U.S. August Inflation Slows Significantly Year-on-Year U.S. Stocks Out of V-Reversal

From a recession prediction perspective, this is a good report that symbolizes a soft landing for the United States.

On September 12th, the U.S. Bureau of Labor Statistics released the final Consumer Price Index (CPI) data ahead of the September interest rate meeting.

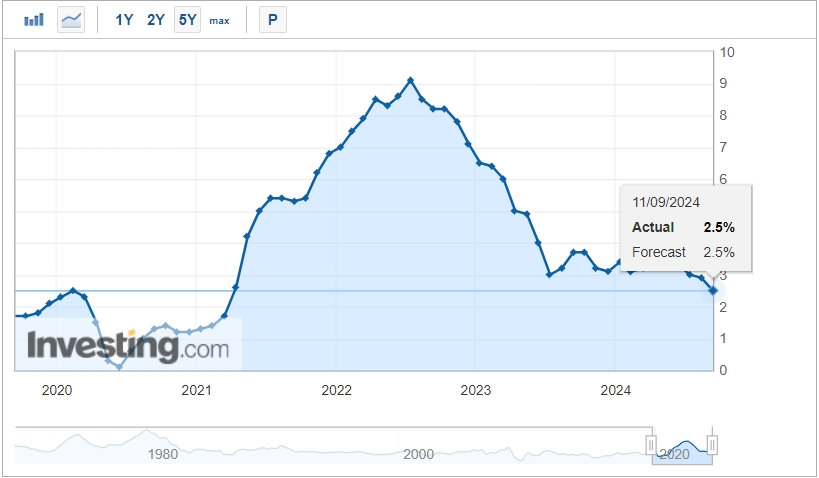

Overall CPI Slows Down Again: The U.S. CPI in August rose 2.5% year-over-year, in line with expectations, a significant decrease from the previous value of 2.9%, marking the fifth consecutive month of deceleration and the lowest level since February 2021. The month-over-month increase was 0.2%, matching expectations and the previous value.

Core CPI Meets Expectations: The U.S. core CPI (excluding the more volatile costs of food and energy) rose 3.2% year-over-year, in line with expectations and the previous value; the month-over-month increase was 0.3%, slightly higher than the expected and previous value of 0.2%, marking the largest increase in four months.

The overall CPI month-over-month increase met expectations, while the core CPI month-over-month increase exceeded expectations due to the decline in energy prices, but an increase in housing and transportation costs.

In terms of energy prices, after being flat in July, they fell by 0.8% in August, with gasoline prices falling by 0.6% month-over-month, electricity prices by 0.7%, and natural gas prices by 1.9%.

The Organization of the Petroleum Exporting Countries (OPEC) predicted in a monthly report on Tuesday that global daily oil demand will grow by 2.03 million barrels in 2024, lower than the previously estimated 2.11 million barrels. OPEC also revised down the global demand growth forecast for 2025 from 1.78 million barrels to 1.74 million barrels.

Housing and transportation prices recorded varying degrees of increase.

Data shows that U.S. housing costs rose by 0.5% month-over-month in August, with the Owners' Equivalent Rent (OER) index rising by 0.5%, the largest increase since January; the rent index rose by 0.4%, and the index for lodging away from home rose by 1.8%; airfare prices, after falling for five consecutive months, surged by 3.9% month-over-month in August, driving up transportation costs.

Other items show that used car and truck prices fell by 1.0% in August after a 2.3% drop in July; new car prices remained essentially flat; medical care costs fell by 0.1% in August, after a 0.2% drop in July; furniture prices fell by 0.3%, reversing the previous month's 0.3% increase.

By category, U.S. goods prices fell by 1.9% year-over-year in August, the lowest level since 2004; service prices continued to rise year-over-year, but the increase was the slowest since 2022. The decline in goods prices dispelled expectations that the Federal Reserve would continue to raise policy rates, while the marginally decreasing service prices continued to prove the resilience of the U.S. service industry. From a recession prediction perspective, this is a good report symbolizing a soft landing for the U.S.

After the data was released, traders significantly reduced aggressive rate cut expectations, betting on the possibility of a 25 basis point rate cut by the Federal Reserve next week from 66% to 85%, but this was also partly due to front-running pricing. The U.S. dollar index and U.S. Treasury yields rose in the short term, and U.S. stocks fell more than 1% at the open, with the Dow Jones Industrial Average falling more than 743 points below the 40,000 mark.

However, as the market re-evaluated the report, the three major U.S. stock indexes staged a V-shaped recovery. After midday, U.S. stocks strongly rebounded, led by Nvidia (Jensen Huang previewed strong demand for Blackwell chips), with the Nasdaq Composite reversing losses to rise more than 2%, the S&P 500 and the Nasdaq 100 erasing intraday drops of at least 1.5% for the first time in two years, and the chip index rising nearly 5%.

By the close, the S&P 500 index rose by 58.61 points, or 1.07%, to 5,554.13; the Dow Jones Industrial Average rose by 124.75 points, or 0.31%, to 40,861.75; the Nasdaq Composite rose by 369.65 points, or 2.17%, to 17,395.53. The Russell 2000 index rose by 0.31%. The CBOE Volatility Index (VIX) fell by 7.29%, closing at 17.69.

Regarding the report, IDX Insights Chief Investment Officer Ben McMillan said, "The direct message we received is that the (CPI data) significantly reduces the likelihood of a 50 basis point rate cut next week. This does not surprise me, as I believe the market's expectation of a 50 basis point rate cut in September is quite aggressive. This once again confirms that the Federal Reserve is truly focused on employment data. This makes the employment data and revisions to these data more important."

UBS FX strategist Vassili Serebriakov said that, given the inflation data and the Federal Reserve's higher likelihood of a 25 basis point rate cut, the U.S. dollar may rebound in September, then decline later in the year and into 2025.

He also said, "In fact, we believe the Federal Reserve will only cut rates by 25 basis points, not 50, and the risk sentiment seems a bit defensive. We think the U.S. dollar may have a slight corrective rebound in September. Then by the end of the year and into 2025, the dollar will start to weaken again."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.