英国8月零售数据超预期 昨日刚维持政策利率不变

于天气转暖促进了食品和服装销售。

9月20日,英国公布8月季调后零售销售数据。该数据环比增长1%,高于经济学家预期的0.4%。此外,7月季调后零售销售月率由此前公布的0.5%向上修正为0.7%。

除去整体数据以外,8月英国不包括汽车燃料在内的零售销售月率增长增长1.1%,高于7月的1.0%,大幅高于经济学家预测的0.5%。

英国国家统计局称,本次销售数据超预期增长,主要是由于天气转暖促进了食品和服装销售。具体而言,与一个月前相比,食品店销售额增长了1.8%,非食品店销售额增长了0.6%。

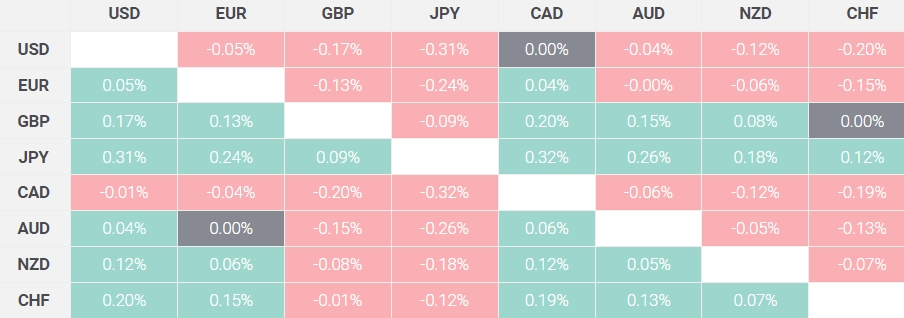

好于预期的数据公布后,英镑立即获得了新的买盘。截至发稿,英镑兑美元上涨0.18%,逼近1.3310。

对于这份数据,德勤在第一时间发表评论。德勤(Deloitte)零售主管奥利弗·弗农-哈科特(Oliver Vernon-Harcourt)表示:“八月姗姗来迟的阳光和繁忙的体育赛事给英国零售业带来了急需的提振,消费者在夏季服装系列和户外社交食品上的支出增加。上个月四年来的首次降息使房地产市场出现反弹,这可能也是家庭用品销售增长的原因之一。”

奥利弗还称,“尽管许多消费者仍持谨慎态度,选择放弃购买大件商品或奢侈品,但仍有一些消费者在小件奢侈品上犒劳自己,从而促进了个人护理和高档食品类小件可支配商品的销售。”

他继续表示,“好于预期的销售增长为零售商带来了希望,即更多的消费者将在未来几个月持续消费。不过,许多消费者还在等待即将公布的秋季预算结果和进一步的利率调整,然后才会完全放松银根。‘黄金季度’即将到来,许多零售商都想看看自己在一年中最繁忙时期的表现如何,然后再放手进行更多重大投资。”

昨日,英国央行一如预期,以8票对1票的投票结果将银行利率维持在5.0%不变,其中一名政策制定者赞成再次降息。而今年8月,政策制定者以5比4的投票结果决定降息,4票赞成维持利率不变。英格兰银行的宽松步子正在放慢。

英国央行强调,有必要采取耐心的方式进一步实现正常化,鉴于潜在价格压力的持续存在,这仍然是有道理的。今日出炉的好于预期的零售数据,无疑在佐证央行的这一设想。

在决议声明中,英国央行行长安德鲁·贝利(Andrew Bailey)表示:“随着时间的推移,我们应该能够逐步降息。”他强调这一路径将取决于价格压力是否持续缓解。“保持低通胀至关重要,因此我们需要小心,不要降息太快或降幅太大。”

市场预计,截至12月,英格兰银行预计将降息41个基点,此前预期为降息50个基点。

此外,英国央行还维持了每年1,000亿英镑(1,320亿美元)的资产负债表缩减速度。这意味着,从10月份开始的12个月内,英国央行主动出售的政府债券数量将从目前的500亿英镑大幅下降至130亿英镑左右。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。