再现”汉唐盛世“!比亚迪Q1营收净利润双双大增 海外业务成新增长点

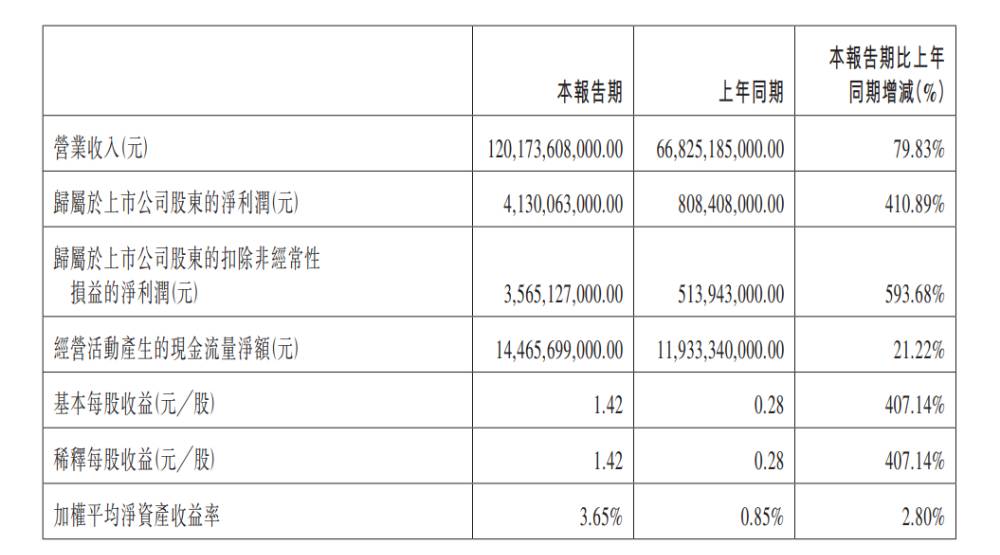

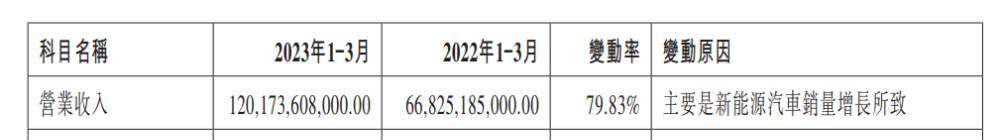

4月27日盘后,比亚迪发布了其2023年一季度业绩报告。财报数据显示,该公司一季度实现营业收入1201.7亿元,同比增长79.8%;归母净利润为41.3亿元,同比增长410%。

4月27日,比亚迪发布了其2023年一季度业绩报告。财报数据显示,该公司一季度实现营业收入1201.7亿元(人民币,下同),同比增长79.8%,环比降低23.15%;归母净利润为41.3亿元,同比增长410%,环比降低43.5%;毛利率为17.86%,同比增长5.46%,环比降低1.14%;净利率为3.64%,同比增长2.28%,环比降低1.3%。

一季度销量同比大增近9成 比亚迪再现“汉唐盛世” 今年锁定300万辆目标

值得注意的是,比亚迪一季度净利润同比增长超过了400%,录得41.3亿元,而在2018年至2021年间,比亚迪的全年净利润只有2020年突破40亿元。在那一年,比亚迪,的旗舰车型“汉”迎来大卖,而其改款车型“唐”销量也增长迅猛,被称为新能源乘用车历史上的“汉唐盛世”。

对于出色的营收增长和净利润“史诗级”突破,比亚迪在财报中指出,这主要得益于其新能源汽车在财报期间的出色销量。2023年第一季度,比亚迪累计销量为55.21万辆,同比增加89.47%。

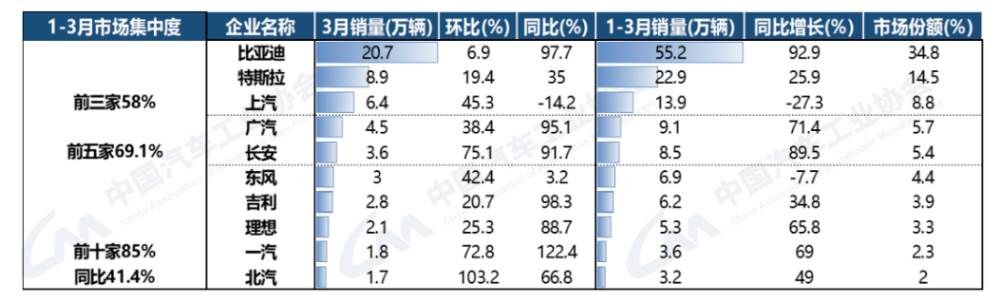

据中国汽车工业协会统计分析,虽然2023年第一季度汽车终端市场整体相对疲软,但是新能源汽车行业却在此期间加速突破交付壁垒。根据协会数据显示,2023年1-3月,新能源汽车产销分别完成165万辆和158.6万辆,同比分别增长27.7%和26.2%,市场占有率达到26.1%。

数据还显示,比亚迪新能源汽车一季度累计销量达55.2万辆,同比增长92.9%,市场份额上升至34.8%。

而在乘联会4月27日公布的3月全国新能源市场深度分析报告中,根据其统计口径,比亚迪在当月和一季度都以超过35%的份额领跑新能源狭义乘用车零售销量榜单,超过排名第二的特斯拉两倍有余,领先优势十分稳固。

从数据中可以看到,比亚迪宋PLUS的出色表现功不可没。在2022年,作为比亚迪明星车型,宋PLUS就拿下了全国SUV PHEV年度双料冠军销量,在当时对比亚迪乃至整个新能源厂商抢占市场起到重要作用。

进入2023年,该车型持续发力。3月16日,比亚迪官博宣布,比亚迪宋PLUS第500,000辆新车下线,成为中国品牌最快实现50万辆销量的新能源SUV车型。今年3月,据官方数据显示,宋PLUS车系当月销量录得32,510辆,同比增长43%。此外,该车型一季度销量已经突破14万辆,同比翻倍,是当之无愧的销售冠军。

另外,比亚迪元PLUS、比亚迪唐、比亚迪护卫舰07都在榜单中名列前茅,助力比亚迪一季度销量同比大增。

2022年,比亚迪全年累计销量超186万辆,拿下全球新能源车销冠,但在2023年上海国际车展期间,比亚迪品牌及公关处总经理李云飞在接受采访时放下豪言,表示比亚迪今年锁定销量目标为300万辆,包括海外市场和中国市场。

净利润暴涨超四倍的背后:锂价暴跌打开利润空间 企业规模效益凸显再助一臂之力

作为新能源汽车电池的重要原材料,锂价一直是众多新能源厂商挥不去的痛。

事实上,碳酸锂的生产难度并不大,其价格主要受产业链下游需求景气度影响。以2021年为例,当年全年新能源汽车产量367.7万辆,同比增长152.5%;同期国内碳酸锂产量为23.04万吨,同比增长32.97%,而锂价则在此期间一路猛升,高点触及2022年11月的60万元/吨大关。

当时,就有不少“业界大佬”对锂价的不合理攀升发表过自己的困惑。孚能科技董事长王瑀就在接受采访时表示, 2022年碳酸锂、氢氧化锂的供需实际上是平衡的,其价格大幅抬升里有很多炒作的因素。他表示,目前碳酸锂资源并不匮乏,生产难度也不是很大,实际的成本在3万元左右,没有任何的理由涨到50万、60万。

随着碳酸锂价格越来越高,近年来新能源厂商们的利润空间一步步被压缩,苦不堪言。2022年,广汽集团董事长曾庆洪就曾无奈透露,动力电池成本占到汽车总成本的近六成,并且还在不断增加。对此,他笑称道:“我现在不是给宁德时代打工吗?”

终于,随着市场逐渐回归理性,从去年11月开始,电池级碳酸锂的价格一路下挫,在不到5个月的时间里,单吨价格就下降约40万元。4月28日,据上海钢联发布最新数据显示,电池级碳酸锂均价仅为18.9万元/吨,较高位跌去三分之二。

碳酸锂价格的下跌,带来了新能源厂商的利好。有分析称,以终端新能源汽车单车耗费55度电为假设,目前新能源整车成本相较去年水平将下降约1.6万元。

另外,伴随比亚迪的持续投入和产能的扩大,其造车工厂的成本规模化效益开始逐渐显现。有分析指出,今年一季度比亚迪的单车收入和单车利润已经能达到17万元和0.67万元。

要知道,一季度为车企的传统淡季,根据此数据,比亚迪单车收入已经达到去年全年平均水平,单车利润更是同比增长约170%。

事实证明,锂价下跌以及规模效应逐渐发力,都是比亚迪一季度净利润同比暴增的隐形推手。

继承优良传统 比亚迪一季度研发费用逾60亿元 云辇系统震撼面世

事实上,比亚迪董事长王传福一直十分注重企业研发创新,这也是去年在新能源全行业面临芯片结构性短缺、碳酸锂价格居高不下困境之时,比亚迪仍能逆势突围拿下全球销冠的“破局之道”。

2022年,在上游成本承压的情况之下,比亚迪正是依托技术创新,通过自供电池技术,牢牢地把主动权掌握在自己手里,才实现逆风翻盘。去年全年,比亚迪先后推出了“刀片电池”、“DM-i超级混动”、“e平台3.0“、“CTB电池车身一体化”和“DM-p王者混动”等颠覆性技术,并在二次充电电池方面取得突破,不断加固自身技术优势。

根据比亚迪2022年财报,该公司去年全年研发费用首次突破百亿元大关,同比增长133%,来到了186.54亿元。进入2023年,比亚迪似乎仍想延续这一“光荣传统”,财报数据显示,今年一季度,比亚迪集团累计研发费用达62.38亿元,同比增长164.24%。

如此投入,自然也结出硕果。

4月10日,比亚迪发布了划时代的云辇智能车身控制系统,该系统为全球首个新能源专属智能车身控制系统。在发布会上,搭载云辇-X技术的仰望U9展现了全主动车身控制技术,可实现“0”侧倾、“0”俯仰、三轮行驶、车辆跳舞与原地起跳等高阶功能,代表了全球车身控制系统的最高水平。据悉,该系统未来还将搭载在比亚迪王朝、海洋的旗舰车型,腾势、仰望以及个性化品牌上,进一步提升比亚迪汽车产品的整车驾乘舒适及安全性。

4月24日,又有消息传来,比亚迪自研电动皮卡也已经处于开发的最后阶段,预计在今年晚间就能面世。据悉,该系列将搭载比亚迪DM插电混动系统,拥有1.5T和2.0T两款动力组成,鉴于车身设有充电插口,该车或提供插电混动和纯电两种动力版本。

比亚迪透露,除了已经在4月26日正式上市的海鸥以外,年内还会有驱逐舰07、宋L、腾势N7、仰望U8等车型陆续进入市场。此外,备受市场瞩目的仰望U9和F品牌则可能在2024年上市。

面对一波又一波的黑科技和新车型,市场有理由相信比亚迪在未来还会不断创造惊喜。

出口创收!海外市场成为业务新增长点 比亚迪欲借“海洋”系列乘风破浪

2022年,比亚迪在国际市场迈出了重要一步,在澳大利亚、日本、巴西等地都推出车型,并销售火爆,一度供不应求。

今年一季度,比亚迪出口业务再次火爆。根据财报,期间内比亚迪累计出口乘用车约3.87万辆,同比增长高达1390%,足迹遍布全球51个国家和地区,已经逐渐成长为该公司业务的新增长点。

去年9月,比亚迪召开欧洲新能源乘用车发布会,面向欧洲市场推出汉 EV、唐 EV、元 PLUS三款车型,并于同年10月在法国巴黎车展亮相上市,标志其打开欧洲市场,为其发展海外业务关键一步。

4月中旬,比亚迪在西班牙巴塞罗那举办新车发布会,并宣布海豚、海豹两款车型将于2023年进入欧洲市场。其中,海豚将于今年夏季开始预售,第四季度交付。海豹也将于不久后在欧洲上市,与欧洲本地消费者见面。

比亚迪国际合作事业部兼欧洲汽车销售事业部总经理舒酉星表示,海豚和海豹两款车型的到来,标志着比亚迪进一步拓展欧洲新能源车市场的决心。

数据显示,虽然国内、欧洲和美国的新能源汽车渗透率目前都分别突破了30%、20%和10%,但除此之外的其他地区和国家,整体新能源汽车渗透率都在两位数以下,发展空间巨大。

花旗预计比亚迪销量录得强劲增长 大摩称关注其高端及海外市场进展

面对出色表现,绩后,各大行纷纷给出观点。

花旗表示,比亚迪为该行在内地汽车行业的首选,预估其今年至后年的销量分别为296万、395万、471万,原因为强劲的订单积压。此外,该行看好比亚迪插电混动车供需情况得到改善,纯电动车平均售价未来向低端和高端渗透,以及未来市场份额。由此,该行宣布将比亚迪取代华晨,纳入泛亚洲焦点名单,评级为“买入”,目标价为602港元。

摩根士丹利称,比亚迪第一季度净利润录得41亿元人民币,环比下降44%,同比上升411%,表明若扣除比亚迪电子贡献,公司旗下单车利润约为7,000元人民币,大致符合市场预期。大摩还称,比亚迪收入环比下降23%至1202亿元人民币,因首季电动车销量环比下滑约20%至54.8万辆,反映出季节性、以及在价格竞争加剧下,汽车行业需求的复苏放缓。

该行进一步指出,除了关注其销售目标外,市场也应高度关注其高端市场和海外市场的开拓进展,因两者均是影响比亚迪增长前景的关键。由此,大摩将比亚迪目标价定为215港元,并维持“与大市同步” 评级。

瑞信则发布研究报告,表示比亚迪一季度业绩符合预期,报告期内单车净利润环比下降30%至7481元人民币,和管理层指引区间7000-8000元人民币一致。展望未来,该行认为由于锂价的大幅下跌,加上比亚迪新品成功上市,该公司毛利润将在第二季度改善。由此,该行维持比亚迪目标价为420港元,评级为“跑赢大市”。

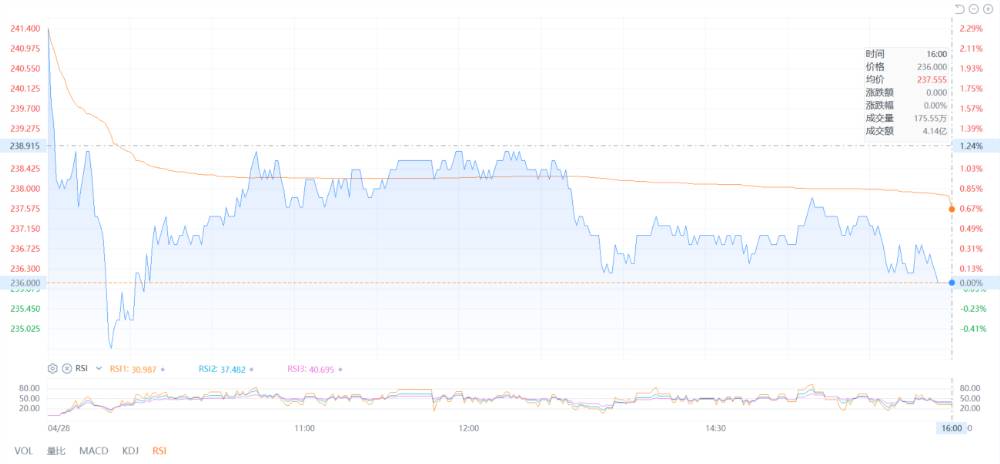

有趣的是,比亚迪H股今日波动较大,但截止收盘,比亚迪股份日内涨跌幅为0%,仍报236.00港元。

鹰瞻声明:本文内容仅供参考,不构成个人投资及操作建议。特别提醒,文章均为原创内容,未经允许不得转载。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。