什么是股息收益率?

股息收益率是比较公司股息规模与其股价的工具,它是年股息除以股票价格。然而,较高的股息并不总是意味着高潜力的投资。

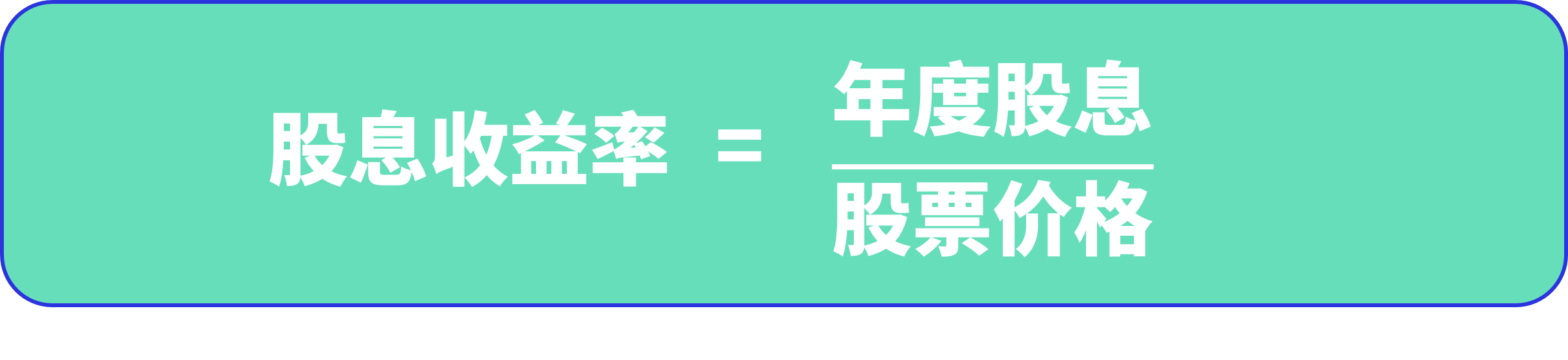

股息收益率是一个重要的财务指标,通过将公司年度支付的股息与其当前股价进行比较,以百分比形式呈现。公式为:

股息收益率的作用

股息收益率能够帮助投资者评估股票的吸引力。较高的股息收益率通常意味着股票相对于其价格提供了更高的现金回报,这对寻求稳定收入的投资者尤其重要。然而,高收益率并不总是意味着公司财务健康,可能会因为股价下跌而虚高。

股息收益率的计算方法

股息收益率的计算涉及多个步骤,具体取决于公司支付股息的频率。以华特迪士尼公司(NYSE: DIS)为例,截至2019年7月12日:

- 股价: 144.88美元

- 半年度股息: 88美分(2019年1月10日和2019年7月25日支付)

- 年度股息计算: 88美分 × 2 = 1.76美元

- 股息收益率计算:股息收益率=1.76美元144.88美元≈1.21%\text{股息收益率} = \frac{1.76 \text{美元}}{144.88 \text{美元}} \approx 1.21\%

这一例子清晰展示了如何通过股息和股价的关系来计算股息收益率。这显示出,尽管华特迪士尼支付股息,但其收益率相对较低,反映出投资者在选择股票时需要综合考虑股息和股价的波动。

股息收益率与总回报的关系

股息收益率是评估投资回报的重要组成部分,但不能孤立使用。总回报包括股息收益率和股价变化的综合效应,计算公式为:总回报率=股息收益率+股价变化率\text{总回报率} = \text{股息收益率} + \text{股价变化率}总回报率=股息收益率+股价变化率

例如,如果某股票的股息收益率为2%,而其价格在一年内上涨了5%,那么该股票的总回报率为7%。相对地,若股价下跌,尽管仍支付股息,可能导致负的总回报率。

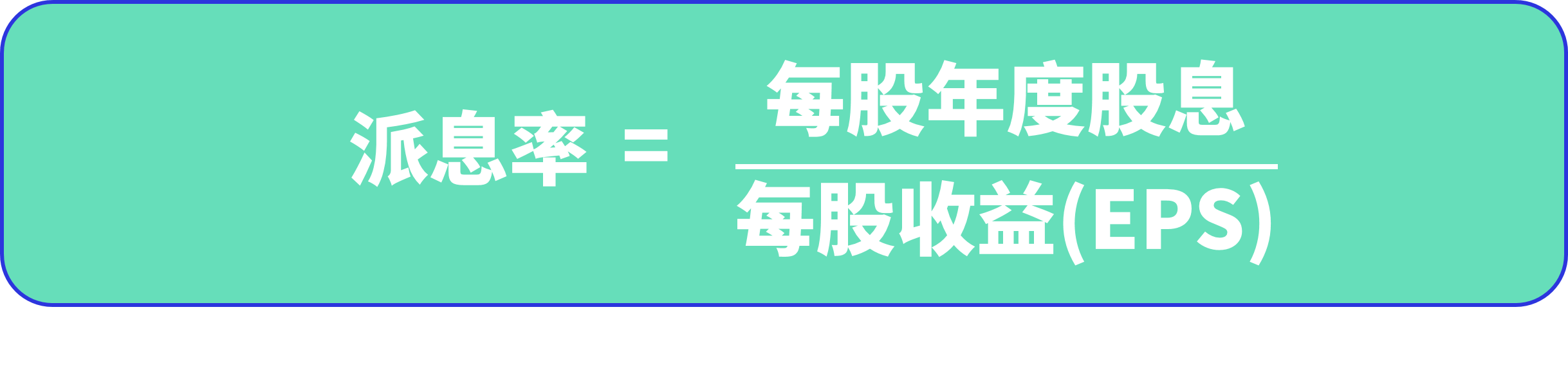

股息收益率与派息率的区别

-

派息率(Payout Ratio): 显示公司用于支付股息的净利润比例。计算公式为:

这表明公司在盈利中有多少比例被用于股息支付。

-

股息收益率: 强调的是投资者获得的现金回报与当前股价的关系,提供了股东从股票投资中直接获得收益的视角。

股息收益率的局限性

虽然股息收益率是评估投资价值的有用工具,但它也存在局限性:

- 股价波动影响: 高股息收益率可能是由于股价下跌引起的,这并不一定意味着公司的前景良好。

- 短期波动: 股息收益率的变化可能会受到市场短期波动的影响,导致误判。

- 股息政策变化: 公司可能会根据经营状况调整股息支付,影响投资者的收益预期。

因此,在评估潜在投资时,投资者应结合多种指标,包括公司盈利能力、历史股息支付、债务水平等,进行全面分析。

高股息收益率公司的特征

高股息收益率通常出现在以下几类公司中:

-

成熟和稳定的企业: 这些公司通常处于生命周期的后期,现金流稳定,能够持续支付股息。例如,消费品巨头如可口可乐(NYSE: KO)和宝洁(NYSE: PG)在经济波动中依然保持良好股息支付。

-

特定行业: 公用事业、房地产投资信托(REITs)等行业,因其业务模式稳定,需求持续,通常拥有较高的股息收益率。这些行业公司往往面临相对较低的市场风险。

-

收入监管的企业: 一些企业如REITs,由于法规要求将大部分收入以股息形式分配,通常会表现出高股息收益率。它们不仅具有吸引力,还能提供稳定的现金流。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。