大战平息?香橼宣布不再做空游戏驿站 咆哮小猫疑似抛售期权

周三,一些短期游戏驿站期权合约交易量激增,这让一些市场参与者认为,网名为咆哮小猫(Roaring Kitty)的投资者Keith Gill可能已经出售了他持有的部分游戏驿站期权头寸。

游戏驿站(GameStop)的多空大战似乎开始平息。

咆哮小猫疑似正抛售游戏驿站期权

周三,一些短期游戏驿站期权合约交易量激增,这让一些市场参与者认为,网名为咆哮小猫(Roaring Kitty)的投资者Keith Gill可能已经出售了他持有的部分游戏驿站期权头寸。

Gill曾是2021年“散户逼空华尔街”事件的核心人物。近日Gill宣布卷土重来,并于6月2日在Reddit上发布了一张截图,里面披露了他正持有的大量游戏驿站股票和期权头寸。

截图显示,他持有12万份游戏驿站6月21日看涨期权,执行价为20美元,买入价格为每份合约5.6754美元,总价值高达6,810万美元。截图还显示,6月2日,他持有500万股游戏驿站股票,价值1.157亿美元。

而在本周三(6月12日),有数据显示,约有93,000份游戏驿站的6月看涨期权易手,其中一些合约的成交量达5,000份或更多。

根据TradeAlert的数据,考虑到周三的交易量,这些合约的平均成交价为7.65美元。TradeAlert的数据显示,许多交易都低于买入价,这表明卖家可能试图抛售合约。

在这种情况下,有策略师怀疑,可能是Gill在试图抛售其持有的期权头寸。Susquehanna International Group衍生品策略联席主管Chris Murphy表示:“看起来他正在平仓。”

Murphy表示:“虽然他没有完成平仓,但如果他想的话,现在可能有足够的现金来行使剩余的权力。”

TradeAlert的数据还显示,游戏驿站期权交易量在周三跃升至120万份合约,比过去一个月该股票期权的平均日交易量高出66%。

自从Gill披露其期权头寸以来,期权市场参与者一直在密切关注。Gill的期权头寸在最近几个交易日中出现了大幅波动,期权头寸的价值一度跃升至3.41亿美元,然后在周二短暂出现750万美元的亏损。

盈透证券(Interactive Brokers)首席策略师Steve Sosnick表示,“我们要等到未平仓合约的数据出炉后才能确定,但我想象不出还会有谁会以折扣价大举抛售。”

如果按照每份合约6.40美元的收盘价计算,Gill持有的12万份合约的总价值将达到7,680万美元,比他买入时高出约870万美元。

香橼宣布停止做空

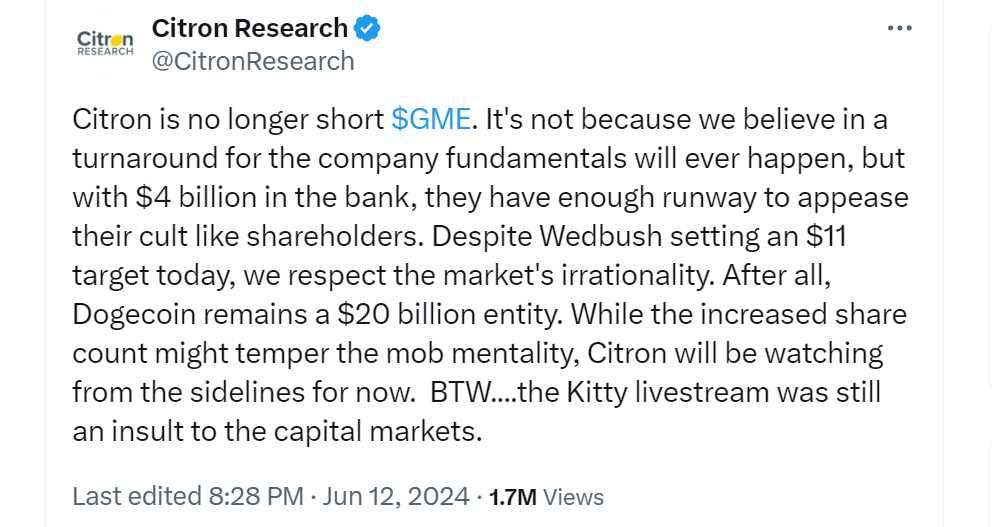

值得注意的是,在周三游戏驿站期权合约交易量激增的前一天,美国做空机构香橼(Citron Research)6月12日在X上宣布,不再做空游戏驿站。

在帖子总,香橼对于停止做空做了解释:“这并不是因为我们相信该公司的基本面会出现转机,而是因为他们有40亿美元的银行存款,有足够的资金来安抚那些崇拜他们的股东。尽管Wedbush今天设定了11美元的目标价,但我们尊重市场的非理性。毕竟,狗狗币(Dogecoin)仍然是一个价值200亿美元的实体。虽然股票数量的增加可能会缓和暴民心态,但香橼目前仍将在场外观望。”

虽然不再做空了,但香橼人表达了对咆哮小猫的不满,宣称咆哮小猫的直播仍然是对资本市场的侮辱。

香橼的创始人Andrew Left在接受采访时表示,如果游戏驿站的股价达到45-50美元的水平,他将再次做空该股。此外他还表示,香橼虽然平仓但仍然获利了,不过他没有透露具体规模。

游戏驿站股价收盘下跌16.5%,至25.46美元。今年以来,该股已上涨45%。

自2018财年以来,游戏驿站一直未能盈利。

在最新的季度财报中,游戏驿站表示,第一季度公司亏损3,230万美元,略好于去年同期的5,050万美元。但销售额仍在持续下滑,第一季度销售额从去年同期的12亿美元下滑至9亿美元。

截至5月4日,游戏驿站拥有约10亿美元现金。该公司表示,继5月份筹集9.334亿美元之后,上周公司在股票出售又套现了约21.4亿美元的收益。游戏驿站选择在上周出手套现的重要原因,就是咆哮小猫时隔三年后再度宣布做多游戏驿站导致该股上涨。

游戏驿站表示,公司打算将这笔资金用于一般公司用途。B. Riley Financial首席市场策略师Art Hogan对此表示,游戏驿站是否能够利用好这些套现的资金,并将其转化为盈利的商业模式,未来才能知道。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。