传英伟达H20断供中国厂商 黄仁勋减持套现超7亿美元

对于H20断供的消息,英伟达方面拒绝做出回应,其首席执行官黄仁勋已完成“减持计划”,成为该公司最大的个人股东。

业内热传,英伟达自8月起已停止接受H20芯片的订单,因为该芯片可能即将被美国列入出口管制。虽然尚未收到官方通知,分销商还在“等待最新消息,部分客户的定制化需求还可以满足”。不过,这并不是全面停止接单,一些手中有现货的厂商表示可以继续接单。

对于这一传闻,英伟达方面回应称:"不对谣言做评论"。

去年,美国监管机构以国家安全为由,禁止英伟达对华出口A100/A800、H100/H800等高性能芯片。为符合管制标准,英伟达基于H100向中国推出了三款特供芯片,其中H20性能最强,约为H100的六分之一,但在价格上并没有明显降低。

由于大多数国内AI企业的应用生态均以英伟达的CUDA平台为基础,H20能够完全兼容,尽管功能上相差甚远,也依然成为了许多企业的首选。而且,H20芯片的HBM容量比H100更高,因此在AI实际训练和推理方面较国产AI芯片有一定优势。

投资银行杰富瑞指出,美国可能在今年10月对其半导体出口政策施加额外限制,英伟达H20芯片或被禁售,形式包括但不限于针对特定产品的禁令、降低芯片的运算能力、或限制其存储器容量。

据其估算,若该禁令施行,英伟达将在中国市场损失高达120亿美元的收入,这将对其在中国市场的可持续性造成巨大打击。

多位产业链人士均明确表示,H20被停售的传言已久,大家普遍关心其是否将在短期内遭遇停售。还有消息传,英伟达正向美国政府请求不要执行该决定。

不过,几家厂商近期仍有大量H20到货,且预计2024全年最终出货量可能有60万-70万枚,远超年前市场普遍预期的40万枚,尚不清楚出货量的拉高是否由于此次的截单消息。

此前,由于GB200、A100等芯片热度很高,不少大厂都有采购需求,加之高端芯片的产能十分有限,因此采购时常常需要配货,H20就是其中之一。

中国企业一直在囤积英伟达芯片,字节跳动据称持有10万枚以上,预计其2024年的H20订单将达到32万至33万台,目前已交付14万至15万台。此外,该公司还计划从海外购买超过3万枚H100芯片,后续可能还会采购B200和H200芯片。

但如今,H20芯片的关注度其实不高,甚至有“鸡肋”一称,业内人士还表示“之前大厂囤货都差不多了,小厂可能还有些需求”。

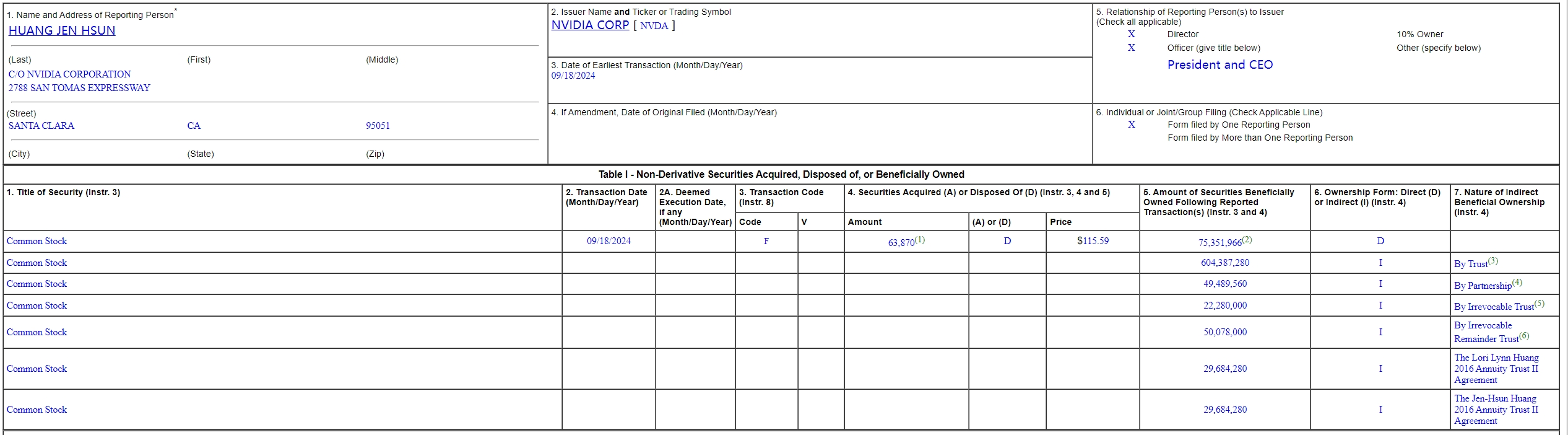

9月25日,英伟达首席执行官黄仁勋刚刚完成了其年初制定的“出售600万股票”的减持计划,从中套现7.13亿美元,平均每股价格为118.83美元。

6月14日至9月13日间,黄仁勋分批出售股票,交易规模从70股至75,300股不等,交易价格最低为8月5日的91.72美元,最高为6月20日的140.24美元。

据其向美国证券交易委员会提交的文件,减持完毕后,黄仁勋目前直接持有7,540万股英伟达股票,并另外通过信托和合伙企业拥有7.86亿股英伟达股票。在该公司最新的委托书中,黄仁勋被列为该公司最大的个人股东。

作为全球人工智能热潮的最大“宠儿”,英伟达股价年初至今已经上涨超150%。今年早些时候,英伟达的市值一度突破3万亿美元,其市场主导地位已经不容忽视,其股价波动影响着更广泛的市场和投资者情绪。

自6月以来,该股走势陷入波动,并经历了近三个月的大幅波动。除市场对于英伟达芯片需求前景出现怀疑以外,黄仁勋持续的减持也是影响市场信心的重要因素之一。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。