全面加码即时零售:京东收购全部沃尔玛所持达达股份

据悉,京东收购了沃尔玛持有的全部达达股份,持股比例升至63.2%。

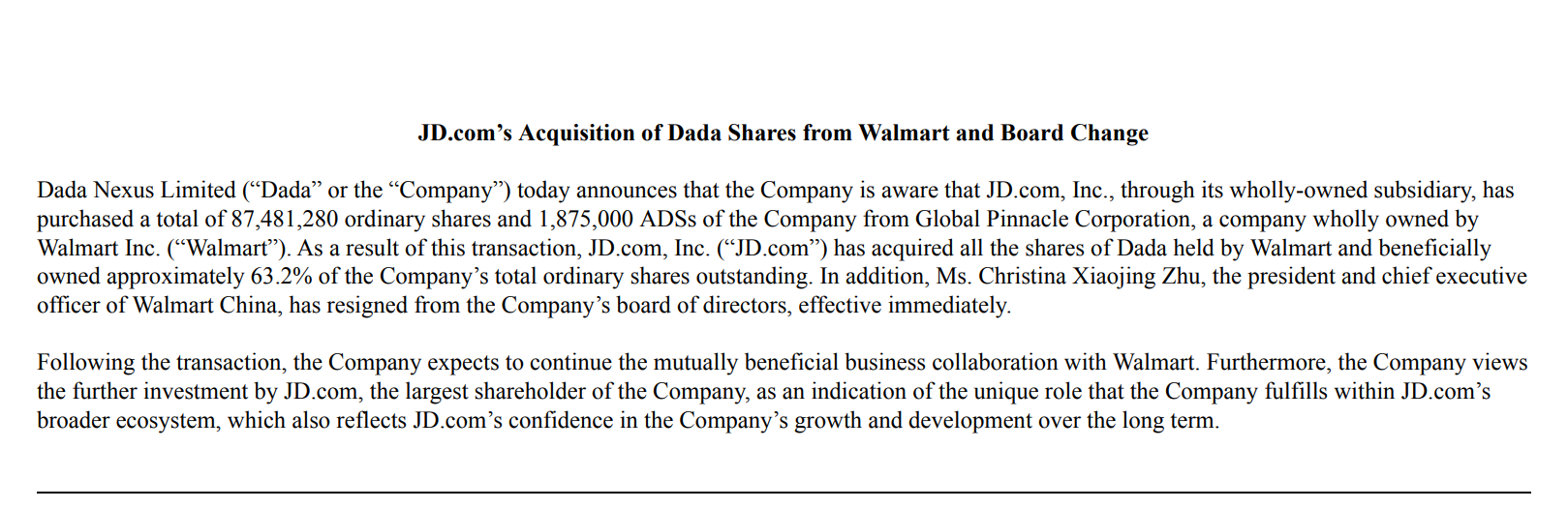

9月17日,达达集团发布公告称,京东透过全资附属公司,买入了沃尔玛子公司所持达达的8,750万股普通股和187.5万股美国存托股份。至此,京东已收购了沃尔玛持有的全部达达股份,持股比例升至63.2%。同时,沃尔玛中国总裁及CEO朱晓静辞任达达董事。

达达内部人士表示,本次交易只是股权投资层面的变动,达达与沃尔玛的业务关系不受影响,双方仍旧是彼此重要的战略合作伙伴,未来也期待继续保持互利的商业合作。

京东内部人士透露,增持达达显示出京东对达达的长期稳健发展始终充满信心,也反映出达达在京东生态中的独特地位,并期待进一步深化双方战略伙伴关系。

受消息刺激,美东时间9月17日,达达美股大涨21.7%,收报1.29美元/股。

达达成立于2014年,2020年6月在美国纳斯达克上市。目前,旗下有达达快送和京东到家两大核心业务,前者是本地即时配送平台,后者是本地即时零售平台。截至今年3月底,京东持有达达53.1%股权,沃尔玛则持有9.4%股权。

2016年,京东与沃尔玛达成了一系列深度战略合作,沃尔玛获得了京东新发行的1.4495亿股A类普通股,自那时起便一直是京东的主要投资者之一,将持有京东约5%的股份。另一方面,京东将拥有沃尔玛全资控股的1号商城主要资产,当时该交易价值达到15亿美元。

对于此笔交易,沃尔玛方面回复称:“股权转让后,我们将把资产配置于其他优先事项。” 截至7月底,沃尔玛全球的现金88亿美元,较年初减少10亿美元。

接盘沃尔玛的达达股权,顺应了京东加码即时零售业务的战略,达达一直是京东不可或缺的一环,也持续受益于京东生态的广泛赋能。

2015年,京东正式入局即时零售,依托达达快送,推出京东到家配送服务。2021年,京东和达达共同发布“京东小时购”,全面整合京东零售与京东到家,达达也顺势承接了京东的即时零售和即时配送业务。2022年2月,京东斥资5.46亿美元增持达达,持股比例增至52%,成为该集团第一大股东。

今年初,京东宣布“内容生态、开放生态、即时零售”为公司2024年“三大必赢之战”。

《2023年中国即时零售行业市场研究报告》指出,2018年以来,即时零售行业一直保持着50%以上的年均增速,预计到2025年,即时零售市场规模将达到2022年的3倍。

由此,京东在今年开始对达达持续发力。

5月,达达宣布其业务将加速全面融入京东生态,将旗下即时零售品牌京东小时达、京东到家全面整合升级为“京东秒送”,最快9分钟送到手,持续优化用户体验。目前,该服务已覆盖全国2,300余县区市,合作门店超50万家,并在流量和曝光度上给予特别支持,在京东APP首页核心位置上线。

8月下旬,达达披露2024财年二季度财报,当季营收约23.5亿元,同比、环比均有所下滑,期内净利润亏损约2.86亿元。其中,京东秒送营收为9.12亿元,同比下降43.6%;达达秒送(现为达达快送)则由于同城配送服务单量的增加,实现了13.38亿元的营收,同比增长46.6%。

与此同时,达达集团上下发生了不小的人事变动。京东集团顾问郭庆出任达达董事会主席,兼任薪酬委员会成员,在此之前,他曾先后负责美团住宿、门票度假、民宿等业务,并入选美团最高决策机构S-team,后又调任骑行事业部总经理。

有内部人士透露称,郭庆在接管达达后,提出了“全面对标美团闪购”的发展规划。财报电话会上,达达高管宣称集团将全面拥抱京东生态,将达达的供应端与京东的需求端结合,在按需零售行业中增加市场份额。

京东2024年二季度业绩报告显示,公司期内收入录得2,914亿元,上半年收入为5,514亿元。期内,京东Non-GAAP归母净利润达145亿元,同比增长69.0%;净利润率首次达到5.0%,都大幅超出市场预期。

其中,物流及其他服务收入达到341亿元,同比增长7.9%;且其物流分部的Non-GAAP经营利润已连续5个季度实现盈利,Non-GAAP经营利润率创京东物流上市以来新高。

本月前几日,京东物流还与达达签订了货运服务框架协议及营运支持服务框架协议,协议有效期至2026年12月31日。根据协议,达达将为京东物流提供本地即时货运服务。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。