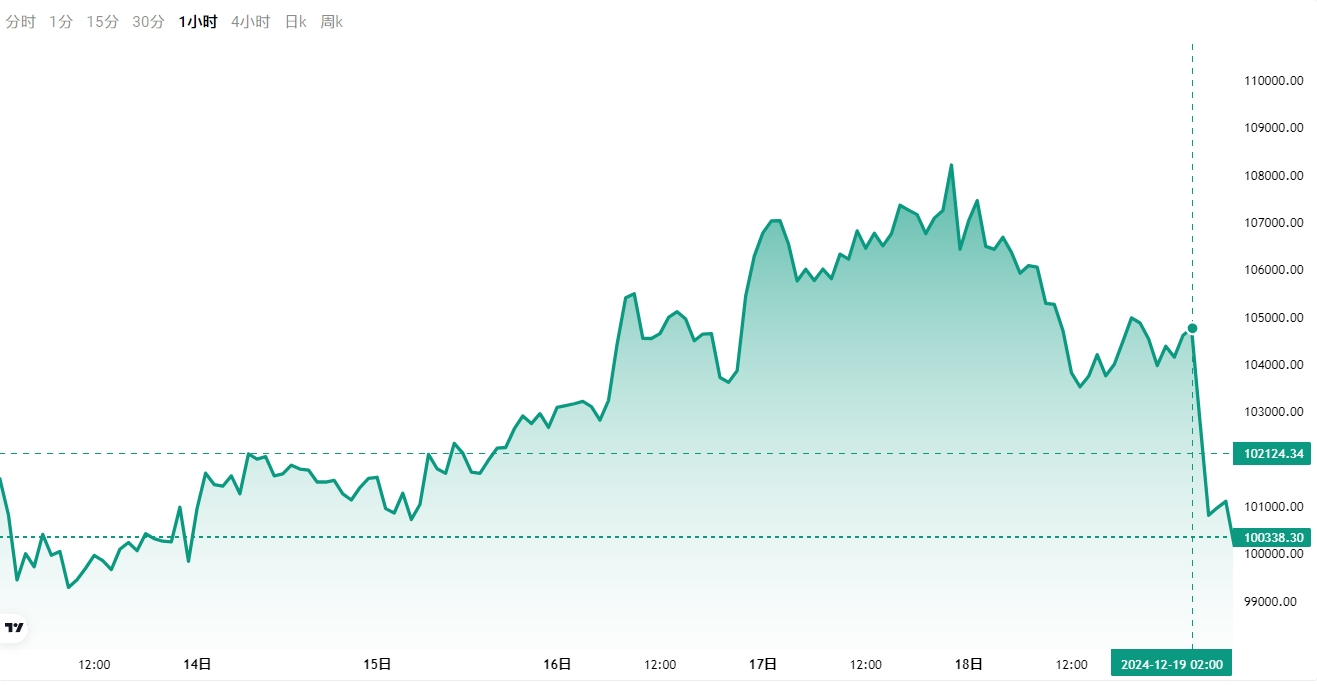

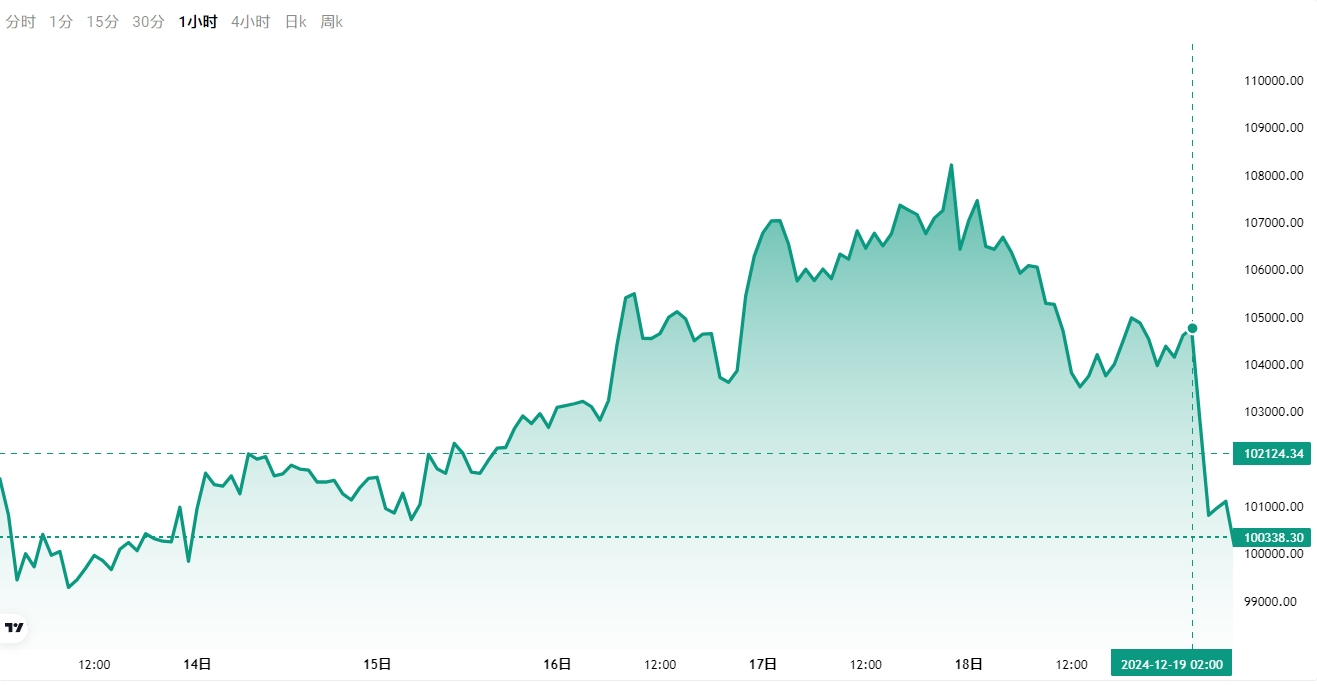

In addition, regarding questions about cryptocurrencies, Powell made it clear that under the Federal Reserve Act, the Federal Reserve is not allowed to own Bitcoin, and the Federal Reserve has no intention of seeking to amend the law governing the ability to hold Bitcoin.The Federal Reserve does not plan to add Bitcoin to its balance sheet.

Affected by this, Bitcoin's short-term decline widened, once falling below US$101,000/piece, falling more than 4% within the day.

Attachment: Full text of the Federal Reserve's December interest rate resolution:

Recent data shows that economic activity continues to expand at a solid pace.Since earlier this year, labor market conditions have generally eased, and the unemployment rate has increased, but remains low.Inflation has made progress towards the committee's 2% target, but remains slightly above the target.

The committee is committed to achieving maximum employment and 2% inflation goals in the long term.The committee believes that the risks to achieving employment and inflation targets are broadly balanced.There is uncertainty about the economic outlook, and the committee closely monitors the various risks facing its dual mission.

To support its goal, the committee decided to lower the target range for the federal funds rate by 0.25 percentage points to 4.25% to 4.50%.When considering the magnitude and timing of further adjustments in the federal funds rate target range, the committee will carefully evaluate the latest data, changes in the economic outlook and the balance of risks.The committee will continue to reduce the size of its holdings of U.S. Treasurys, agency debt and agency mortgage-backed securities.The committee is firmly committed to supporting the goal of maximizing employment and restoring inflation to 2%.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the impact of the latest information on the economic outlook.Should risks arise that may hinder the achievement of the Committee's goals, the Committee will be prepared to adjust its monetary policy stance as appropriate.The committee's assessment will consider a wide range of information, including readings on labor market conditions, inflationary pressures and inflation expectations, as well as financial and international developments.

Voters for the monetary policy action included Chairman Jerome Powell, Vice Chairman John Williams, Thomas Barkin, Michael Barr, Raphael Bostick, Michelle Bowman, Lisa Cook, Mary Daly, Philip Jefferson, Adrianne Kugler and Christopher Waller.Voting no was Beth Hamack, who preferred to keep the federal funds rate target range at 4.50% to 4.75%.